How maps conquered the planet

A payment card today is the most popular payment tool, although it seems its age is about to end. In 2013, the number of payments from credit cards in the United States exceeded the number of payments from checks, and debit cards reached the same level in 2004. A magnetic card is gradually being supplanted by chip cards, and all plastic may be lost due to mobile payments, such as Apple Pay.

Let's take a look at what people used to use credit cards: where did they come from, how did they adopt the modern form and why was this font printed on them?

One of the earliest ancestors of modern payment cards is metal tokens, which at the beginning of the twentieth century gave out to department stores to customers to track their purchases. Sellers made an imprint of a token in the accounting books opposite the name of the buyer.

')

You had to pay the bills: if now, if you delay the payment of the loan, they will start calling you, then a hundred years ago a collector would immediately come to you in a horse-drawn cart and take your property.

But it was only about local business, so entrepreneurs tied customers to themselves. On a journey, these steel plates would not benefit you; they would not be received anywhere. But traveling with a lot of cash is not the best idea either now or a hundred years ago. This was taken care of in the 1880s by American Express. Because of the need to use credit letters to receive money, the president of the company charged the head of one of the departments to develop an alternative to which traveler’s checks became.

This tool is used now, travelers checks are issued in euros and dollars. They can only be paid by the owner, and in case of theft or loss they are repaired in the offices of American Express and partners.

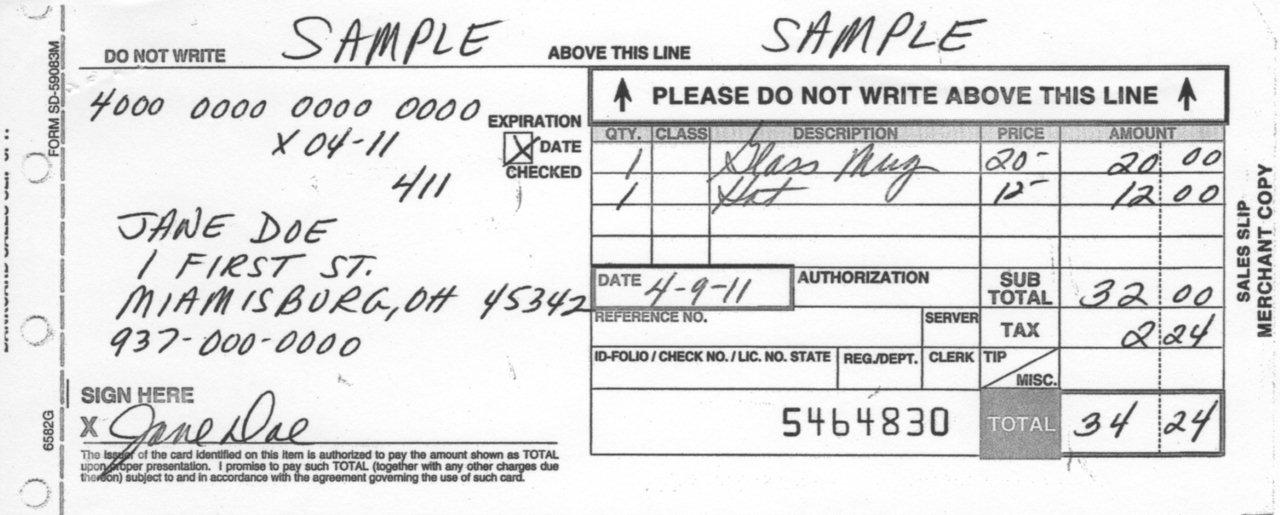

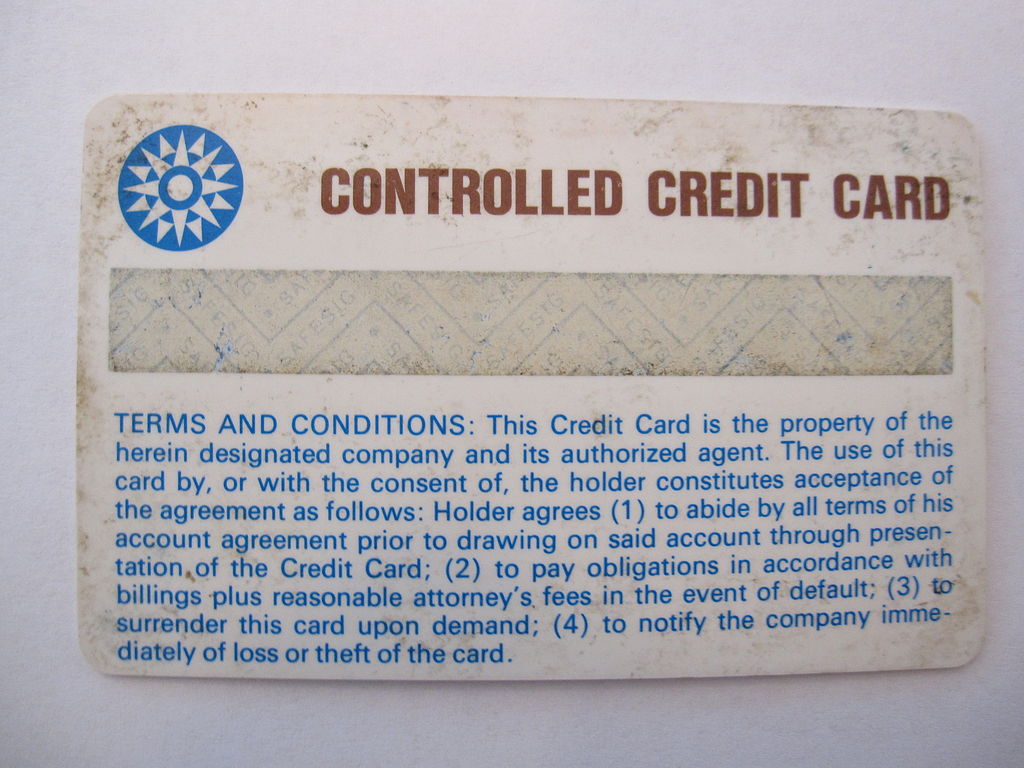

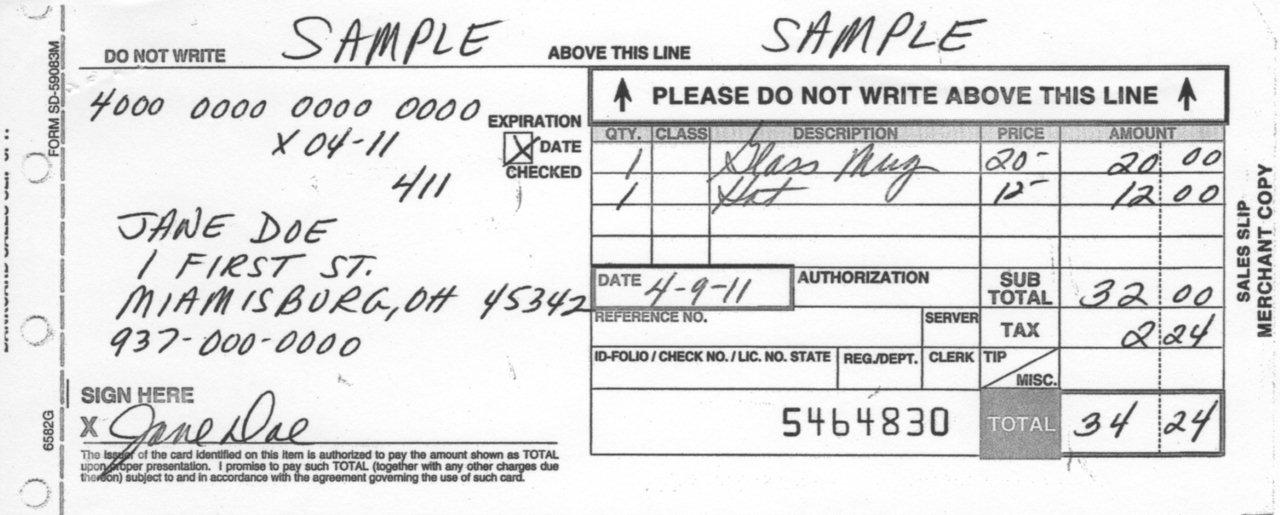

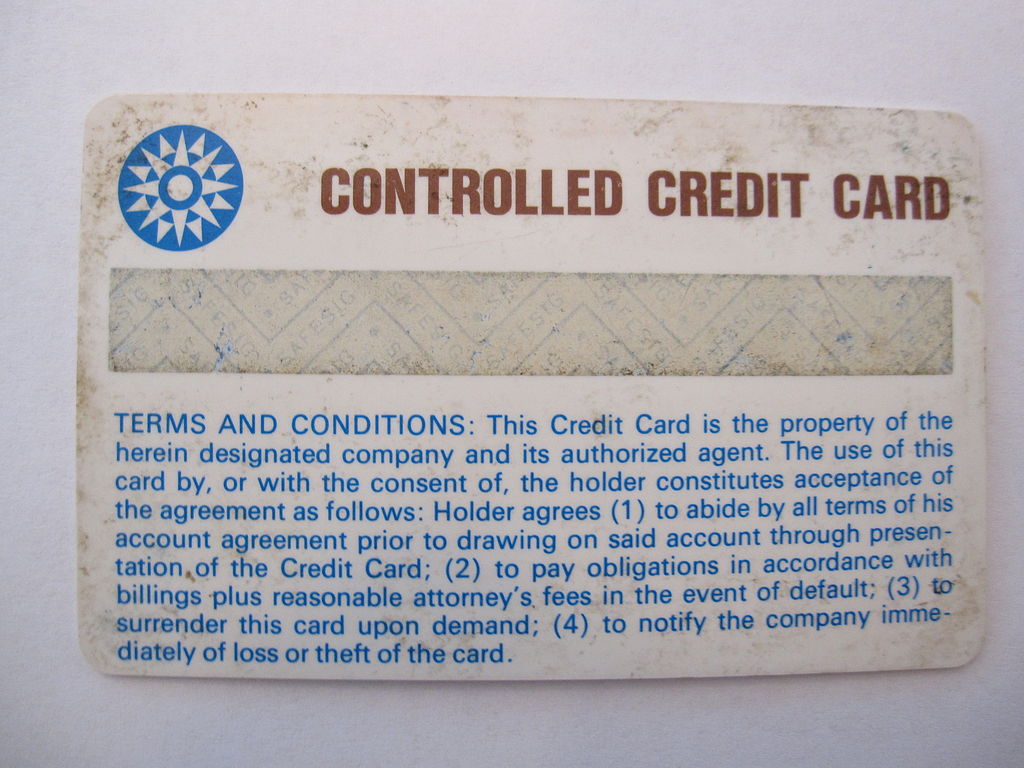

In 1920, Texaco began producing cardboard cards for its customers - so that they use them at gas stations. It soon became clear that the carton for refills is not suitable, it is too easy to stain. Therefore, Farrington Manufacturing has issued steel embossed cards. They helped automate the payment process — the clerk needed to make a data imprint. The document that is issued when buying with a bank card is called a slip. For extruding letters, the company found the most appropriate font Farrington 7B. It is still used for embossing plastic cards.

