Prospects for cryptocurrency and how to use blockchain technology - in Moscow, Russian FinTech Meetup # 1

Three speakers spoke at the meeting: Alexander Waves, founder and CEO of the blockchain platform Waves, CTO of the KL10CH tech hub, Vladimir Maslyakov, and Head of the Innovation Department of the Higher School of Economics, Blockchain Community member Marina Gureva. At the end of the series of presentations, a round table was held as part of the meeting, in addition to the three speakers listed above, Igor Khmel, the founder of the BankEx platform, and Konstantin Goldstein, an expert on strategic technologies at Microsoft, joined the speakers.

Mitap is organized by the Russian Fintech community, namely:

- Alexander Ivanov (founder and CEO of the Waves Platform ),

- Vladimir Maslyakov (CTO of the Klyuch hub),

- Dmitry Faller,

- Vitaly Tsigulev (CEO of the communication agency Digital Finance ),

- Natalya Kosyanova (event- and media manager of the Klyuch hub),

- Fedor Pshirkov (managing partner in Datalogia )

')

The event opened with a speech by Vladimir Maslyakov on the topic “The evolution of money: from seashells to bitcoins”. At the beginning of his presentation, the speaker singled out the theses cited by the English economist William Stanley Jevons , who formulated 3 basic functions of money:

- Value storage

- Medium of exchange

- Means of accounting.

Maslyakov himself derived his own theses based on the concept of Jevons:

- Value is the property of money to preserve capital,

- Portability / convertibility - the ability to exchange money for goods or other money,

- Reliability / stability - how much price fluctuation is strong, on which depends how easy it is to use this unit as a settlement system.

The speaker presented a three-dimensional scale to the guests of the event, which displayed settlement systems typical of different eras and civilizations: from barter exchange of livestock and using shells as currency to US dollars and cryptocurrencies.

Vladimir spoke about the appearance of the first Huiji paper notes in China in the 12th century in the era of the Song Empire. Currency could be converted to silk, gold and silver. Then it turned out that at the first fluctuations of the course, people would get out of this monetary system and begin to use bronze coins. The state in turn, with the help of legislation, tried for the first time to force people to use paper banknotes and pay taxes.

In the 18th century, Scottish economist Adam Smith proposed the “ invisible hand of the market ” theory. Smith believed that the lack of regulation of money leads to the replacement of gold and silver. In this case, the one who issues money without restrictions is capable of expanding his sphere of influence as the volume of the money supply and its distribution increase.

In the 19th century, a “ gold standard ” formed in Western Europe. Due to the fact that gold is difficult to mine and forge, this metal has become a central element of exchange.

After the end of the Napoleonic wars in Britain in the 19th century, the first paper money appeared, backed by gold. The Central Bank of England took control of the issue of banknotes and introduced the concept of " legal tender " at the legislative level - Legal tender.

Toward the end of the Second World War, the Bretton Woods system or the gold exchange standard replaced the “gold standard”. As a result, the US dollar has become the central world currency. 1 ounce of gold could be converted into $ 35. All other currencies of the world were pegged to the dollar.

The system collapsed in 30 years due to different rates of development of European countries. The currencies of economic leaders, such as Germany, have been revalued . In the 70s, with the development of the automotive industry there was a sharp jump in oil prices, and it became obvious that the peg of world currencies to the dollar was ineffective.

Vladimir Maslyakov singled out faith as a factor determining the value of money. Thus, according to the speaker, the internal properties of money have grown into external ones.

In the 20th century, states took control of emissions. In order to stimulate the circulation of money as a medium of exchange, the principle of payment for storage appeared - demurrage.

With the development of the Internet, digital currencies began to appear, including E-gold , Liberty Reserve and Bitcoin. According to Maslyakov, the bitcoin portability function is higher than that of gold. However, the speaker referred to the greater vulnerability of Bitcoin as a relatively young technology compared to reliable and proven for thousands of years gold. Vladimir led the calculations, according to which the potential for bitcoin turnover versus the dollar is 3-4 times undervalued. In the field of cryptocurrency, there is a trade-off between ease of exchange and reliability as a means of saving money.

Vladimir demonstrated the text of correspondence with Reddit, whose participants referred to the risks of Bitcoin due to the lack of understanding of the principle of forming the value of a currency and the tools of its control. At the same time, participants admitted that the processes of issuing and controlling dollars are also not at all transparent.

