What is The DAO and how it became the largest crowdfunding project in history

In the previous part of a series of articles on Vitalik Buterin's projects, we talked about how Ethereum came to the forefront of the blockchain world. In this issue we will talk about the largest crowdfunding project to date - “ The DAO ”: the Decentralized Autonomous Organization (decentralized autonomous organization), which has collected more than 150 million US dollars. What is The DAO? What makes it so popular? How does the DAO work? Why is there no consensus in the blockchain community about the success of the project? All this you will find further.

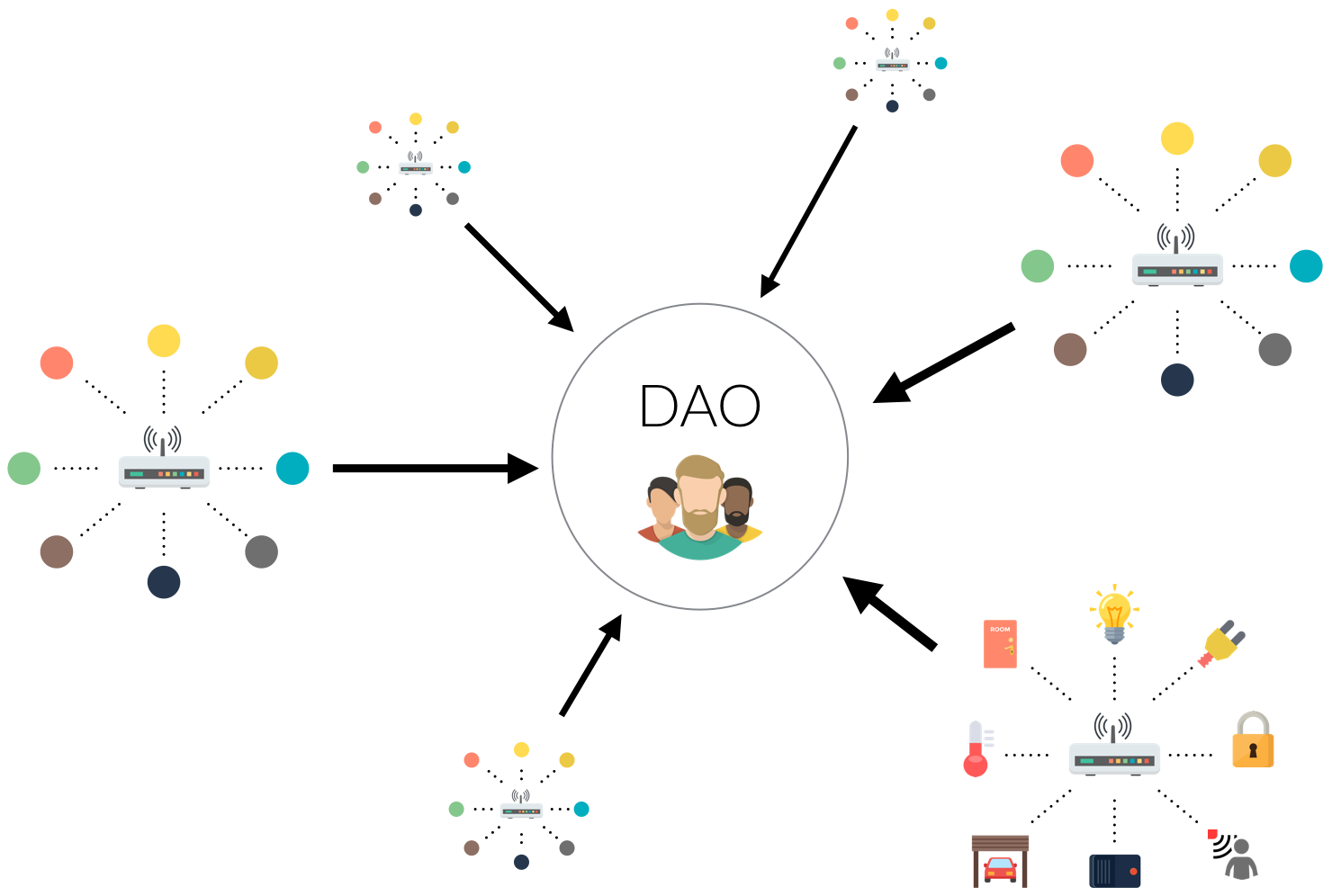

In the previous part of a series of articles on Vitalik Buterin's projects, we talked about how Ethereum came to the forefront of the blockchain world. In this issue we will talk about the largest crowdfunding project to date - “ The DAO ”: the Decentralized Autonomous Organization (decentralized autonomous organization), which has collected more than 150 million US dollars. What is The DAO? What makes it so popular? How does the DAO work? Why is there no consensus in the blockchain community about the success of the project? All this you will find further.Despite the fact that the idea of The DAO is aimed at the effective use of the advantages of crowdfunding, the project itself is not just another crowdfunding platform. The DAO is positioning itself as an organization that is based on the cloud code, is not a legal entity and is managed collectively by all its investors (in fact, the “ giant committee of geeks ”). In the traditional sense, such an organization does not create anything and does not hire employees. A group of developers from Slock.it and the core team of Ethereum presented a new development that for the first time in history allowed to create organizations whose members can directly and in real time control the invested funds, and the rules of management are formalized and implemented with the help of automated programs.

The DAO is similar to the democratic version of a virtual hedge fund not regulated by law, a share in which can be obtained by investing personal funds (in the form of ETH) and buying DAO tokens on them, giving the holder the right to participate in managing the invested collective funds.

The DAO is closed and controls itself: its program code operates autonomously, and internal rules are an integral and immutable part of the Ethereum-blockchain. The main activity of the organization is to unite like-minded people with the goal of working together on projects and achieving certain goals. Participants may be completely unfamiliar in real life, however, by joining together within The DAO, they can do something meaningful together. And the strangers really got together: more than 20 thousand investors have already “thrown firewood”, having invested a total of more than 150 million dollars in The DAO.

')

What makes The DAO so interesting?

The DAO is a new type of organization that is best described by a comparison with a digital company that is not tied to any legal entity. Created using an unchangeable code, it is managed exclusively by a community of investors who have invested in it in the form of ETH (tokens on which Ethereum works) and exchanged them for special DAO tokens.

