Top 5 Financial Information Aggregators According to PayOnline

In the course of our work at PayOnline processing company , we not only focus on international experience within our service line, but also observe projects of the global fintech industry. In this material, we have prepared for you a selection of solutions whose users can monitor all their spending and account balances through a single interface online.

In the course of our work at PayOnline processing company , we not only focus on international experience within our service line, but also observe projects of the global fintech industry. In this material, we have prepared for you a selection of solutions whose users can monitor all their spending and account balances through a single interface online.AnyBalance +

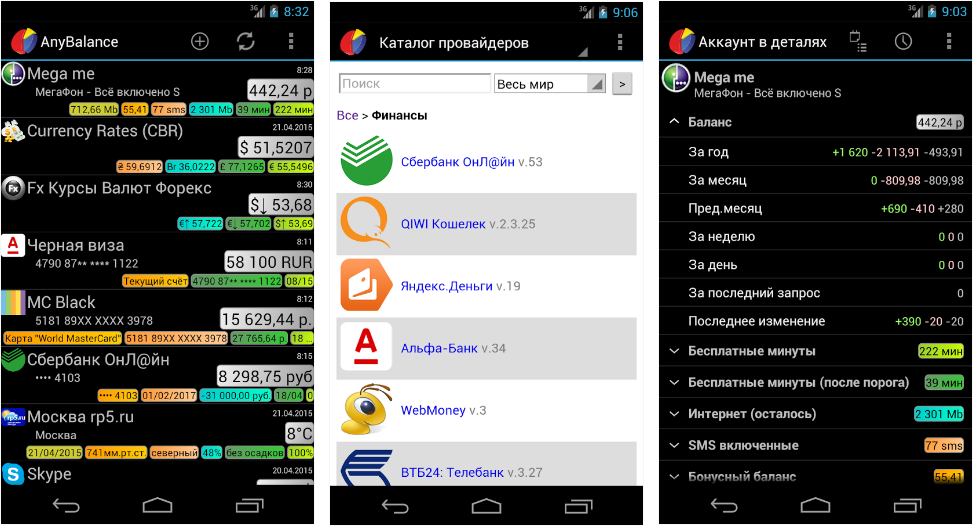

The AnyBalance + solution, developed and launched by Krawlly, which received investments from Qiwi Venture Venture Fund last year, allows consolidating account data that a user has acquired during their daily activities in a single application. This includes balance sheets of telecom operators and Internet service providers, as well as balances of bank accounts and electronic wallets. In addition, AnyBalance + users are also available weather forecast and currency exchange information.

The feature of the AnyBalance + functionality is also that the user can stay up to date with the state of not only the balances of his own accounts, but also the accounts of his relatives and friends.

According to the information on the AnyBalance + page in Google Play, the application works with more than 1,300 providers.

')

In order to try out the functionality of a free application, the user must first specify their service providers in the service catalog section and enter the corresponding identification data in order to start receiving information about their accounts online.

User login and password for AnyBalance + are stored in the keychain. When a corresponding user request occurs, the password is decrypted and automatically inserted into the relevant fields, for example, on the website of the telecom operator or telecommunications company.

EasyFinance.ru

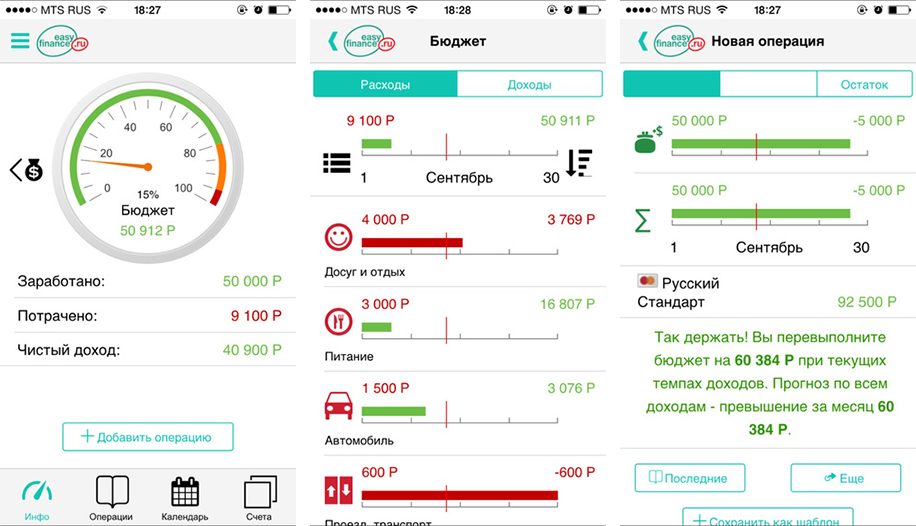

Unlike AnyBalance +, EasyFinance.ru service positions itself not as a convenient balance aggregator, but as a financial management tool.

