Alphabet occupied the first line of the ranking of the most expensive companies in the world, replacing Apple. Exactly one day

Welcome readers of the blog iCover ! Capitalization is one of the main benchmarks for companies that manage collective investment funds. In particular, the strategy Large Cap, an investment in corporations with maximum capitalization, is very popular among institutional investors working with ETF funds. The level of capitalization and its dynamics is a kind of beacon, symbolizing the strength of the company's position and the correctness of its chosen strategy. That is why the top of the rating is so attractive both for the leading players of the IT market and for investors who adhere to this strategy.

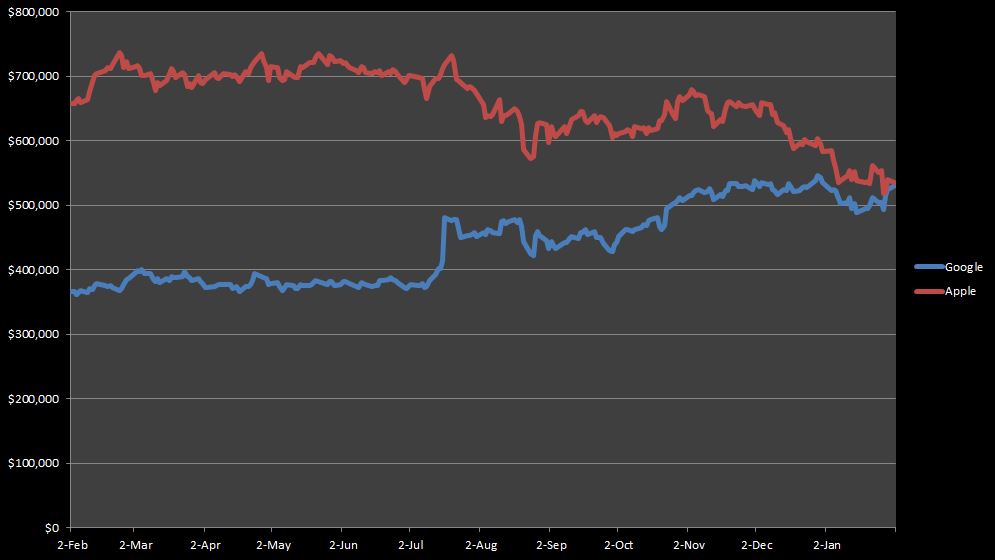

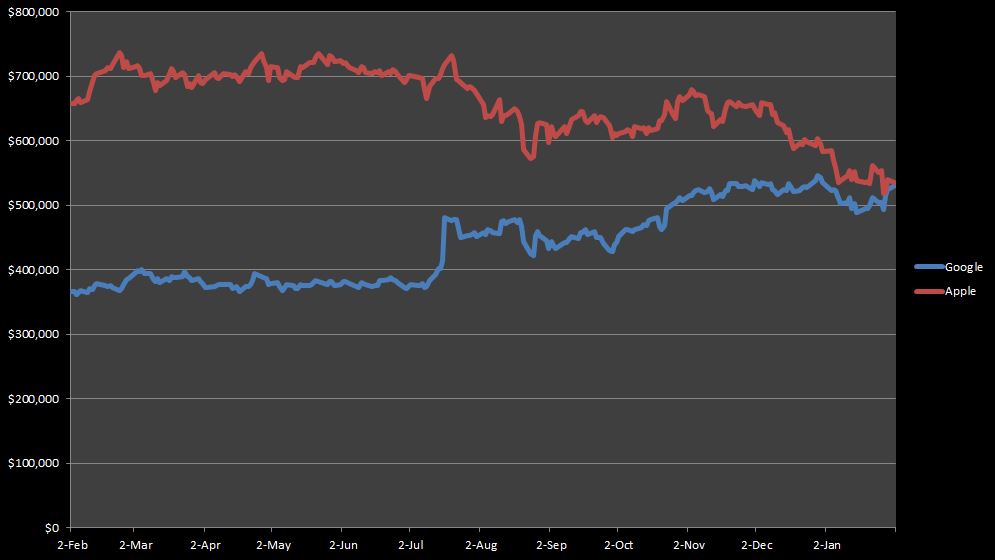

At the beginning of this week, an event occurred that immediately affected the moods of hundreds of thousands of investors - on February 1, the parent company Google Alphabet provided a quarterly and annual financial report. An hour later, the curves of the graphs of the capitalization of Apple (AAPL Market Cap) and Alphabet (GOOGL Market Cap) first became equal and then crossed, which made it possible to speak of a change in the global market leader of global IT in terms of market capitalization.

As we have already mentioned, the quarterly and annual report provided by Alphabet’s financial department as of February 1 turned out to be better than analysts had supposed. And not just better, this quarterly report just one hour after the publicity changed the location of two key figures on the technological Olympus board, allowing the Alphabet to rise to the throne, where until this point more than 4 years after the overthrow of ExxonMobil in 2011, Apple Inc. firmly sat.

')

This situation becomes clear if you look at the charts of the dependence of the volume of capitalization of Google and Alphabet on the time period of a month. The relatively dynamic growth of Google's positions (blue graph) since mid-July and the chaotic-choppy, sometimes upward, red Apple graph from the beginning of November 2015.

The relatively smooth ascending dynamics of the Alphabet graphics are explained by the very specifics of the income structure: Google so far firmly holds the position of the most popular search engine on the planet, YouTube, the leading video hosting service, and Android, the most popular mobile OS. Stable income of about $ 2 billion in monthly fees for the use of cloud services and sales of the Google Play application store, as well as the collection from advertising, also come so far quite regularly and predictably.

