Arithmetic HashFlare

I have always been attracted to the topic of personal finance. He experimented with various financial instruments - depersonalized metal accounts, the stock market, mutual investment funds, even indulged in PAMM accounts. I did not spend much time and money on this, more for the sake of interest and for general development.

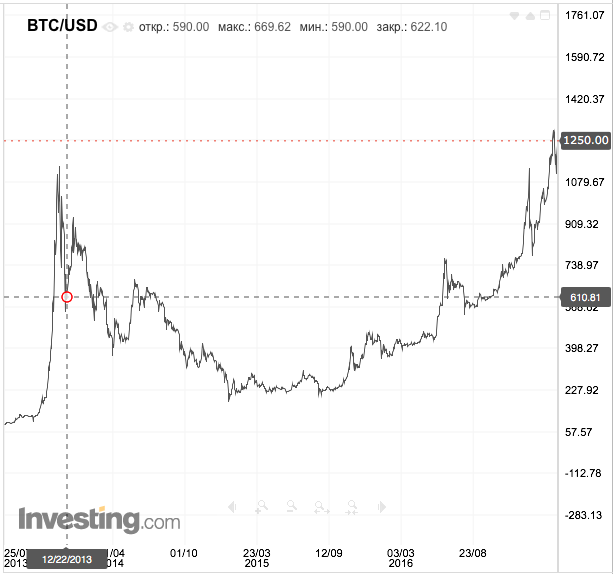

Acquaintance with cryptocurrencies began in late 2013. I read publications about Satoshi, algorithms, mining and prospects for investing in bitcoin - and decided to take a chance. At that time, btc just flew into the heavens, teasing the imagination. Registered on btc-e.com and purchased. As usual, immediately after that, everything suddenly became bad :)

Looking at the course falling during the first year, I was sad, lazily and not always successfully juggled with ltc, nvc, nmc, and then completely abandoned the remaining funds to the mercy of fate.

')

At the end of 2016, I came across an article about HashFlare . It became curious, and the desire to experiment again woke up. Just in case, I studied the current situation with cloud mining services ( bitmakler.com helped a lot ), and decided. The btc-e has enough funds to purchase 1.41 TH / s SHA-256 perpetual power and 20 MH / s Scrypt. It was December 23, 2016, SHA-256 then cost 1 usd for 0.01 TH / s, Scrypt - 6.6 usd for 1 MH / s.

I spent a week monitoring the situation and played with the pools - the first payments were made, for an even account I reinvested them into SHA-256 to 1.5 TH / s and left mine.

By the beginning of March, 0.04026 btc came running. I checked the conclusion (I can recommend bestchange.ru for choosing the exchanger): I stopped at the hashflare variant → cryptopay.me → x-pay.cc → Tinkoff Black, c sent 0.04 btc to the card I received 2,608.83 rubles (65,220.75 rub / btc) at a market rate of about 67,000 rub / btc.

Questions began to appear - Is it not enough for 2.5 months? What is the annual rate? How soon can I go to zero? - and I began to count.

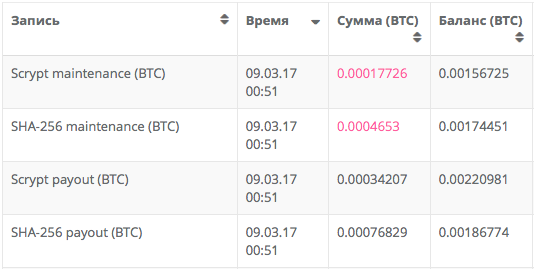

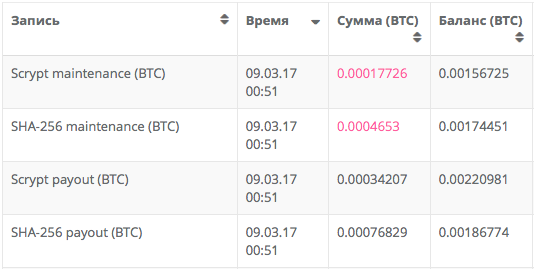

HashFlare has a complete history of operations in your account:

Also, there is a capacity purchase journal:

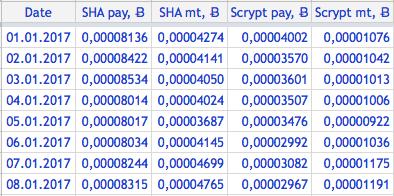

This is quite enough to start. I take all this and bring in divine form:

Here I will explain a couple of nuances:

Types of operations

For the calculations, only payments for mining (pay) and charges for maintenance (mt) matter, blank lines are reinvestment operations, which are not taken into account.