According to Slock.it, The DAO has 4 characteristics.

First, it should be noted absolute impartiality in the selection of participants. Using the implementation of smart contracts from Ethereum, The DAO allows anyone from all over the world to participate in the management of the general fund of funds. Supported project members receive DAO tokens for use in voting and other company activities.

Secondly, The DAO is a flexible structure. This is manifested in the fact that the principle of the organization allows you to support proposals of any nature, be it the creation of a product that is useful for it, investment in venture projects for profit, or their referral to charitable needs (the salvation of whales has already been proposed). Participants can vote for the allocation of funds for innovative proposals, the further practical implementation of which will fall on the shoulders of involved artists.

Thirdly, The DAO can make a profit from the products or services developed under the project. Customer fees and potential profits (at ETH) can be directed to further growth of the organization or simply converted into DAO tokens and distributed among project participants.

Another remarkable feature of The DAO is a fair decentralized management model. The Slock.it team promises that The DAO Ethereum-owned tokens will never be managed centrally. Holders of DAO tokens have the right to vote in the course of making important decisions related to the management of an organization or projects, including the possibility of redistributing ETH among participants.

How The DAO Works

The operating model of The DAO consists of 4 stages: proposal, voting, development and practical implementation.

To begin with, any owner of a DAO token can make an offer, where he will indicate the amount of ETH that will be required to develop a product or service. The proposal also defines the level of control over the powers with which The DAO should vest potential contractors.

After making a proposal, the owners of DAO-tokens participate in the voting. Each of them has absolute power over their own funds invested in the project. They can also vote for changing the service provider or changing any other offer parameter. Moreover, even if the owner of the DAO tokens subsequently decides to leave the project, he or she will still have the right to make a profit from the sale of the product or service.

As soon as the holders of DAO-tokens approve the offer, the service provider is obliged to conclude with them a smart contract regulating the terms and methods of performing the tasks set. The contractor receives payment in several tranches, which allows you to establish a long-term relationship between him and The DAO.

The purpose of the proposal is indicated in its description. In the case of creating a product or service requiring payment for their use, after launching the project, The DAO will charge customers and use the earnings earned by ETH at the discretion of the community.