Announced February 1, the financial department of Alphabet, the company's results for the IV quarter and 2015 exceeded the wildest expectations of analysts. Over the past 3 months of last year, the company managed to earn $ 21.329 billion instead of the estimated $ 20.8 billion, which added its quotes to nearly 9% and exceeded last year's figure ($ 18.103 billion) by 18%. Taking into account the change in the exchange rate, the increase was 24%. At the same time, the operating profit for the quarter increased by 25%, reaching $ 5.380 billion, and net - $ 4.923 billion (relative to $ 4.675 billion in the fourth quarter of 2014).

Alphanet financial results for the fourth quarter of 2014/2015

In addition to summarizing the results for the fourth fiscal quarter, the company also provided for publication the results of work over the past 12 months, divided into 2 segments. Google's operating profit increased from $ 19.011 billion at the end of 2014 to $ 23.425 billion at the end of 2015, and revenue from $ 65.674 billion to $ 74.541 billion, respectively. Revenues of the remaining divisions amounted to $ 448 million.

The financial results of Google and the rest of Alphanet units for the 12 months of 2014/2015

The table shows that the lion’s share of Alphabet revenue ($ 23.425 billion) was provided by popular Google services, which included ads, Google Maps, revenues from the sale of Android applications and the You-Tube channel etc. So, following the results of the fourth quarter, the Sundar Pichai team earned nearly $ 20 billion. The remaining divisions of the Alphabet holding ended the year with a loss - the amount of their operating losses was $ 3.567 billion. According to the above information, it becomes clear why analysts have already called Google “typewriter” for total holding Alphabet.

It should be noted that in the future Google will be able to circumvent Apple in terms of capitalization, some analysts pointed out in 2014 based on the figures of the comparative growth rates of two IT giants: 32% from Apple against 57% from Google from January 2013 to September 2014. So, according to the forecast of Wall Street Journal experts, Google will be the first company whose market value will be able to reach and overcome the $ 1 trillion bar. until 2020.

