Pokemonomaniya at the service of bank marketing

The Internet is not the first week excites the growing popularity of the game Pokemon Go. Experts processing company PayOnline decided to explore the possibilities of Pokemon Go in the field of bank marketing. While pokemon hunters surf the augmented reality in search of rare specimens, marketers with the help of game monsters set their traps on real customers. One of the first who managed to do this was Russian banks. For them, Pokemon Go turned out to be a relevant tool for promoting financial products.

The Internet is not the first week excites the growing popularity of the game Pokemon Go. Experts processing company PayOnline decided to explore the possibilities of Pokemon Go in the field of bank marketing. While pokemon hunters surf the augmented reality in search of rare specimens, marketers with the help of game monsters set their traps on real customers. One of the first who managed to do this was Russian banks. For them, Pokemon Go turned out to be a relevant tool for promoting financial products.The Pokemon Go game app, developed and presented on July 6 by the Japanese company Nintendo, has caused a stir among users of iOS and Android operating systems. The application gives gamers the opportunity to search for Pokemon - fictional creatures hidden in the real world. Nintendo officially announced Pokemon Go only in the USA, Australia and New Zealand, so players from Russia had to look for workarounds.

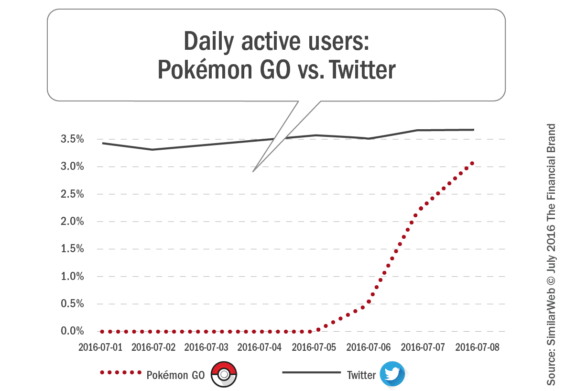

In less than a month, the game has set several popularity records. According to SimilarWeb, Pokemon Go players spend on average 43 minutes 23 seconds per day - more than Whatsapp, Instagram, Snapchat and Messenger, and the total number of Pokemon GO users is closer to Twitter.

In less than a month, the game has set several popularity records. According to SimilarWeb, Pokemon Go players spend on average 43 minutes 23 seconds per day - more than Whatsapp, Instagram, Snapchat and Messenger, and the total number of Pokemon GO users is closer to Twitter.Less than a week after the release of Pokemon Go, Nintendo’s shares have risen by more than 25 percent on the Tokyo Stock Exchange - a record number since Nintendo’s shares were listed on the stock exchange in 1983. Han Yun Kim, an analyst at Deutsche Bank, calls Pokemon Go a real phenomenon.

')

One of the first who decided to try to ride Pokemon Go good luck, were the domestic banks, mentioned in the publication Bankir.Ru. Less than two weeks after the game, Sberbank announced plans to install special modules for luring Pokemon in bank branches in 16 cities. Sberbank Life Insurance, a subsidiary of Sberbank of Russia, announced the possibility of insuring itself against injuries when fishing for Pokemon in the amount of up to 50 thousand rubles. "This project will help improve the financial literacy of the population," the Sberbank said. "The younger generation will be able to get acquainted with such a financial instrument as insurance in a game."

"Pokemon marketing" was akin to a virus - Russian banks began one after another to announce special offers for Pokemon catchers. VTB24 launched a campaign, under the terms of which participants who took a photo of Pokemon with a VTB24 bank card and published it in the bank’s Facebook community from July 19 to July 31, will receive a double cashback on all types of payment cards in August.

