What is a pamp, and how not to trade on a cryptocurrency exchange

Explanation

This publication is not an insult to the team of traders with whom I participated in the pampa, advertising someone or something, calling for gambling and easy money, or trading / investing in cryptocurrency, but only trying to figure out what happened, in order to shed light on what is happening daily, and warn the reader against thoughtless actions.

Fraer's greed is overrun

The furious desire to make money on an extra lucrative deal, namely, on a pump (artificially raising the price of an asset) in case of rash actions can lead to ruin.

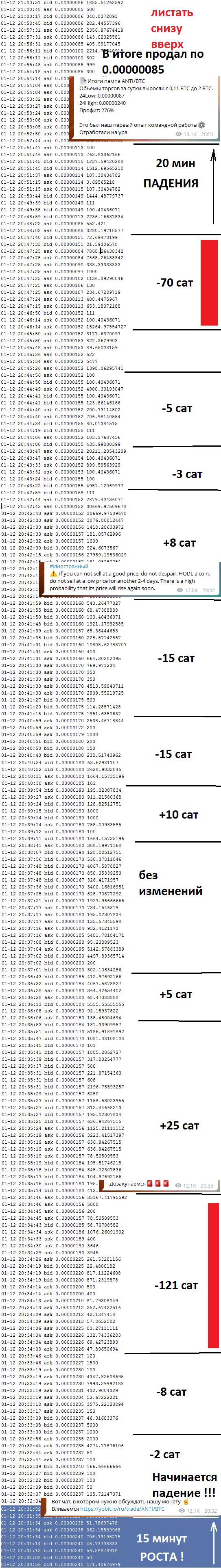

At that moment, I watched the course from the beginning to the top.

')

I tried to go several times from the beginning, but the price always ran up.

The computer, the Internet and the exchange were slow.

The price of BTC is not so perceptibly perceived by the human eye as RUR, since we are still not used to this because of the high bitcoin volatility of Fiat.

I relaxed and distracted, I was not on time.

It was the first, but far from the last pamp in which I took part before finding out what was happening and dotting i.

The desire to understand what happened

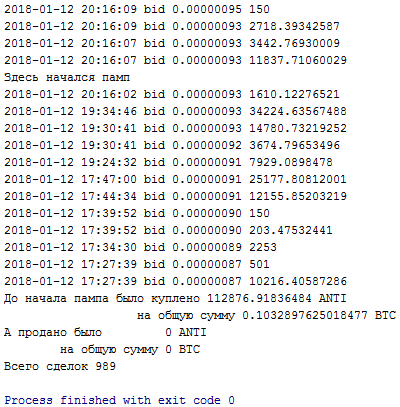

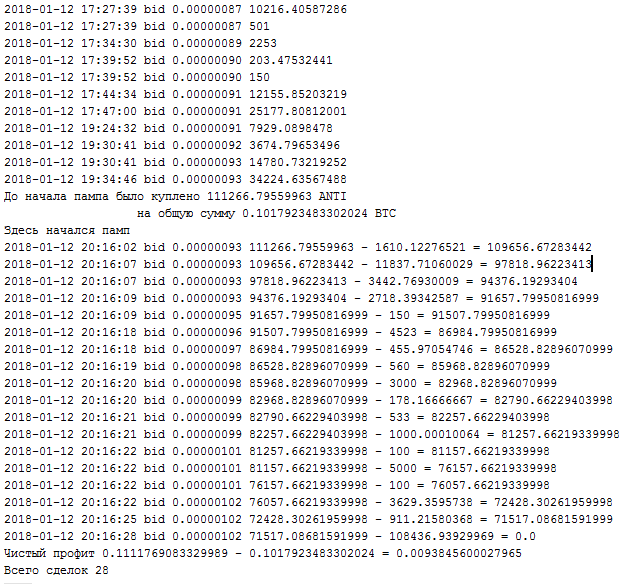

On the stock exchange you can not see the entire history of transactions for a particular pair, as this is superfluous and great information for the browser. But almost any exchange provides its own API. On a githaba, I found a project of a trading bot in python3, borrowed code and modified it to fit my needs.

The API allows you to get data on the latest 2000 transactions. But in response, I received only 989. I understood further ...