The reorganization and the company's openness policy played a role in ensuring a stable income. Gathering nine companies under their umbrella and assigning Google Personal CEO to each of them significantly expanded the opportunities for the development of each individual direction. For comparison, before the global restructuring and the creation of the Alphabet, only a few people made all the responsible final decisions on the projects, which inevitably entailed a fatal bureaucratization of processes. Today, the development of each key area has gone much faster, and the volume of investment in promising projects for the reporting period of 2015 has increased almost twice as compared with 2014, from S1.94 billion to S3.57 billion, respectively. And shareholders take such initiatives with enthusiasm, despite the fact that they obviously do not promise quick profits, and at some stage, as the report shows, they only incur losses.

One of the promising projects developed by the Alphabet division, Google X - Project Loon, which aims to deliver the Internet to all corners of the globe, in its perspective will increase the number of users of Google services. In test mode, the project has already been launched in Sri Lanka. The second project, which is in the company's special attention zone, is Google Auto, which is dedicated to the development of unmanned vehicles, which in the future could become one of the most popular means of transportation for millions of people, again - potential users of the Google service - Alphabet. And purposefully to support such initiatives in Alphabet created a special project dedicated to the development of urban infrastructure. However, at this stage, the company attracts the bulk of its income “in the old-fashioned way”, due to the monetization of advertising traffic.

One way or another, but the fact of "castling" took place:

)

“Fiscal year 2015 was the most successful year in Apple’s history; annual revenue grew by 28% and reached almost $ 234 billion. This success was made possible by our commitment to creating the best and most advanced products in the world, which is a testament to the grandiose skill of our team, - said Tim Cook, CEO of Apple. “We are approaching the holiday season with the best product line ever created by a company that includes the iPhone 6s and iPhone 6 Plus , Apple Watch with an expanded range of cases and bracelets, the new iPad Pro and the brand new Apple TV , which starts shipping this week ”(October 2015).

"Apple's record-breaking results in the September quarter ensured a growth in earnings per share of 38%, while quarterly cash flow from operations was $ 13.5 billion," said Luca Maestri, Apple's chief financial officer. - During the quarter, we returned $ 17 billion dollars to our investors in the form of share repurchases and dividend payments. To date, the total amount of payments to investors has exceeded $ 143 billion of the $ 200 billion that we have put into the capital return program. ”

Apple's forecasts for the first quarter of fiscal year 2016:

Revenues range from $ 75.5 billion to $ 77.5 billion.

Gross quarterly profit from 39% to 40%

Operating expenses from $ 6.3 billion to $ 6.4 billion.

Other income / (expenses) of $ 400 million.

Tax deductions in the amount of 26.2%.

Such data were published on the official Apple website on October 27, 2015. Well, that sounds good. But many experts agree that the current year will not be the easiest for Apple and the financial indicators in reality will not be able to come close to the forecasts made by Tim Cook last fall. How intrigue will develop further in the nearest historical retrospective time will show.

Already a day later, Apple regained the title of absolute champion in heavyweight weight among the IT giants of the first magnitude. As a result of trading on NASDAQ on Tuesday, Alphabet's market price fell by almost 5% to $ 520 billion, while Apple, on the contrary, grew by 1.8%, reaching $ 524 billion. Thus, the leader, who dropped the crown by day I managed to pick it up almost on the fly and continued the race with a minimum margin.

The last time Google overtook Apple in terms of capitalization was back in 2010, when both companies were valued at close to $ 200 billion. However, by 2012, Apple made a historic leap, rising to $ 650 billion, while Google’s capitalization remained almost unchanged. In 2011, Apple overtook ExxonMobil, becoming the most expensive company in the world in terms of market capitalization, and maintained this status for almost five years.

From 2008 to 2010, Apple and Google have repeatedly changed places in the ranking of leaders. Therefore, we can not exclude the possibility that in the very near future, the cherished crown at the next round of confrontation between the bulls and bears will not switch to Alphabet again for an indefinite time, in order to return to the Apple King again for a while.

Alphabet

cnbc.com

Forbes

apple.com

Dear readers, we are always happy to meet and wait for you on the pages of our blog. We are ready to continue to share with you the latest news, review materials and other publications, and we will try to do everything possible so that the time spent with us will be useful for you. And, of course, do not forget to subscribe to our headings .

