90% of the largest Western banks are preparing or exploring solutions on the blockchain

It seems that more and more banks realize that “it’s impossible to live like this” - and they are looking for opportunities to update the fairly hardened banking industry with its slow, complicated and expensive payments, manual processing of transactions and many other problems using the blockchain. At least, this is evidenced by the results of a study by Accenture, which revealed that nine of the ten largest American Canadian and European banks are now studying the use of the blockchain in payments, writes CryptoCoinsNews.

Columbus brings blockchain to America

The study, entitled “ Blockchain: How Banks Develop a Global Network of Instant Payments, ” gathered the views of 32 top managers in the banking industry.

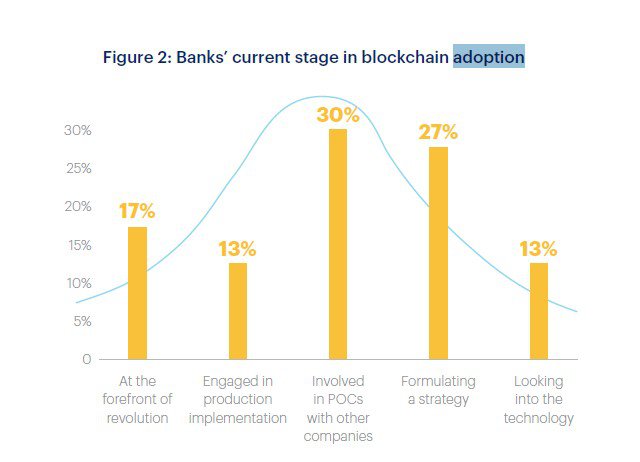

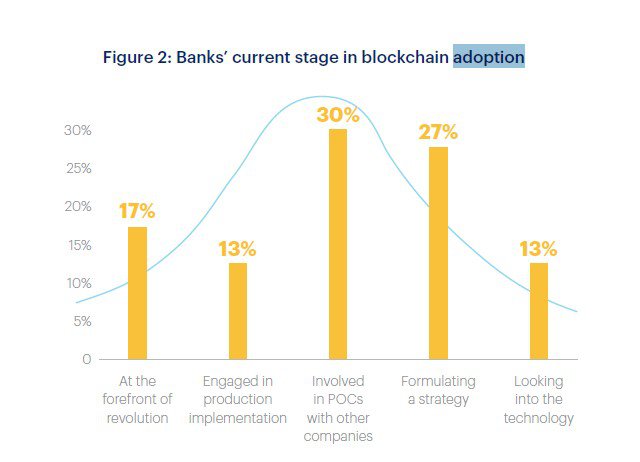

30% of these banks are already creating or planning to work on prototypes of distributed payment systems. 13% of banks are already engaged in the implementation of development on the blockchain. 17% of banks are already at the peak of progress, already using these solutions.

')

However, every tenth bank from this survey still looks at the situation somewhat differently. A Canadian bank, for example, claims that they do not have enough information to have an opinion on this matter. Here one could make jokes about Canada in the style of South Park, but we will not.

Another Canadian bank went further than a simple stupor in the question, and, examining the capabilities of the technology, came to the conclusion that the blockchain is not suitable for processing each payment.

