Berkshire Hathaway for the Internet

For us, in the processing company PayOnline , the procedure for selling a business is familiar firsthand . The author of the material compares the traditional international approach to acquiring companies with the method of the most famous investor in the world, Warren Buffett, at the same time telling about the results of incorporating the experience of the owner of Berkshire Hathaway into his work.

️

Warren Buffett is famous for his habit of making deals with one handshake and making one-page contracts. He often buys multibillion-dollar companies on the basis of just a few phone calls, usually without even meeting with the management personally or visiting production facilities of the purchased companies. Moreover, he usually pays below the market price and avoids working with investment bankers. Despite all this, he has accumulated a whole collection of more than 65 wholly owned companies, from See's Candies to Dairy Queen and Fruit of The Loom.

Today, its holding company Berkshire Hathaway is estimated at nearly $ 500 billion.

')

So why, then, if he pays below the market price, refuses long negotiations and does not hold a single personal meeting, wealthy entrepreneurs and families sell him their businesses? Because it simplifies everything.

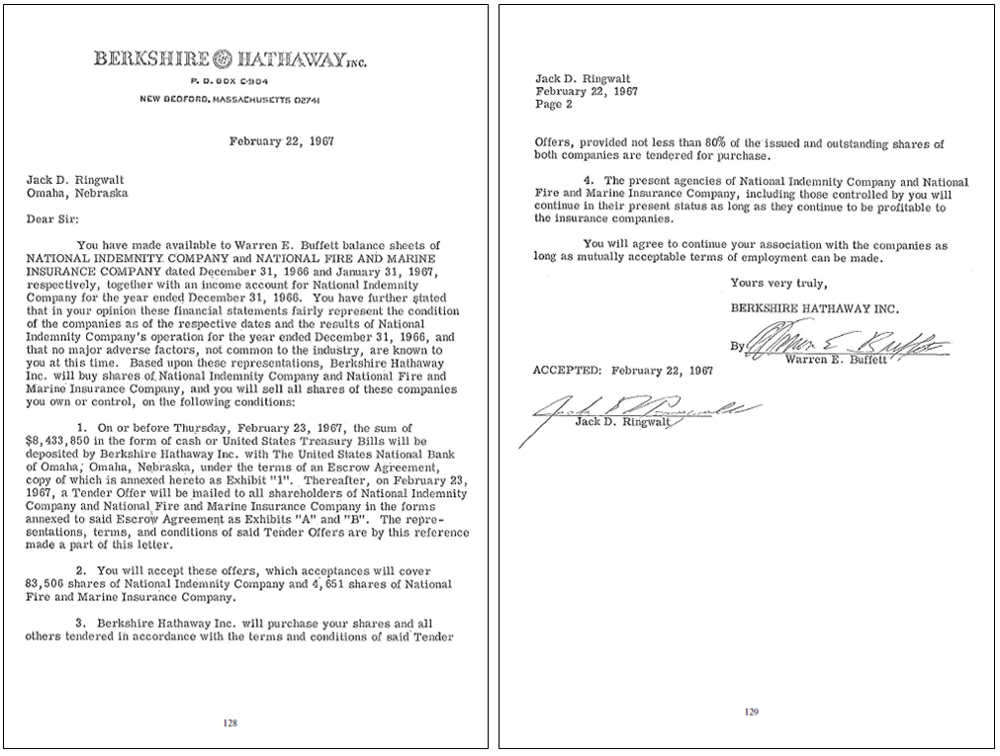

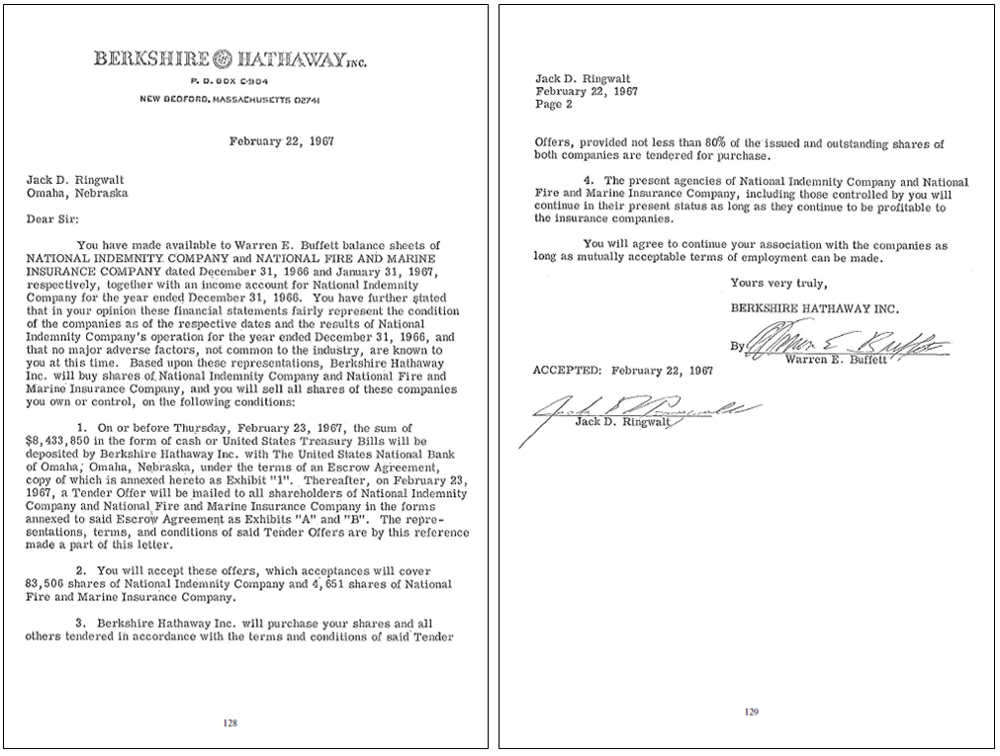

A simple two-page contract that Buffett signed for the purchase of National Indemnity for $ 8 million (61 million by the standards of 2017) in 1967.

Selling a business is actually a long and exhausting process, full of deadlocks and situations when you have to start all over again, hard negotiations and emotional “fires”.

As a rule, it takes from six months to a year and looks like this:

And now let's look at the process of buying a business according to Warren Buffett:

I think now you begin to understand why people like to sell companies to Warren Buffett, even if it costs them certain concessions? In addition to the general “painlessness” of the process, he also promises not to interfere with the work of the main business units, leave the current management on the ground and become the owner forever.

I own almost a dozen operating businesses, so those who want to buy them are always there. In the past, I was guided by the “always pick up” approach, and therefore whenever a potential buyer showed interest in one of my businesses, I always listened to the offer and considered the numbers. After all, everything has its price, I thought then ...