In the 1940s and 1950s, during the “trade boom” in the United States, cashless payments began to replace checkbooks. John S. Biggins, a consumer credit specialist at Flatbush in Brooklyn, laid the foundation for credit cards and organized the Charge-it system in 1946: buyers paid for the goods with receipts, the store gave receipts to the bank and paid for the goods from customers' accounts. This chain has not changed, but its speed has increased.

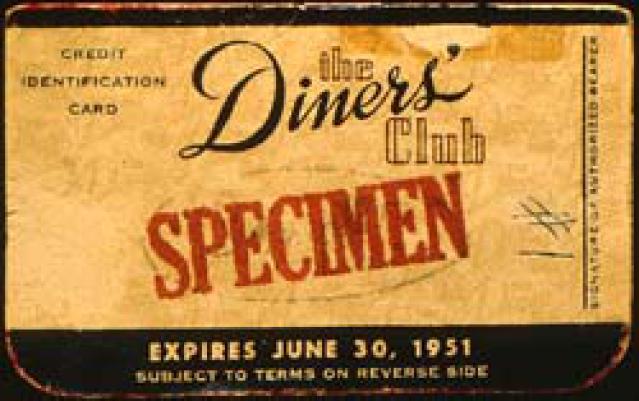

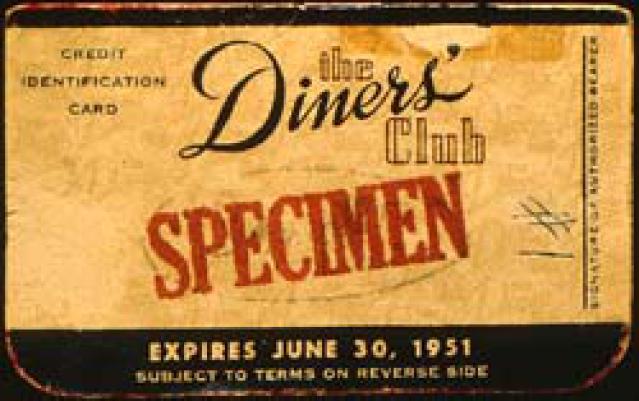

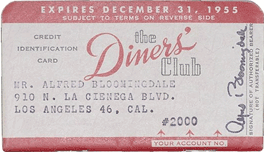

Diners Club was founded in 1950 and became the first independent credit company to start working with cards primarily for travel and entertainment. According to legend, it all started with a wallet that was forgotten at home - the company’s founder in 1949 was unable to pay for dinner at a restaurant. The aim of the project was the opportunity for visitors to such establishments not to be limited to cash. The club issued cards, acted as guarantors for obligations, paid invoices, and the club members received an extract once a month and had to pay the entire amount to the club in two weeks.

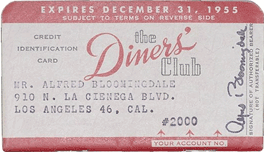

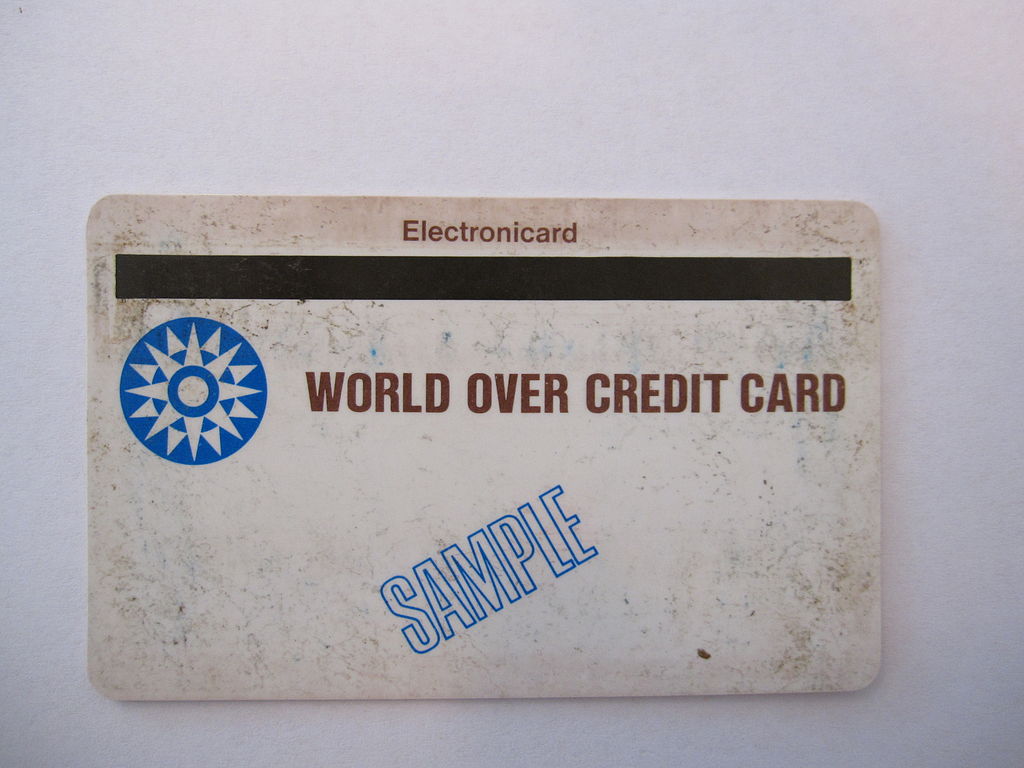

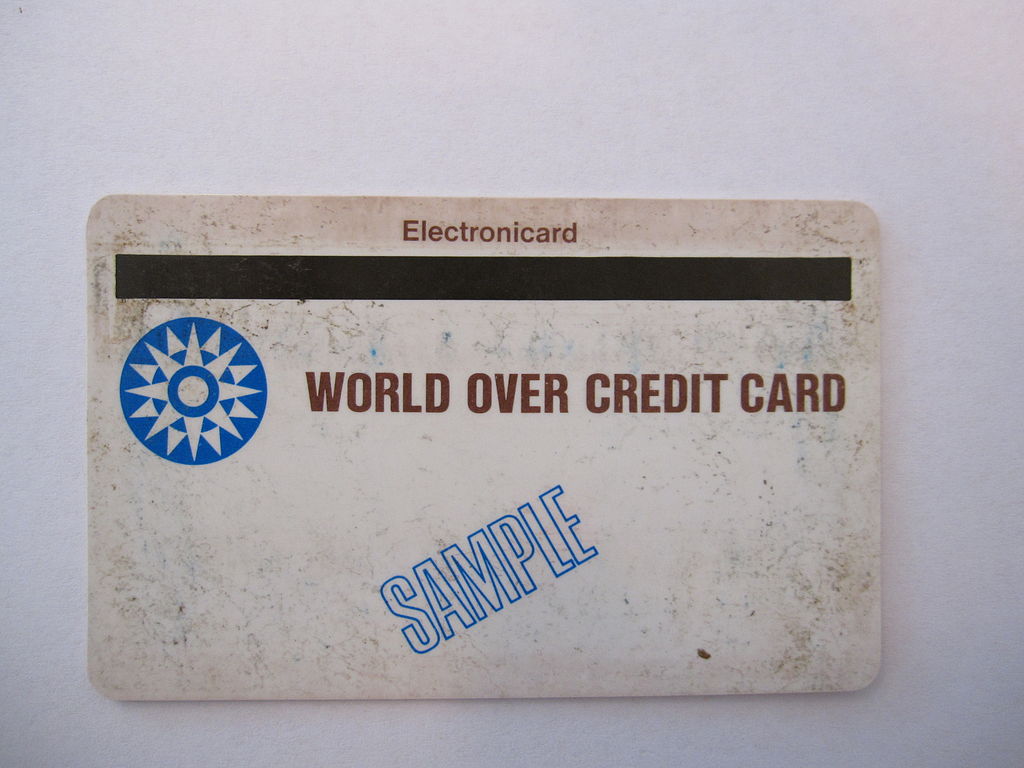

In 1950, they issued the first 200 Diners Club credit cards. They were mostly friends of the company's founder. Cards taken in 14 restaurants in New York. The cards were made of paper, on the back are the addresses and restaurants where they are accepted.

That was one of the first Diners Club cards:

Cards were made of paper. By the end of 1950, there were already 20,000 card holders who could pay in 285 restaurants. From the mid-1950s, the company entered the international market, the American Stock Exchange, and in 1981, Citibank bought it.

In the USSR, the first credit cards began to operate in 1969, when they began to accept Diners Club for payment in the shops "Birch". Since 2004, Diners Club plastic cards from the USA and Canada have received the MasterCard logo, and it has become possible to pay with them at any point where the cards of this system are accepted. On July 1, 2008, Discover Financial Services bought Diners Club International for $ 165 million.

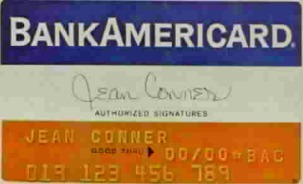

Until 1958, Diners Club had no competitors - they did not physically exist. Until BankAmericard cards appeared.

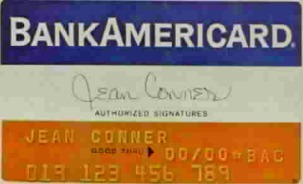

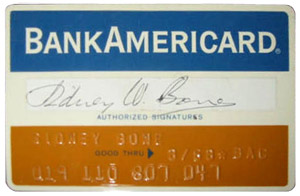

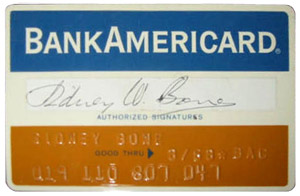

In 1958, Bank of America began its experiment to reduce the costs associated with payments in small business. 60 thousand BankAmericard bank credit cards were sent to residents of Fresno, California. These were ready-to-use cards for which you did not need to fill out an application at the bank. Now such carelessness would have ended in disaster, but in the 1950s everything went smoothly.

