The oil war is just beginning. Truth in the model [1]

Forecasts are a thankless task. But in some situations, the future is predictable at the conceptual level due to leading indicators or inertia of processes. It is unlikely that it will be possible to predict the price of oil or the state of the oil market before the onset of technological singularity, but it is quite possible to catch something.

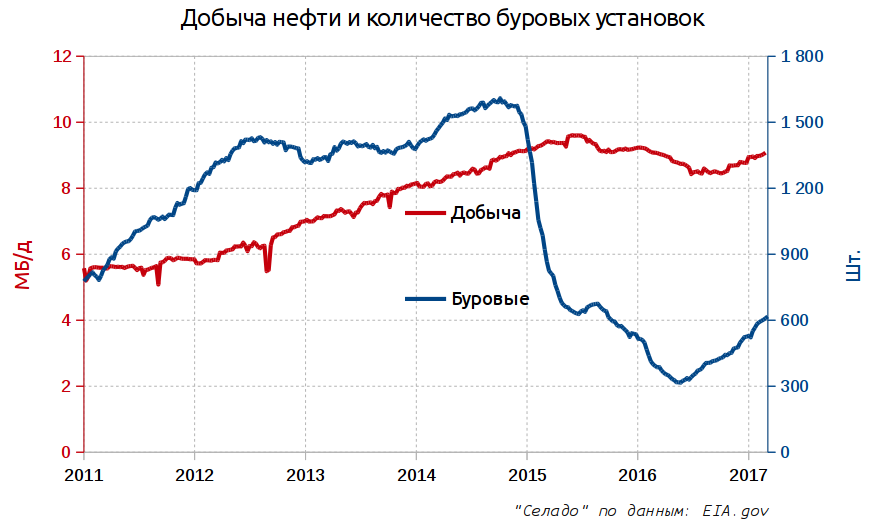

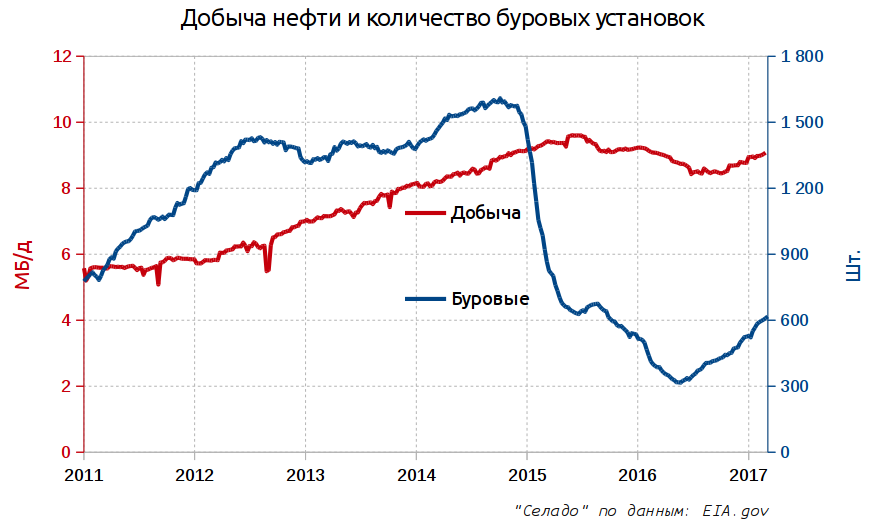

The world is full of surprises: just a year ago, Saudi Arabia’s (SA) oil production growth and the collapse of shale oil in the United States were discussed due to a sharp decline in drilling rigs, and now the opposite is true. The CA, along with other countries, went to reduce production, and the US Ministry of Energy reported on the growth of drilling rigs at shale fields and production itself. The catchy words are hiding quite substantial figures: if OPEC and Co. recently agreed to cut production by 1.75 million barrels per day (MB / d), the United States in recent months managed to add 0.6 MB / d, thereby playing back half of its previous fall and a third of OPEC cuts . Thus, the process has begun to reverse the last two years. All that OPEC has acquired by overworking is now declining again, and the additional revenue and initiative are leaving the American oil industry workers. Thus, the oil war is not over, but is just beginning - shale production has not collapsed and once again began to grow. US oil industry:

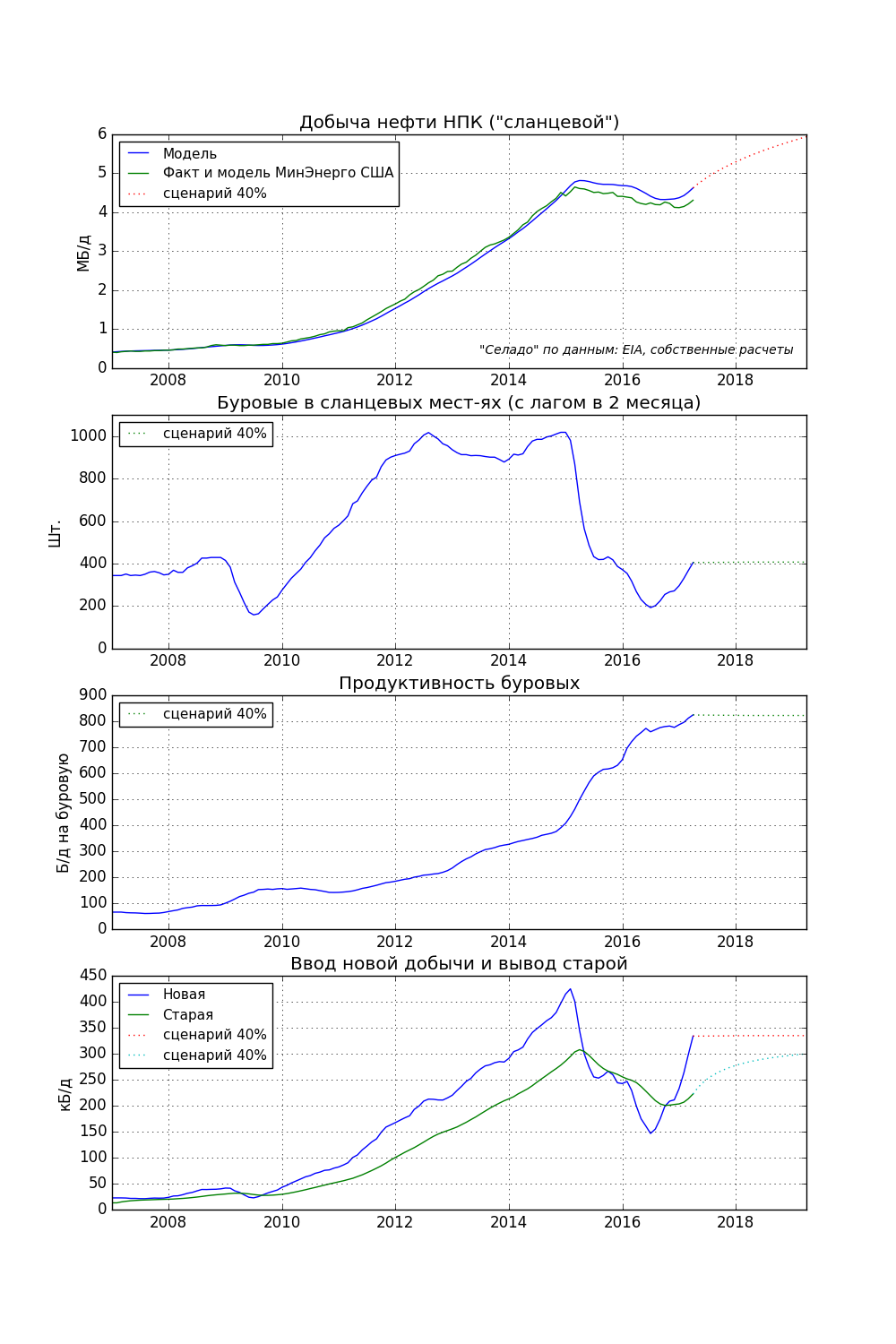

More than a year ago, I modeled the production of shale oil in the United States and everything indicated that production would not collapse. The simulation showed that even with a fivefold reduction in the stock of drilling rigs in shale deposits (from the peak of 2014), the decline in production by 2017 would be only 20%. And the scenario of a threefold reduction of drilling by 2017 stops the decline in production and over time even leads to growth. An advanced version of this growth can be observed now on the chart above. Since then a lot of water has flowed, the model has shown itself well and it makes sense to look into the future again.