Over all these years, I have heard the desired price many times. I got excited and even decided for myself in my mind that in the next few years I would sell a variety of businesses. In reality, I managed to sell only one. Instead of driving around the district in my own “lembo” of pure gold, scattering money right and left, I myself went through all this depressing, time-consuming and time-consuming process described above. Over the past five years I have participated in 5 sales deals of various businesses. Only one of them I could bring to the end. On average, I spent 6 to 8 months a year working with them.

In short, my life in the last five years can not be called a fairy tale. In total, for months, I conducted senseless telephone conversations with potential buyers, worked with investment bankers, tried to bargain for the right conditions for transactions that were not closed as a result, forced my accountants team to constantly audit and check something. All this time I could work on the development of my business or just enjoy life. This whole undertaking turned out to be one big waste of time and very distracted me from managing my companies.

The funny thing is that if someone then played at Buffett and simplified the process, I would sell each of the businesses. Psychologically and emotionally, I was ready to complete the transaction. And at the same time I am an entrepreneur and got used to work at a fast pace. If I make a decision, I want to see how it comes to life. I could not understand why it was so important for customers to dig into the accounting routine. In one of the cases, we spent a month trying to figure out a 0.5% deviation between the revenue of two months. There was no need for such complication: all our companies are understandable, not burdened with excessive assets and easily verifiable business sources.

In general, these five years of torment were enough for me. I declare this process inoperative. We roll up our sleeves, go over to the other side of the barricades and become the kind of buyer we always dreamed of getting. From now on, we are creating Berkshire Hathaway for the Internet. We call it Tiny .

Opened earlier this year, Tiny takes the cue from Buffett, trying to make it so that owners can sell us their business easily and pleasantly. The first acquisition was Dribbble . The deal ended in January, a little more than two months after it began.