The card limit was set at $ 500. Translated at today's prices is more than 4 thousand dollars. The data went to the bank not instantly, no one could follow the loan - in theory, it was possible to buy a huge amount of goods and hide from the police in the woods, with a car, a tent and a supply of food for twenty years.

By 1959, there were over two million such cards, and twenty thousand entrepreneurs accepted them for payments. These figures will become more significant if we mention that then when making a purchase an imprint of the data from the card on the receipt was made - slip. Without convenient terminals, computers and the Internet. Automation helps embossed data on the map.

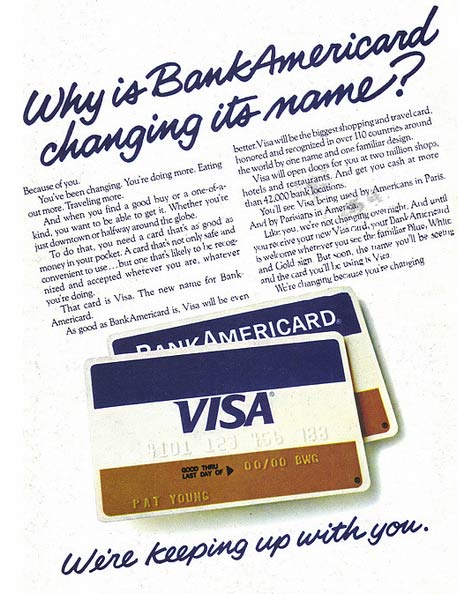

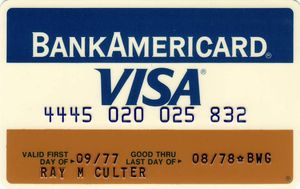

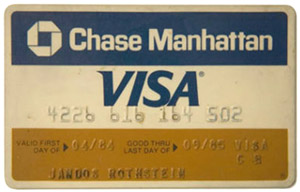

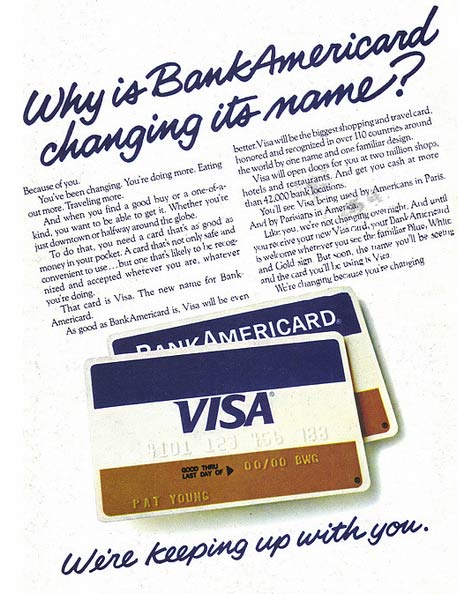

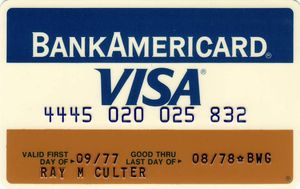

Bank of America began to provide its system to other US banks, but not everyone was comfortable with it. Imagine that Sberbank is written in capital letters on Alfa-Bank’s credit card - a very strange situation. Therefore, we had to invent a new name for the system, not associated with a specific bank.

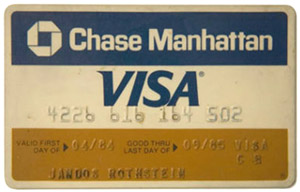

Thus, the “Visa” mark appeared on the cards, and Bank of America transferred the operations with them to National Bank Americard, which was specially created for this. Later it was renamed Visa USA, then Visa International.

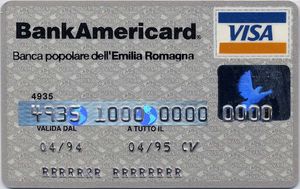

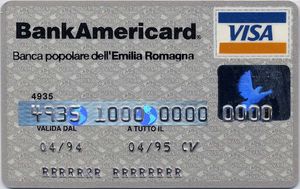

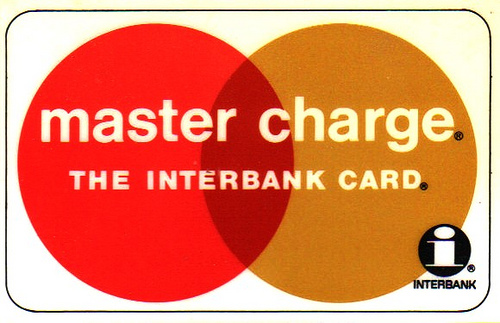

In terms of transaction volume for 2016, Visa is the leader in payment systems with 56%. Behind her comes MasterCard with 26%. China UnionPay takes the honorable third place, while its main turnover falls on operations within the country.

Infographics: Nilsonreport

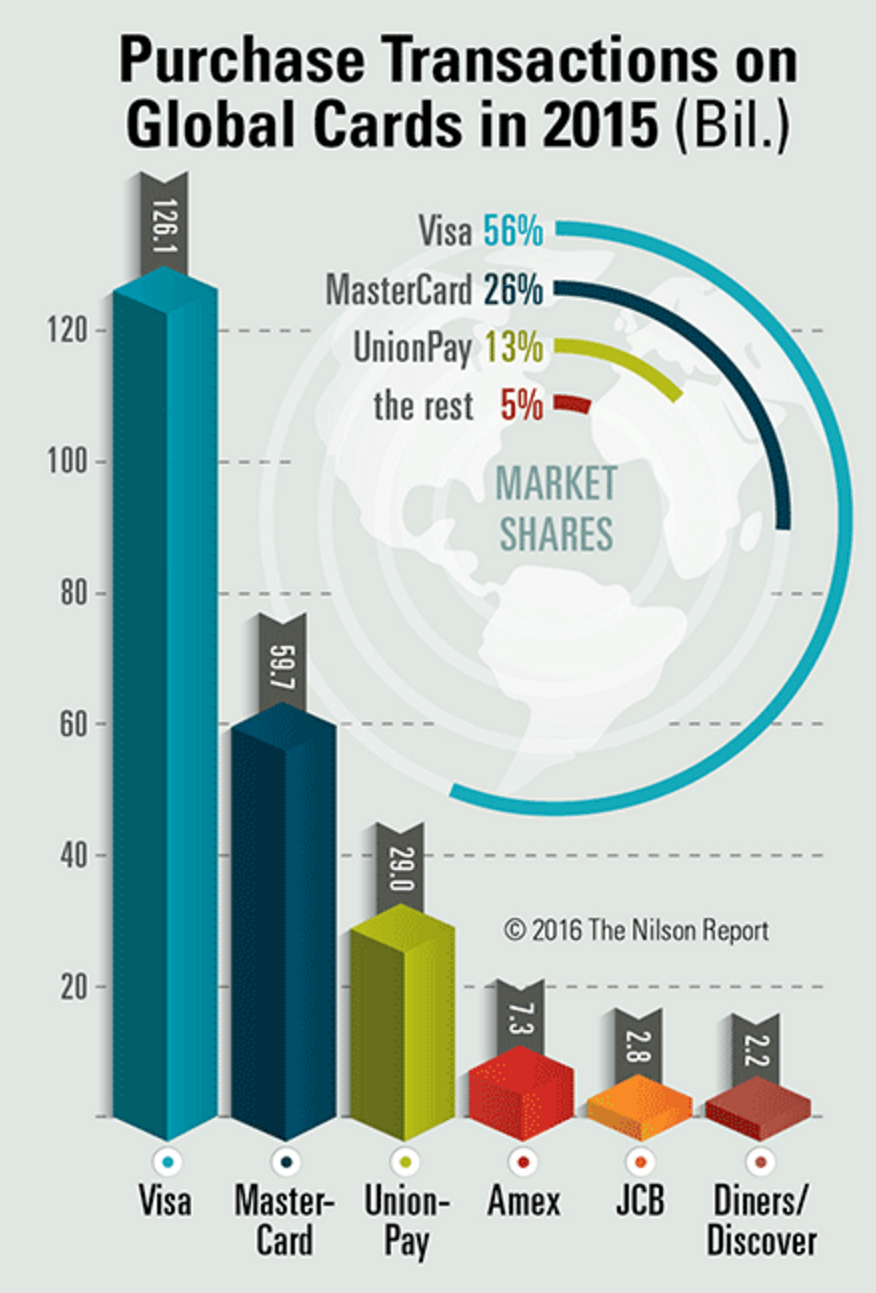

The MasterCard system was created as a competitor to BankAmericard and was originally called Interbank. The company was founded in 1966, when several banks agreed to use a single system and formed the Interbank Card Association.

In 1968, MasterCard with the help of the European system Eurocard entered the European market - the agreement provided for the mutual acceptance of payments in two systems.

From the foundation until 1979, the product from the association was called “Master Charge: The Interbank Card”, and in 1979 the system acquired its current name - MasterCard. In 1996, the company signed a contract with AT & T to create an operating infrastructure with the goal of reducing request processing time. By 1998, ATMs appeared to host MasterCard in the Antarctic.

In 2014, MasterCard, together with Apple, included the functionality of a mobile wallet in the iPhone.

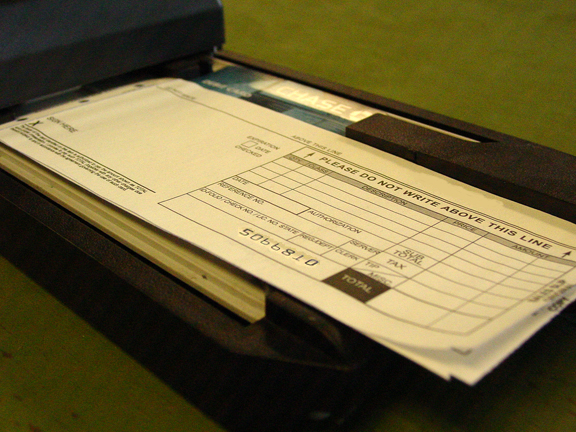

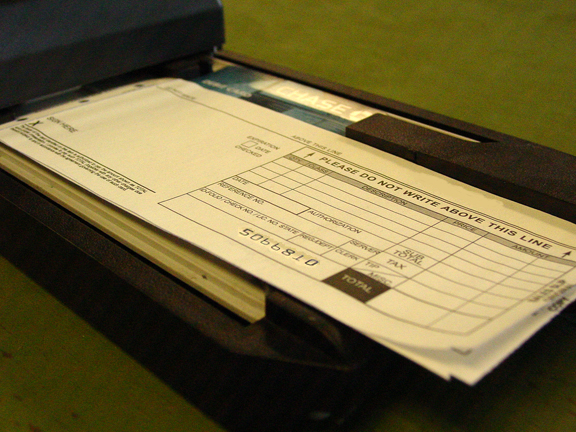

The first cards had identification numbers. In the receipt in the institutions where they were accepted, the numbers were entered manually. First, the data embossed on the map was simplified, and later the imprinters.

