“Why it doesn’t work”: Telematics and cost reductions for CASCO

Hi GT! Most recently, I decided to launch a podcast on the intricacies of the insurance market. Mikhail Miheev , an insurance expert of the Insurance Team, agreed to speak as my interlocutor.

Today we decided to move away from the audio format and wrote a material about why today it is difficult to talk about the working application of telematics systems and reducing the cost of hull insurance.

')

In the field of voluntary auto insurance is still a decline. According to estimates of the Central Bank, the companies concluded 27% of the hull insurance contracts less than last year: this is due to a decrease in car sales, as well as rising prices for parts and maintenance. At the same time there are several options to save on hull insurance. One of them is the “smart” insurance extended abroad.

It is believed that it is enough to install a telematics device (or just download the application on a smartphone) in the car, which will collect information about your driving style. Having received a large number of points, the driver, according to insurance companies and manufacturers of telematic devices, can purchase a CASCO policy with a discount of up to 55%. However, not everything is so cloudless - just a few insurance clients use such a seemingly profitable service: let us see why this is happening.

What is telematics?

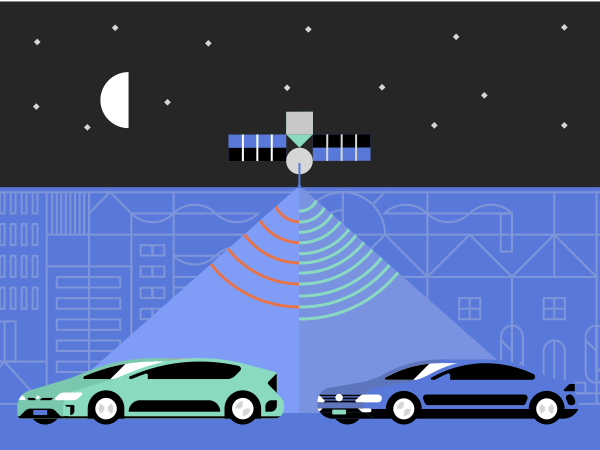

Telematics, as the name suggests, implies a merger of telecommunication technology and informatics. Drivers familiar with the technology under the telematics understand a small device with a set of sensors that connects to the car and collects information in the direction of travel.

It not only determines such parameters as average speed, mileage and travel time: the device also allows you to monitor the condition of the car - for example, it will tell you when to charge the battery and whether damage has occurred on the car after the impact.

Smart Insurance Market in Russia

Since the year before last, several major insurance companies have offered services in the use of technology in the country: Intach Insurance, Liberty Insurance, Ingosstrakh, AlfaStrakhovanie, Rosgosstrakh and a number of others. The process of providing services for most companies is not much different. The insurer offers the client to install a telematics device in his car for free. Before you use it, you need to download the application and specify the device identification number in it.

After that, in the application, you can view detailed information about your driving style - for example, see the number of dangerous accelerations and decelerations. The device by satellite communication transmits data on driving to the server of the company, where they are analyzed. If the driver did not create a hazard on the roads, the system gives the driver the highest score. At the end of the monitoring period, which usually lasts up to six months, conscientious drivers can get a discount on hull insurance.

Telematics among Russian drivers is not as common as in Europe or the USA. According to some data , 40-50 thousand "smart" policies were sold for all the time, that is, about 1% of the number of all CASCO policies.

The most active service is used by young drivers aged 24-29 years who, due to their low length of service, find it difficult to find a profitable CASCO offer, as explained by the representative of AlfaStrakhovania. Interestingly, 82% of the clients of this company who installed telematics in their cars received a high score and, accordingly, the maximum discount on insurance.

It is worth noting that “smart insurance” is beneficial only for accurate drivers. Likhachi, knowing that they are unlikely to save money, will give up on telematics, and their aggressive driving style will go unnoticed.

Why it doesn't work

Unfortunately, one percent - namely, so many car owners use "smart" insurance - this is very little. While telematics devices and applications are not particularly popular among vehicle owners.