"Pokemon marketing" was akin to a virus - Russian banks began one after another to announce special offers for Pokemon catchers. VTB24 launched a campaign, under the terms of which participants who took a photo of Pokemon with a VTB24 bank card and published it in the bank’s Facebook community from July 19 to July 31, will receive a double cashback on all types of payment cards in August.Tinkoff Bank announced a special loyalty program, embodied in the Tinkoff Google Play map. Users who have issued such a card before August 14, the bank promises to reward bonuses with which you can pay in Pokemon Go. For any purchases within the game on this card will be charged cashback in the form of bonuses. With their help, you can make new purchases within the game or on Google Play.

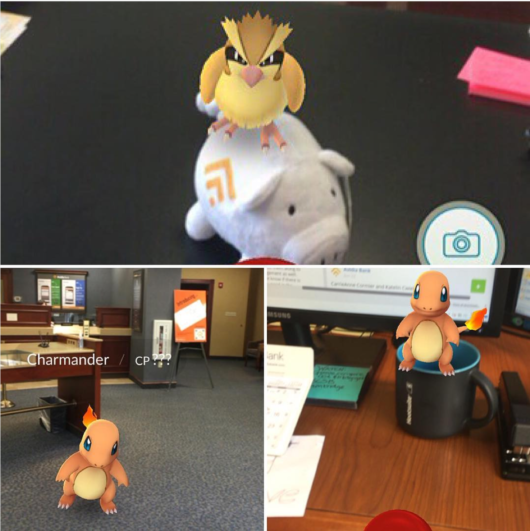

Around the same time, Western banks began to demonstrate loyalty to Pokemon Go. Their main method is the purchase of game "baits" for Pokemon, the duration of which is 30 minutes. The Financial Brand publication lists a number of banks: Avidia Bank Massachusetts, which encourages customers to take pictures of Pokémon at bank branches and upload them to Instargam, as well as Citizens Bank of Edmond and Center State Bank in the United States and ME Bank in Australia.

Hunting banks for pokemoners is a bold embodiment of the forecasts of leading western experts regarding the potential of gamification in communication with customers. That is why digital banking guru Chris Skinner writes with such enthusiasm about the Sberbank initiative in his blog. Moreover, he is confident that the market needs even more applications using gamification, and he advises banking marketers to make an agreement with Nintendo and other developers as soon as possible. Experts are pinning great hopes on the use of geolocation data of players, which, together with the already existing analysis of customers' financial behavior, can raise the effectiveness of targeted offers from banks to a new level.

Hunting banks for pokemoners is a bold embodiment of the forecasts of leading western experts regarding the potential of gamification in communication with customers. That is why digital banking guru Chris Skinner writes with such enthusiasm about the Sberbank initiative in his blog. Moreover, he is confident that the market needs even more applications using gamification, and he advises banking marketers to make an agreement with Nintendo and other developers as soon as possible. Experts are pinning great hopes on the use of geolocation data of players, which, together with the already existing analysis of customers' financial behavior, can raise the effectiveness of targeted offers from banks to a new level.Rainbow loom prospects. Is not it? But there is another point of view. With the seemingly unanimous rush of the banking community around Pokemon, it was not without the discontented. In particular, a number of Western banks and insurance companies perceived pokemon hunters as an annoying hindrance to their business. So the president of the Association of Banks of Wisconsin Oswald Poels called on the players at Pokemon Go, who find Pokemon in the bank branches, to first ask the permission of the bank managers to continue the game. In case of failure, the game is recommended to urgently stop in order to avoid trouble.

“Pokemon marketing” of banks is the first case of using augmented reality for commercial purposes. This is akin to a step into the virtual abyss, in which the steps to the unknown materialize in front of the player. Pokemon Go is one of those times when a new technology suddenly turns from niche entertainment into something more. And the banks here are pioneers in pioneering the marketing hunt for pokemoners, while the pokemoners themselves are passionate about catching fictional creatures.

Continue to follow the publications on the PayOnline blog and learn about the most interesting cases of the global fintech industry and the banking sector.

Source: https://habr.com/ru/post/396339/

All Articles