The device did slip, typing the card number on the form. So imprinters and standard forms for them are still selling. In 2010, Banki.ru discussed whether, in addition to the POS-terminal, a manual imprinter is needed, which will work when there is no connection or electricity.

In the video - instructions for using the imprinter.

In 1960, they made the first plastic card with a magnetic strip. IBM had a hand in this. The goal was to develop a method of safe data storage - reliability of bar codes and perforation are no different. Therefore, we decided to use magnetic media, which was already used to store information in computers.

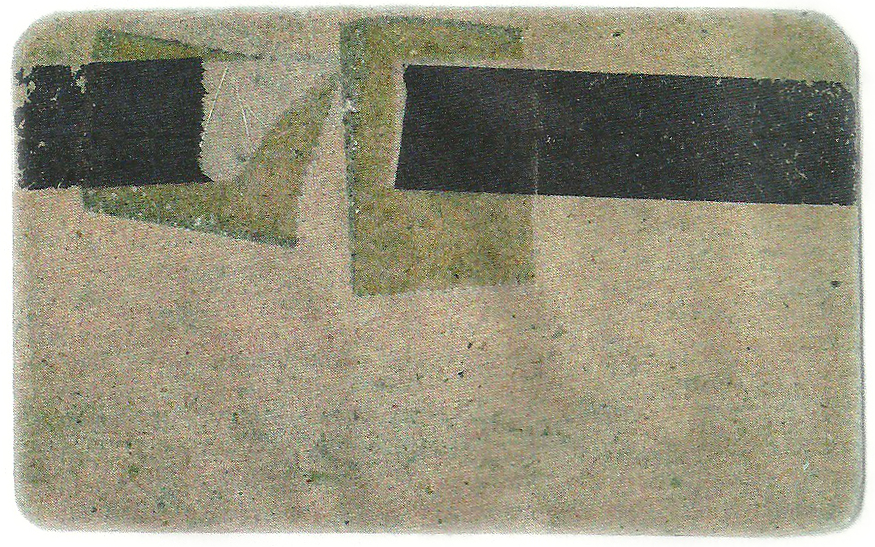

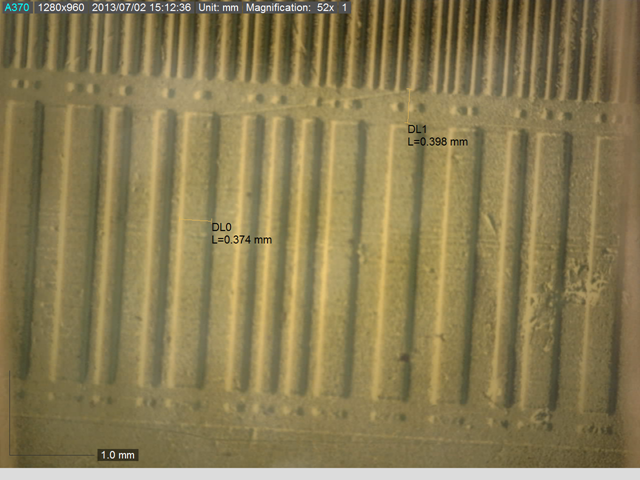

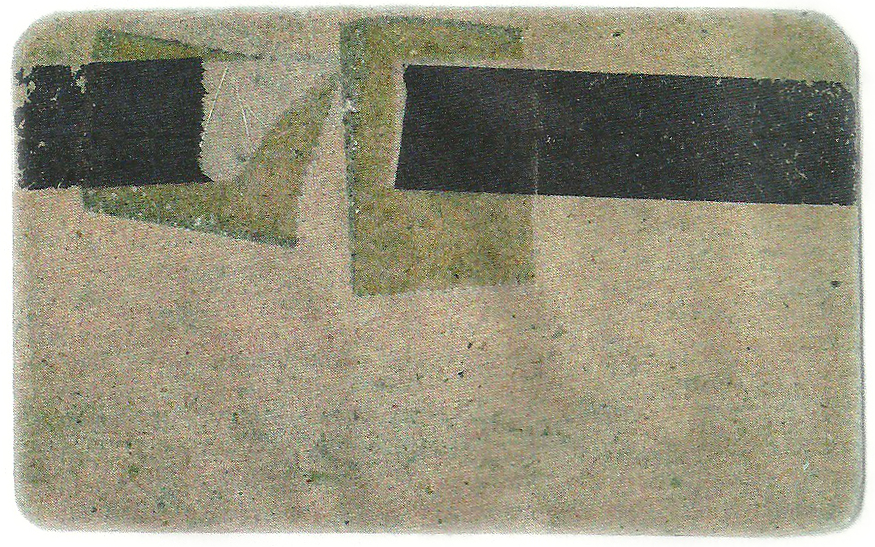

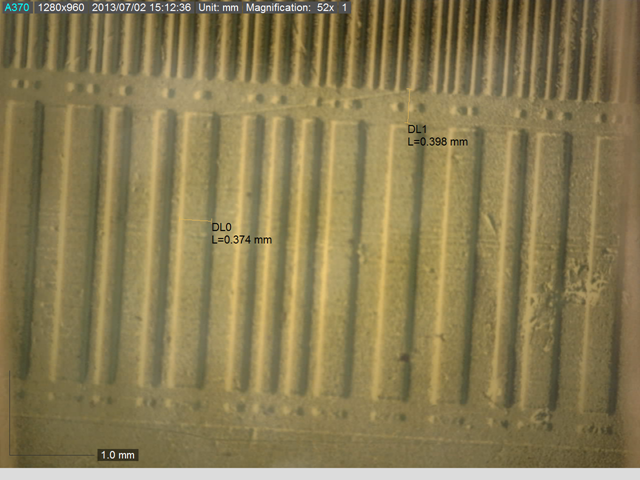

The photo below is a prototype magnetic stripe card made by IBM. Engineer Forrest Perry tried to glue the strip, but it broke. He told about his wife, and she suggested to try to melt the strip in plastic with the help of an ordinary iron. improvised experiment was successful.

Now the production of cards with a magnetic strip is as follows: a plastic base is printed - both sides of the card are covered with two sheets of laminate, a magnetic strip is fixed on the surface and placed in a thermal press, in which this sandwich is processed at a temperature of 160 degrees.

The first magnetic stripe on the map was on the front side of it.

The first prototype of a magnetic stripe card

The magnetic layer of a bank card contains three bands - a track. Earlier on the third track was stored pin-code for the card in ATMs that do not have access to the network. Now only two are used.

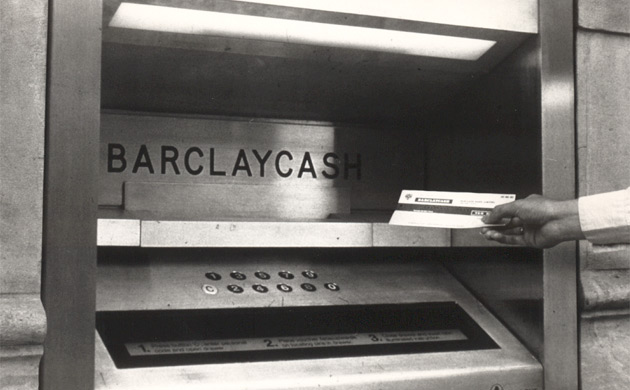

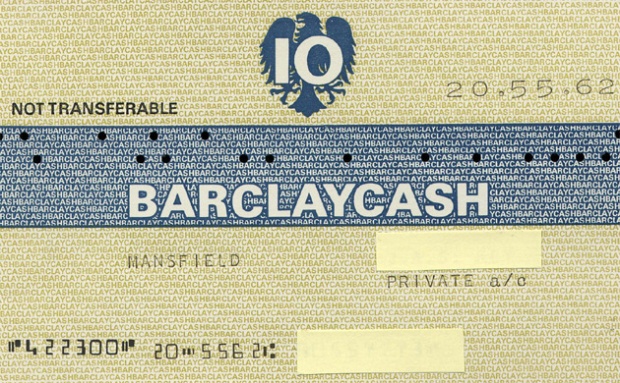

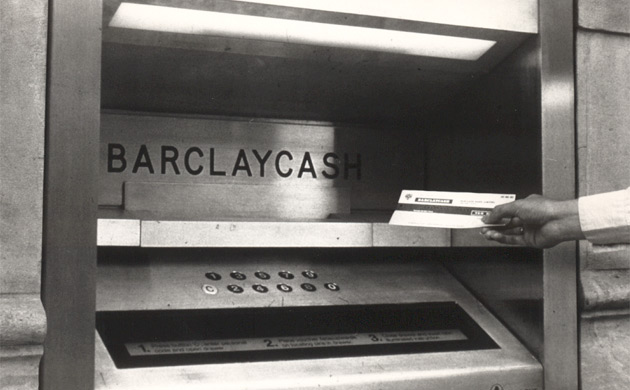

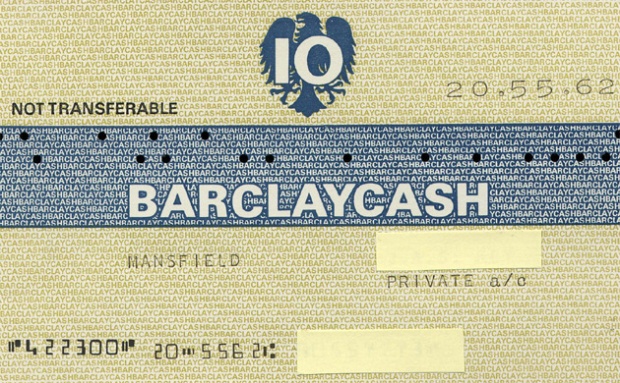

The world's first active ATM appeared in Barclays in 1967 in north London. But he did not accept plastic cards, but paper vouchers. At one time you could get no more than 10 pounds. Vending machines with chocolates were already common then, and it was they, as well as the bank branch closed overnight, that prompted the Scottish inventor John Sheppard-Barron to the idea of automating the receipt of money.