Project Criticism

The significance of many amazing and revolutionary inventions is often overestimated. The magazine MIT Technology Review considers a venture to trust the masses rather risky. After all, even if experienced, educated and holding a finger on the pulse, venture capitalists are not always able to choose the right startup for a profitable investment, what can we expect from a motley crowd, most of which has nothing to do with investments at all?

Another point is related to the platform on which The DAO operates. The “wise crowd” of people who supported The DAO may be so absorbed in the hype around ETH that, in choosing projects for support, it will start to give preference to Ethereum and related ideas, the usefulness of which, according to experts, has not yet been proven.

Moreover, the broad success of DAO depends largely on whether ETH can become a popular means of paying for products and services. Regardless of the degree of autonomy, The DAO will have to, in one way or another, involve third-party organizations that conduct their financial affairs in traditional currencies. Payment for their services will require the conversion of ETH tokens, which will certainly create for the organization some additional inconvenience in communicating with the rest of the world.

Tim Swanson, director of market research at R3CEV , shared interesting thoughts on the disadvantages of The DAO:

“... The DAO, in fact, is an investment fund. However, many people view it as a gold-filled repository at the very bottom of the ocean, the value of which must somehow grow sometime in an unknown way, and they, in turn, should benefit from it.

Of course, we will always be able to watch these funds lying “there at the depth”, but someone still needs to give DAO-tokens real value in order to extract at least some profit from the project. ”

Swanson also asks reasonable questions: “Will a DAO be a profitable asset for its investors during the first time of its existence? What will happen when the owners and recipients of the organization’s funds encounter problems with the legal regulation of its activities? ”

Jeremy Gardner, co-founder of Augur's similar crowdfunding project and venture capitalist investing in blockchain development, also expressed doubts about the project:

“How are the participants of The DAO going to analyze the proposals and check the biographies of programmers and entrepreneurs from whom they came? How will the discussion of decisions be held? Of course, you have forums or Slack, but how to select really valuable ideas from all this noise created by several hundreds or thousands of people? ...

... From Russia and China to the United States, hackers and scammers of all kinds are trying to chop off their own piece of this tasty morsel. ”

Many commentators acknowledge the risks associated with the shadow legal position of The DAO, as well as the likelihood that a recent fundraising project can adversely affect the cost of an ETH:

“As soon as the holders of DAO tokens will be able to exchange them back for Ether [which has risen in price largely due to the hype around this crowdfunding], the cost of ETH will drop dramatically,” said Joseph Lee, owner of Magnr.

Another opinion , owned by Dan Larimer, technical director of Steemit:

“The theoretical concept of a joint solution within The DAO will still face the reality in the form of the personal interests of the participants, as well as political and economic obstacles. As soon as people begin to realize that this undertaking brings them more losses than profits, many of them will begin to leave the project.

At first, everything can be good, but over time, the Ethereum community will understand what BitShares project participants already know from their own mistakes, ”Larimer continues. - Creating social systems aimed at joint investment in projects is not an easy task. Of course, technologies will help you to improve communication, but they cannot eliminate the fundamental discrepancy between the personal interest of individuals and common interests. ”

Another controversial point is the quorum level of 20% of the vote. Jonathan Chester, founder and president of Bitwage, calls this idea into question : “What happens if a 20% quorum is never reached, and The DAO investors are so divided that they cannot even agree to reduce the mandatory minimum votes?”

Be that as it may, the idea of The DAO is now widely discussed and receives a lot of contradictory reviews. She attracted a lot of interest and generated a lot of speculation on whether the project will be successful or fail. Even with a significant amount of funds raised, The DAO remains a legally non-existent entity that exists only in the cloud and can disappear at any time if its participants want to return their funds. Only time and projects implemented under the auspices of the organization will show whether it will be effective and whether it will be able to find its place in the modern financial world.

What do you think, will The DAO succeed in carrying out its ambitious plans?

Prepared by materials LTP . Well, we in turn suggest that you order our dual currency debit card Wirex, for this you need to leave a request on our website or install the free app on your smartphone: Android or iOS .

Source: https://habr.com/ru/post/394903/

All Articles