What influenced the course of Bitcoin in 2016

2016 was a year of big surprises - and these surprises affected the price of Bitcoin for the better. Coindesk listed the main events that influenced the price of cryptocurrency in the past year.

For the year, the Bitcoin course experienced four big waves

For the year, the Bitcoin course experienced four big waves

Over the year, the rate of cryptocurrency increased from $ 430 at the beginning of the year to $ 845 at the time of posting. The main factors that influenced the bitcoin rate this year were: Brexit, breaking into the Bitfinex exchange and halving the remuneration during mining from 25 BTC to 12.5 BTC per block. And if the events connected with the functioning of cryptocurrency slowed down or churned, then any external crises - first of all, political ones - consistently add value to Bitcoin.

Brexit was one of the most powerful crises of the year - 52% of the votes for the UK leaving the EU came as a complete surprise even to supporters of this idea. The pound collapsed along with hopes for a bright future for a united Europe, and Bitcoin jumped in just one day from $ 551 in the morning of June 23, the day of the referendum, to $ 625.49 the next day, when the results became known.

')

Coincidentally, regular bitcoin halving took place immediately after the referendum in the United Kingdom, and took place on July 9, 2016. Halving the block reward is bad news for miners, but good for bitcoin: the more scarce it becomes, the higher its price.

During the year after the previous halving on November 28, 2012 , the price of this crypt increased a hundred times: from 12 to 1,200 dollars per coin. Before halving this year, bitcoin rose to $ 704.42 on July 3, and fell to $ 664.74 on July 8, on the eve of the halving. After the event took place, the price of Bitcoin settled in the area between $ 625 and $ 675.

Pytar ivkowski, the COO of the Whaleclub exchange, explained to Koindescu that by itself the idea of a bitcoin deficit pushes its value to new heights.

Arthur Heiss, co-founder and CEO of the BitMEX exchange, with great skepticism appreciated the importance of halving: "The price from January to July has hardly doubled."

However, as 2012 showed, the halving effect is long-term - so the continued rise in the cost of Bitcoin throughout 2016 can be attributed to the increase in the complexity of its production.

The next halving is tentatively on July 2, 2020 .