In 2005, John Sheppard-Barron received the Order of the British Empire for his invention, and a year later the same order was given to James Goodfellow as the creator of a PIN code.

The first ATMs to accept bank cards began to install Lloyds Bank in the UK in 1972. These machines are developed by IBM. The development of telecommunications allowed the creation of entire networks of ATMs that could be used by several banks. In Russia, the first ATMs appeared in 1991 at the World Trade Center and in the office of American express.

In the late seventies , the first payment terminals for magnetic stripe cards, EFTPOS, appeared in the USA. Of course, such cards could have been taken earlier in stores, but only with the help of imprinters.

Cash register IBM 3663

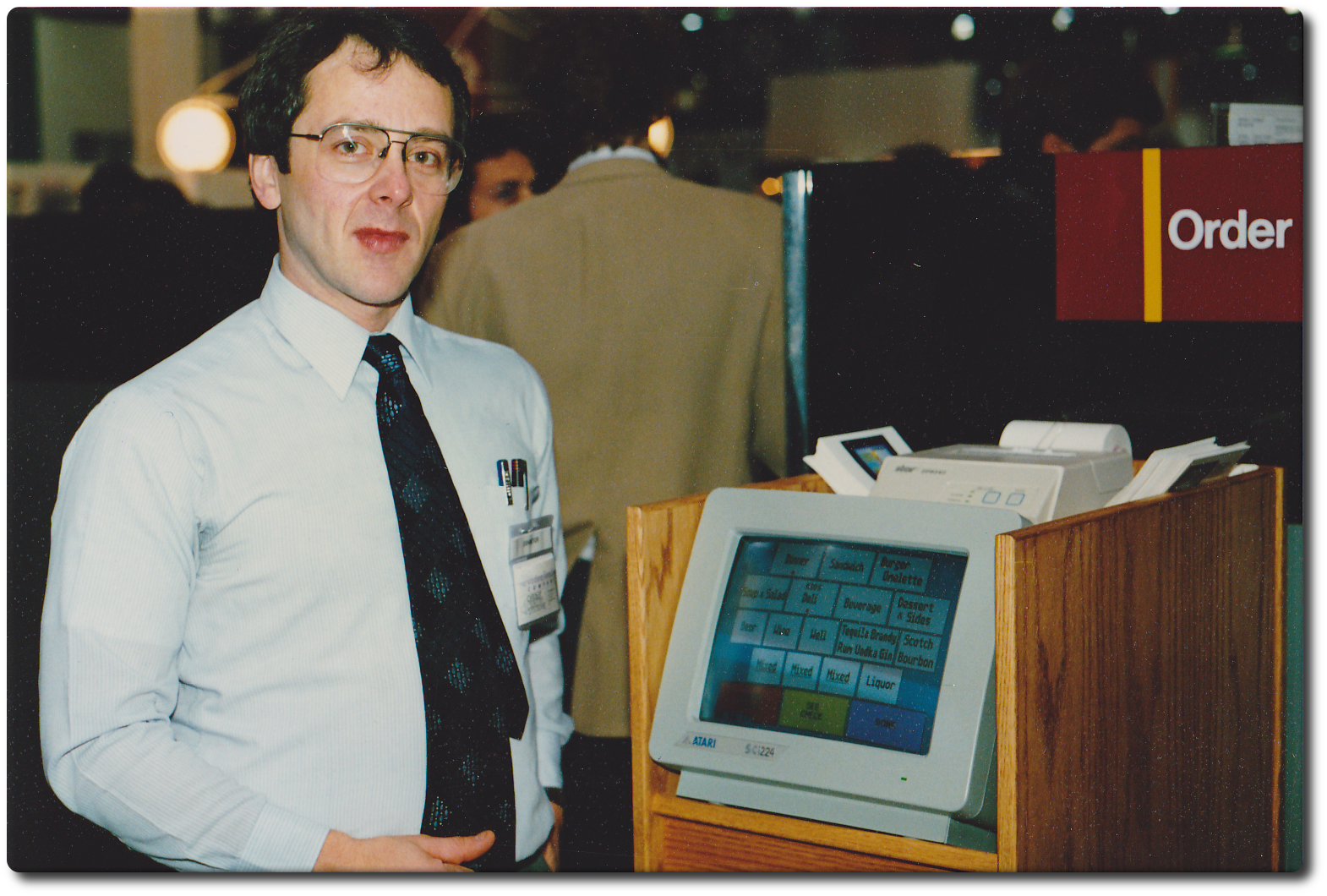

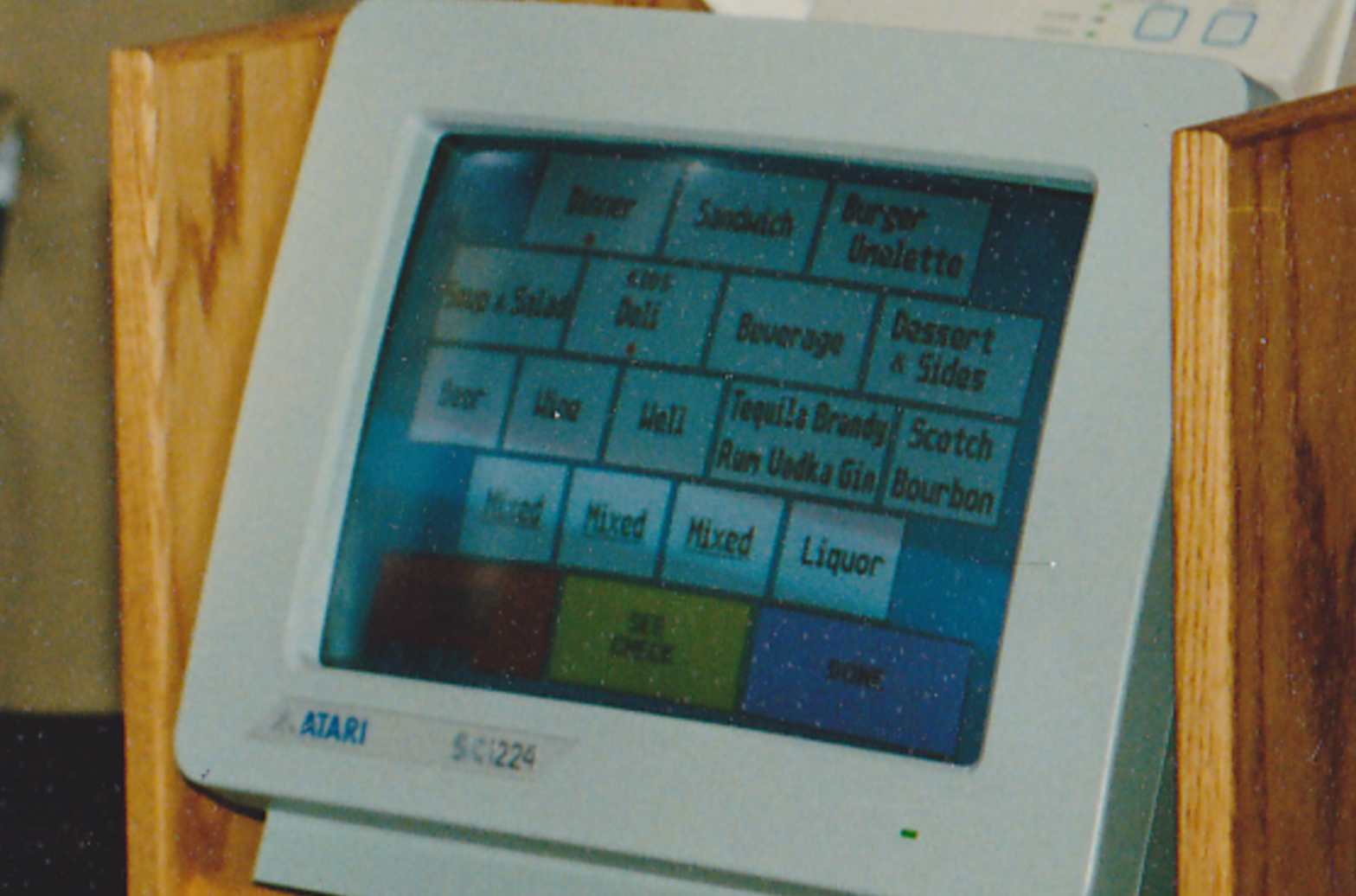

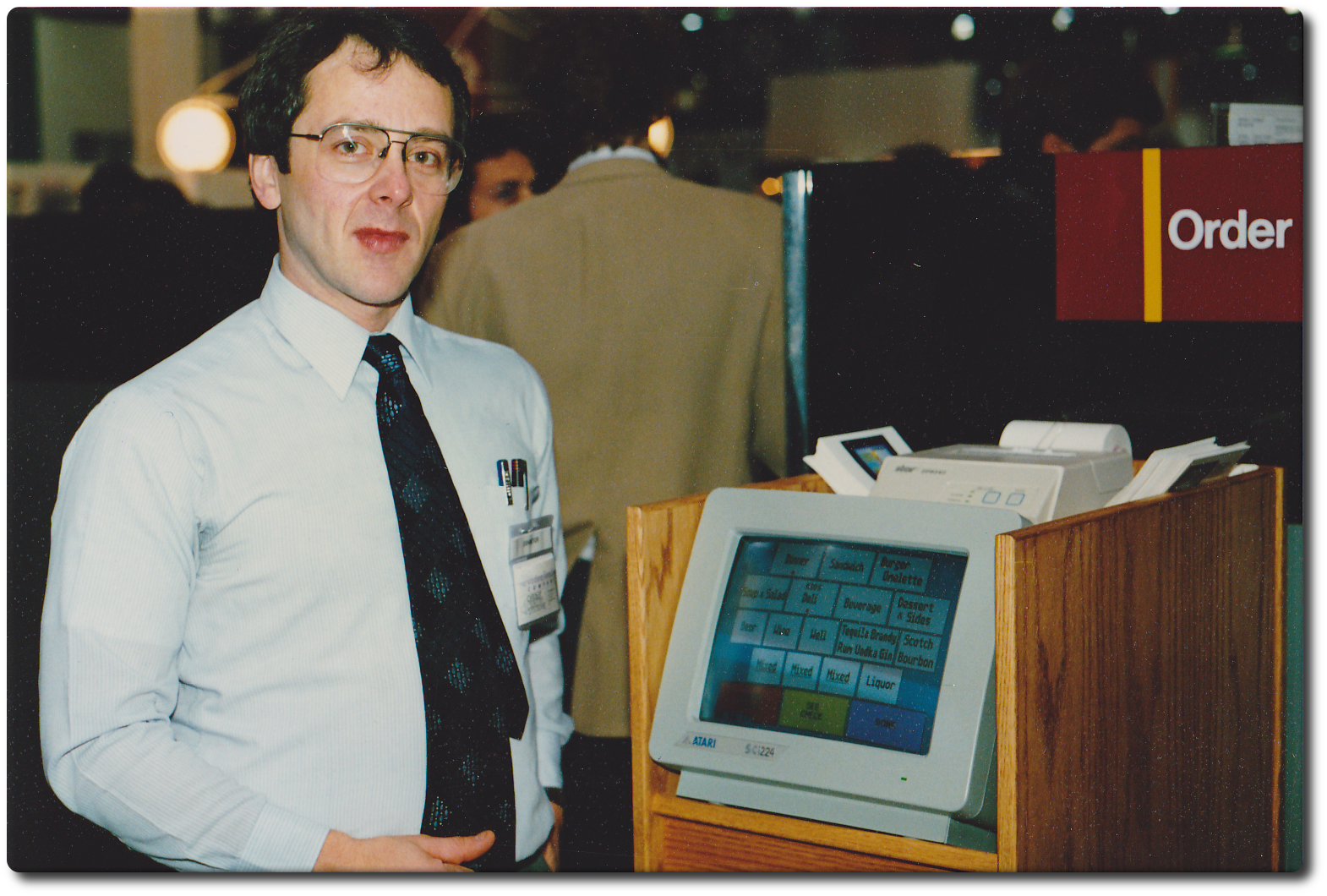

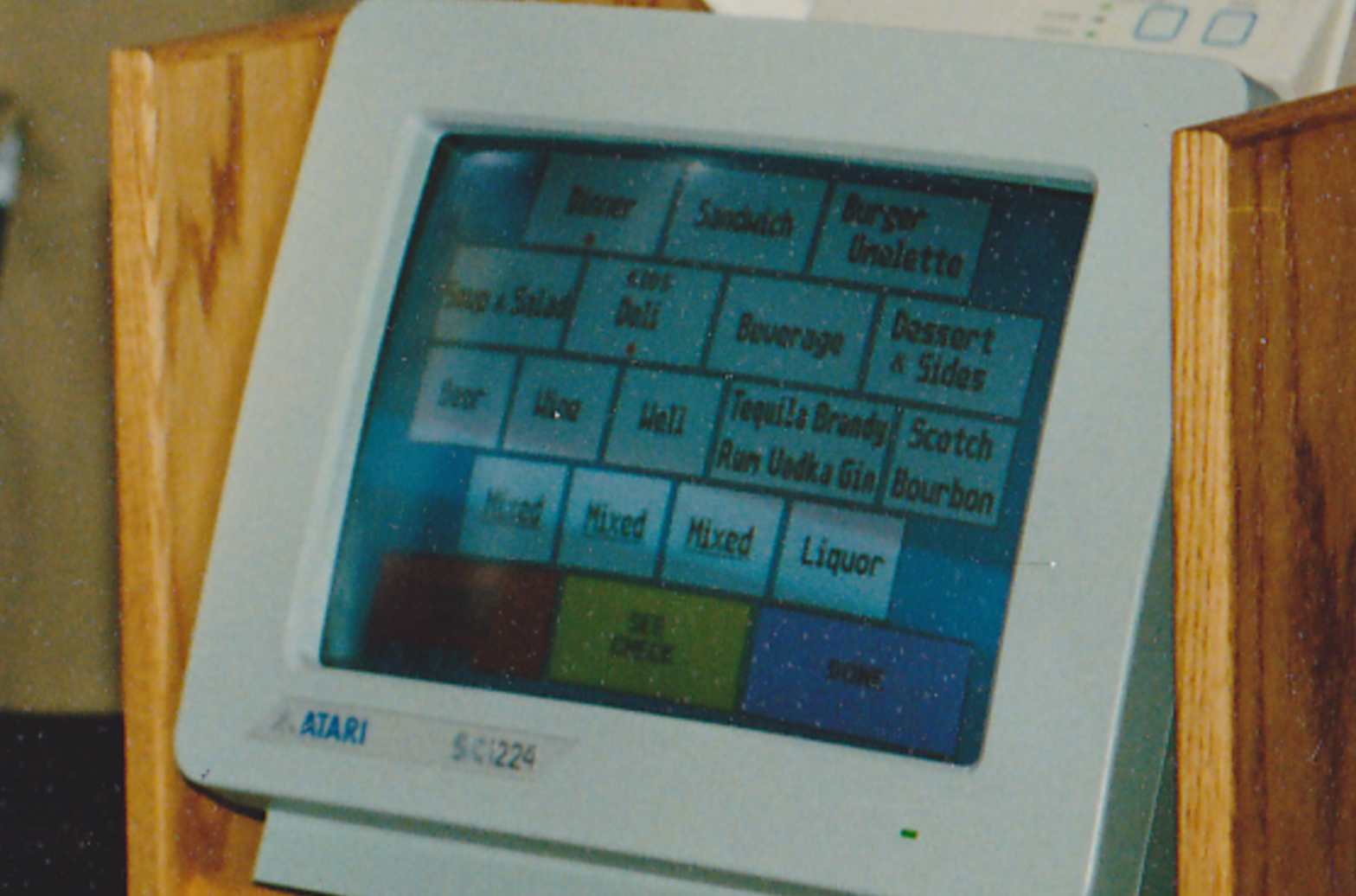

In 1986, for the first time, a touchscreen was used in a cash terminal with support for magnetic stripe cards. It was a POS under the brand ViewTouch, built on the basis of a 16-bit Atari 520ST computer with a 12-inch Atari SC1224 color touchscreen display. The device was presented by engineer Eugene Mosher at ComDex on November 17, 1986.

The device was first delivered in several restaurants in the USA and Canada.

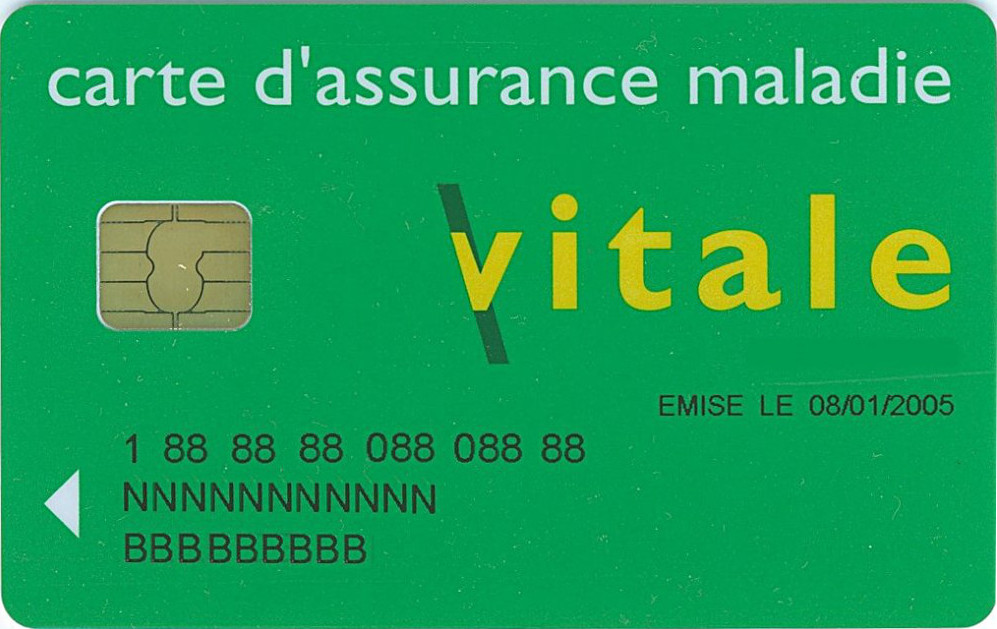