Owners of Dribbble Dan and Rich for many years seriously considered the possibility of acquiring their service by a third-party company, but the options offered to them earlier looked difficult. Buyers always asked for a comprehensive legal audit, intended to carry out fundamental changes in business after the purchase that threatened the culture of the company, and offered schemes with deferred remuneration or deals with shares. Such attempts looked frightening and aggressive, and therefore they abandoned them, focusing instead on their main activities.

When we turned to them, we made the process as painless as possible and did everything necessary to make them feel comfortable. We chose the path of Buffett.

Want to know what our process looks like? Everything is very simple. We focused on four key points:

Of course, we could spend another 3 months on an audit. We could begin to bargain and try to take them into a ditch. Could "marinate" their managers for weeks. But even if after all these actions we wouldn’t lose the deal, we would still ruin the newly minted partners and our relations with them would begin, to put it mildly, not in the way we would like.

Like the Berkshire approach, we also agreed to leave the existing team unchanged and not to go into the company's work at all. We are always ready to help with hiring important personnel (if the company’s management itself wants to replace them) and with any other issues (accounting, legal issues, strategy, etc.). At the same time, they always receive exactly as much attention from our side as they wish. Unlike traditional buyers, we plan to keep the course of things that has developed in the companies we have bought seriously and for a long time. We buy them because we believe that they are cool and would like them to continue to remain so.

I am glad to share with you that since the closing of the January deal with Dribbble, we have bought 3 more other companies. Each of these transactions took less than one month.

However, we will be realistic: we are still very far from Berkshire Hathaway, because we are Tiny, both literally and figuratively. Now we are still new to this business. Our market capitalization is many millions of times smaller than Berkshire, but we want to continue using the Buffett methodology to continue to buy more and more great Internet companies. While he focuses on railway companies and fast food chains, we want to buy simple, profitable Internet businesses with cool teams.

We know that there are thousands of phenomenal entrepreneurs in the world who want to sell their business without the risk of brain damage. They do not want their employees to be worn out in the process. They do not want to risk their business, trusting its customers, who can at any moment pump all the juice out of it and quit. They do not want to work in micromanagement conditions. I know this because I myself was in their place and every day I meet more and more such people.

And therefore tell everyone about it. Let everyone know that there is a better way to sell your business.

PS I understand why private equity firms and other traditional buyers use this approach. They play the role of trustees managing the money of large institutional investors, and if something goes wrong with the transaction, the phrase “I had a good feeling” will be the last thing they want to say to the real owners of the invested funds. I understand where the need arises to conduct a thorough audit, but I think that this difference gives us a particular advantage over the establishment.

️

Warren Buffett is famous for his habit of making deals with one handshake and making one-page contracts. He often buys multibillion-dollar companies on the basis of just a few phone calls, usually without even meeting with the management personally or visiting production facilities of the purchased companies. Moreover, he usually pays below the market price and avoids working with investment bankers. Despite all this, he has accumulated a whole collection of more than 65 wholly owned companies, from See's Candies to Dairy Queen and Fruit of The Loom.

Today, its holding company Berkshire Hathaway is estimated at nearly $ 500 billion.

')

So why, then, if he pays below the market price, refuses long negotiations and does not hold a single personal meeting, wealthy entrepreneurs and families sell him their businesses? Because it simplifies everything.

A simple two-page contract that Buffett signed for the purchase of National Indemnity for $ 8 million (61 million by the standards of 2017) in 1967.

Buffett's approach against the traditional approach

Selling a business is actually a long and exhausting process, full of deadlocks and situations when you have to start all over again, hard negotiations and emotional “fires”.

As a rule, it takes from six months to a year and looks like this:

- Hiring an investment bank or broker (1 month)

Investment bankers can be compared with realtors in the business world. They help you bring your business to an ideal state in order to make it as attractive as possible for potential buyers, after which they look for those who want to buy it, lure them to make an offer to buy and conduct the negotiation process. - Create datarum (1 month)

Datarum (English, Data room) - a large catalog of all sorts of things that the buyer wants to know about your business. In particular, it includes financial statements, a table of capitalization, important contracts and obligations, legal disclosures and other such fun things. - Getting started with customers (1-2 months)

The employees of your investment bank make a huge list, sometimes consisting of hundreds of potential buyers. After that, they begin to build contacts with each company from the list individually in an attempt to determine if they are interested in your business. - Main show (1-2 months)

