Jeff Bezos became the richest man on the planet. Why Amazon will eat the whole world

Last week, Jeff Bezos, the head of Amazon , became the richest man in the world, and the value of his company exceeded $ 500 billion. The businessman’s assets reached $ 91.4 billion - despite the fact that in March of this year he had “only” $ 70 billion , and he did not even enter the top three. Now Jeff Bezos with Bill Gates is planning a game of "Tug-of-war." The difference between their states is less than $ 1 billion, and in the Forbes rating they will replace each other, depending on the fluctuations of Microsoft and Amazon shares. Gates will not hold the first place for sure: he has no goal to increase his capital, he is busy with charity, but Mr. Bezos is developing his brainchild in full force, thanks to the correct use of big data. American businessmen have serious concerns about his work.

In May, even before the new growth round of Amazon shares, a lot of noise in the United States made a study of how the company "will eat the whole world . " The conclusions there are: to compete with the prices of the retailer is impossible. The best big data analysis allows the store to keep all its competitors in check, and all the other big sellers in the American market will simply gradually withdraw from the race. The only company that can stop the complete monopolization of all online sales is Walmart (a lot of people). Banderolk considers revenues and understands the business empire of Jeff Bezos →

For 23 years, Bezos has moved from selling books from the garage to managing one of the four largest companies on the planet. Expensive $ 500 billion in addition to Amazon are only Apple, Alphabet and Microsoft. If 5-6 years ago on the Internet, people were seriously telling each other horror stories that in the future, Google would take over the “good corporation”, now all serious economists are betting on an online retailer. Amazon is everywhere: it now also makes robots, and releases food. Its revenues for the last 10 years have grown by an average of 32% per year - an unprecedented figure for such a giant. Amazon is expected to be the first company in the world with a capitalization above $ 1 trillion. In theory, only two organizations can prevent this. Apple, if it launches any miracle device, sales of which will overshadow the iPhone, or the US Federal Anti-Monopoly Commission - if it decides to divide the business of Bezos, as it was done in 1911 with the Rockefeller Empire . The second option, by the way, is very likely: Trump threatens to start an investigation about Amazon if the Washington Post, which is owned by Jeff Bezos, does not cease to publish revealing articles about him.

')

Business Bezos is a little more complex than Apple, Microsoft or Google. He earns good income not only from operations in the online store. Zach Kanter with TechCrunch says:

Amazon grew very quickly in the early 2000s, when no one offered enterprise-class SaaS solutions. Like Google, it had to build its infrastructure. Amazon's IT achievements later developed into AWS (WebMoney Web Services) cloud web services platform . It provides other companies with the computing power of Amazon, provides file hosting, rents virtual servers, and so on. AWS is used by Netflix, Reddit, NASA and another two thousand corporations and government agencies in 190 countries. Net profit surpasses: for every dollar spent, Amazon gets $ 6 . Cloud computing sales are growing at 50% per year, and now AWS gives $ 14 billion in revenue every 12 months. This is more than ten percent of the total profit of the company.

Microsoft and Google are trying to tear off a piece of cake. But Amazon’s position in this direction is very strong. According to rumors, only one AWS section (Amazon EC2) contains more servers than Microsoft, eBay and Facebook combined. Ahead of only Google , which in 2013 had more than 1 million servers.

At first, Amazon released only the Kindle reader (from 2007). She did not bring profit at all, even if she managed to sell under half a billion devices. This year, Bezos finally admitted that they released the reading rooms at a loss. All in order to attract users to books and magazines in your store. Amazon earns little revenue from this: $ 800 million a year - for such a corporation it is pocket money. New versions of Kindle, however, allow you to watch movies and TV shows from Amazon. Content buyers pay $ 8 per show or up to $ 20 per film. It turns out Netflix competitor, only much more expensive for those who do not have an Amazon Prime subscription.

