Trading in the era of robots and Bitcoin - the Russian FinTech Meetup # 2 took place in Moscow

All photos can be viewed in the album on the Facebook page .

')

Presentations

Fedor Pshirkov (Datalogia) - Download

Pavel Fedorov (TRData) - Download

Alexander Ivanov (Waves) - Download

The event was organized by the Russian FinTech community, which includes:

- Alexander Ivanov (CEO Waves Platform ),

- Vladimir Maslyakov (CTO of the Klyuch hub),

- Dmitry Faller,

- Maria Popova ( Digital October ),

- Vitaly Tsigulev (CEO of communication agency Digital Finance ),

- Natalia Kosyanova (event- and media manager of the Klyuch hub),

- Fedor Pshirkov (managing partner in Datalogia ).

Mitap opened with a speech by Fedor Pshirkov, managing partner of Datalogia consulting company. His presentation was devoted to the topic: "Algo Revolution 2.0 - the evolution of approaches to the construction of algo-strategies."

In the course of his speech, Fedor told about the history of the development of trading technologies from the beginning of the 20th century up to the present moment. The starting point of Pshirkov’s story was the case of the famous trader of the first half of the 20th century, Jesse Livermore, who made a fortune from the collapse of the American market during the Great Depression. According to Fedor, the main instrument of trading in the first half of the 20th century was the calculation and construction of trading strategies on paper. The simplest tools and the primary analysis worked. One of the methods of the time - plotting on transparent paper to overlay on other graphs to identify coincidences and divergences in trends. The main competitive advantage was information and data access.

In the 1980s, technical analysis systems were used by introducing the CQG terminals into the trading process. The minuses of the terminals were the impossibility of checking them with the help of backtesting . In this connection, supersystems began to appear, the cost of which was $ 3,000.

After 2005 there was a jump in algorithmic trading. Appeared brokerage API. The process of trading was influenced by machine learning technology and big data analysis.

In the course of his speech, Fyodor cited the shortcomings of the formed algo methods.

- Hindsight bias error - forecast based only on a retrospective.

- Look forward bias. use of trading information with a delay, without access at the current time.

- Data snooping bias . If there are many systems, then the probability of obtaining a positive result is random.

- Bad data. Lack of purity and asynchronous data, leading to errors in trading.

- Survivor's error (survivorship bias). Generalization of data only on the basis of positive results.

- Over fitting. The problem, the occurrence of which is due to the use of advanced methods of analysis. With this approach, the model can adapt to "random noise" and be mistakenly sharpened for results that can not be repeated.