The application EasyFinance.ru analyzes user spending, allows you to set financial goals and offers individual recommendations depending on a particular situation. The service is designed not so much for informing about the status of various balances as for the opportunity for users to plan their budget.

Users of EasyFinance.ru can act as individuals, as well as representatives of small businesses who wish not only to manage personal expenses, but also to plan the budget of their own business.

Access to the EasyFinance.ru functionality can be obtained both through the mobile application and through the web interface.

Especially for banks, EasyFinance.ru offers its PFM-platform, which allows to strengthen communication with customers through personalized recommendations on financial management. And for independent financial advisors and investment advisors EasyFinance.ru has a special affiliate program.

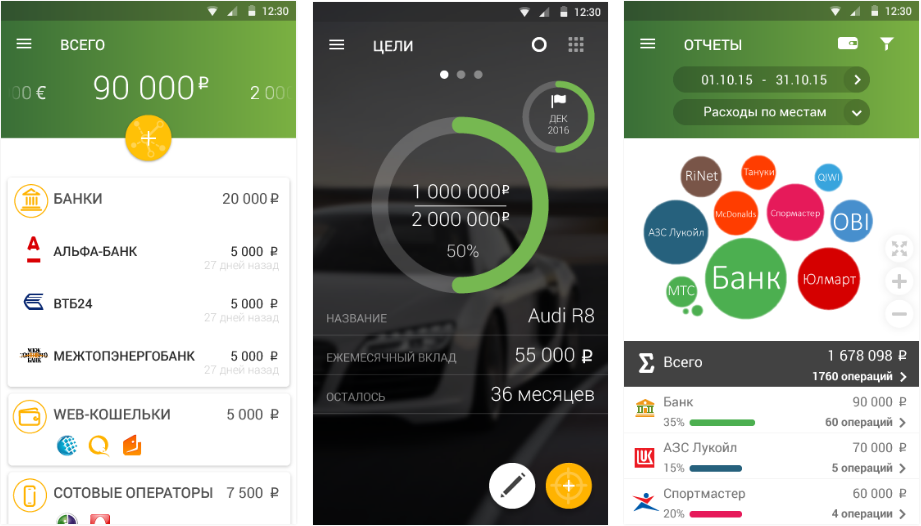

CASHOFF

Applications CASHOFF its functionality reminds EasyFinance.ru. Here, in addition to spending information, you can also plan a budget, set financial goals and receive personal recommendations. But unlike AnyBalance + and EasyFinance.ru, which have both paid and free versions, all the functionality of the CASHOFF application, if you believe the information on the developer’s website, is absolutely free.

In addition, CASHOFF cooperates not only with banks, but also with retailers, providing the latter with tools for communicating with customers, including: Internet and mobile applications, consumer preference analysis systems, developing individual customer offers, and the ability for consumers to manage their shopping.

Yodlee

Considering the aggregators of balance sheets and personal finance management services, you should also refer to the western counterparts of domestic projects.