The company tried to produce its smartphone and a couple of other products, but they did not take off. On the other hand, Amazon Echo's smart speaker with Alexa's virtual voice assistant turned out to be very popular: it helps with small things and makes the day more fun. The device is able to respond to commands, talk about the weather, include TV shows, play tracks from Amazon Music , manage all the systems of a smart home. With it, you can start an alarm clock, turn off the lights, close the front door, make shopping lists or read Wikipedia. The device appeared only a couple of years ago, and sales are only in full in the USA. It is expected that this year will buy 10 million Amazon Echo. For comparison: iPhones in the States sell 40 million per year. From such sales of a smart column, even Google got nervous. To compete with Alexa, the company launched Google Assistant and an inexpensive smart speaker for Google Home .

Jeff Bezos's company manufactures products under the Amazon Basics brand: wires, notebooks, backpacks, home textiles, small electronics, clothes, and other basic things — with designs like those of popular brands, but much cheaper. If Amazon’s internal algorithms notice an interesting hot new product, the store can immediately offer a cheaper alternative. Headphones, which originally cost $ 35, Amazon makes and sells for $ 15. Therefore, in the US, all businessmen panic, not just shop owners.

Both Kindle Fire and Amazon Echo are working to keep people attached to Amazon content. Such an idea in China developed LeEco (LeTV) quite well. You are releasing a smartphone / tablet / bukrider or smart column. And you are doing so that the device works best with your online libraries of books, music and movies. And then you get a profit from this. It seems to be a trifle, nonsense - the dollar is there, the dollar is here, and as a result, almost a third of Amazon’s profit comes!

The Internet platform receives about $ 25 billion a year from media content. This is more than the profits of Gazprom, Lukoil, Rosneft, Sberbank and Russian Railways combined. Amazon buys the rights to movies and broadcasts, and also produces its TV shows, competing with cable networks. For $ 10 per month (or $ 8 per month for Prime users), you can subscribe to Amazon Music — and listen to popular tracks. There is a separate section of Prime Music with a catalog of 2 million songs, which is available for free to customers with a Prime subscription. Everything is tied up with each other: the music is best listened to with the Echo column, videos and tracks are on the store's website along with the goods, and if you subscribe to Prime, then you and other bonuses are given, so why not use them? Other companies of such an extensive system cannot offer: they have either a TV show, or music, or things for the house. Apple is probably experiencing that it is Amazon, and not iTunes, that will eventually become the base platform for streaming and buying content in the US.

Amazon in the United States visits 150 million customers every month. Of these, 80 million are Amazon Prime subscribers. It brings together all the services of the company: subscribers receive bonuses and benefits in each of them. Many movies, TV shows and books become free, delivery in the store is two days, special discounts are offered on goods, and in July, Prime Day is held with the best deals, more profitable than on Black Friday. Bonuses are offered even on third-party sites controlled by Amazon. For example, gamers on Twitch, taking Prime, get one free subscription to their favorite streamer.

In America, the service is very popular. The number of customers is growing annually by 40%. 55% of households in the United States are now connected to it, and they all pay $ 99 annually to Jeff Bezos’s pocket. With Prime subscriptions, the company earns $ 8 billion a year. For comparison, the cable network of HBO with its “Game of Thrones” and other TV shows on all subscriptions receives one and a half times less, $ 5 billion. And if HBO has to pay actors, invest in creating special effects, etc., then Amazon gets money for already created infrastructure. Of the $ 99 profit is $ 98. Subscribers still have to pay for premium TV shows or popular films.

Two thirds of Amazon Prime customers are also subscribed to Netflix. But Prime is growing much faster, and in the next two to three years, according to forecasts, the cult phrase "netflix and chill" may no longer be so relevant. Experts predict that in the end, users will abandon Netflix in favor of cheap products and fast delivery. So far, there are two options for saving a competitor: foreign customers (Prime has almost all subscribers in the US, Netflix has half in other countries) and very high-quality original TV shows.

Companies do not like to go out of their comfort zone. Facebook buys other social networks - Instagram, Whatsapp. Google programs gadgets and works on IT. Shareholders, as a rule, do not like to invest billions in unfamiliar industries. But the leadership of Amazon drives as he wants. Experts say that the company has no brakes at all: it already owns everything that can potentially bring profit in the future.

Amazon already has assets:

For pocket money, Jeff Bezos bought the Washington Post , one of the largest newspapers in America, paying $ 250 million in cash. And the billionaire's most famous project is the Blue Origin program, which should help a person colonize space.