Over the entire period of work in the insurance business, I had to listen to a lot of loud statements from insurance companies, making it clear that without this equipment customers will not be accepted for insurance or that the tariffs will increase significantly.

In fact, everything is different - in the absence of demand, another question arises: how long the insurer's representatives (their staff members and agents) will be able to believe in this idea and promote it to the masses. As practice has shown - usually the "craze" of telematics in an insurance company lasts about 2-3 weeks. And then very quickly there are alternative sources of preserving the client portfolio.

The “smart insurance” market faces a number of unsolved problems. First, Russian insurance companies are very different from their American and European counterparts. Therefore, foreign development is not so easy to adopt: all components of the new solutions - in particular, software and hardware - will have to be adapted to the peculiarities of our country.

Secondly, in Russia there is no legal basis for the introduction of such technologies. State standards are currently being developed - work that will require efforts from both the authorities and insurers. In addition, there are significant differences between the insurance markets of individual countries: this will create additional difficulties in developing global standards in this area.

Not so long ago, the media discussed the idea of equipping vehicles with the ERA-GLONASS system - an analogue of European eCall - which will allow services to respond more quickly to emergency situations. But she has not reached implementation.

The thought was very good - a “two in one” solution: on the one hand, by establishing this system, dangerous maneuvers, accidents and other offenses could be tracked; on the other hand, for trouble-free drivers there would be a system of discounts at the conclusion of insurance contracts.

But even with such a unified approach there are significant drawbacks that we should not forget. In this case, a monopoly on telematics actually arises in the market, which cannot well affect the healthy economic system in the country.

Pros and cons of technology

Summing up, we will try to identify the main advantages and disadvantages of “smart insurance”.

Pros:

Thrift . Despite the increase in prices, drivers (with the most favorable outcome) can reduce the cost of the policy by more than two times, not to mention the additional services and promotions. In addition, by monitoring the condition of their cars, drivers will be able to identify a defect or breakdown in time, ensuring timely repair of the vehicle. For companies, however, a similar mechanism of price reduction in theory allows us to attract more customers, and data on driving style will help predict losses.

Safety Developed incentive systems force drivers to behave more cautiously on the roads, thereby reducing the number of potential accidents by 30%. Considering that most devices are equipped with GPS and GSM modules, the risk of car theft is reduced.

Objectivity Accident data available to drivers will not allow insurers to understate the size of payments and eliminate unnecessary disputes, which, in principle, can reduce the level of traffic jams. Drivers will also not be able to deceive the system, since an attempt to turn off the device automatically deprives the client of the discount.

Minuses:

Telematics is not for everyone . The mileage limit and driving requirements will not allow aggressive drivers and those who often move in their cars to get a discount. In addition, as practice shows, such products are quite strict even for neat drivers.

For example, one of the users of such a program notes : only one sharp acceleration and only two sharp braking are allowed for 200 kilometers. It turns out that even with a trouble-free ride, it is not so easy to get a CASCO discount using smart insurance systems, and its real size in most cases turns out to be much lower than the maximum declared discount.

Total surveillance . One of the main reasons for abandoning telematics is that no one knows how insurers will use data about the driving style of their clients.

The complexity of the introduction of telematics - both at the level of creating an appropriate legislative framework, and at the level of using specific devices and applications. A good initiative to equip all vehicles with the ERA-GLONASS system can turn into a means of monopolizing manipulation of the auto insurance market.

And if drivers use alternative telematics systems that are not accredited by insurance companies, the question arises of how the discount system should be formed - especially if the insurance company cannot or does not want to work with a specific telematics manufacturer for one reason or another.

All this leads to the fact that telematics devices and "smart insurance" in general are not particularly popular with drivers. Of course, this initiative allows us to quickly respond to difficult situations on the roads and encourage careful driving, but at present it creates more questions than answers, and more stringent conditions for granting discounts (compared to Europe and the US) simply demotivate car owners to them. It turns out to be easier to pay for the full comprehensive insurance policy and continue driving as you like.

PS More information on the topic can be found in the Insurance Team blog .

Source: https://habr.com/ru/post/396231/

All Articles