In the early 1990s, Europe began to develop standards for bank smart cards - plastic cards with a built-in microchip, very much like a sim card. A patent for the technology was issued in 1982, and in 1983 France began producing chip cards for paying telephone bills. These cards are used in the health care system in France. And it was in France in 1992 that all debit cards acquired microchips. In the 1990s, SIM-cards appeared on smart cards - “full-size” SIM cards.

The RFID chip installed inside the card allows you to make contactless payments using PayPass and PayWave technologies. Below - Visa PayWave advertising for the Russian market.

In 2012, MasterCard introduced a card with a keyboard and an LCD screen. The microcomputer inside the card generates one-time passwords and stores the history of operations in the memory, and also shows the account balance.

It looks like a modern terminal for receiving cards. Such terminals communicate with the bank via a mobile network and can operate on batteries, which makes them convenient, for example, to pay in restaurants. Some devices support contactless payment, but a minority of them so far - especially in the conservative United States.

Credit card frauds began immediately after their appearance. Savvy Americans realized that having a large credit limit, you can collect goods, sell some of them and go to another state or country.

The next wave was the boom of Internet commerce in the mid-1990s. On the sites appeared buttons "buy". The attackers used the numbers of stolen cards and well-known names - for example, Mickey Mouse, Lex Luther, John Wayne, Bill Clinton. Then the system did not suggest checking the name of the payer and comparing it with the card number, and the sellers had to change it.