Units of power (unit)

In order not to become attached to his capacities, but to make the calculations more universal, I decided to bring all the amounts to a unit of power. To obtain comparable values, the SHA-256 unit selected 0.1 TH / s, and the Scrypt unit selected 1 MH / s. Thus, in the BTC per unit column, the amount of the operation in terms of unit capacity of the corresponding algorithm was obtained.

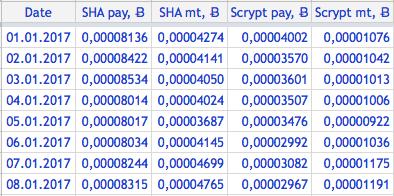

Now I will present this data in a more convenient form for analysis - by day, I place the operations in columns:

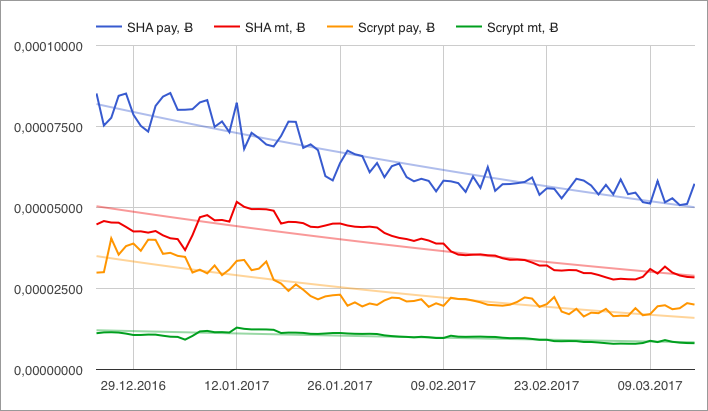

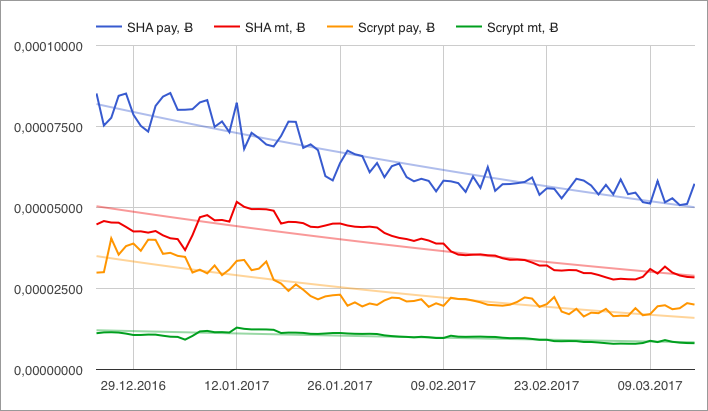

Here, even visually begin to be traced fluctuations in amounts. Let's draw them:

So-so tendency - payments fall, charges for service begin to take away all the greater part of them.

I will make a small lyrical digression about charges for service . On bitmakler and other resources, Hashflare customers are outraged by the growing share of write-offs in payments, without thinking about how they are calculated. To understand this, just look at the frequently asked questions on the site of the service, it is written there in Russian and white:

There's also a little messy about the calculation of the amount of write-offs in btc. And let's check! For this we need to perform the reverse operation. It’s a bit confusing with buy / sell rates, time zones, etc., but we’ll take a course to open usd / btc from the FAQ specified in investing.com and use it to calculate write-offs for the completed day:

Let's draw:

And here I am in some confusion. The charges for Scrypt confidently keep at the level of the promised 0.1 usd per 1 MH / s. But the write-off for SHA-256 is somehow strange sausage from 0.0354 to 0.0409 usd per 0.1 TH / s instead of the promised 0.035 (remember that the amount for 10 GH / s is indicated in the FAQ, and in the calculations SHA-256 unit - 100 GH / s). If someone tells me where I was wrong, I will be grateful. Otherwise, I would like to receive comments from a HashFlare representative .