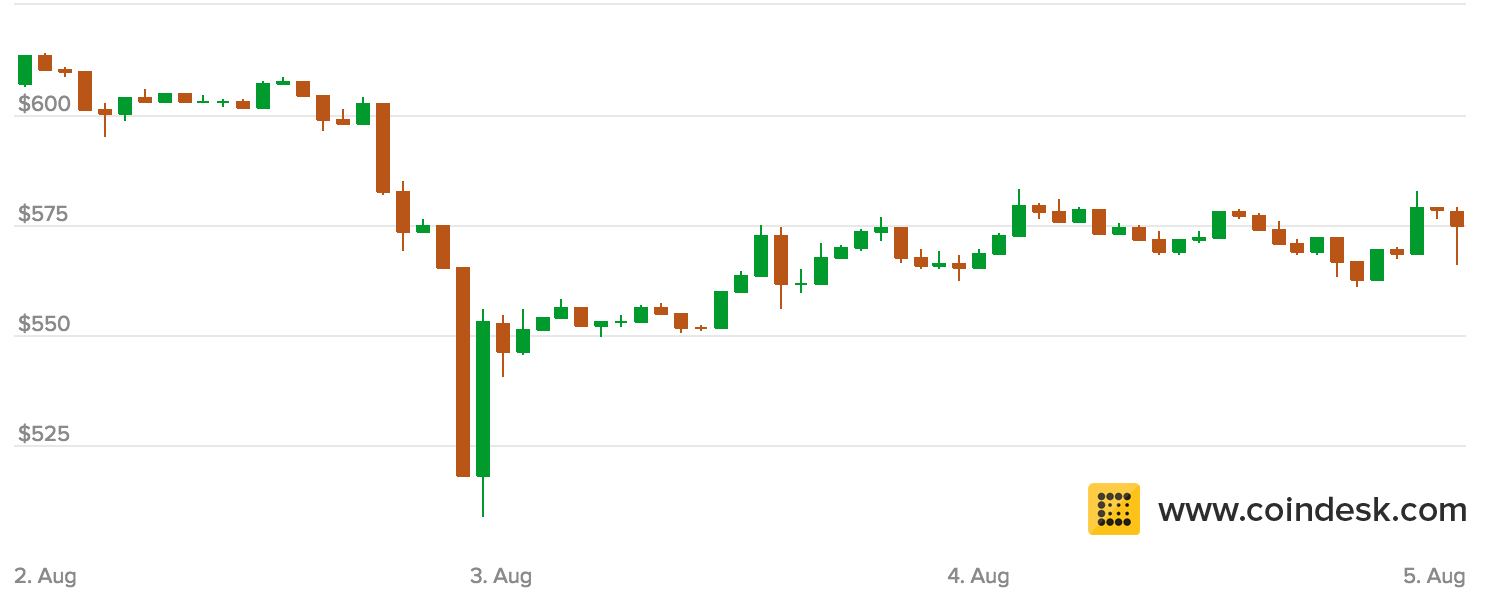

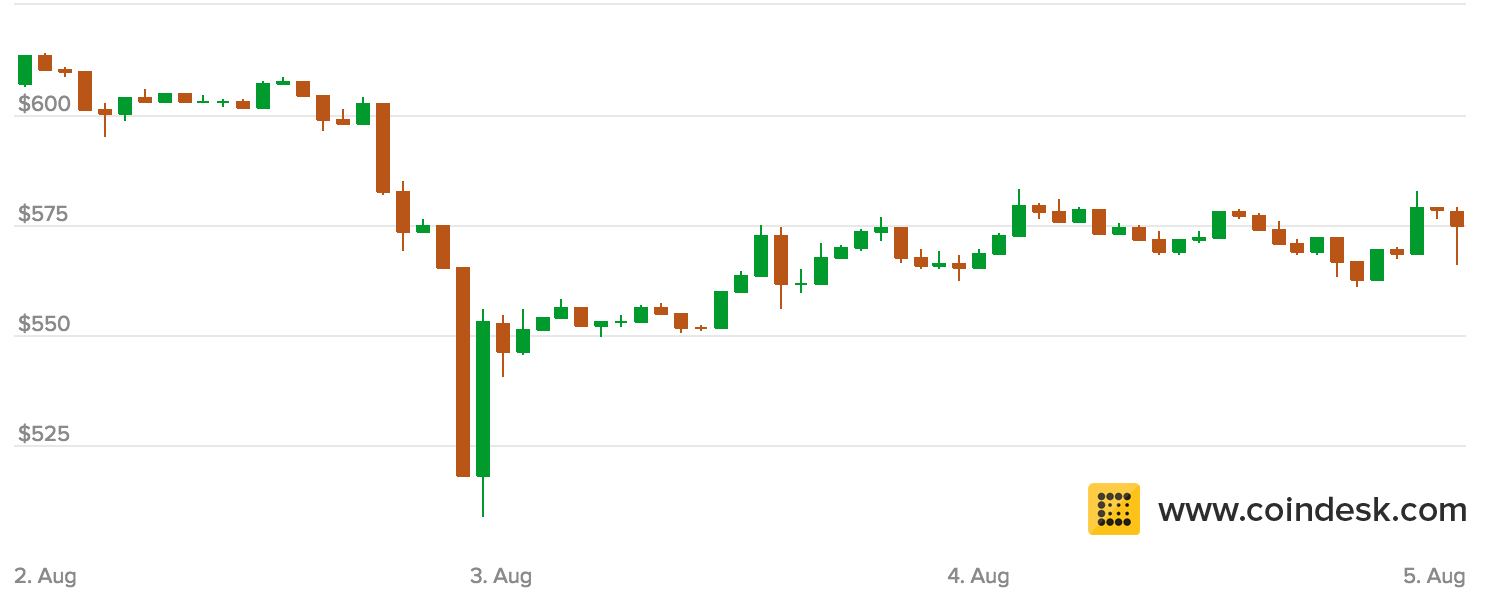

The Bitfinex exchange hack, which took place on August 2 and ended with the withdrawal of 120,000 bitcoins, was the hardest hit on the cost of cryptocurrency in the outgoing year, leading to a collapse from $ 607.37 to $ 480 in one day. However, by August 4, prices returned to the level of $ 580.

On this occasion, Arthur Hayes told Koindescu that the hack gave rise to doubts about the viability of startups managing a huge amount of customer money and made them start thinking twice before sending cryptocurrency or Fiats to any exchange at all. And although the market eventually digested this event, if not for hacking, then the Bitcoin course today could be even higher.