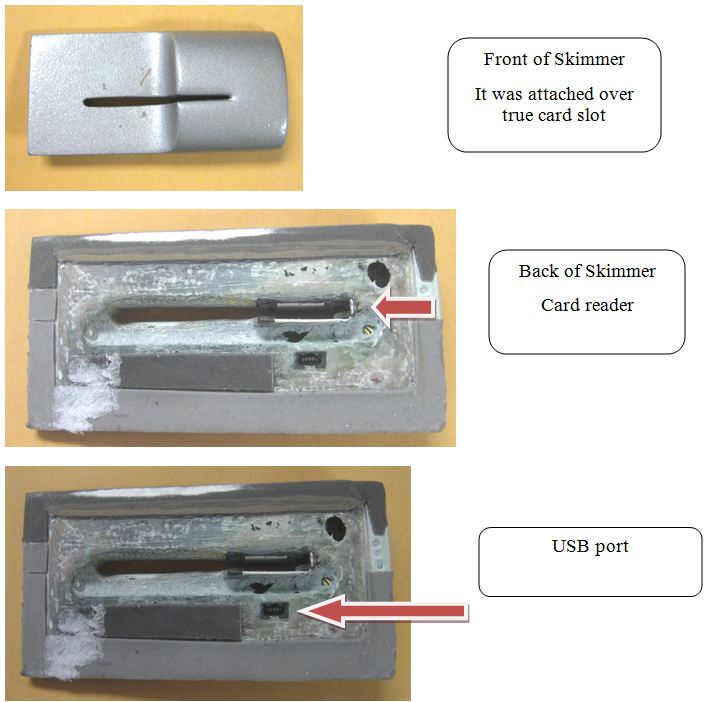

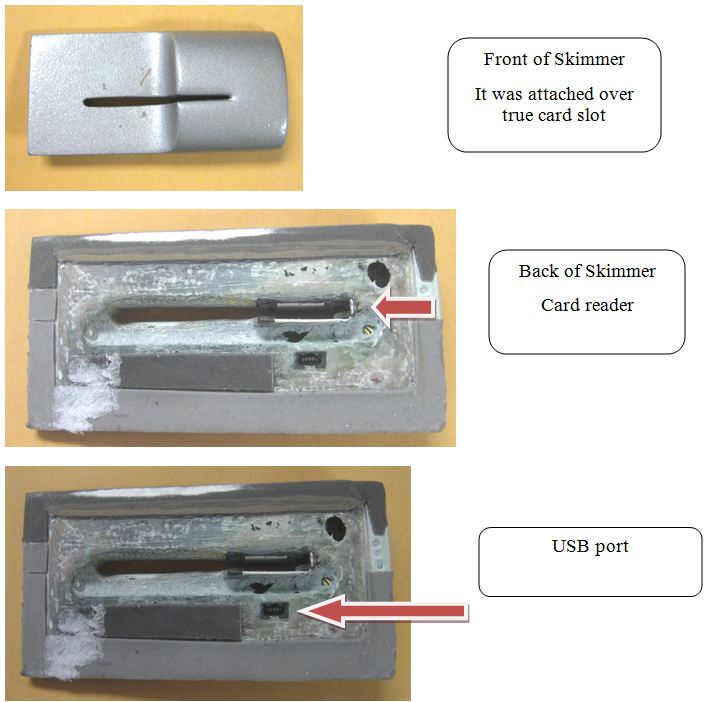

The presence of ATMs on every corner led to the spread of another type of fraud: making a copy of the card using a skimmer. The device, sometimes almost invisible , is installed on the slot to receive a plastic card. Skimmer makes a copy, but in order to fully use it then you need to know the pin. In this case, miniature video cameras aimed at the keyboard come to the rescue. Many people do not palm off the keyboard when typing, and not all ATMs are equipped with a protective panel above it. Below in the photo is an example of a skimmer and an ATM with a video camera installed by scammers (pay attention to the upper left corner of the ATM), as well as a pad on the keyboard, which is used instead of the camera to get a pin code.

Even if you know about skimmers and are able to reveal such an overlay, you cannot relax. Sometimes on the doors to ATMs they put a lock opening with a card - so that you can withdraw money at night when the bank is closed. And on this device also put skimmers .

Sometimes fraudsters do not bother to install skimmers on ATMs of other banks. Instead, they themselves put ATMs . In 2015, in Udmurtia, fraudsters bought decommissioned ATMs and set up in Moscow. They did not give out the money, but read the information from the magnetic tape of the card and the pin-code, after which they reported a “breakdown” and returned the card to the owner.

Skimmers are used not only in ATMs. Technologies have come a long way in advance - in three seconds a fraudster can put a similar device on the terminal to pay for purchases with bank cards in a store.

When a scammer has card data and PIN codes, he can go and spend money. Like Bulgarian Konstantin Kavrakov, who took the money, including from a copy of the bank card of Bill Gates. When a scammer was arrested in 2015, he was found with several Citi Visa, Standard Chartered MasterCard, Citibank MasterCard, Citi MasterCard, Citibank Visa, East-west Bank Vice credit cards, credit cards, transactions checks and 76 thousand Filipino pesos (about 1700 US dollars).

You can do without a copy of the card, having received the original. For this you need the personal presence of a scammer at the ATM. The thief sets the loop in the card reader and waits. The victim receives the money, but can not pick up the card. The attacker is called to help in order to see the pin-code himself, but nothing works - and he advises to contact the bank. There is a PIN, it remains to pull out the card in the loop and withdraw all the money.

Many people constantly carry with them several bank cards, loyalty cards, a pass to work, a subscription to the fitness room - that is, a large amount of plastic. Several projects are trying to save us from this problem by using devices that store data from several cards at the same time. In Russia, this is Cardberry. In January 2016, a startup presented a map in Las Vegas at CES. Already, the cards are used by beta testers in Teremka, Chokoladnitsa and other institutions. But - in the form of loyalty cards. Bank cards add only in the plans, then there are problems with security.

A similar project a little earlier appeared in the US - Coin, this card supports NFC. After the pre-order, this card was waited for two years, but now its status is unclear.

Perhaps LG will enter this market.

The second possible replacement of bank cards is mobile devices. Apple Pay and Android Pay use NFC in mobile gadgets. But while Apple is looking to the future, when all payment terminals will be able to accept contactless payments, Samsung uses technology developed by LoopPay to work with old terminals that read the magnetic stripe.

Plastic cards can become a thing of the past thanks to the biometric identification systems of bank customers. German Gref, head of Sberbank, hopes to implement a voice recognition and identification system by appearance in the next two to three years. But it will work only in Russia, and in other countries - only with Sberbank. On this statement, the representative of VTB24 said that the goal for the implementation of any technology related to the rejection of the use of cards, no.

In the meantime, Mastercard is testing a payment plan using a selfie .

Let's take a look at what people used to use credit cards: where did they come from, how did they adopt the modern form and why was this font printed on them?

One of the earliest ancestors of modern payment cards is metal tokens, which at the beginning of the twentieth century gave out to department stores to customers to track their purchases. Sellers made an imprint of a token in the accounting books opposite the name of the buyer.

')

You had to pay the bills: if now, if you delay the payment of the loan, they will start calling you, then a hundred years ago a collector would immediately come to you in a horse-drawn cart and take your property.

But it was only about local business, so entrepreneurs tied customers to themselves. On a journey, these steel plates would not benefit you; they would not be received anywhere. But traveling with a lot of cash is not the best idea either now or a hundred years ago. This was taken care of in the 1880s by American Express. Because of the need to use credit letters to receive money, the president of the company charged the head of one of the departments to develop an alternative to which traveler’s checks became.

This tool is used now, travelers checks are issued in euros and dollars. They can only be paid by the owner, and in case of theft or loss they are repaired in the offices of American Express and partners.

In 1920, Texaco began producing cardboard cards for its customers - so that they use them at gas stations. It soon became clear that the carton for refills is not suitable, it is too easy to stain. Therefore, Farrington Manufacturing has issued steel embossed cards. They helped automate the payment process — the clerk needed to make a data imprint. The document that is issued when buying with a bank card is called a slip. For extruding letters, the company found the most appropriate font Farrington 7B. It is still used for embossing plastic cards.

In the 1940s and 1950s, during the “trade boom” in the United States, cashless payments began to replace checkbooks. John S. Biggins, a consumer credit specialist at Flatbush in Brooklyn, laid the foundation for credit cards and organized the Charge-it system in 1946: buyers paid for the goods with receipts, the store gave receipts to the bank and paid for the goods from customers' accounts. This chain has not changed, but its speed has increased.

Diners club

Diners Club was founded in 1950 and became the first independent credit company to start working with cards primarily for travel and entertainment. According to legend, it all started with a wallet that was forgotten at home - the company’s founder in 1949 was unable to pay for dinner at a restaurant. The aim of the project was the opportunity for visitors to such establishments not to be limited to cash. The club issued cards, acted as guarantors for obligations, paid invoices, and the club members received an extract once a month and had to pay the entire amount to the club in two weeks.

In 1950, they issued the first 200 Diners Club credit cards. They were mostly friends of the company's founder. Cards taken in 14 restaurants in New York. The cards were made of paper, on the back are the addresses and restaurants where they are accepted.

That was one of the first Diners Club cards:

Cards were made of paper. By the end of 1950, there were already 20,000 card holders who could pay in 285 restaurants. From the mid-1950s, the company entered the international market, the American Stock Exchange, and in 1981, Citibank bought it.

In the USSR, the first credit cards began to operate in 1969, when they began to accept Diners Club for payment in the shops "Birch". Since 2004, Diners Club plastic cards from the USA and Canada have received the MasterCard logo, and it has become possible to pay with them at any point where the cards of this system are accepted. On July 1, 2008, Discover Financial Services bought Diners Club International for $ 165 million.

Until 1958, Diners Club had no competitors - they did not physically exist. Until BankAmericard cards appeared.

Visa

In 1958, Bank of America began its experiment to reduce the costs associated with payments in small business. 60 thousand BankAmericard bank credit cards were sent to residents of Fresno, California. These were ready-to-use cards for which you did not need to fill out an application at the bank. Now such carelessness would have ended in disaster, but in the 1950s everything went smoothly.

The card limit was set at $ 500. Translated at today's prices is more than 4 thousand dollars. The data went to the bank not instantly, no one could follow the loan - in theory, it was possible to buy a huge amount of goods and hide from the police in the woods, with a car, a tent and a supply of food for twenty years.

By 1959, there were over two million such cards, and twenty thousand entrepreneurs accepted them for payments. These figures will become more significant if we mention that then when making a purchase an imprint of the data from the card on the receipt was made - slip. Without convenient terminals, computers and the Internet. Automation helps embossed data on the map.

Bank of America began to provide its system to other US banks, but not everyone was comfortable with it. Imagine that Sberbank is written in capital letters on Alfa-Bank’s credit card - a very strange situation. Therefore, we had to invent a new name for the system, not associated with a specific bank.

Thus, the “Visa” mark appeared on the cards, and Bank of America transferred the operations with them to National Bank Americard, which was specially created for this. Later it was renamed Visa USA, then Visa International.

In terms of transaction volume for 2016, Visa is the leader in payment systems with 56%. Behind her comes MasterCard with 26%. China UnionPay takes the honorable third place, while its main turnover falls on operations within the country.