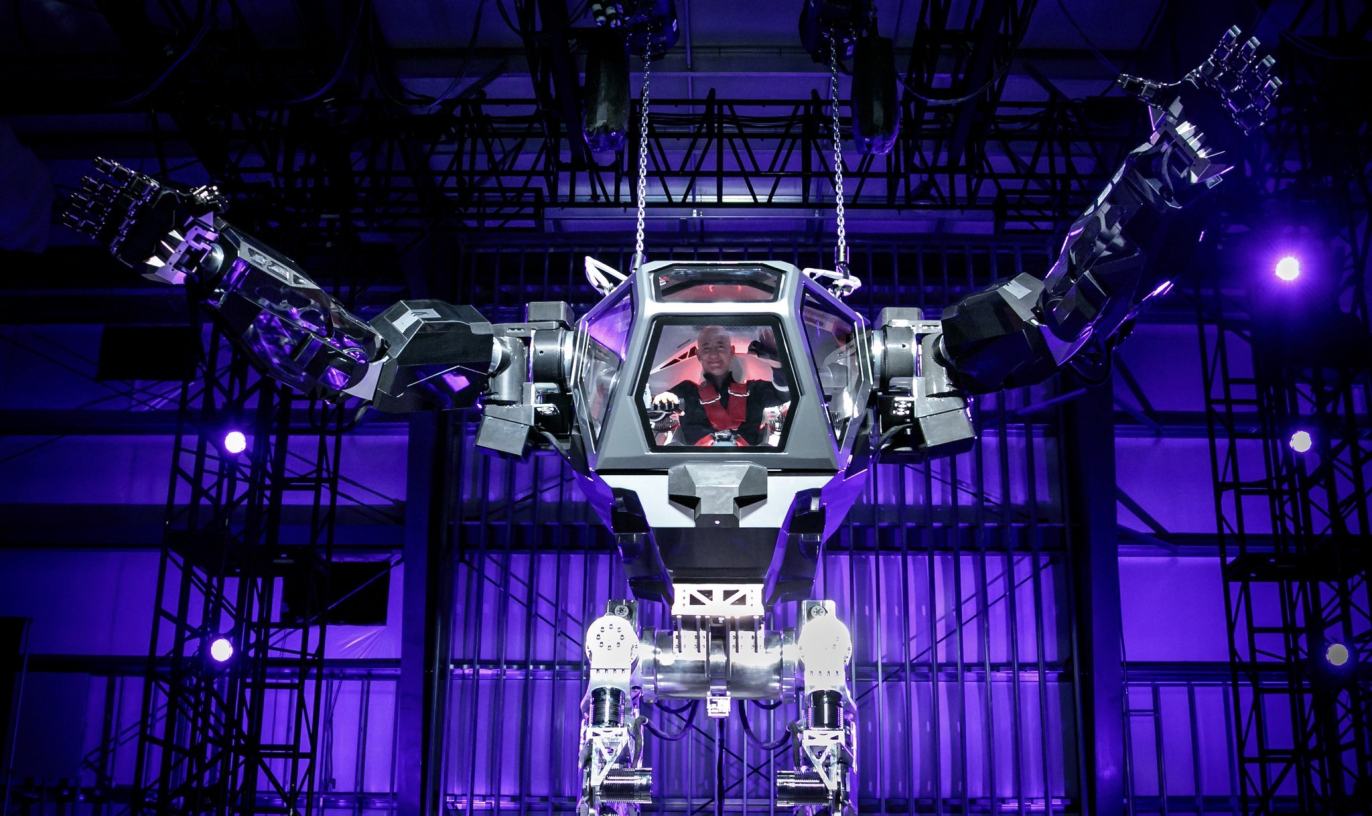

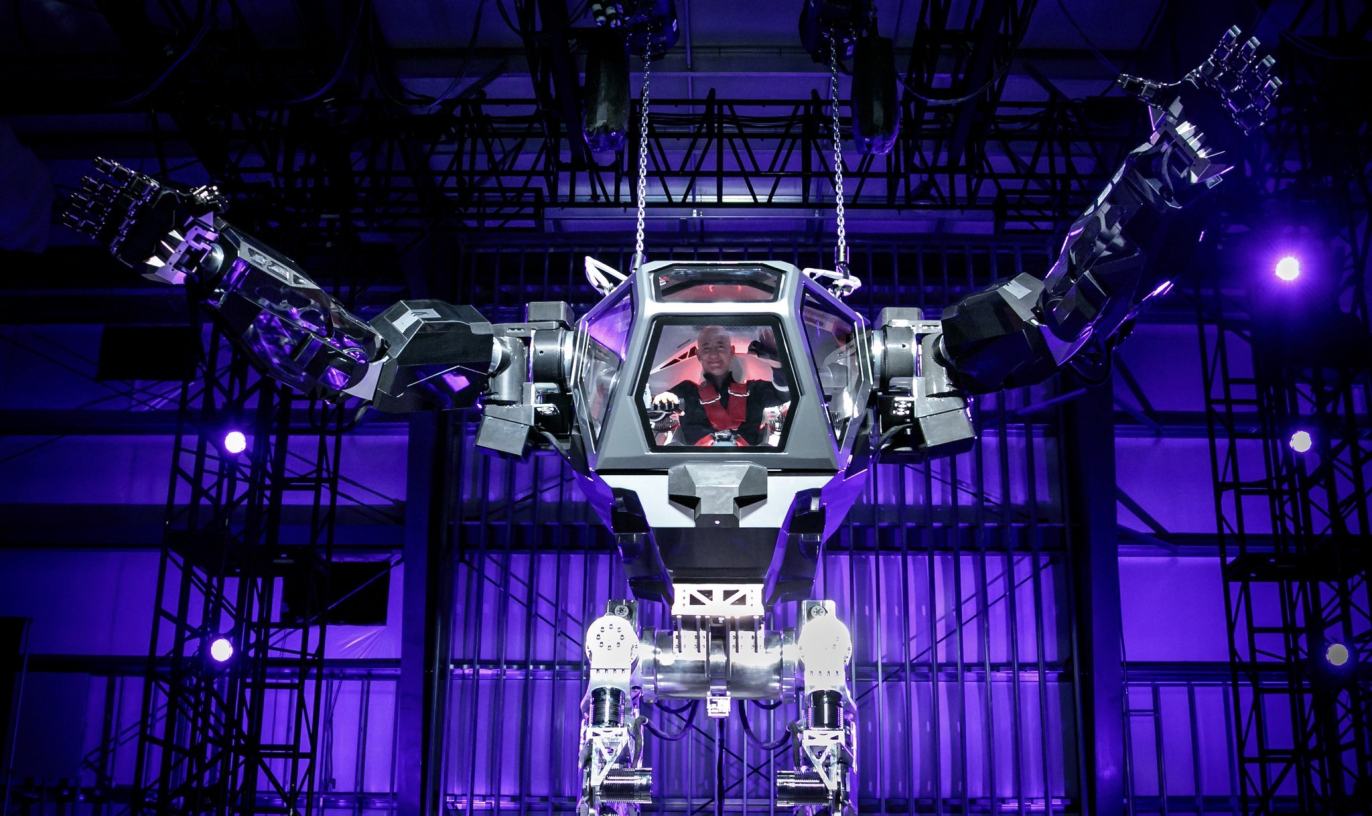

A couple of months ago, the Internet giant bought Whole Foods healthy food chain for $ 14 billion. Amazon has its own fleet of 40 huge aircraft and thousands of trucks. She makes smart robots - so that they can find the necessary goods in her warehouse and send them to the address. At the end of last year, the company launched stores without cashiers . And to deliver things around the city in 30 minutes will be unmanned drones working on GPS. In the bright future of the Amazon, there may be no place for employees ...