Let's return to the question of annual interest. To do this, prepare the following data:

Explanation of indicators:

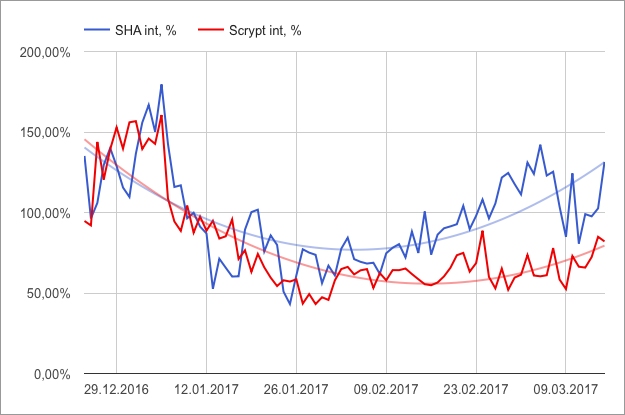

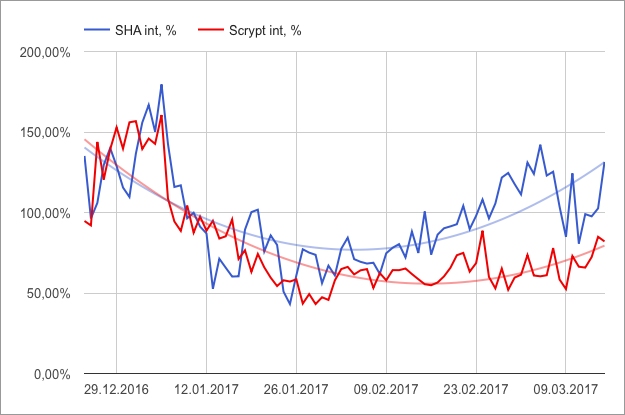

Let's draw:

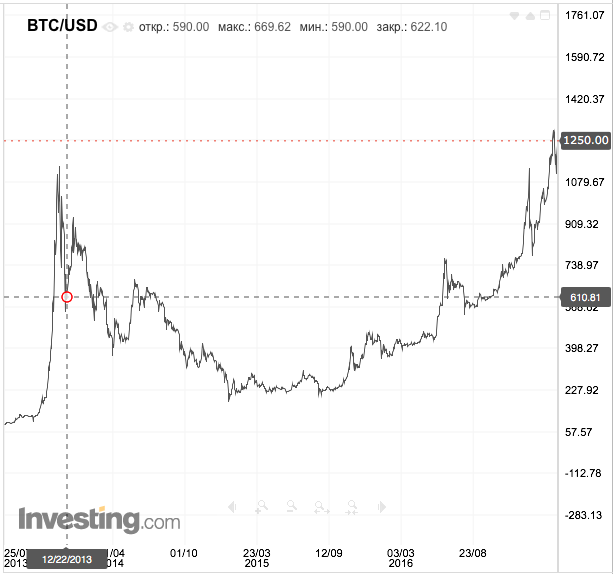

The percentage does not stand still and depends mainly on the btc rate (remember about the almost fixed for fiat currency write-offs for services). For comparison, here is the btc rate chart for the same period:

The annual percentage seems to fall equally with the course, and grows twice as slowly.

The final calculations remain based on the obtained detailed data, which give answers to the questions I am interested in:

The average annual percentage for the period of 83 days -

103.16% for SHA-256 and 86.30% for Scrypt

The payback period for investments with such percentages is 385 days.

In less than 3 months, almost 20% of the invested funds returned (such deposits never dreamed of), and in 10 months, if the situation doesn’t change much, I’ll go to zero and start making a profit. I hope that the btc course will only grow, and HashFlare will get stronger and not increase the cost of maintenance :)

All my calculations arecompletely free, without registration and SMS you can study in Google Docs . I will be glad to any additions and corrections in the comments.

UPD: By the way, you can make yourself a copy of the document and recount everything on your data. There will be questions - please contact.

UPD 06/03/2017: The growing rate of BTC has a very positive effect on the overall picture.

Average annual percentage by months:

But do not forget that all calculations are made taking into account the prices of the end of 2016, now they are already higher.

Acquaintance with cryptocurrencies began in late 2013. I read publications about Satoshi, algorithms, mining and prospects for investing in bitcoin - and decided to take a chance. At that time, btc just flew into the heavens, teasing the imagination. Registered on btc-e.com and purchased. As usual, immediately after that, everything suddenly became bad :)

Looking at the course falling during the first year, I was sad, lazily and not always successfully juggled with ltc, nvc, nmc, and then completely abandoned the remaining funds to the mercy of fate.

')

At the end of 2016, I came across an article about HashFlare . It became curious, and the desire to experiment again woke up. Just in case, I studied the current situation with cloud mining services ( bitmakler.com helped a lot ), and decided. The btc-e has enough funds to purchase 1.41 TH / s SHA-256 perpetual power and 20 MH / s Scrypt. It was December 23, 2016, SHA-256 then cost 1 usd for 0.01 TH / s, Scrypt - 6.6 usd for 1 MH / s.

I spent a week monitoring the situation and played with the pools - the first payments were made, for an even account I reinvested them into SHA-256 to 1.5 TH / s and left mine.

