2016 Nobel Prize in Economics awarded for contract theory

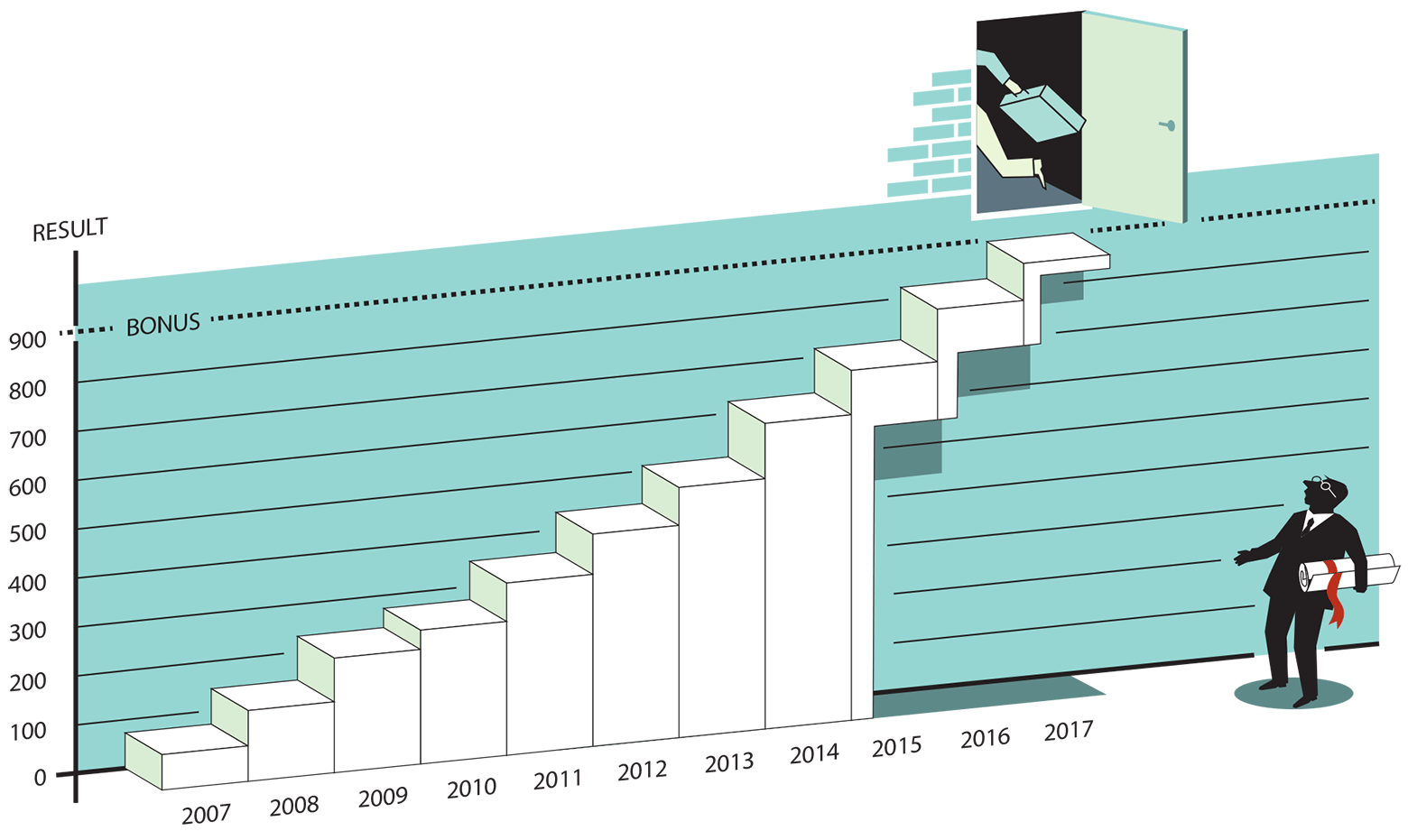

Illustration of Bengt Holmström’s work on remunerating managers, depending on the result of the company’s work. Illustration: Royal Swedish Academy of Sciences

The Swedish National Bank for Economic Sciences in Memory of Alfred Nobel today announced the winners of the 2016 Award, which was established in 1969 and is unofficially considered the Nobel Prize in Economics.

The winners were the British economist Oliver Hart, a professor at Harvard University (USA), and the Finnish economist Bengt Holmström, a professor at the Massachusetts Institute of Technology (USA), for working out the theory of contracts in neoclassical economics. Neoclassical direction implies the rationality of economic agents, widely uses the theory of economic equilibrium and game theory. This trend is now dominant in microeconomics. Together with Keynesianism (in macroeconomics), the two trends constitute neoclassical synthesis , the basis of modern economics.