At the end of his speech, Maslyakov quoted Benjamin Franklin, who singled out the exchange function of money as the main one. The speaker added that in the era of the development of digital technologies, the information function of money also becomes important.

The series of speeches was continued by the founder of the Waves blockchain platform, Alexander Ivanov. He stressed the main thesis of the meeting RusFinTech - “Money is numbers”, meaning that modern money is information. Ivanov's presentation “Crowdfunding VS Venture” was devoted to the comparison of crowdfunding on the blockchain and venture financing as instruments for raising funds for the development of projects.

The speech of the Waves founder began with the rating of the largest crowdfunding campaigns, in which the platform developed under his leadership ranks 7th. By June this year, the project platform Waves has attracted with the help of collective investment of about 16 million dollars.

According to Alexander, the venture model originates in the United States, where the venture capital investment market rests on unicorns — projects whose capitalization exceeded $ 1 billion in the absence of clearly defined performance indicators. Taking into account the peculiarities of the Russian economy for projects seeking to attract funding, collective investment instruments are much more accessible. However, crowdfunding campaigns, for example, on the Kickstarter site, are reduced to collective support for projects rather than to collective investment. By investing in a project, users do not have the right to rely on profit, which means that this method of attracting funding is suitable for a limited number of projects.

Therefore, crowdinvesting becomes a logical continuation of crowdfunding, the model of which implies earnings prospects for co-investors in case of a project’s success. However, for the model of collective attraction of investments, legal regulation becomes necessary, which has not yet been created in Russia, which means that there is no established legal basis for such a concept.

The functionality developed by the Ivanov team of the Waves platform gives projects the opportunity to issue tokens - cryptographic analogues of securities. Interested in the success of a startup, crowdinvestors can provide support during the testing phase, give feedback on the product, as well as help in promoting it through recommendations to their friends. Thanks to the community created around the project, $ 1 raised through crowdinvesting is, according to Alexander, $ 3, obtained through the attraction of venture capital investments.

With this approach, the blockchain provides a natural distributed environment for the production of digital tokens without a single administrative center. The token can be sold, exchanged or transferred at the request of the owner. There are no regulatory restrictions, since the token is a digital unit.

The token emission process is called Initial Coin Offering or ICO. There is a demand for issued tokens due to the prospects of the project and the limited release of cryptographic analogues of securities. Binding a token to a project creates an investment potential in case of successful development of a startup.

According to Alexander, this model creates a new class of financial instruments that combine: a digital product, a share in the company and a voucher. The last of the listed properties of the token allows you to bind it to the products manufactured by the startup.

As an example of crowdinvesting on the blockchain, Ivanov cited a fundraising campaign to launch a social network. A way to monetize a project can be, for example, advertising and paid functionality. The cost of the token of this social network will grow as the number of its users increases. At the same time, the founders do not lose control over their project, since the tokens are strictly tied to the cost of products released by the startup.

With the 3rd final presentation on the topic “The current state of cryptoeconomics”, Marina Hureva, Director of the Department of Information Activities at HSE, made a presentation. At the beginning of her speech, Marina spoke about the blockchain school, which is held at the HSE base every Tuesday and Thursday with the support of the QIWI payment service and the Waves blockchain platform, and also announced the blockchain hackathon scheduled on November 11-13.