The lion's share of Jeff Bezos's profit, of course, falls on his huge online store. Starting from the sale of books in the garage, it has grown to gigantic proportions, and threatens to become a monopolist in the field of online sales. This is what CNBC analysts write in their prediction about Amazon's record value of $ 1 trillion:

Such a system creates a vicious circle: the biggest sales - the lowest prices - even more customers - even more sales. The store's profit is growing at 23% per year, and already reaches $ 38 billion per year. Amazon accounts for 43% of all online sales in the US, and by the end of 2018 the store is going to increase this figure to 55%. Here is what the company founder says:

Even if the current growth rate slows down twice, in ten years Amazon will cost more than $ 2 trillion, and Bezos will exceed $ 300 billion. The company can reach its goal of $ 1 trillion this decade. For businessmen who want to compete with Jeff Bezos, this sounds ominous. But you and I are only a plus: the bigger the Amazon , the lower the prices on it.

Already, electronics on Amazon — video cards , laptops , smartphones — cost much less than in Russian online stores. There are the most favorable prices for high-quality toys , cosmetics , branded clothing and shoes . And the best delivery from Amazon to Russia is at Banderolki . Sign up at this link and get a 7% discount on the first delivery of your purchases from the USA.

In May, even before the new growth round of Amazon shares, a lot of noise in the United States made a study of how the company "will eat the whole world . " The conclusions there are: to compete with the prices of the retailer is impossible. The best big data analysis allows the store to keep all its competitors in check, and all the other big sellers in the American market will simply gradually withdraw from the race. The only company that can stop the complete monopolization of all online sales is Walmart (a lot of people). Banderolk considers revenues and understands the business empire of Jeff Bezos →

For 23 years, Bezos has moved from selling books from the garage to managing one of the four largest companies on the planet. Expensive $ 500 billion in addition to Amazon are only Apple, Alphabet and Microsoft. If 5-6 years ago on the Internet, people were seriously telling each other horror stories that in the future, Google would take over the “good corporation”, now all serious economists are betting on an online retailer. Amazon is everywhere: it now also makes robots, and releases food. Its revenues for the last 10 years have grown by an average of 32% per year - an unprecedented figure for such a giant. Amazon is expected to be the first company in the world with a capitalization above $ 1 trillion. In theory, only two organizations can prevent this. Apple, if it launches any miracle device, sales of which will overshadow the iPhone, or the US Federal Anti-Monopoly Commission - if it decides to divide the business of Bezos, as it was done in 1911 with the Rockefeller Empire . The second option, by the way, is very likely: Trump threatens to start an investigation about Amazon if the Washington Post, which is owned by Jeff Bezos, does not cease to publish revealing articles about him.

')

Business Bezos is a little more complex than Apple, Microsoft or Google. He earns good income not only from operations in the online store. Zach Kanter with TechCrunch says:

Amazon is the most impressive company on Earth, and therefore, I think it is least understood.Where does Amazon have such growth and why can it become the first company to cross the capitalization of $ 1 trillion?

Cloud Services

Amazon grew very quickly in the early 2000s, when no one offered enterprise-class SaaS solutions. Like Google, it had to build its infrastructure. Amazon's IT achievements later developed into AWS (WebMoney Web Services) cloud web services platform . It provides other companies with the computing power of Amazon, provides file hosting, rents virtual servers, and so on. AWS is used by Netflix, Reddit, NASA and another two thousand corporations and government agencies in 190 countries. Net profit surpasses: for every dollar spent, Amazon gets $ 6 . Cloud computing sales are growing at 50% per year, and now AWS gives $ 14 billion in revenue every 12 months. This is more than ten percent of the total profit of the company.

Microsoft and Google are trying to tear off a piece of cake. But Amazon’s position in this direction is very strong. According to rumors, only one AWS section (Amazon EC2) contains more servers than Microsoft, eBay and Facebook combined. Ahead of only Google , which in 2013 had more than 1 million servers.

Electronic devices and products under their own brand

At first, Amazon released only the Kindle reader (from 2007). She did not bring profit at all, even if she managed to sell under half a billion devices. This year, Bezos finally admitted that they released the reading rooms at a loss. All in order to attract users to books and magazines in your store. Amazon earns little revenue from this: $ 800 million a year - for such a corporation it is pocket money. New versions of Kindle, however, allow you to watch movies and TV shows from Amazon. Content buyers pay $ 8 per show or up to $ 20 per film. It turns out Netflix competitor, only much more expensive for those who do not have an Amazon Prime subscription.

