Who will earn in case of adoption of Ethereum hard-fork?

After finding a bug in the soft-fork, which led to the community rejecting this decision, the creators of The DAO are trying to gain time by using counter-attacks through the voting system in the contract, and the developers of the blockchain have tentatively decided to go for a more radical hard-fork 'a paths with the forced transfer of all funds of the hacked The DAO contract (including the money of the “attacking” user) to the community-controlled wallet. Behind the scenes, people try to play on the volatility of the courses and make a profit even on the tokens at risk of the failed decentralized organization.

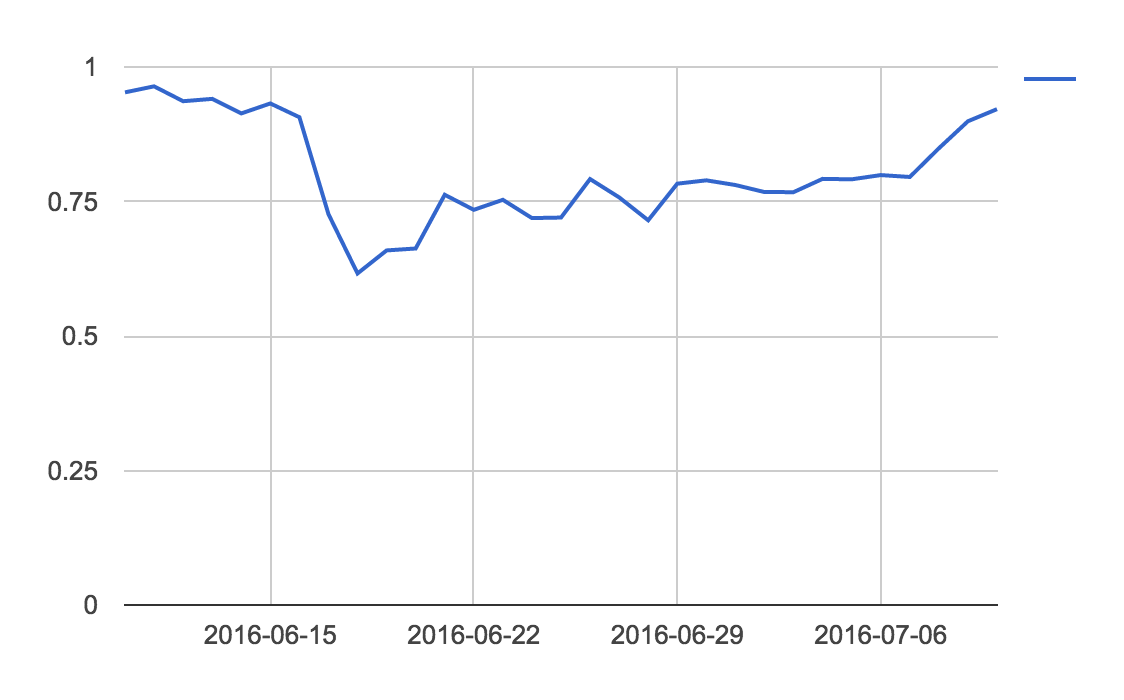

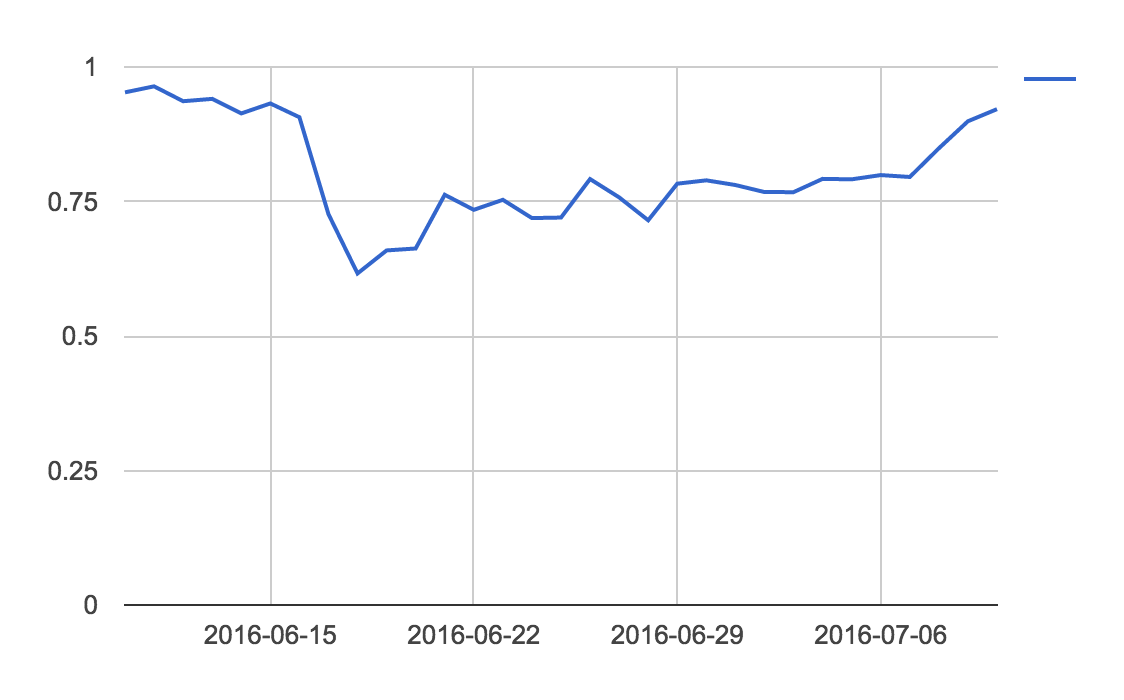

Currently, for 100 tokens they give about 0.92 ETH. If a hard fork is accepted, then the DAO tokens will exchange back to ETH, at the rate of at least 1 ETH per 100 tokens - the initial price for the first customers at the crowdfunding sale. The cost chart for 100 DAO tokens in ETH is as follows:

Thus, people who bought tokens at the time of a panic at the lowest cost have a serious economic interest in adopting hard-fork, which will allow them to get a good return on investment. Tokens turned out to be a very liquid asset, for example - trading volumes per day 08 / 07-09 / 07 on the largest exchanges:

')

The total trading volume is around 2615 bitcoins, at the time of this writing - more than $ 1.7 million. Thus, there is a very active trade and interested individuals can buy / sell tokens, depending on the expectations of the outcome of the hard fork story. The community also raises many questions regarding payments: within the framework of the current strategy, it is proposed to divide the broadcast evenly among all owners of tokens, which leads to the loss of those people who made the purchase at later stages at a price of 1.5 ETH per 100 tokens, in this case - the winners are the first investors and speculators who have played to buy tokens at the lowest price. In addition, if the biggest miners, pool owners, and persons affiliated with them actually engaged in buying tokens, this could mean a serious conflict of interests given that they have one of the decisive roles in “voting” for adopting forks.

Simple developers from the community, not affiliated with the main team, were offered the option of voting for hard fork bypassing the miners - voting with the amount of available cryptocurrency , the results of which can be found on the Carbonvote website. Voting is conducted by a zero transaction on the corresponding YES and NO wallets, while the addresses of the largest exchanges are removed from the default results, as described by the developers. Counting of votes is carried out by summing up the balances of all voted wallets at the current time (and not at the time of voting), thus - it is impossible to vote with one amount twice simply by transferring money to a new wallet. At the moment, 2.5% of the total airtime participates in the voting, which indicates the impossibility to consider its results as a reflection of the position of the entire community.

Unfortunately, in this system there is a place for potential fraud, and the origin of funds in some of the largest voted wallets is doubtful , there is a suspicion of attempts to manipulate the results by the exchanges added to the exceptions. In addition, some people pointed to fluctuations in the number of votes “against”, but this could be connected with the transfer of funds from their wallets by the voters themselves.

Thus, besides the first investors of The DAO, a large number of speculators who bought tokens for cheap may be interested in saving the organization, and taking into account the problems mentioned in previous articles and the mining forces tilting towards the largest pools, it’s hard to say whether people are trying who have a direct financial interest in saving funds from The DAO, influence the outcome of the vote using their administrative and technical resources.

Currently, for 100 tokens they give about 0.92 ETH. If a hard fork is accepted, then the DAO tokens will exchange back to ETH, at the rate of at least 1 ETH per 100 tokens - the initial price for the first customers at the crowdfunding sale. The cost chart for 100 DAO tokens in ETH is as follows:

Thus, people who bought tokens at the time of a panic at the lowest cost have a serious economic interest in adopting hard-fork, which will allow them to get a good return on investment. Tokens turned out to be a very liquid asset, for example - trading volumes per day 08 / 07-09 / 07 on the largest exchanges:

')

The total trading volume is around 2615 bitcoins, at the time of this writing - more than $ 1.7 million. Thus, there is a very active trade and interested individuals can buy / sell tokens, depending on the expectations of the outcome of the hard fork story. The community also raises many questions regarding payments: within the framework of the current strategy, it is proposed to divide the broadcast evenly among all owners of tokens, which leads to the loss of those people who made the purchase at later stages at a price of 1.5 ETH per 100 tokens, in this case - the winners are the first investors and speculators who have played to buy tokens at the lowest price. In addition, if the biggest miners, pool owners, and persons affiliated with them actually engaged in buying tokens, this could mean a serious conflict of interests given that they have one of the decisive roles in “voting” for adopting forks.

Simple developers from the community, not affiliated with the main team, were offered the option of voting for hard fork bypassing the miners - voting with the amount of available cryptocurrency , the results of which can be found on the Carbonvote website. Voting is conducted by a zero transaction on the corresponding YES and NO wallets, while the addresses of the largest exchanges are removed from the default results, as described by the developers. Counting of votes is carried out by summing up the balances of all voted wallets at the current time (and not at the time of voting), thus - it is impossible to vote with one amount twice simply by transferring money to a new wallet. At the moment, 2.5% of the total airtime participates in the voting, which indicates the impossibility to consider its results as a reflection of the position of the entire community.

Unfortunately, in this system there is a place for potential fraud, and the origin of funds in some of the largest voted wallets is doubtful , there is a suspicion of attempts to manipulate the results by the exchanges added to the exceptions. In addition, some people pointed to fluctuations in the number of votes “against”, but this could be connected with the transfer of funds from their wallets by the voters themselves.

Thus, besides the first investors of The DAO, a large number of speculators who bought tokens for cheap may be interested in saving the organization, and taking into account the problems mentioned in previous articles and the mining forces tilting towards the largest pools, it’s hard to say whether people are trying who have a direct financial interest in saving funds from The DAO, influence the outcome of the vote using their administrative and technical resources.

Source: https://habr.com/ru/post/395835/

All Articles