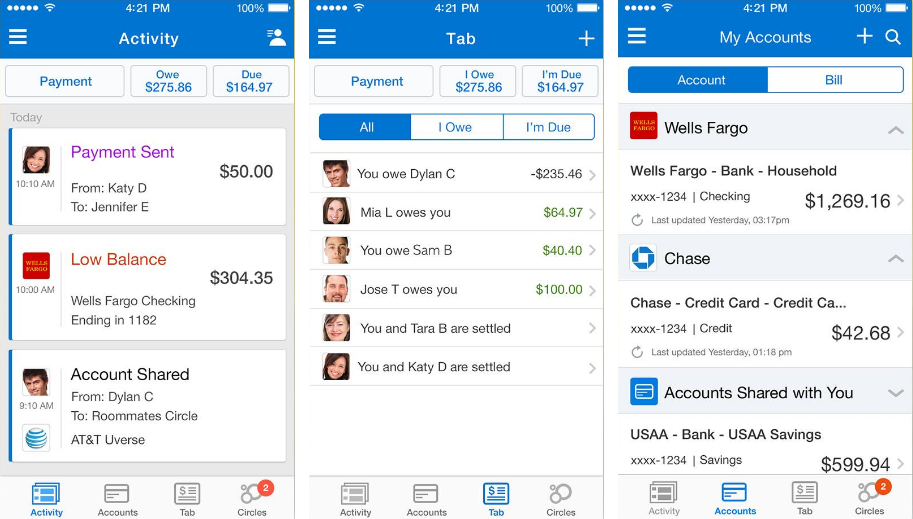

The company Yodlee appeared on the market back in 1999 and by now has grown into a large-scale business, not only providing a financial management platform and an aggregator of deposit, credit, mortgage, investment and other data, but also developing solutions for financial services. Yodlee customers include 11 of the top 20 US banks.

Tandem’s collaborative financial management application developed by Yodlee deserves special attention. The solution allows you not only to be aware of and control your expenses, but also to plan expenses together with relatives, colleagues and friends. In addition, using the application, you can set up joint financial goals, as well as exchange payment documents.

Application users can customize the level of access. Thus, parents who transfer funds to their children can always stay abreast of exactly how their children manage their finances.

Mint

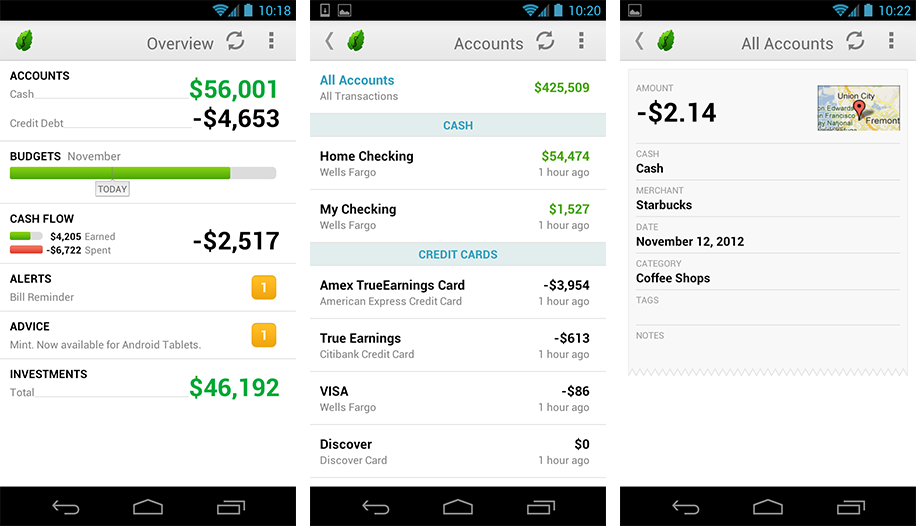

Considered the second most popular after Yodlee, the Mint service developed the concept of an account aggregator and gained users popularity by offering them a financial planning solution. However, Mint was able to develop into a separate platform only after it was acquired by Intuit, which strengthened its technological infrastructure and turned Mint into an aggregator of financial information.

The Mint platform not only provides personal statistics and financial recommendations, but also notifies of strange payments on the account, and also advises how to reduce costs by using these or other services.

Despite the fact that such large-scale foreign balance aggregators and financial management platforms like Yodlee and Mint were launched in comparison with Russian solutions for quite some time, domestic services like AnyBalance +, EasyFinance.ru and CASHOFF confidently take foreign experience as a basis, thereby developing Russian infrastructure of balance aggregators.

In addition, as the experience of the aggregators Yodlee and Mint shows, over time these platforms become part of the infrastructure of global fintech corporations. So Mint in 2009 acquired the developer of financial and tax software for small business Intuit, and Yodlee was successfully acquired in 2015 by the provider of solutions for financial institutions Envestnet. Time will tell how the fate of the Russian decisions described in the article will be.

In this article, PayOnline processing company experts tried to look through the eyes of users on 5 Russian and foreign solutions that allow not only to receive the most up-to-date personal financial information, but also, more importantly, to manage their own expenses. Continue to follow the updates in our blog and find out about the most interesting from a technological point of view, financial services.

Source: https://habr.com/ru/post/395939/

All Articles