The list of buyers is reduced to a handful of companies that have already managed to delve into your data room. You start to call up with them and tell your story. If everything goes as it should, they, as a rule, fly to you for a day with a visit in order to get a better look at your business. In general, here you are waiting for endless telephone conversations, meetings, presentations and dinners. - The main conditions of the transaction and negotiations on them (1 month)

Most serious buyers send you their offers, usually in the form of a non-binding letter of intent, which reflects the intended structure of the transaction, its cost and so on. - Due Diligence (1-2 months)

You choose a buyer and agree on exclusivity, that is, that you agree not to tell the rest of it. Do you think the end of the epic is near? Think again, since this is where your visit to the proctologist begins. You get a huge list of required financial reports, KPI-metrics, legal checklists, examples of organizational charts and process documentation schemes, as well as everything else that the buyer wants to receive from you. But unless all this information was not in the datarum, you ask? No, never had. From now on, your entire team will be constantly distracted from the main activity, engaged in producing the data necessary for buyers in the form of whole “telephone directories”. During this period, the buyer will often meet with your management and soar them as in a bath, leaving no stone unturned in their peace of mind and efficiency. - Negotiations and attempts to bargain (1 month)

When a customer rummages through your company's activities and finds out about all of its weak points, he often starts bargaining and trying to change the previously agreed conditions in his favor. And here you understand that you have already spent 8-10 months on this whole business. You have no strength and you are tired of the deal. And then either you make some concessions just to finish what you have already begun, or the buyer decides to give up, simultaneously depriving the last year of your life of any meaning. - Closing a deal? (1-2 months)

If you are lucky, you will agree with the buyer about the transaction and complete this business with a handshake. I spoke on this subject with one of my friends, part-time successful investment banker. So he told me that, as a rule, successful closing of a transaction occurs only in 20% of cases. Therefore, only 20% of people going through this process, which takes 8-12 months, will come out of it with the result. Those who are in the remaining 80% will feel very dejected.

And now let's look at the process of buying a business according to Warren Buffett:

- Letter (1 day)

He asks the selling party to send a simple letter explaining why he should buy this or that company. The letter also contains some key financial indicators and a reasonable price for senders. - Analysis (2–5 days)

If he likes business, management and price, the process begins. - Offer (1 day)

He calls or writes to the owner and makes an honest offer. - Reaching an agreement (2-3 days)

If the buyer agrees to the price, the parties agree on certain details and Buffett sends a short contract, devoid of any elaborate legal jargon. - Closing a deal (4-8 weeks)

The parties are working on the usual legal issues and complete the transaction. If the current business owner is too hung up on certain details, like working capital, or is “punched” by sentimentality, Buffett is inferior, because he knows that in the long run all these disputes will turn out to be a trifle, not worth spending time and effort on it .

I think now you begin to understand why people like to sell companies to Warren Buffett, even if it costs them certain concessions? In addition to the general “painlessness” of the process, he also promises not to interfere with the work of the main business units, leave the current management on the ground and become the owner forever.

My five years of experience

I own almost a dozen operating businesses, so those who want to buy them are always there. In the past, I was guided by the “always pick up” approach, and therefore whenever a potential buyer showed interest in one of my businesses, I always listened to the offer and considered the numbers. After all, everything has its price, I thought then ...

Over all these years, I have heard the desired price many times. I got excited and even decided for myself in my mind that in the next few years I would sell a variety of businesses. In reality, I managed to sell only one. Instead of driving around the district in my own “lembo” of pure gold, scattering money right and left, I myself went through all this depressing, time-consuming and time-consuming process described above. Over the past five years I have participated in 5 sales deals of various businesses. Only one of them I could bring to the end. On average, I spent 6 to 8 months a year working with them.

In short, my life in the last five years can not be called a fairy tale. In total, for months, I conducted senseless telephone conversations with potential buyers, worked with investment bankers, tried to bargain for the right conditions for transactions that were not closed as a result, forced my accountants team to constantly audit and check something. All this time I could work on the development of my business or just enjoy life. This whole undertaking turned out to be one big waste of time and very distracted me from managing my companies.

The funny thing is that if someone then played at Buffett and simplified the process, I would sell each of the businesses. Psychologically and emotionally, I was ready to complete the transaction. And at the same time I am an entrepreneur and got used to work at a fast pace. If I make a decision, I want to see how it comes to life. I could not understand why it was so important for customers to dig into the accounting routine. In one of the cases, we spent a month trying to figure out a 0.5% deviation between the revenue of two months. There was no need for such complication: all our companies are understandable, not burdened with excessive assets and easily verifiable business sources.