Infographics: Nilsonreport

Mastercard

The MasterCard system was created as a competitor to BankAmericard and was originally called Interbank. The company was founded in 1966, when several banks agreed to use a single system and formed the Interbank Card Association.

In 1968, MasterCard with the help of the European system Eurocard entered the European market - the agreement provided for the mutual acceptance of payments in two systems.

From the foundation until 1979, the product from the association was called “Master Charge: The Interbank Card”, and in 1979 the system acquired its current name - MasterCard. In 1996, the company signed a contract with AT & T to create an operating infrastructure with the goal of reducing request processing time. By 1998, ATMs appeared to host MasterCard in the Antarctic.

In 2014, MasterCard, together with Apple, included the functionality of a mobile wallet in the iPhone.

How to accept cards

The first cards had identification numbers. In the receipt in the institutions where they were accepted, the numbers were entered manually. First, the data embossed on the map was simplified, and later the imprinters.

The device did slip, typing the card number on the form. So imprinters and standard forms for them are still selling. In 2010, Banki.ru discussed whether, in addition to the POS-terminal, a manual imprinter is needed, which will work when there is no connection or electricity.

In the video - instructions for using the imprinter.

In 1960, they made the first plastic card with a magnetic strip. IBM had a hand in this. The goal was to develop a method of safe data storage - reliability of bar codes and perforation are no different. Therefore, we decided to use magnetic media, which was already used to store information in computers.

The photo below is a prototype magnetic stripe card made by IBM. Engineer Forrest Perry tried to glue the strip, but it broke. He told about his wife, and she suggested to try to melt the strip in plastic with the help of an ordinary iron. improvised experiment was successful.

Now the production of cards with a magnetic strip is as follows: a plastic base is printed - both sides of the card are covered with two sheets of laminate, a magnetic strip is fixed on the surface and placed in a thermal press, in which this sandwich is processed at a temperature of 160 degrees.

The first magnetic stripe on the map was on the front side of it.

The first prototype of a magnetic stripe card

The magnetic layer of a bank card contains three bands - a track. Earlier on the third track was stored pin-code for the card in ATMs that do not have access to the network. Now only two are used.

The world's first active ATM appeared in Barclays in 1967 in north London. But he did not accept plastic cards, but paper vouchers. At one time you could get no more than 10 pounds. Vending machines with chocolates were already common then, and it was they, as well as the bank branch closed overnight, that prompted the Scottish inventor John Sheppard-Barron to the idea of automating the receipt of money.

In 2005, John Sheppard-Barron received the Order of the British Empire for his invention, and a year later the same order was given to James Goodfellow as the creator of a PIN code.

The first ATMs to accept bank cards began to install Lloyds Bank in the UK in 1972. These machines are developed by IBM. The development of telecommunications allowed the creation of entire networks of ATMs that could be used by several banks. In Russia, the first ATMs appeared in 1991 at the World Trade Center and in the office of American express.

In the late seventies , the first payment terminals for magnetic stripe cards, EFTPOS, appeared in the USA. Of course, such cards could have been taken earlier in stores, but only with the help of imprinters.

Cash register IBM 3663

In 1986, for the first time, a touchscreen was used in a cash terminal with support for magnetic stripe cards. It was a POS under the brand ViewTouch, built on the basis of a 16-bit Atari 520ST computer with a 12-inch Atari SC1224 color touchscreen display. The device was presented by engineer Eugene Mosher at ComDex on November 17, 1986.

The device was first delivered in several restaurants in the USA and Canada.

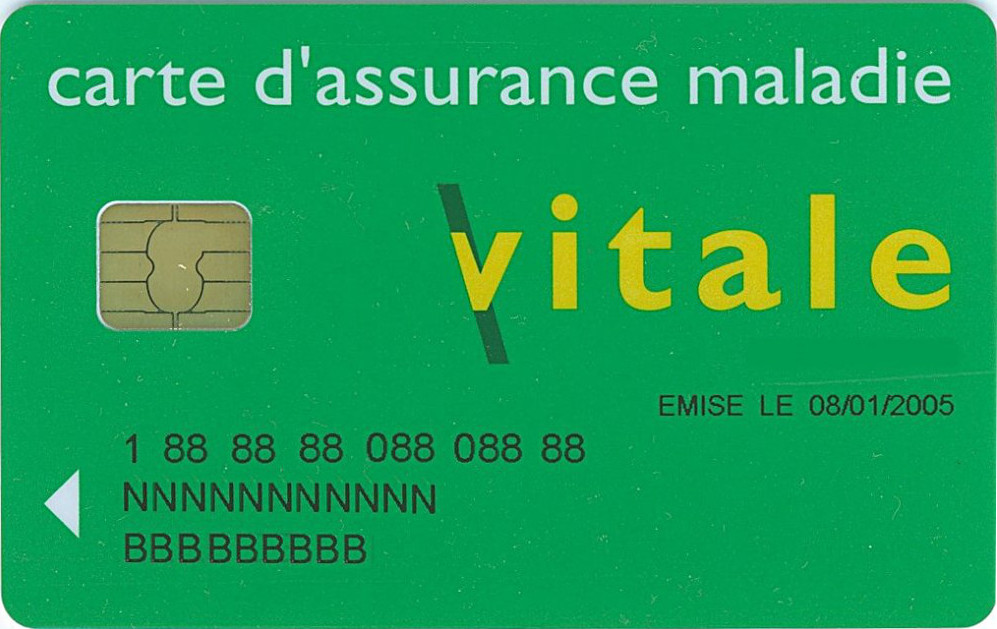

In the early 1990s, Europe began to develop standards for bank smart cards - plastic cards with a built-in microchip, very much like a sim card. A patent for the technology was issued in 1982, and in 1983 France began producing chip cards for paying telephone bills. These cards are used in the health care system in France. And it was in France in 1992 that all debit cards acquired microchips. In the 1990s, SIM-cards appeared on smart cards - “full-size” SIM cards.

The RFID chip installed inside the card allows you to make contactless payments using PayPass and PayWave technologies. Below - Visa PayWave advertising for the Russian market.

In 2012, MasterCard introduced a card with a keyboard and an LCD screen. The microcomputer inside the card generates one-time passwords and stores the history of operations in the memory, and also shows the account balance.

It looks like a modern terminal for receiving cards. Such terminals communicate with the bank via a mobile network and can operate on batteries, which makes them convenient, for example, to pay in restaurants. Some devices support contactless payment, but a minority of them so far - especially in the conservative United States.

Fraud

Credit card frauds began immediately after their appearance. Savvy Americans realized that having a large credit limit, you can collect goods, sell some of them and go to another state or country.

The next wave was the boom of Internet commerce in the mid-1990s. On the sites appeared buttons "buy". The attackers used the numbers of stolen cards and well-known names - for example, Mickey Mouse, Lex Luther, John Wayne, Bill Clinton. Then the system did not suggest checking the name of the payer and comparing it with the card number, and the sellers had to change it.

The presence of ATMs on every corner led to the spread of another type of fraud: making a copy of the card using a skimmer. The device, sometimes almost invisible , is installed on the slot to receive a plastic card. Skimmer makes a copy, but in order to fully use it then you need to know the pin. In this case, miniature video cameras aimed at the keyboard come to the rescue. Many people do not palm off the keyboard when typing, and not all ATMs are equipped with a protective panel above it. Below in the photo is an example of a skimmer and an ATM with a video camera installed by scammers (pay attention to the upper left corner of the ATM), as well as a pad on the keyboard, which is used instead of the camera to get a pin code.

Even if you know about skimmers and are able to reveal such an overlay, you cannot relax. Sometimes on the doors to ATMs they put a lock opening with a card - so that you can withdraw money at night when the bank is closed. And on this device also put skimmers .

Sometimes fraudsters do not bother to install skimmers on ATMs of other banks. Instead, they themselves put ATMs . In 2015, in Udmurtia, fraudsters bought decommissioned ATMs and set up in Moscow. They did not give out the money, but read the information from the magnetic tape of the card and the pin-code, after which they reported a “breakdown” and returned the card to the owner.

Skimmers are used not only in ATMs. Technologies have come a long way in advance - in three seconds a fraudster can put a similar device on the terminal to pay for purchases with bank cards in a store.

When a scammer has card data and PIN codes, he can go and spend money. Like Bulgarian Konstantin Kavrakov, who took the money, including from a copy of the bank card of Bill Gates. When a scammer was arrested in 2015, he was found with several Citi Visa, Standard Chartered MasterCard, Citibank MasterCard, Citi MasterCard, Citibank Visa, East-west Bank Vice credit cards, credit cards, transactions checks and 76 thousand Filipino pesos (about 1700 US dollars).

You can do without a copy of the card, having received the original. For this you need the personal presence of a scammer at the ATM. The thief sets the loop in the card reader and waits. The victim receives the money, but can not pick up the card. The attacker is called to help in order to see the pin-code himself, but nothing works - and he advises to contact the bank. There is a PIN, it remains to pull out the card in the loop and withdraw all the money.

Replacement cards

Many people constantly carry with them several bank cards, loyalty cards, a pass to work, a subscription to the fitness room - that is, a large amount of plastic. Several projects are trying to save us from this problem by using devices that store data from several cards at the same time. In Russia, this is Cardberry. In January 2016, a startup presented a map in Las Vegas at CES. Already, the cards are used by beta testers in Teremka, Chokoladnitsa and other institutions. But - in the form of loyalty cards. Bank cards add only in the plans, then there are problems with security.

A similar project a little earlier appeared in the US - Coin, this card supports NFC. After the pre-order, this card was waited for two years, but now its status is unclear.

Perhaps LG will enter this market.

The second possible replacement of bank cards is mobile devices. Apple Pay and Android Pay use NFC in mobile gadgets. But while Apple is looking to the future, when all payment terminals will be able to accept contactless payments, Samsung uses technology developed by LoopPay to work with old terminals that read the magnetic stripe.

Plastic cards can become a thing of the past thanks to the biometric identification systems of bank customers. German Gref, head of Sberbank, hopes to implement a voice recognition and identification system by appearance in the next two to three years. But it will work only in Russia, and in other countries - only with Sberbank. On this statement, the representative of VTB24 said that the goal for the implementation of any technology related to the rejection of the use of cards, no.

In the meantime, Mastercard is testing a payment plan using a selfie .

Source: https://habr.com/ru/post/394993/

All Articles