In turn, Zhivkovski again stands up for Bitcoin, arguing that Bitfinex was a small player whose file is not capable of undermining the value of Bitcoin as a whole.

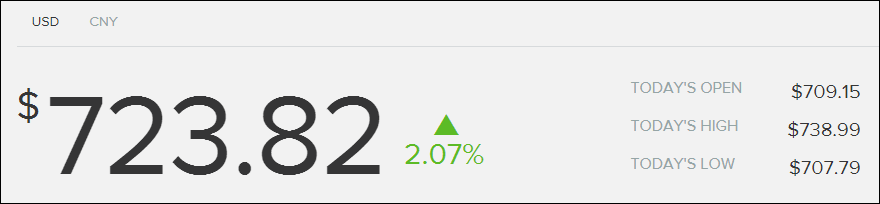

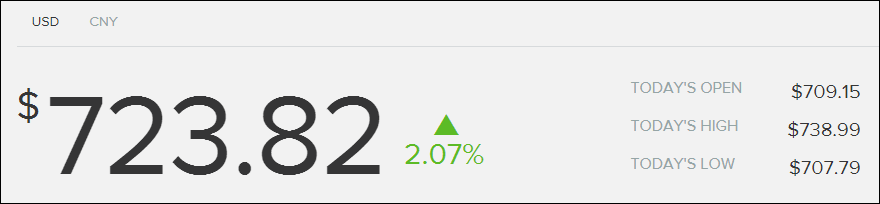

The election of the President of the United States was the next big event in 2016, the approximation of which was felt by the state with the exchange rate. And although the growth in itself was not as significant as many expected , reaching only 4% (from $ 709 to $ 739 on November 9) - this happened against the background of a temporary fall in stock market indices around the world.

Such big events as Brexit and elections in the US, along with a bunch of small ones, such as restrictions on the amount of cash in India , demonstrate the same effect: while traditional markets react to unpleasant surprises by falling prices, the Bitcoin rate is growing.

As the year 2016 showed, a surge in bitcoin quotes against the background of historical events is always speculative, and quickly refuses to go back, so in itself this is more good news for speculators than just supporters of cryptoeconomics.

Another thing is more important here: what exactly Bitcoin is considered as a “safe haven”, an alternative to traditional currencies and investments, which allows you to survive shakes in the market. This happens for two reasons: first, the independent nature of Bitcoin looks attractive in principle against the background of crises, which have quite a man-made political nature. And secondly, specifically Bitcoin already against the background of all other cryptocurrencies, which are becoming more and more, seems to be a more reliable investment due to its prevalence.

Events such as Brexit, Trump, or the breaking of the exchange are speculative factors that, of course, are not in themselves worth considering as arguments for or against investments in cryptocurrency because of their random nature. But they definitely help to better understand the place of Bitcoin in the modern financial system.

At the end of the year, the bitcoin rate is growing strongly again: today the rate has already struck $ 850 and by the new year "with 65% confidence" they are waiting to overcome the $ 900 level - and although analysts believe that the nature of this growth, again, is purely speculative, this does not negate That bitcoin’s long-term trend is going up. Especially should win those who can not spend all the coins, for example, the next halving in 2020.

The strength of Bitcoin is in its very nature: independence, transparency and democracy - and predictability, oddly enough. At least, the next halving of awards during mining, expected up to a day, looks like a pleasant contrast against the background of the absolute unpredictability of the collapse of traditional currencies - for example, the possibility of an upcoming fourth explosive devaluation of the ruble already discussed in the media (sorry for bad news in the morning).

2016 is called by many as a lousy and crazy year. But we in HashFlare were convinced that it is precisely among the general madness that Bitcoin is a very reasonable choice.

For the year, the Bitcoin course experienced four big waves

For the year, the Bitcoin course experienced four big wavesOver the year, the rate of cryptocurrency increased from $ 430 at the beginning of the year to $ 845 at the time of posting. The main factors that influenced the bitcoin rate this year were: Brexit, breaking into the Bitfinex exchange and halving the remuneration during mining from 25 BTC to 12.5 BTC per block. And if the events connected with the functioning of cryptocurrency slowed down or churned, then any external crises - first of all, political ones - consistently add value to Bitcoin.