Our other articles and events

At the beginning of this week, an event occurred that immediately affected the moods of hundreds of thousands of investors - on February 1, the parent company Google Alphabet provided a quarterly and annual financial report. An hour later, the curves of the graphs of the capitalization of Apple (AAPL Market Cap) and Alphabet (GOOGL Market Cap) first became equal and then crossed, which made it possible to speak of a change in the global market leader of global IT in terms of market capitalization.

As we have already mentioned, the quarterly and annual report provided by Alphabet’s financial department as of February 1 turned out to be better than analysts had supposed. And not just better, this quarterly report just one hour after the publicity changed the location of two key figures on the technological Olympus board, allowing the Alphabet to rise to the throne, where until this point more than 4 years after the overthrow of ExxonMobil in 2011, Apple Inc. firmly sat.

')

This situation becomes clear if you look at the charts of the dependence of the volume of capitalization of Google and Alphabet on the time period of a month. The relatively dynamic growth of Google's positions (blue graph) since mid-July and the chaotic-choppy, sometimes upward, red Apple graph from the beginning of November 2015.

The relatively smooth ascending dynamics of the Alphabet graphics are explained by the very specifics of the income structure: Google so far firmly holds the position of the most popular search engine on the planet, YouTube, the leading video hosting service, and Android, the most popular mobile OS. Stable income of about $ 2 billion in monthly fees for the use of cloud services and sales of the Google Play application store, as well as the collection from advertising, also come so far quite regularly and predictably.

Short castling

Announced February 1, the financial department of Alphabet, the company's results for the IV quarter and 2015 exceeded the wildest expectations of analysts. Over the past 3 months of last year, the company managed to earn $ 21.329 billion instead of the estimated $ 20.8 billion, which added its quotes to nearly 9% and exceeded last year's figure ($ 18.103 billion) by 18%. Taking into account the change in the exchange rate, the increase was 24%. At the same time, the operating profit for the quarter increased by 25%, reaching $ 5.380 billion, and net - $ 4.923 billion (relative to $ 4.675 billion in the fourth quarter of 2014).

Alphanet financial results for the fourth quarter of 2014/2015

In addition to summarizing the results for the fourth fiscal quarter, the company also provided for publication the results of work over the past 12 months, divided into 2 segments. Google's operating profit increased from $ 19.011 billion at the end of 2014 to $ 23.425 billion at the end of 2015, and revenue from $ 65.674 billion to $ 74.541 billion, respectively. Revenues of the remaining divisions amounted to $ 448 million.

The financial results of Google and the rest of Alphanet units for the 12 months of 2014/2015

The table shows that the lion’s share of Alphabet revenue ($ 23.425 billion) was provided by popular Google services, which included ads, Google Maps, revenues from the sale of Android applications and the You-Tube channel etc. So, following the results of the fourth quarter, the Sundar Pichai team earned nearly $ 20 billion. The remaining divisions of the Alphabet holding ended the year with a loss - the amount of their operating losses was $ 3.567 billion. According to the above information, it becomes clear why analysts have already called Google “typewriter” for total holding Alphabet.

It should be noted that in the future Google will be able to circumvent Apple in terms of capitalization, some analysts pointed out in 2014 based on the figures of the comparative growth rates of two IT giants: 32% from Apple against 57% from Google from January 2013 to September 2014. So, according to the forecast of Wall Street Journal experts, Google will be the first company whose market value will be able to reach and overcome the $ 1 trillion bar. until 2020.

The reorganization and the company's openness policy played a role in ensuring a stable income. Gathering nine companies under their umbrella and assigning Google Personal CEO to each of them significantly expanded the opportunities for the development of each individual direction. For comparison, before the global restructuring and the creation of the Alphabet, only a few people made all the responsible final decisions on the projects, which inevitably entailed a fatal bureaucratization of processes. Today, the development of each key area has gone much faster, and the volume of investment in promising projects for the reporting period of 2015 has increased almost twice as compared with 2014, from S1.94 billion to S3.57 billion, respectively. And shareholders take such initiatives with enthusiasm, despite the fact that they obviously do not promise quick profits, and at some stage, as the report shows, they only incur losses.