')

The model works quite simply. Suppose we know the law that reduces oil production from wells: every month twice. Thus, knowing the well production in the first month (100 barrels), you can calculate its production in any period of time: in the second 50 barrels, in the third 25, and so on ... If several wells were entered in a month, it is enough to know the amount of their production without breakdowns for each specific well and apply the law to the amount. And so monthly. The law of reduction is hyperbolic, is not a secret and varies slightly from field to field (thousands of mentions and studies), data on total well production for the first month is also in the public domain. So you can predict their prey at any time. Production from future wells is already a scenario at their own discretion.

Despite the simplicity, the model and in general the quantitative approach give more than satisfactory results.

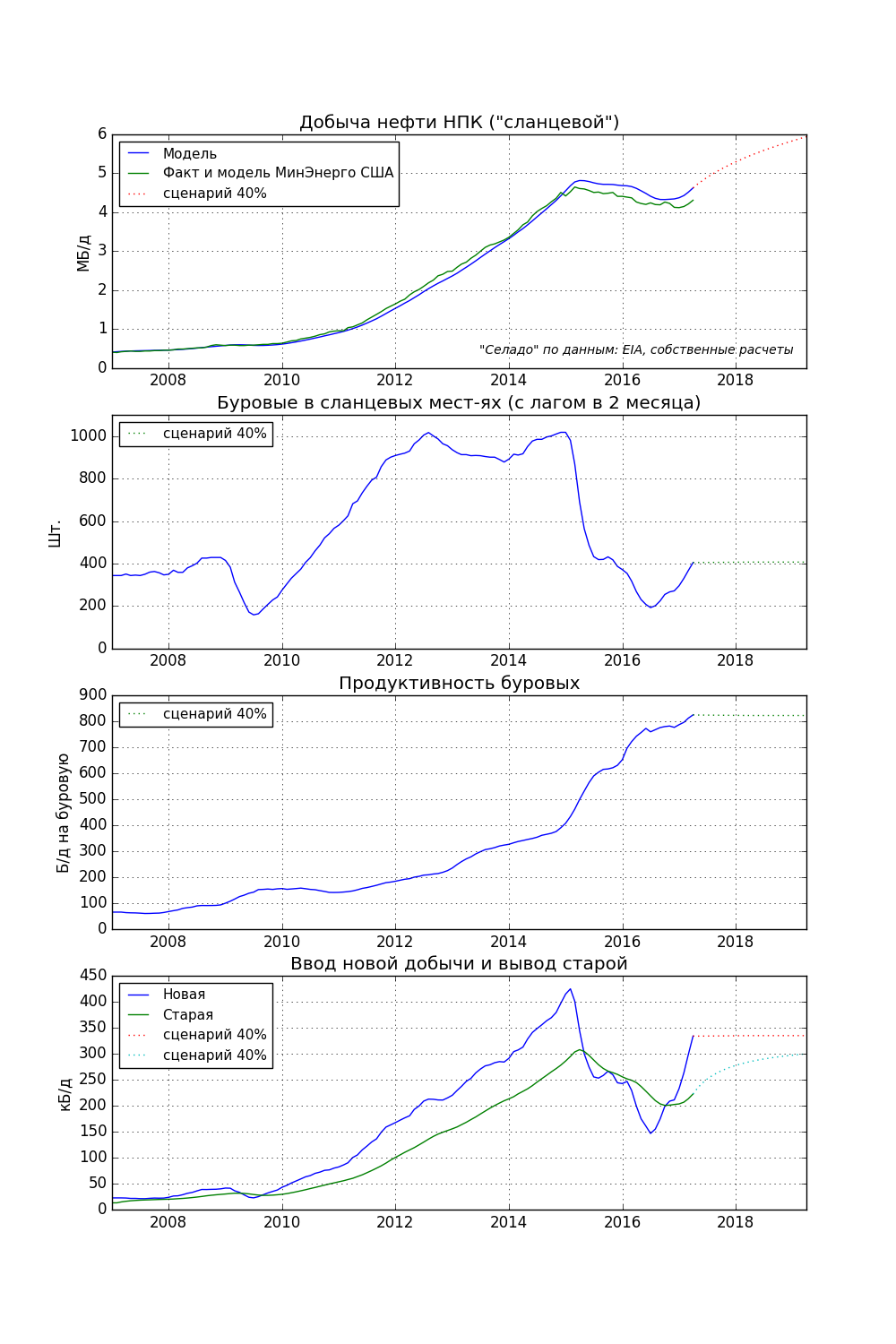

Let's see how shale mining will behave in different situations. To begin with the simplest scenario in which the number of drilling rigs in shale deposits remains at the current level (40% of the maximum) for two years. In the first graph, oil production (blue and red dotted - my model), on the bottom structure of production change:

The model, in my opinion, coincides quite well with reality. The insignificant discrepancy over the past two years is due to the fact that part of the drilled wells were not immediately put into operation, but remained “for later”. Production has already begun to grow, so it is not surprising that with the current value, growth will continue. In this scenario (the number of drilling rigs does not change) after a few months, shale oil production will return to a maximum of two years ago and then growth will continue. Over time, the growth rate will slow down: as you know, the wells for shale oil quickly lose production and once the number of drilling rigs in this scenario does not increase, then there is nothing to compensate for the losses.

This nuance is reflected in the lower graph, where losses in the production of already functioning wells are reflected in blue dotted lines, and the additive to production from new wells is red dotted lines. The difference between the two lines is the monthly change in production - if input of production is greater than output, then there is an increase and vice versa. In the limit, the withdrawal of old production always seeks to balance the input of new production: more new wells → more loss from them, fewer new wells → less loss from them.

As an “adequacy test”, the obtained data can be compared with the opinion of leading consulting agencies: forecasts for the dynamics of shale oil production in 2017 differ in growth from 0.4 to 0.9 MB / d and the obtained data fit into this range.