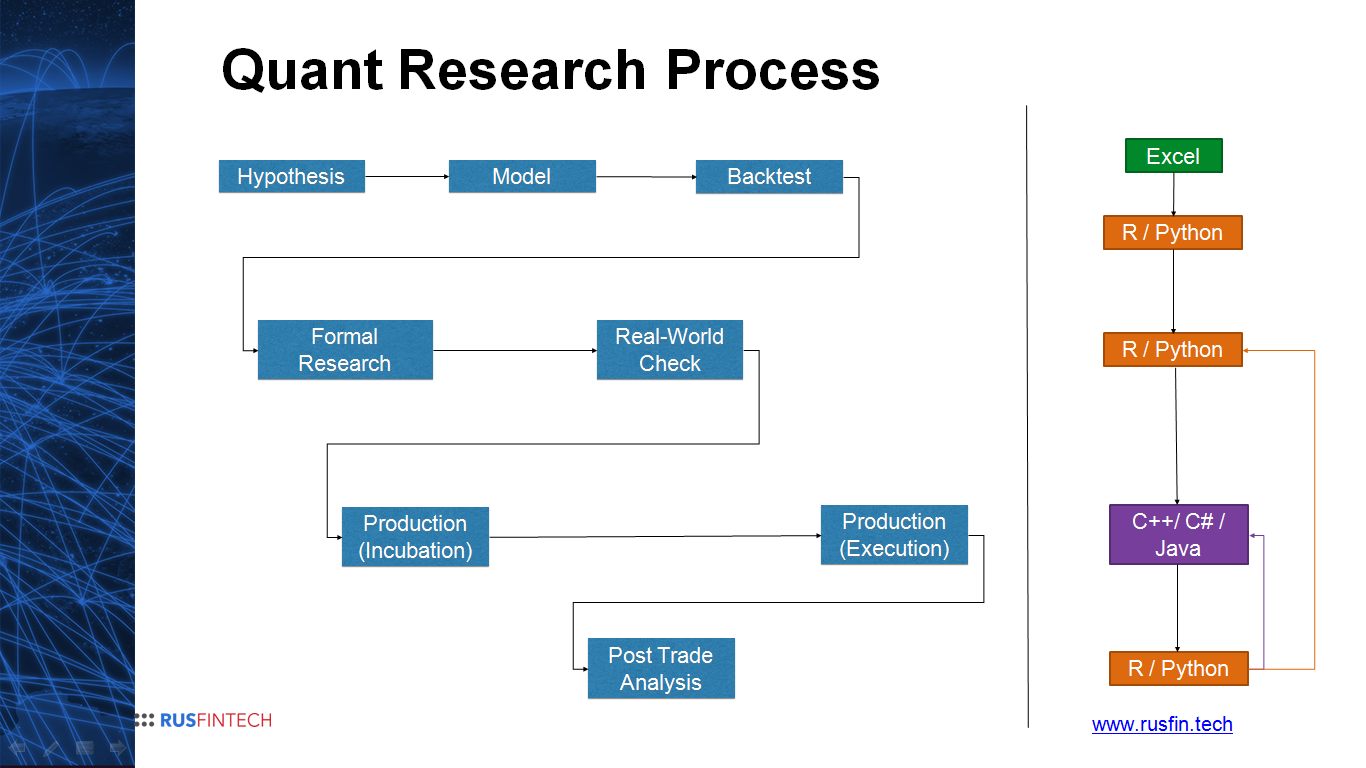

After listing the problems, Fedor cited a flowchart consisting of the research stages used by leading market players. According to practice, the study is based on data, observations, and hypotheses. Then testing hypotheses against facts. The speaker presented a block diagram with a list of tools that can be used at each stage of its implementation.

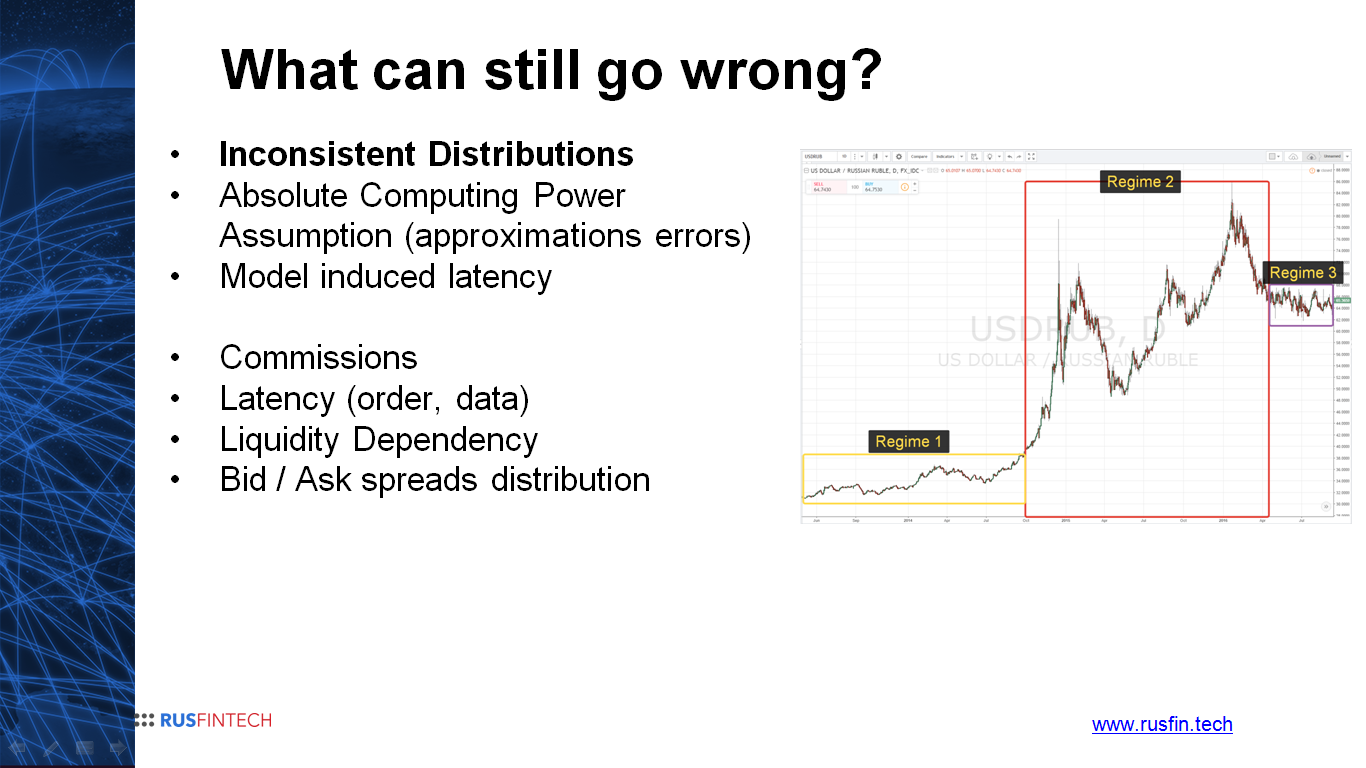

Using the example of a graph showing the transition of the market to different modes, Pshirkov highlighted possible “pitfalls” in the work of algorithmic models:

- Inconsistent distribution of price series. If the market moves from Mode 1 to Mode 2, the model should disconnect based on the discrepancy of the changes that have occurred to the programmed expectations of the model.