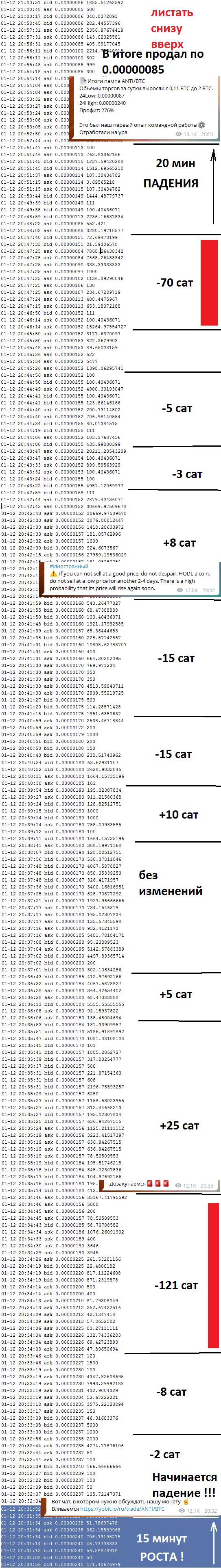

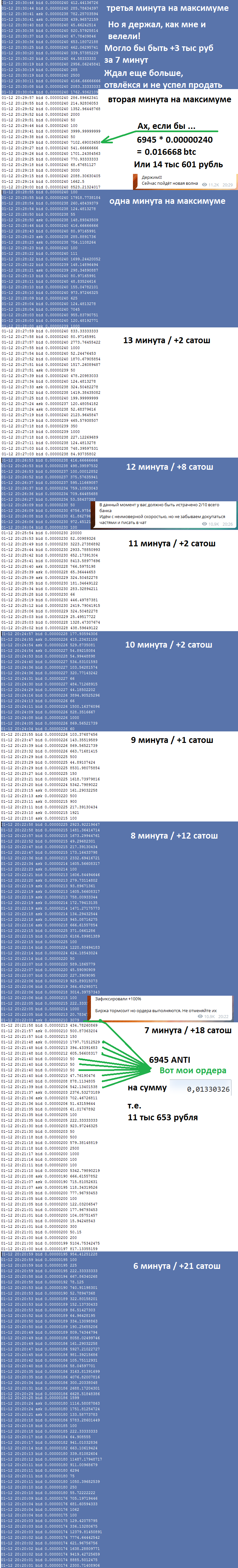

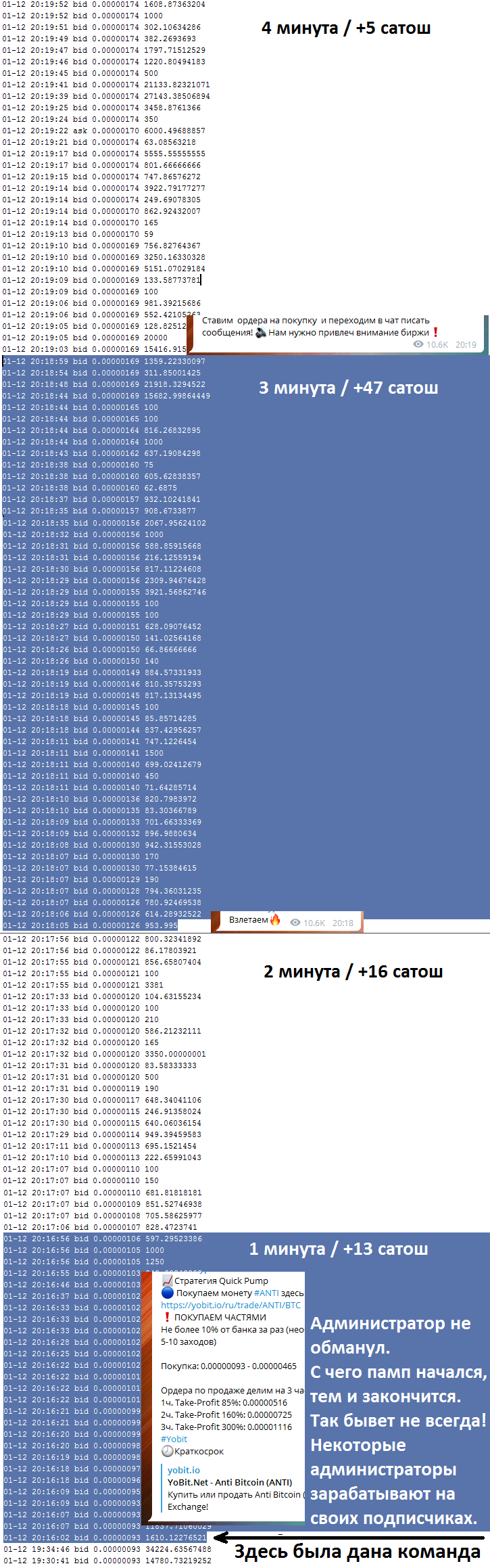

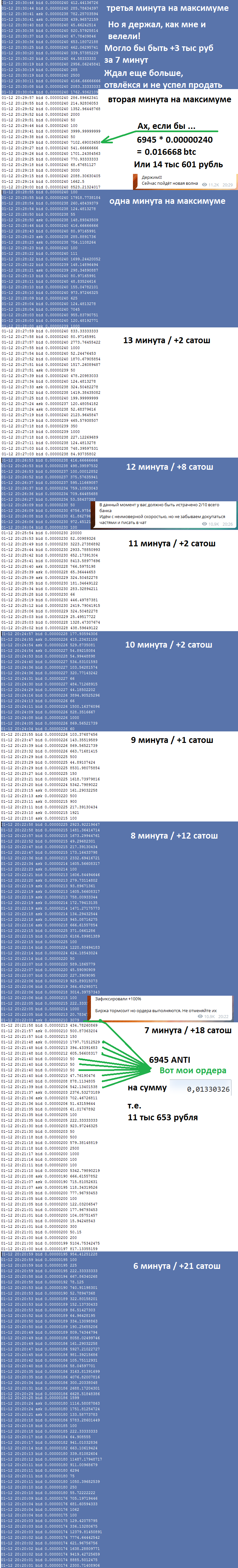

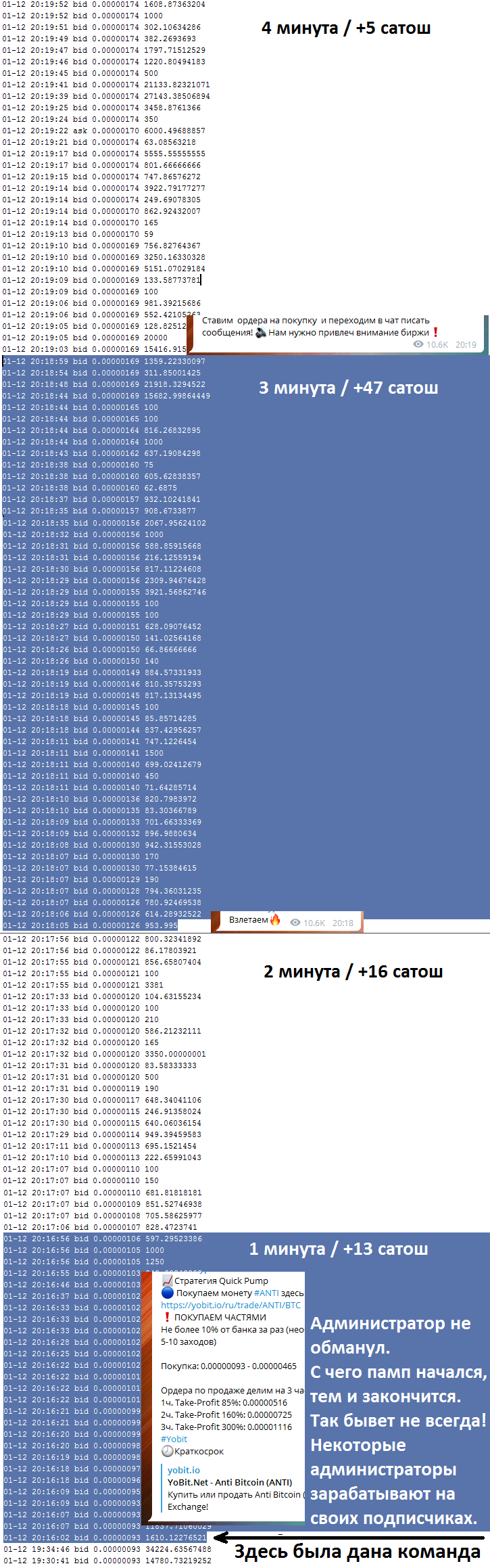

The story in pictures about how pamp happened

Long pictures of the story of how pamp happened

Conclusions on what happened

- Plans are not met.

- Even with a delay of 7 minutes, you can get a profit.

- The price rises so quickly that you can often not have time to buy on time.

- Do not blindly believe the commands.

What was before the pampas

Prelude

989 transactions. Even after the pampas? Total? And before the start of the pampas 12 transactions ...

What does this mean?

1) Very low liquidity.

2) The currency is still unknown and not clear to anyone.

3) It is not clear how its owners behave.

Someone has been created cryptocurrency ANTI. Then it was added to the exchange. Since no one knows about her, and she is most likely with a limited circle of people, her owner placed orders immediately at ~ 85 satoshes. And no one can bring down this price, because no one else has this currency anymore! What happens next - no one knows.

Such investments are super risky!

The moral of this story is: not knowing ford, do not poke your nose in the water .

In fact

2.5 hours before the start, the pampas began to buy ANTI at the lowest rate, and bought up about 85 thousand rubles for the total cost.

Then, as already described, hamsters flew ...

But what if we assume that I bought all this, then put up small portions of Bid orders at an inflated price and attracted a demand with an audience of 2,000 people? Wow ?!

Fortunately this can be calculated, the script will help us.

Those. if the administrator purchased in advance and immediately sold everything, then he would have been in the positive by ~ 8 thousand rubles.

It was so or not, alas, no one will know. But it is worth thinking. If someone won, then someone else must lose.

Do not step on my rake !

PS: Everyone will talk about how they made x2, x3, x5, x10, x25, x50, x100 and so on to infinity, about money out of thin air and other rubbish. A history of defeat rarely tell. Learn from the mistakes of others. I hope the publication was useful.

Source: https://habr.com/ru/post/374225/

All Articles