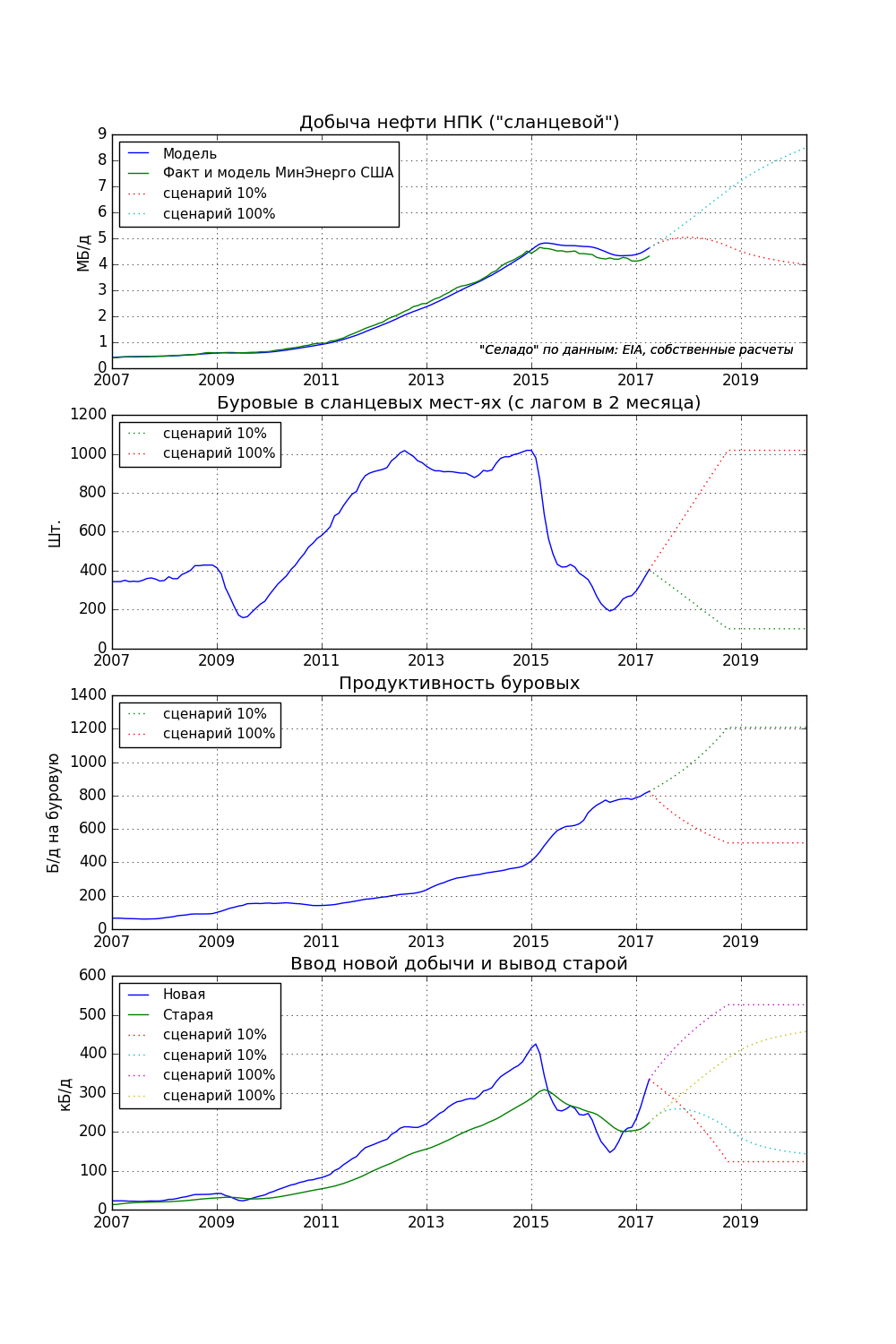

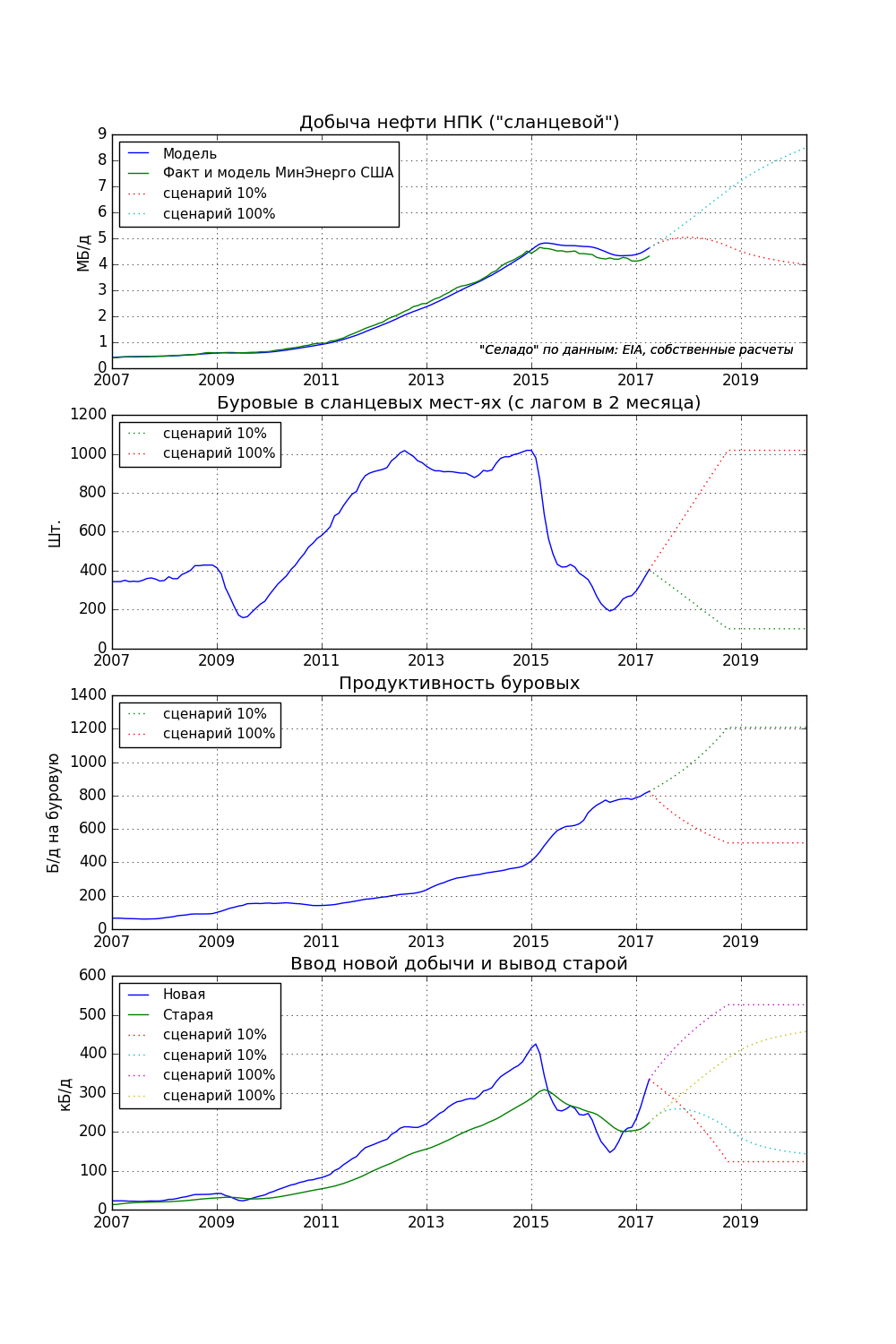

Playing with the model you can see that at the moment “shale” production is not easy to expand to reduce: for this you need to reduce the number of drilling rigs to 15% of the maximum (from the current 36%), and for a significant reduction to 5-10%. If the drilling rigs return to historic highs over the next year and a half, then you can get +3.7 MB / d in the coming years. This is a small figure if you have to save the world from energy starvation (4% of world oil production), but sufficient for an imbalance in the oil market. The two opposite scenarios mentioned are:

In the scenarios on the graph above, the rigs first and a half and a half change to the value in the scenario, then as many more stagnate

In the scenarios on the graph above, the rigs first and a half and a half change to the value in the scenario, then as many more stagnate

Thus, there are more and more arguments in favor of the concept of a “shale regulator”, where this oil acts as a regulator of world prices, linking them to its cost of production. Something similar is already happening: oil production in the United States quickly crawled up as soon as prices exceeded $ 50 per barrel, and now because of this they have begun to decline again.

You can play with the model personally in the “telegraph”. I wrote a bot (Celado_bot), from which you can get a more or less adequate forecast of the production of shale oil in a certain scenario of drilling rigs without getting up from the couch - just send a couple of digits to the bot to chat.

The world is full of surprises: just a year ago, Saudi Arabia’s (SA) oil production growth and the collapse of shale oil in the United States were discussed due to a sharp decline in drilling rigs, and now the opposite is true. The CA, along with other countries, went to reduce production, and the US Ministry of Energy reported on the growth of drilling rigs at shale fields and production itself. The catchy words are hiding quite substantial figures: if OPEC and Co. recently agreed to cut production by 1.75 million barrels per day (MB / d), the United States in recent months managed to add 0.6 MB / d, thereby playing back half of its previous fall and a third of OPEC cuts . Thus, the process has begun to reverse the last two years. All that OPEC has acquired by overworking is now declining again, and the additional revenue and initiative are leaving the American oil industry workers. Thus, the oil war is not over, but is just beginning - shale production has not collapsed and once again began to grow. US oil industry:

More than a year ago, I modeled the production of shale oil in the United States and everything indicated that production would not collapse. The simulation showed that even with a fivefold reduction in the stock of drilling rigs in shale deposits (from the peak of 2014), the decline in production by 2017 would be only 20%. And the scenario of a threefold reduction of drilling by 2017 stops the decline in production and over time even leads to growth. An advanced version of this growth can be observed now on the chart above. Since then a lot of water has flowed, the model has shown itself well and it makes sense to look into the future again.

')

The model works quite simply. Suppose we know the law that reduces oil production from wells: every month twice. Thus, knowing the well production in the first month (100 barrels), you can calculate its production in any period of time: in the second 50 barrels, in the third 25, and so on ... If several wells were entered in a month, it is enough to know the amount of their production without breakdowns for each specific well and apply the law to the amount. And so monthly. The law of reduction is hyperbolic, is not a secret and varies slightly from field to field (thousands of mentions and studies), data on total well production for the first month is also in the public domain. So you can predict their prey at any time. Production from future wells is already a scenario at their own discretion.

Despite the simplicity, the model and in general the quantitative approach give more than satisfactory results.

Production growth will continue

Let's see how shale mining will behave in different situations. To begin with the simplest scenario in which the number of drilling rigs in shale deposits remains at the current level (40% of the maximum) for two years. In the first graph, oil production (blue and red dotted - my model), on the bottom structure of production change:

The model, in my opinion, coincides quite well with reality. The insignificant discrepancy over the past two years is due to the fact that part of the drilled wells were not immediately put into operation, but remained “for later”. Production has already begun to grow, so it is not surprising that with the current value, growth will continue. In this scenario (the number of drilling rigs does not change) after a few months, shale oil production will return to a maximum of two years ago and then growth will continue. Over time, the growth rate will slow down: as you know, the wells for shale oil quickly lose production and once the number of drilling rigs in this scenario does not increase, then there is nothing to compensate for the losses.

This nuance is reflected in the lower graph, where losses in the production of already functioning wells are reflected in blue dotted lines, and the additive to production from new wells is red dotted lines. The difference between the two lines is the monthly change in production - if input of production is greater than output, then there is an increase and vice versa. In the limit, the withdrawal of old production always seeks to balance the input of new production: more new wells → more loss from them, fewer new wells → less loss from them.

As an “adequacy test”, the obtained data can be compared with the opinion of leading consulting agencies: forecasts for the dynamics of shale oil production in 2017 differ in growth from 0.4 to 0.9 MB / d and the obtained data fit into this range.

Toys for geeks

Playing with the model you can see that at the moment “shale” production is not easy to expand to reduce: for this you need to reduce the number of drilling rigs to 15% of the maximum (from the current 36%), and for a significant reduction to 5-10%. If the drilling rigs return to historic highs over the next year and a half, then you can get +3.7 MB / d in the coming years. This is a small figure if you have to save the world from energy starvation (4% of world oil production), but sufficient for an imbalance in the oil market. The two opposite scenarios mentioned are:

In the scenarios on the graph above, the rigs first and a half and a half change to the value in the scenario, then as many more stagnate

In the scenarios on the graph above, the rigs first and a half and a half change to the value in the scenario, then as many more stagnateThus, there are more and more arguments in favor of the concept of a “shale regulator”, where this oil acts as a regulator of world prices, linking them to its cost of production. Something similar is already happening: oil production in the United States quickly crawled up as soon as prices exceeded $ 50 per barrel, and now because of this they have begun to decline again.

You can play with the model personally in the “telegraph”. I wrote a bot (Celado_bot), from which you can get a more or less adequate forecast of the production of shale oil in a certain scenario of drilling rigs without getting up from the couch - just send a couple of digits to the bot to chat.

Source: https://habr.com/ru/post/402443/

All Articles