- Misconception about absolute computer power. Calculations that can be successfully carried out at the testing stage cannot always be effectively used in a real market environment.

- The resource-demanding model will generate delays that will become noticeable at the most inappropriate moment.

- The need to account for non-permanent fees. The need to understand the cash flow of an algorithmic model.

In addition to the above nuances, Fedor also highlighted:

- Delays

- Liquidity,

- Spread between bid and ask.

Pavel Fedorov, a representative of the platform for real-time market monitoring of TRData, followed Fedor on the scene.

Pavel spoke about the advantages of the solution against the background of current trends in trading.

The series of speeches ended with the presentation “Cryptocurrencies: new perspectives for trading”, prepared by the founder and CEO of the blockchain platform Waves Alexander Ivanov. The speaker spoke about current trends in the cryptocurrency market.

Alexander began with the history of the bitcoin market since its inception in 2008. Ivanov mentioned the first Bitcoin exchange Mt.Gox , founded in 2010 in Japan by the French programmer Mark Carpeles . The exchange closed in 2013 due to the presence of technical infrastructure vulnerabilities and repeated withdrawals of funds by hackers. According to Alexander, all major cryptocurrency exchanges are at risk of hacking and stealing funds. As a recent example, Ivanov cited the August hacking of Bitfinex with the subsequent withdrawal of about $ 70 million.

Despite all the risks, cryptocurrency trading attracts players with opportunities for earning. According to Alexander, the cryptocurrency market is inefficient. Between the exchanges, there are arbitrations to bypass financial control. The market is unregulated and very volatile. Regimes are constantly changing in the market.

According to Ivanov, the cryptocurrency market will move in the direction of regulation and efficiency. Arbitrage opportunities will gradually disappear. High-frequency trading will develop, there will appear trading networks similar to the already existing ones intended for trading stocks. Trade funds will enter the market.

Using the example of his Waves platform, Alexander described the advantages of the blockchain in trading, which is the lack of access by exchanges to money traders. With this approach, the central exchange matches orders, and all transactions occur on the blockchain.

During his speech, Ivanov listed the prospects for using blockchain technology in stock markets:

- Markets transferred to the blockchain do not have sufficient speed of operations, but they can provide transparency and decentralization of business processes. As an example, Alexander cited the Nasdaq Linq project.

- The technology of the distributed registry allows you to combine the processes of interaction between exchanges, brokers, depository, clearing systems and clearing houses. The blockchain cannot provide fast operations, but within these processes transparency is more important than speed.

In the final part of his speech, the founder of Waves made several conclusions and predictions:

- The cryptocurrency market is very inefficient and you can earn money on it.

- In the cryptocurrency market, technical analysis is effective.

- Arbitrage bots work well.

- Securities transactions will be transferred to the blockchain. The need for an IPO will disappear. Exchange transactions will be carried out using smart contracts.

- The development of settlement systems and exchange clearing on the blockchain will occur.