By the beginning of March, 0.04026 btc came running. I checked the conclusion (I can recommend bestchange.ru for choosing the exchanger): I stopped at the hashflare variant → cryptopay.me → x-pay.cc → Tinkoff Black, c sent 0.04 btc to the card I received 2,608.83 rubles (65,220.75 rub / btc) at a market rate of about 67,000 rub / btc.

Questions began to appear - Is it not enough for 2.5 months? What is the annual rate? How soon can I go to zero? - and I began to count.

HashFlare has a complete history of operations in your account:

Also, there is a capacity purchase journal:

This is quite enough to start. I take all this and bring in divine form:

Here I will explain a couple of nuances:

Types of operations

For the calculations, only payments for mining (pay) and charges for maintenance (mt) matter, blank lines are reinvestment operations, which are not taken into account.

Units of power (unit)

In order not to become attached to his capacities, but to make the calculations more universal, I decided to bring all the amounts to a unit of power. To obtain comparable values, the SHA-256 unit selected 0.1 TH / s, and the Scrypt unit selected 1 MH / s. Thus, in the BTC per unit column, the amount of the operation in terms of unit capacity of the corresponding algorithm was obtained.

Now I will present this data in a more convenient form for analysis - by day, I place the operations in columns:

Here, even visually begin to be traced fluctuations in amounts. Let's draw them:

So-so tendency - payments fall, charges for service begin to take away all the greater part of them.

I will make a small lyrical digression about charges for service . On bitmakler and other resources, Hashflare customers are outraged by the growing share of write-offs in payments, without thinking about how they are calculated. To understand this, just look at the frequently asked questions on the site of the service, it is written there in Russian and white:

Maintenance fee and electricity are 0.0035 USD for every 10 GH / s SHA-256 and 0.01 USD for every 1 MH / s Scrypt. For Ethereum contracts no fees are charged.If representatives of Hashflare read this, correct “the fee is charged in BTC” and the rest of the typographical errors in the FAQ;)

Maintenance and electricity charges are not billed separately. The fee is deducted from the user's balance at the time of the daily accrual of the designated funds. Although the balance sheet is kept at BTC and the service charge is in USD, the fee is charged at BTC at the current USD / BTC exchange rate, which is beneficial for the client if the exchange rate grows, since more BTC remains on the client’s account.

There's also a little messy about the calculation of the amount of write-offs in btc. And let's check! For this we need to perform the reverse operation. It’s a bit confusing with buy / sell rates, time zones, etc., but we’ll take a course to open usd / btc from the FAQ specified in investing.com and use it to calculate write-offs for the completed day:

Let's draw:

And here I am in some confusion. The charges for Scrypt confidently keep at the level of the promised 0.1 usd per 1 MH / s. But the write-off for SHA-256 is somehow strange sausage from 0.0354 to 0.0409 usd per 0.1 TH / s instead of the promised 0.035 (remember that the amount for 10 GH / s is indicated in the FAQ, and in the calculations SHA-256 unit - 100 GH / s). If someone tells me where I was wrong, I will be grateful. Otherwise, I would like to receive comments from a HashFlare representative .

Let's return to the question of annual interest. To do this, prepare the following data:

Explanation of indicators:

- ret, $ - return, the difference between payment and withdrawal of service in terms of usd

- int,% - interest, shows what part of the cost of a unit of power will give a return for 365 days, let's call this “annual interest”, but do not forget that, unlike a bank deposit, the investments must be subtracted from the amount received

Let's draw:

The percentage does not stand still and depends mainly on the btc rate (remember about the almost fixed for fiat currency write-offs for services). For comparison, here is the btc rate chart for the same period:

The annual percentage seems to fall equally with the course, and grows twice as slowly.

The final calculations remain based on the obtained detailed data, which give answers to the questions I am interested in:

The average annual percentage for the period of 83 days -

103.16% for SHA-256 and 86.30% for Scrypt

The payback period for investments with such percentages is 385 days.

In less than 3 months, almost 20% of the invested funds returned (such deposits never dreamed of), and in 10 months, if the situation doesn’t change much, I’ll go to zero and start making a profit. I hope that the btc course will only grow, and HashFlare will get stronger and not increase the cost of maintenance :)

All my calculations are

UPD: By the way, you can make yourself a copy of the document and recount everything on your data. There will be questions - please contact.

UPD 06/03/2017: The growing rate of BTC has a very positive effect on the overall picture.

Average annual percentage by months:

But do not forget that all calculations are made taking into account the prices of the end of 2016, now they are already higher.

Source: https://habr.com/ru/post/402295/

All Articles