In general, these five years of torment were enough for me. I declare this process inoperative. We roll up our sleeves, go over to the other side of the barricades and become the kind of buyer we always dreamed of getting. From now on, we are creating Berkshire Hathaway for the Internet. We call it Tiny .

New process

Opened earlier this year, Tiny takes the cue from Buffett, trying to make it so that owners can sell us their business easily and pleasantly. The first acquisition was Dribbble . The deal ended in January, a little more than two months after it began.

Owners of Dribbble Dan and Rich for many years seriously considered the possibility of acquiring their service by a third-party company, but the options offered to them earlier looked difficult. Buyers always asked for a comprehensive legal audit, intended to carry out fundamental changes in business after the purchase that threatened the culture of the company, and offered schemes with deferred remuneration or deals with shares. Such attempts looked frightening and aggressive, and therefore they abandoned them, focusing instead on their main activities.

When we turned to them, we made the process as painless as possible and did everything necessary to make them feel comfortable. We chose the path of Buffett.

Want to know what our process looks like? Everything is very simple. We focused on four key points:

- Do we trust them?

Dan and Rich have an impeccable reputation in the design community. We have a lot of mutual friends. We know for sure that if they say something about their business, then their words can be relied upon. - Are the numbers correct with a rough estimate?

Instead of spending months digging into the details of accounting, we focused on the overall picture. We looked at bank account statements, credit card transactions to quickly make sure that the business as a whole really corresponded to the profit and revenue figures given in the financial statements. So it was, and it does not matter that at the same time we found a couple of inaccuracies. The main thing is that, in general, the performance of their business corresponded to their statements. - Are there any major risks?

Did they sign any insane treaties? Do they owe money to anyone? Perhaps someone created a ring inside the company to conduct illegal cockfighting? (No no and one more time no.) - Can we explain their business, as well as the investment model, with one simple scheme?

How simple is the company? Will we be able to recapture the investment in a reasonable time? Can this business grow? The answer to all these questions was sure yes. Discussion of the basic conditions and the price of the transaction took us a week. We shook hands and closed the deal a little over two months after it began. Without any fuss or worry.

Of course, we could spend another 3 months on an audit. We could begin to bargain and try to take them into a ditch. Could "marinate" their managers for weeks. But even if after all these actions we wouldn’t lose the deal, we would still ruin the newly minted partners and our relations with them would begin, to put it mildly, not in the way we would like.

Like the Berkshire approach, we also agreed to leave the existing team unchanged and not to go into the company's work at all. We are always ready to help with hiring important personnel (if the company’s management itself wants to replace them) and with any other issues (accounting, legal issues, strategy, etc.). At the same time, they always receive exactly as much attention from our side as they wish. Unlike traditional buyers, we plan to keep the course of things that has developed in the companies we have bought seriously and for a long time. We buy them because we believe that they are cool and would like them to continue to remain so.

I am glad to share with you that since the closing of the January deal with Dribbble, we have bought 3 more other companies. Each of these transactions took less than one month.

Creating Berkshire 2.0

However, we will be realistic: we are still very far from Berkshire Hathaway, because we are Tiny, both literally and figuratively. Now we are still new to this business. Our market capitalization is many millions of times smaller than Berkshire, but we want to continue using the Buffett methodology to continue to buy more and more great Internet companies. While he focuses on railway companies and fast food chains, we want to buy simple, profitable Internet businesses with cool teams.

We know that there are thousands of phenomenal entrepreneurs in the world who want to sell their business without the risk of brain damage. They do not want their employees to be worn out in the process. They do not want to risk their business, trusting its customers, who can at any moment pump all the juice out of it and quit. They do not want to work in micromanagement conditions. I know this because I myself was in their place and every day I meet more and more such people.

And therefore tell everyone about it. Let everyone know that there is a better way to sell your business.

PS I understand why private equity firms and other traditional buyers use this approach. They play the role of trustees managing the money of large institutional investors, and if something goes wrong with the transaction, the phrase “I had a good feeling” will be the last thing they want to say to the real owners of the invested funds. I understand where the need arises to conduct a thorough audit, but I think that this difference gives us a particular advantage over the establishment.

Source: https://habr.com/ru/post/399143/

All Articles