The company tried to produce its smartphone and a couple of other products, but they did not take off. On the other hand, Amazon Echo's smart speaker with Alexa's virtual voice assistant turned out to be very popular: it helps with small things and makes the day more fun. The device is able to respond to commands, talk about the weather, include TV shows, play tracks from Amazon Music , manage all the systems of a smart home. With it, you can start an alarm clock, turn off the lights, close the front door, make shopping lists or read Wikipedia. The device appeared only a couple of years ago, and sales are only in full in the USA. It is expected that this year will buy 10 million Amazon Echo. For comparison: iPhones in the States sell 40 million per year. From such sales of a smart column, even Google got nervous. To compete with Alexa, the company launched Google Assistant and an inexpensive smart speaker for Google Home .

Jeff Bezos's company manufactures products under the Amazon Basics brand: wires, notebooks, backpacks, home textiles, small electronics, clothes, and other basic things — with designs like those of popular brands, but much cheaper. If Amazon’s internal algorithms notice an interesting hot new product, the store can immediately offer a cheaper alternative. Headphones, which originally cost $ 35, Amazon makes and sells for $ 15. Therefore, in the US, all businessmen panic, not just shop owners.

What if you release something cool and the Basics algorithm points to your products?

Media and content

Both Kindle Fire and Amazon Echo are working to keep people attached to Amazon content. Such an idea in China developed LeEco (LeTV) quite well. You are releasing a smartphone / tablet / bukrider or smart column. And you are doing so that the device works best with your online libraries of books, music and movies. And then you get a profit from this. It seems to be a trifle, nonsense - the dollar is there, the dollar is here, and as a result, almost a third of Amazon’s profit comes!

The Internet platform receives about $ 25 billion a year from media content. This is more than the profits of Gazprom, Lukoil, Rosneft, Sberbank and Russian Railways combined. Amazon buys the rights to movies and broadcasts, and also produces its TV shows, competing with cable networks. For $ 10 per month (or $ 8 per month for Prime users), you can subscribe to Amazon Music — and listen to popular tracks. There is a separate section of Prime Music with a catalog of 2 million songs, which is available for free to customers with a Prime subscription. Everything is tied up with each other: the music is best listened to with the Echo column, videos and tracks are on the store's website along with the goods, and if you subscribe to Prime, then you and other bonuses are given, so why not use them? Other companies of such an extensive system cannot offer: they have either a TV show, or music, or things for the house. Apple is probably experiencing that it is Amazon, and not iTunes, that will eventually become the base platform for streaming and buying content in the US.

Amazon prime

Amazon in the United States visits 150 million customers every month. Of these, 80 million are Amazon Prime subscribers. It brings together all the services of the company: subscribers receive bonuses and benefits in each of them. Many movies, TV shows and books become free, delivery in the store is two days, special discounts are offered on goods, and in July, Prime Day is held with the best deals, more profitable than on Black Friday. Bonuses are offered even on third-party sites controlled by Amazon. For example, gamers on Twitch, taking Prime, get one free subscription to their favorite streamer.

In America, the service is very popular. The number of customers is growing annually by 40%. 55% of households in the United States are now connected to it, and they all pay $ 99 annually to Jeff Bezos’s pocket. With Prime subscriptions, the company earns $ 8 billion a year. For comparison, the cable network of HBO with its “Game of Thrones” and other TV shows on all subscriptions receives one and a half times less, $ 5 billion. And if HBO has to pay actors, invest in creating special effects, etc., then Amazon gets money for already created infrastructure. Of the $ 99 profit is $ 98. Subscribers still have to pay for premium TV shows or popular films.

Two thirds of Amazon Prime customers are also subscribed to Netflix. But Prime is growing much faster, and in the next two to three years, according to forecasts, the cult phrase "netflix and chill" may no longer be so relevant. Experts predict that in the end, users will abandon Netflix in favor of cheap products and fast delivery. So far, there are two options for saving a competitor: foreign customers (Prime has almost all subscribers in the US, Netflix has half in other countries) and very high-quality original TV shows.

What they have not yet?

