Bug in Ethereum software fork, rollback and Ripple growth

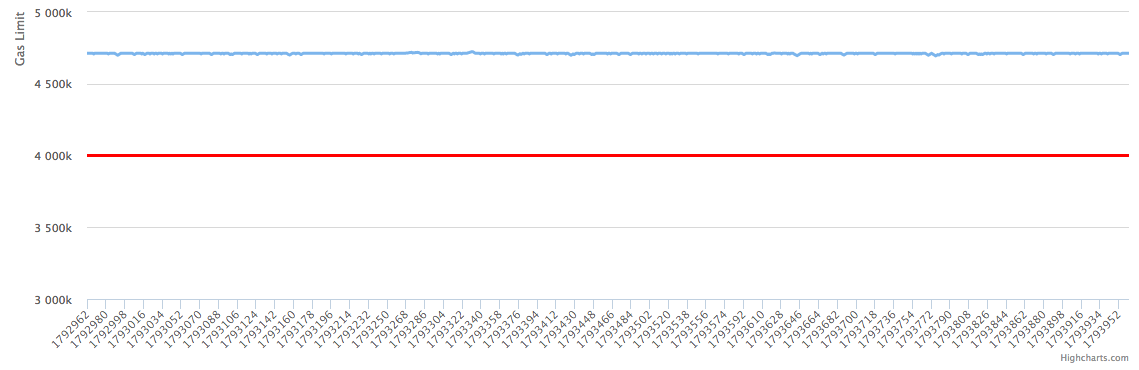

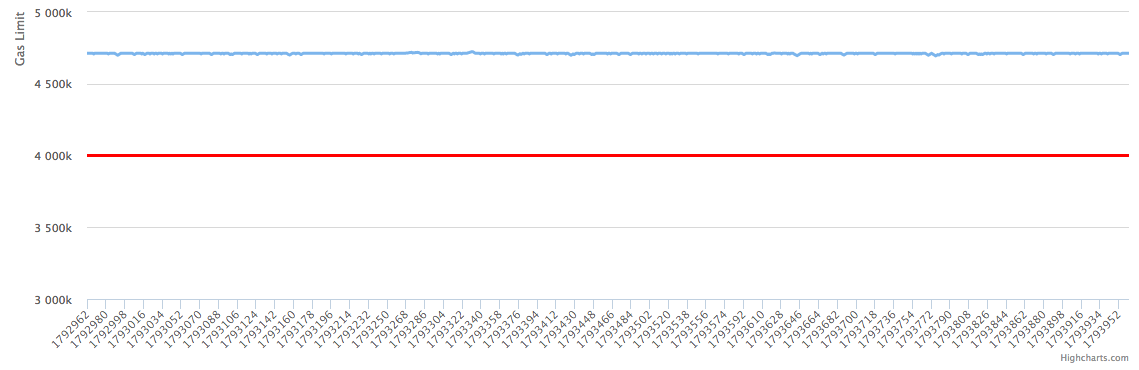

After auditing the code of the proposed Ethereum soft fork, a GETH client found a vulnerability that allows operations to be performed without paying for gas'om calculations (briefly about it - here ), which violates the main principle of protecting the network from flood by transactions - for each calculation it is necessary to give some is a fraction of the available cryptocurrency. At the moment, the gas limit for the 1.800.000 block on which the vote is being built (its essence is there ) has returned to its original level, so with the completion of the vote today - the software fork will be rejected by the system (you can follow the block numbers here ).

With the appearance of information about the presence of the vulnerability, the large mining pools rolled back their customers to versions without a positive decision about the soft fork (note that without conducting an additional vote among their customers) and the gas limit chart quickly went up. As you can see, the voting schedule has changed dramatically since the last article :

')

In connection with these events, more and more people in the community are talking about the need for a hard-fork without pre-blocking money with a soft-fork. The fundamental differences in terms of development and implementation are that hard-fork is much simpler to implement (developers simply need to point out that all funds from all subsidiaries of The DAO should be transferred to some new wallet), but this approach with more likely to lead to a network split . Before switching over to the new client with a hard-fork of all miners, it’s possible to split the network into two, where miners with old client versions can give an opportunity to withdraw funds from an account belonging to the “attacker” when the money freeze period passes according to The DAO’s rules, which will happen through 17 days. In addition, ardent opponents of the hard-fork may simply refuse to go and, potentially, split off into a separate network in which all those who disagree with the current policy of changes regarding The DAO will work. Naturally, this can happen only if there is a critical mass of “dissenters” and they find the department economically viable.