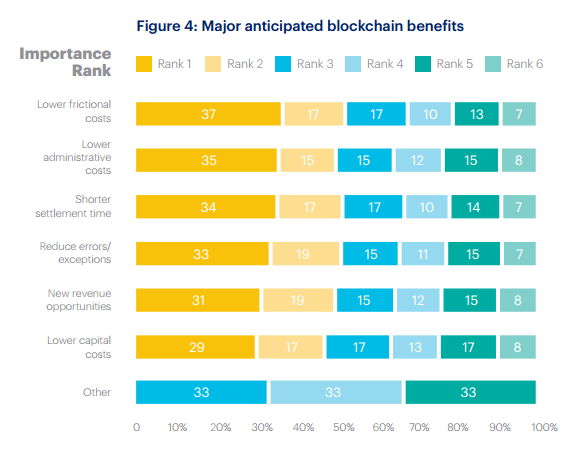

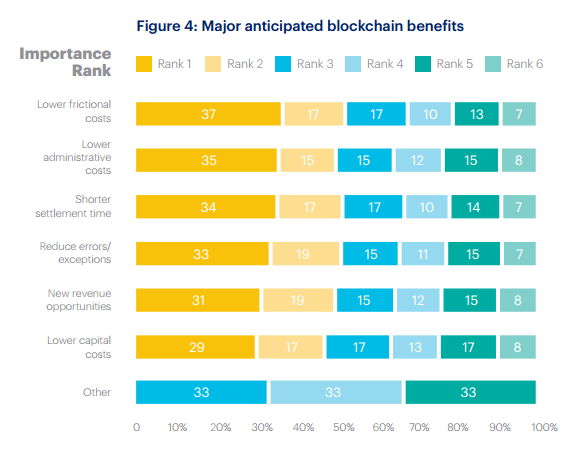

Mainly, banks see the blockchain as a way to save on administrative costs. Next in the list of priorities is a reduction in the time of payment and an increase in the efficiency of a transaction due to a smaller number of errors. And of course, banks are exploring the question of which blockchain opportunities for new earnings will open for them. For example, what new financial services and products can be created using transactions and real-time synchronization.

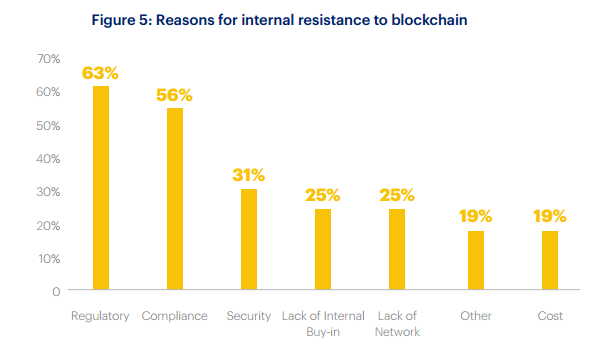

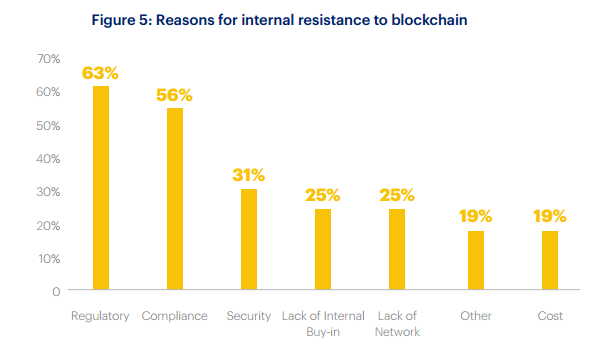

Analyzed in Accenture and factors hindering the transition of banks to the blockchain:

The main problems of banks with the blockchain are their own procedures and the need for their significant changes for new solutions. As the researchers write, behind all this is a more global problem: the inertia of thinking of some part of the management and shareholders of banks. Someone sees the strengths of innovation immediately, but someone needs to sort out the issue in detail before they make an important decision. It takes a lot of educational work, so that the advantages of the blockchain become more obvious to them, and the answers like: “It is not clear what the benefits of your offer are” - less often.

Most of the research participants agreed that no matter what decision the banks took as a result, this should not be a private club of the elect. The truly viable solutions banks see are those that will allow any non-banking structure - whether they are startups or technology giants like Google and Apple to be part of this ecosystem.

In another study , already conducted by IBM, he adds that at least 30 out of 200 surveyed banks will be working on blockchain solutions already in 2017.