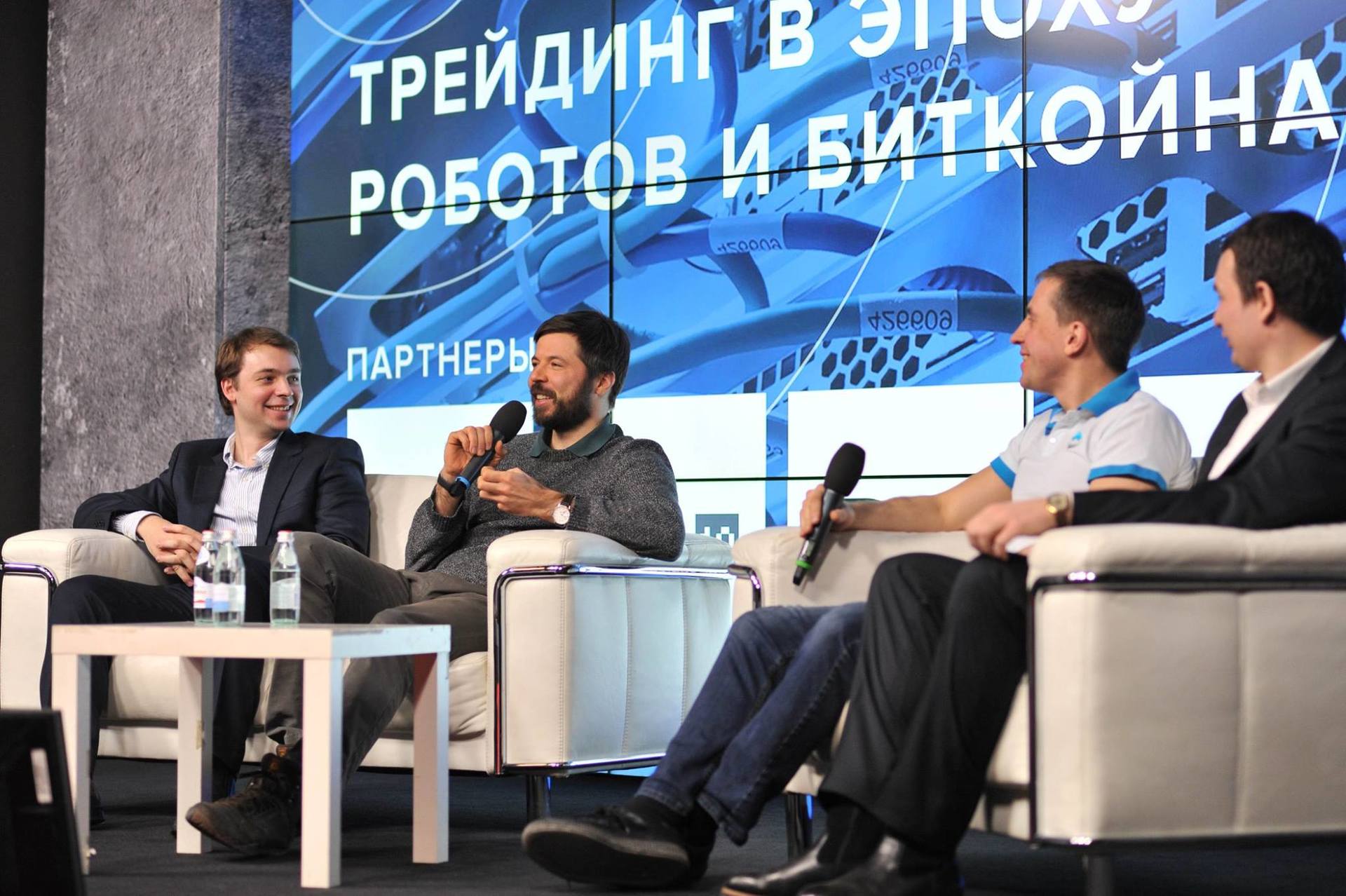

During the round table, which began immediately after Alexander's speech, other speakers joined the Waves founder: Fedor Pshirkov and Pavel Fedorov and CTO of the KL10CH tech-hub Vladimir Maslyakov.

The first question from the audience was addressed to Alexander Ivanov. CEO of Digital Finance communication agency Vitaly Tsigulev asked which currency pairs to trade the most profitable. The Waves founder advised to try Bitcoin trading against the US dollar. Alexander recommended to pay attention to the new cryptocurrency, the price of which is changing rapidly. Ivanov recommended bitcoin trading in the context of arbitrage opportunities between Asian and European exchanges.

One of the guests of the event asked the founder of the Waves, what signs indicate that the exchange must go. According to Alexander, a large amount of funds indicates an increased risk of hacking the stock exchange, which means it will be safer to leave it.

Answering the question of one of the participants in the mitap, Vladimir Maslyakov noted that there is still no perfect algorithmic trading software on the Russian market.

Alexander Ivanov recommended to the guest mitap who inquired about the nuances of trading on the cryptocurrency market, to invest in volatile currencies. According to Fedor Pshirkov, in the cryptocurrency market it is possible to use long strategies in the distribution of cryptocurrencies and monitoring trading volumes.

Using derivatives as an investment tool in the cryptocurrency market, Fyodor Pshirkov recommended to carefully study the specifications of contracts and how to delve into their work.

During the discussion, Alexander Ivanov asked Fedor Pshirkov about his opinion on the effectiveness of the market. The managing partner of Datalogia replied that the statement about market efficiency means recognition of hedge funds by charlatans. According to Fedor, the market is inefficient, and first of all, in terms of the approaches of its participants. Vladimir Maslyakov, who joined the dialogue, noted that arbitrageurs and HFT -shniki make an efficient market.

The last question from the floor was devoted to the stability of cryptocurrency markets. According to Maslyakov, cryptocurrency can now be used without resorting to fiat. At the same time, cryptocurrencies are still not widespread. Alexander Ivanov expressed the opinion that the collapse of markets with the help of news manipulations and actions of cryptoanarchists is impossible.

In order not to miss the next RusFinTech mitap , follow the announcements on our blog, on the mitap page on Facebook or in the Telegram channel .

Source: https://habr.com/ru/post/399579/

All Articles