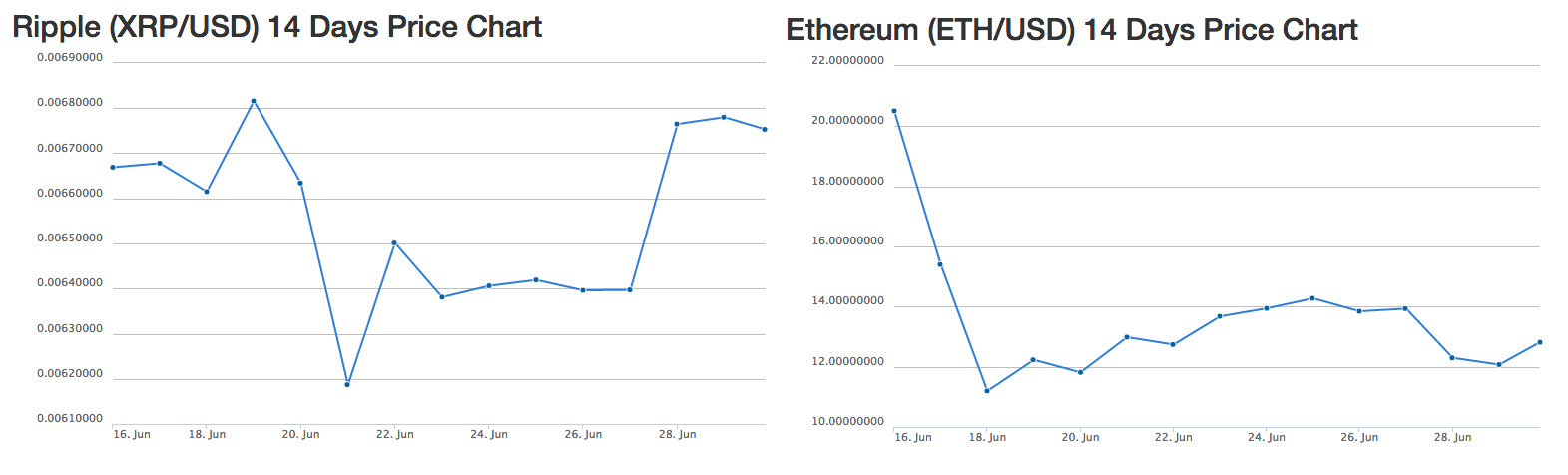

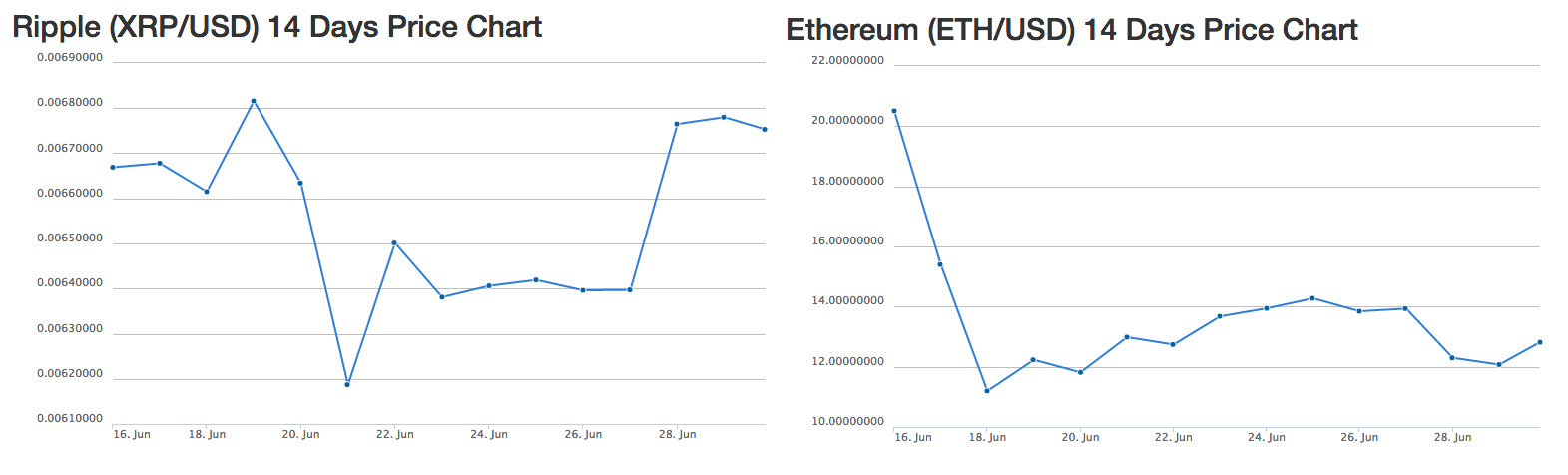

It is curious that against the background of the history of the fall in the value of the Ethereum currency, one of its competitors is growing - Ripple, which, although based on other principles and technologies, is a competitor of Ether in banking. Check out the Ripple and Ethereum charts:

It is curious that for the first time the rapid growth of Ripple was recorded from June 13 to June 14, almost 19 percent; this happened 2 days before the attack on Ethereum. Prior to that, there was a significant increase in Bitcoin, but if along with it ETH grew from the 11th, then no one showed interest in the Ripple currency. After the appearance of information about the attack on Ethereum, the Ripple course fluctuated to a greater extent on the news about the success / failure of Soft-fork, and with the appearance of information about the bug in the code, it again increased significantly.

As you can see, the story of the attack on The DAO and subsequent attempts to change the blockchain code greatly influences the cryptocurrency market as a whole, investors are beginning to pay attention to tools that have similar functionality and we can see a triumph for any Ethereum failure. from alternatives to this blockchain.

With the appearance of information about the presence of the vulnerability, the large mining pools rolled back their customers to versions without a positive decision about the soft fork (note that without conducting an additional vote among their customers) and the gas limit chart quickly went up. As you can see, the voting schedule has changed dramatically since the last article :

')

In connection with these events, more and more people in the community are talking about the need for a hard-fork without pre-blocking money with a soft-fork. The fundamental differences in terms of development and implementation are that hard-fork is much simpler to implement (developers simply need to point out that all funds from all subsidiaries of The DAO should