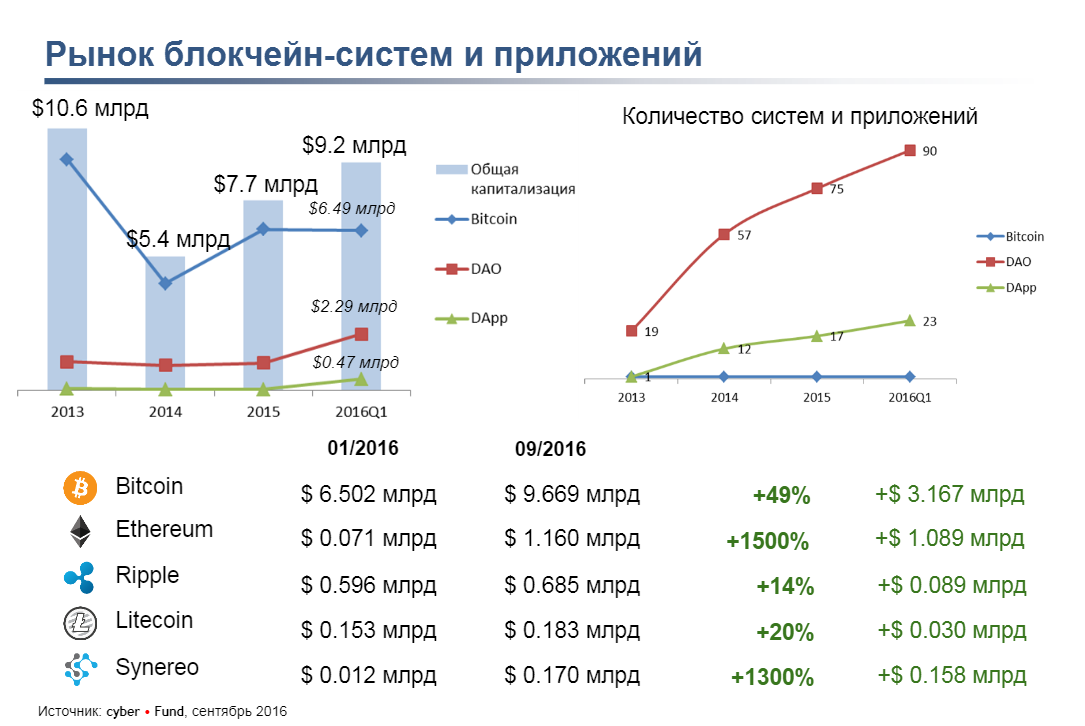

According to Marina, cryptocurrents are still a nascent, but already attractive market. Top 3 of the blockchain systems market is Bitcoin, Ethereum and Ripple.

In the course of her speech, Marina presented data illustrating modern cryptocurrency infrastructure.

The main trends in cryptoeconomics Gureva attributed the growth in the volume of transactions with bitcoins and the increase in the number of ATMs processing operations with cryptocurrencies. According to the speaker, Bitcoin is increasingly used in developing countries as a tool for storing funds, as well as an infrastructure for micro-payments.

The Ethereum project, developing as an open platform for blockchain applications,

- BitShares blockchain system based on Graphene II technology

- The blockchain-based social network Steemit, whose members can receive a reward in cryptocurrency for content generation,

- The Russian-language analogue and fork Steemit is the Voice project, created for users living in the post-Soviet space.

Gureva called the "bloody" development prospects for the blockchain. In her opinion, it will be more active to investigate this technology by countries that already occupy leading positions in the financial sphere. In Russia, the Central Bank is interested in the blockchain technology, as well as a number of financial organizations to create closed private blockchain systems.

At the end of a series of speeches, the guests of the meeting were expected to have a round table devoted to the topic “Services based on blockchain technologies”. In addition to the speakers who spoke earlier, Igor Khmel, the founder of the BankEx platform, and Konstantin Goldstein, an expert on strategic technologies at Microsoft, joined in the discussion.

During the round table, experts answered a number of questions from the audience. We publish the most interesting abstracts of the discussion below.

The main risk is to treat the blockchain and cryptocurrencies as a complete production-system, which should always work in all situations. Everything is just emerging, this is an experimental system.

There is a risk in the market overheating, in high expectations.

There is no legislation and it is not clear what it will be. There are local risks, the technology is not tested and this is natural. If technology has the potential, everything will evolve.

Blockchain is a database that will potentially be integrated with the same Internet of things. It is this integration / interaction that is still a security weakness.

DAO situation: $ 160 million investment, while the system is not debugged and there is a lot of hyip. As a result, a lot of people are skeptical about smart contracts and cryptocurrencies.

In Russia, crypto technology will definitely develop. There is a demand. We are at the beginning of the path, and in the future, the development of blockchain platforms will only stabilize.

We are moving with great speed towards the economy of intangible assets.

About 250 people took part in the first meeting of RusFinTech . In order not to miss the next RusFinTech mitap, follow the announcements on our blog, on the mitap page on Facebook or in the Telegram channel .

Full video from the event:

All photos can be viewed here .

Presentations

Vladimir Maslyakov (KL10CH) - Download .

Alexander Ivanov (Waves) - Download .

Marina Gurevoy (HSE) - Download .

Source: https://habr.com/ru/post/398837/

All Articles