Companies do not like to go out of their comfort zone. Facebook buys other social networks - Instagram, Whatsapp. Google programs gadgets and works on IT. Shareholders, as a rule, do not like to invest billions in unfamiliar industries. But the leadership of Amazon drives as he wants. Experts say that the company has no brakes at all: it already owns everything that can potentially bring profit in the future.

Amazon already has assets:

- The main American online outlet (it is very much loved by the customers of the Parcel Pack ) - 6pm ;

- Shop Woot.com sales: up to 80% off just a few products every day;

- Jewelry line with Paris Hilton;

- Twitch online platform;

- American "Film Search" - IMDB ;

- Audiobook seller Audible ;

- Clothing store and shoes Zappos , etc.

For pocket money, Jeff Bezos bought the Washington Post , one of the largest newspapers in America, paying $ 250 million in cash. And the billionaire's most famous project is the Blue Origin program, which should help a person colonize space.

A couple of months ago, the Internet giant bought Whole Foods healthy food chain for $ 14 billion. Amazon has its own fleet of 40 huge aircraft and thousands of trucks. She makes smart robots - so that they can find the necessary goods in her warehouse and send them to the address. At the end of last year, the company launched stores without cashiers . And to deliver things around the city in 30 minutes will be unmanned drones working on GPS. In the bright future of the Amazon, there may be no place for employees ...

Online store

The lion's share of Jeff Bezos's profit, of course, falls on his huge online store. Starting from the sale of books in the garage, it has grown to gigantic proportions, and threatens to become a monopolist in the field of online sales. This is what CNBC analysts write in their prediction about Amazon's record value of $ 1 trillion:

The Internet has changed everything. Now the bigger the company, the more profitable and profitable it is for the client.Amid the dotcom crisis, Amazon was lucky to be the biggest online retailer, and now the company is not likely to miss its chance. From the most impressive: the store can monitor and adjust prices in order to always offer the customer as cheap as possible. And just like we have many CEO-shniki trying to guess the algorithms of "Yandex", so in the US sellers are trying to adapt to the algorithms of "Amazon" - so that their product is one of the first to come out in the search field. According to the WSJ, there appeared whole price optimization services, "reprayers." They automatically change the prices of your products, so that they like the "Amazon". The systems there are so complex that WSJ journalists compared them to trading on the stock market. And the result - always favorable prices for buyers, and profit to Jeff Bezos, who earns a commission and delivery.

Such a system creates a vicious circle: the biggest sales - the lowest prices - even more customers - even more sales. The store's profit is growing at 23% per year, and already reaches $ 38 billion per year. Amazon accounts for 43% of all online sales in the US, and by the end of 2018 the store is going to increase this figure to 55%. Here is what the company founder says:

“I am often asked what will change in the next 10 years. But this is a bad question. More importantly, it does NOT change. On this you can build your business strategy. In our retail, we know that buyers want low prices. And I know that it will be like this in ten years. They want fast delivery; they want the greatest selection. I can’t imagine that in ten years a customer came to me and said, “Jeff, I love Amazon, but I would like prices to be a little higher.” Or "I love Amazon, but your delivery is too fast."

Even if the current growth rate slows down twice, in ten years Amazon will cost more than $ 2 trillion, and Bezos will exceed $ 300 billion. The company can reach its goal of $ 1 trillion this decade. For businessmen who want to compete with Jeff Bezos, this sounds ominous. But you and I are only a plus: the bigger the Amazon , the lower the prices on it.

Already, electronics on Amazon — video cards , laptops , smartphones — cost much less than in Russian online stores. There are the most favorable prices for high-quality toys , cosmetics , branded clothing and shoes . And the best delivery from Amazon to Russia is at Banderolki . Sign up at this link and get a 7% discount on the first delivery of your purchases from the USA.

A few more articles from the package:

- How to teach your phone how to make you coffee and save pictures without hands: a review of the IFTTT MAP service

- Miracle tape from USA: stand a ton, weighs a few grams

- Amazon's history: from the garage to flying warehouses in 20 years

- How Google makes the world's first smart clothes

- What is a notification, or “Legalize it!”

- Why we chose Vue.js (and not React)

Source: https://habr.com/ru/post/373691/

All Articles