be transferred to some new wallet), but this approach with more likely to lead to a network split . Before switching over to the new client with a hard-fork of all miners, it’s possible to split the network into two, where miners with old client versions can give an opportunity to withdraw funds from an account belonging to the “attacker” when the money freeze period passes according to The DAO’s rules, which will happen through 17 days. In addition, ardent opponents of the hard-fork may simply refuse to go and, potentially, split off into a separate network in which all those who disagree with the current policy of changes regarding The DAO will work. Naturally, this can happen only if there is a critical mass of “dissenters” and they find the department economically viable.

It is curious that against the background of the history of the fall in the value of the Ethereum currency, one of its competitors is growing - Ripple, which, although based on other principles and technologies, is a competitor of Ether in banking. Check out the Ripple and Ethereum charts:

It is curious that for the first time the rapid growth of Ripple was recorded from June 13 to June 14, almost 19 percent; this happened 2 days before the attack on Ethereum. Prior to that, there was a significant increase in Bitcoin, but if along with it ETH grew from the 11th, then no one showed interest in the Ripple currency. After the appearance of information about the attack on Ethereum, the Ripple course fluctuated to a greater extent on the news about the success / failure of Soft-fork, and with the appearance of information about the bug in the code, it again increased significantly.

As you can see, the story of the attack on The DAO and subsequent attempts to change the blockchain code greatly influences the cryptocurrency market as a whole, investors are beginning to pay attention to tools that have similar functionality and we can see a triumph for any Ethereum failure. from alternatives to this blockchain.

Source: https://habr.com/ru/post/395565/

All Articles