Britain is out. Long live bitcoin

Brexit was one of the most powerful crises of the year - 52% of the votes for the UK leaving the EU came as a complete surprise even to supporters of this idea. The pound collapsed along with hopes for a bright future for a united Europe, and Bitcoin jumped in just one day from $ 551 in the morning of June 23, the day of the referendum, to $ 625.49 the next day, when the results became known.

')

Halving

Coincidentally, regular bitcoin halving took place immediately after the referendum in the United Kingdom, and took place on July 9, 2016. Halving the block reward is bad news for miners, but good for bitcoin: the more scarce it becomes, the higher its price.

During the year after the previous halving on November 28, 2012 , the price of this crypt increased a hundred times: from 12 to 1,200 dollars per coin. Before halving this year, bitcoin rose to $ 704.42 on July 3, and fell to $ 664.74 on July 8, on the eve of the halving. After the event took place, the price of Bitcoin settled in the area between $ 625 and $ 675.

Pytar ivkowski, the COO of the Whaleclub exchange, explained to Koindescu that by itself the idea of a bitcoin deficit pushes its value to new heights.

Arthur Heiss, co-founder and CEO of the BitMEX exchange, with great skepticism appreciated the importance of halving: "The price from January to July has hardly doubled."

However, as 2012 showed, the halving effect is long-term - so the continued rise in the cost of Bitcoin throughout 2016 can be attributed to the increase in the complexity of its production.

The next halving is tentatively on July 2, 2020 .

Hacking Bitfinex

The Bitfinex exchange hack, which took place on August 2 and ended with the withdrawal of 120,000 bitcoins, was the hardest hit on the cost of cryptocurrency in the outgoing year, leading to a collapse from $ 607.37 to $ 480 in one day. However, by August 4, prices returned to the level of $ 580.

On this occasion, Arthur Hayes told Koindescu that the hack gave rise to doubts about the viability of startups managing a huge amount of customer money and made them start thinking twice before sending cryptocurrency or Fiats to any exchange at all. And although the market eventually digested this event, if not for hacking, then the Bitcoin course today could be even higher.

In turn, Zhivkovski again stands up for Bitcoin, arguing that Bitfinex was a small player whose file is not capable of undermining the value of Bitcoin as a whole.

Trump effect

The election of the President of the United States was the next big event in 2016, the approximation of which was felt by the state with the exchange rate. And although the growth in itself was not as significant as many expected , reaching only 4% (from $ 709 to $ 739 on November 9) - this happened against the background of a temporary fall in stock market indices around the world.

Such big events as Brexit and elections in the US, along with a bunch of small ones, such as restrictions on the amount of cash in India , demonstrate the same effect: while traditional markets react to unpleasant surprises by falling prices, the Bitcoin rate is growing.

As the year 2016 showed, a surge in bitcoin quotes against the background of historical events is always speculative, and quickly refuses to go back, so in itself this is more good news for speculators than just supporters of cryptoeconomics.

Another thing is more important here: what exactly Bitcoin is considered as a “safe haven”, an alternative to traditional currencies and investments, which allows you to survive shakes in the market. This happens for two reasons: first, the independent nature of Bitcoin looks attractive in principle against the background of crises, which have quite a man-made political nature. And secondly, specifically Bitcoin already against the background of all other cryptocurrencies, which are becoming more and more, seems to be a more reliable investment due to its prevalence.

Events such as Brexit, Trump, or the breaking of the exchange are speculative factors that, of course, are not in themselves worth considering as arguments for or against investments in cryptocurrency because of their random nature. But they definitely help to better understand the place of Bitcoin in the modern financial system.

At the end of the year, the bitcoin rate is growing strongly again: today the rate has already struck $ 850 and by the new year "with 65% confidence" they are waiting to overcome the $ 900 level - and although analysts believe that the nature of this growth, again, is purely speculative, this does not negate That bitcoin’s long-term trend is going up. Especially should win those who can not spend all the coins, for example, the next halving in 2020.

The strength of Bitcoin is in its very nature: independence, transparency and democracy - and predictability, oddly enough. At least, the next halving of awards during mining, expected up to a day, looks like a pleasant contrast against the background of the absolute unpredictability of the collapse of traditional currencies - for example, the possibility of an upcoming fourth explosive devaluation of the ruble already discussed in the media (sorry for bad news in the morning).

2016 is called by many as a lousy and crazy year. But we in HashFlare were convinced that it is precisely among the general madness that Bitcoin is a very reasonable choice.

Source: https://habr.com/ru/post/400071/

All Articles