One of the promising projects developed by the Alphabet division, Google X - Project Loon, which aims to deliver the Internet to all corners of the globe, in its perspective will increase the number of users of Google services. In test mode, the project has already been launched in Sri Lanka. The second project, which is in the company's special attention zone, is Google Auto, which is dedicated to the development of unmanned vehicles, which in the future could become one of the most popular means of transportation for millions of people, again - potential users of the Google service - Alphabet. And purposefully to support such initiatives in Alphabet created a special project dedicated to the development of urban infrastructure. However, at this stage, the company attracts the bulk of its income “in the old-fashioned way”, due to the monetization of advertising traffic.

One way or another, but the fact of "castling" took place:

And what about Apple?

“Fiscal year 2015 was the most successful year in Apple’s history; annual revenue grew by 28% and reached almost $ 234 billion. This success was made possible by our commitment to creating the best and most advanced products in the world, which is a testament to the grandiose skill of our team, - said Tim Cook, CEO of Apple. “We are approaching the holiday season with the best product line ever created by a company that includes the iPhone 6s and iPhone 6 Plus , Apple Watch with an expanded range of cases and bracelets, the new iPad Pro and the brand new Apple TV , which starts shipping this week ”(October 2015).

"Apple's record-breaking results in the September quarter ensured a growth in earnings per share of 38%, while quarterly cash flow from operations was $ 13.5 billion," said Luca Maestri, Apple's chief financial officer. - During the quarter, we returned $ 17 billion dollars to our investors in the form of share repurchases and dividend payments. To date, the total amount of payments to investors has exceeded $ 143 billion of the $ 200 billion that we have put into the capital return program. ”

Apple's forecasts for the first quarter of fiscal year 2016:

Revenues range from $ 75.5 billion to $ 77.5 billion.

Gross quarterly profit from 39% to 40%

Operating expenses from $ 6.3 billion to $ 6.4 billion.

Other income / (expenses) of $ 400 million.

Tax deductions in the amount of 26.2%.

Such data were published on the official Apple website on October 27, 2015. Well, that sounds good. But many experts agree that the current year will not be the easiest for Apple and the financial indicators in reality will not be able to come close to the forecasts made by Tim Cook last fall. How intrigue will develop further in the nearest historical retrospective time will show.

Meanwhile

Already a day later, Apple regained the title of absolute champion in heavyweight weight among the IT giants of the first magnitude. As a result of trading on NASDAQ on Tuesday, Alphabet's market price fell by almost 5% to $ 520 billion, while Apple, on the contrary, grew by 1.8%, reaching $ 524 billion. Thus, the leader, who dropped the crown by day I managed to pick it up almost on the fly and continued the race with a minimum margin.

The game of thrones

The last time Google overtook Apple in terms of capitalization was back in 2010, when both companies were valued at close to $ 200 billion. However, by 2012, Apple made a historic leap, rising to $ 650 billion, while Google’s capitalization remained almost unchanged. In 2011, Apple overtook ExxonMobil, becoming the most expensive company in the world in terms of market capitalization, and maintained this status for almost five years.

From 2008 to 2010, Apple and Google have repeatedly changed places in the ranking of leaders. Therefore, we can not exclude the possibility that in the very near future, the cherished crown at the next round of confrontation between the bulls and bears will not switch to Alphabet again for an indefinite time, in order to return to the Apple King again for a while.

Alphabet

cnbc.com

Forbes

apple.com

Dear readers, we are always happy to meet and wait for you on the pages of our blog. We are ready to continue to share with you the latest news, review materials and other publications, and we will try to do everything possible so that the time spent with us will be useful for you. And, of course, do not forget to subscribe to our headings .

Our other articles and events

Source: https://habr.com/ru/post/390125/

All Articles