')

Oliver Hart and Bengt Holmstrom separately laid the foundations for the theory of contracts. Their work allows for a deeper understanding of the functioning of certain types of contracts and, therefore, to optimize economic systems in the real world, which operates in conditions of asymmetric information and unobservable actions.

Contract theory is a section of economic theory that considers the definition of contract parameters by economic agents in terms of (as a rule) asymmetric information. Contract theory is one of the youngest and fastest growing branches of economic theory. The first works on the theory of contracts appeared only in the early 1970s and there are still not enough comprehensive textbooks. Despite this, the theory of contracts has taken a strong place in the curriculum of leading Western universities, and this is the third of the recent Nobel Prizes in economics, awarded for scientific work in this particular area.

The theory of contracts does not contradict the theory of equilibrium in an ideal economy with perfect competition, perfect information and no transaction costs. In reality, it even complements the theory of equilibrium. Here we are talking about exactly how the relationship of agents and equilibrium is arranged in the case of non-fulfillment of the Coase theorem (as well as the Modigliani-Miller theorem and the first welfare theorem ) and why the conditions of the Coase theorem may not be satisfied. According to the first welfare theorem, the distribution (p, x, y), which characterizes the general equilibrium in the economy, will also be Pareto-optimal, provided that the utility functions of all consumers are locally unsaturated. The validity of this theorem ensures that the equilibrium in the market will always be optimal, so that there is no need for state intervention in the economy. In reality, this is far from the case.

From the point of view of the theory of contracts, the entire modern economy rests on an infinite number of contracts. Virtually no relationship is established without their registration in the form of a contract. They are in the form of laws, contracts, user agreements, verbal agreements and relations between market participants.

In their work, economists analyze the design of a system of contracts that bind all economic agents. These are relations between shareholders and top managers, between the insurance company, car owners, between the government of the country and government contractors, and so on. The contract system is truly comprehensive.

Developed by Hart and Holmstrom, the tools reveal potential pitfalls in the construction of formal contracts. Any contractual relationship between the two parties potentially conceals a conflict of interest. Therefore, it is very important to competently draw up contracts so that their implementation would be beneficial for both parties.

The authors analyze the effectiveness of various types of contracts and specific conditions, such as the payment of remuneration to top managers for good performance of the company, insurance deductions, as well as the privatization of state enterprises and organizations.

Bengt Holmström is known for his work in the late 1970s on the payment of remuneration to managers for the result of the company's work. The basic idea here is that the company owner hires the manager as an agent. He takes unobservable actions by the owner, but the reward for his work is tied to the observed performance indicators. That is, the remuneration of an employee occurs for the result of his work, and not for the amount of effort spent (number of hours worked), as is customary in most companies.

In his later works, Holmström refined his theory to include other incentives for an agent other than payment, including the possibility of an increase. He analyzed situations where the employer observes only part of the activity of an employee and sees only part of the results of his work, as well as a situation where individual team members can receive rewards for the results that are achieved through the efforts of others.

In turn, Oliver Hart in the mid-1980s made a fundamental contribution to the new model of contract theory, which deals with the most important case of incomplete contracts . In the contract it is impossible to foresee all possible circumstances and outcomes. Therefore, this model prescribes the most optimal conditions for the distribution of control rights between the parties: which party should assume the authority to decide in which situation (in the Anglo-Saxon tradition, traditionally residual control rights are “unfair” equal to the right of ownership, and the owner usually disposes of them in his own interests ). By and large, the model of incomplete contracts is a model of bilateral opportunistic behavior, in which there are observable but not verifiable variables. For example, the parties see the factors leading to the winning partner, but it is impossible to determine their value, so these factors affect the negotiations after the fact, but they cannot be included in the contract. In other words, the model of incomplete contracts describes the choice of a mechanism that establishes the bargaining position of the parties after they select their actions.

Hart's work on incomplete contracts shed new light on the essence of property rights and business ownership, which seriously affected several sectors of the economy, as well as political science and jurisprudence. Thanks to these studies, economists have revised the toolkit for assessing which types of companies should be involved in merger transactions, what is the correct ratio of debt to equity. In which cases state institutions (schools, prisons, etc.) should be transferred to public ownership or private property.

In general, Oliver Hart and Bengt Holmstrom laid the foundations of contract theory. As shown in recent years, this direction of the neoclassical economy has proved extremely fruitful and useful in a variety of applications, from bankruptcy law to organizing the political system in the country.

By and large, not only the modern economy, but also our whole life - the relationship between relatives, husband and wife, and friends — holds on to formal and informal contracts. All of this informal contractual relations, which imply: the rights and obligations and the consequences of default. So the 2016 Nobel Prize in economics indirectly affects the lives of everyone. In fact, a more optimal contract system will make life a lot easier.

Award winners will receive 8 million Swedish crowns ($ 920,000) for two.

Source: https://habr.com/ru/post/398267/

All Articles