One of the most striking signs of banks' willingness to change is a move toward open source projects. On November 30, the blockchord Corda of the R3 consortium uniting the world's largest banks will be included in the global Hyperledger project launched by the Linux Foundation in December 2015, whose task is to unite the efforts of various companies to create distributed payment systems for different industries. Laying out Corda in open access, R3 seeks thereby to ensure that their development becomes the global banking standard.

It is already clear that after a furious race for the creation of blockchain solutions, standardization and the development of common rules for games will be the next step in the adoption of the blockchain by the financial sector.

Columbus brings blockchain to America

The study, entitled “ Blockchain: How Banks Develop a Global Network of Instant Payments, ” gathered the views of 32 top managers in the banking industry.

30% of these banks are already creating or planning to work on prototypes of distributed payment systems. 13% of banks are already engaged in the implementation of development on the blockchain. 17% of banks are already at the peak of progress, already using these solutions.

')

However, every tenth bank from this survey still looks at the situation somewhat differently. A Canadian bank, for example, claims that they do not have enough information to have an opinion on this matter. Here one could make jokes about Canada in the style of South Park, but we will not.

Another Canadian bank went further than a simple stupor in the question, and, examining the capabilities of the technology, came to the conclusion that the blockchain is not suitable for processing each payment.

- Most banks are exploring the possibility of using the blockchain for intra-bank cross-border transfers.

- Two thirds of banks are exploring blockchain options for processing corporate payments.

- About half of the banks are exploring the blockchain for inter-bank cross-border transfers.

- A third of banks are interested in how inter-bank transfers will work on the blockchain.

- Direct transfers between individuals excite only 21% of banks, being in fifth place.

- Below is only the management of accounts and balances as such.

Mainly, banks see the blockchain as a way to save on administrative costs. Next in the list of priorities is a reduction in the time of payment and an increase in the efficiency of a transaction due to a smaller number of errors. And of course, banks are exploring the question of which blockchain opportunities for new earnings will open for them. For example, what new financial services and products can be created using transactions and real-time synchronization.

Analyzed in Accenture and factors hindering the transition of banks to the blockchain:

The main problems of banks with the blockchain are their own procedures and the need for their significant changes for new solutions. As the researchers write, behind all this is a more global problem: the inertia of thinking of some part of the management and shareholders of banks. Someone sees the strengths of innovation immediately, but someone needs to sort out the issue in detail before they make an important decision. It takes a lot of educational work, so that the advantages of the blockchain become more obvious to them, and the answers like: “It is not clear what the benefits of your offer are” - less often.

Banks go open-source

Most of the research participants agreed that no matter what decision the banks took as a result, this should not be a private club of the elect. The truly viable solutions banks see are those that will allow any non-banking structure - whether they are startups or technology giants like Google and Apple to be part of this ecosystem.

Inclusiveness is the most important requirement in terms of payment development. We should be able to pay anyone, anywhere. Only interbank payments are not needed.

- notes one of the Canadian top managers

In another study , already conducted by IBM, he adds that at least 30 out of 200 surveyed banks will be working on blockchain solutions already in 2017.

Changes and movement of the banking sector in the direction of the blockchain is much faster than many expected,

- summarize the research specialists IBM

One of the most striking signs of banks' willingness to change is a move toward open source projects. On November 30, the blockchord Corda of the R3 consortium uniting the world's largest banks will be included in the global Hyperledger project launched by the Linux Foundation in December 2015, whose task is to unite the efforts of various companies to create distributed payment systems for different industries. Laying out Corda in open access, R3 seeks thereby to ensure that their development becomes the global banking standard.

We want other banks and developers to create products based on our platform, and not everyone to develop their own platform, because it will lead to fragmented solutions and the impossibility of communication.

- James Carlyle, Senior Developer R3

It is already clear that after a furious race for the creation of blockchain solutions, standardization and the development of common rules for games will be the next step in the adoption of the blockchain by the financial sector.

Source: https://habr.com/ru/post/398613/

All Articles