Trump's victory: stock markets are falling, bitcoin and gold are rising

The latest news from America confirms the thesis that Bitcoin is digital gold . Like the precious metal, the cue ball becomes a refuge for people in moments of uncertainty. And the election of the US president is one of those moments, especially when the result is unexpected for almost everyone who made some serious predictions.

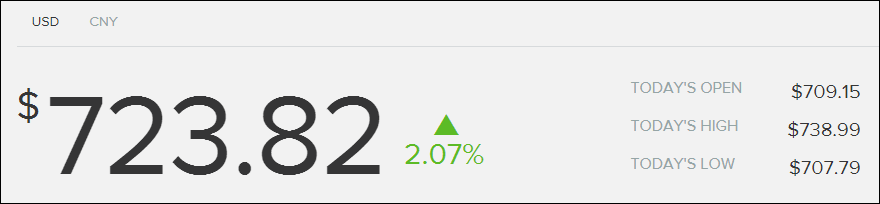

In one day, Bitcon rose by 3%, almost mirroring the fall of the famous Dow Jones index, which fell by 3.8%. However, by the evening the course was slightly corrected, but still the day of the announcement of the election results ended for cryptocurrency with a result of + 2% - more than any other world currency could boast.

Of course, the point is not that financiers love or dislike Trump - simply, unlike Hillary, his policy is as unpredictable as his victory was. And in moments of uncertainty, money is looking for a safe haven, which, along with gold, is Bitcoin for the umpteenth time.

The very nature of bitcoins makes them look like precious metals, which has been discussed repeatedly. More precisely, the very nature of cryptocurrency - against the news from the United States, not only cue balls but also barely running Zcash are growing. By the way, HashFlare will start to mine Zcash in less than two weeks, on November 21, and you can issue pre-order now - I advise you to use the promotional code HF16MSKCONF10. However, as TechCrunch notes, exchange rate variability is typical for novice currencies.

')

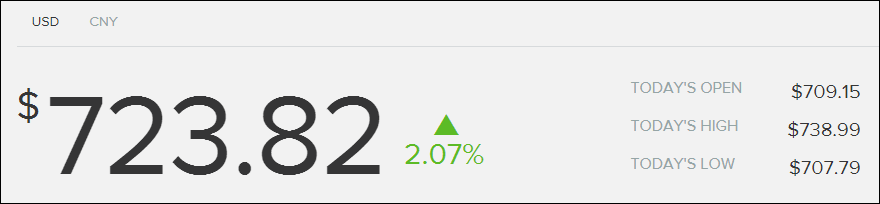

Well, the usual gold, of course, also feels great:

A similar story occurred during this year’s earlier surprise, Brexit. When the people of Great Britain decided to make a pen to the European Union, all markets and major currencies were in a fever - and gold and Bitcoin grew in value. Therefore, all those interested in Bitcoin expected this surge in advance:

Commenting on the prospects for cryptocurrency in the current political situation, some clearly go too far:

Nevertheless, if we abandon the rhetorical exaggeration, investment in Bitcoin actually became a financial incarnation of the expression “the worse, the better.” Unlike most traditional inevstitions, it tends to grow when others are sausage. But from investing in gold, weapons, or whatever it is customary to earn from bad guys in moments of global upheaval, it is characterized by universal accessibility and the lack of need for special knowledge, experience, and even the need to leave home to acquire it.

Of course, gold can also be bought online, but physically it will be stored somewhere else. And the history of the Czechoslovak case and gold reserves of Russia suggests that this is not always a good idea. Especially in moments of really great upheavals.

Of course, not all economists share such unconditional enthusiasm about Bitcoin, and some of them warn about the importance of the accuracy and reasonableness of using cryptocurrency for savings:

Moreover, the hysteria around Trump, like any other media-bloated panic, faded away just as quickly as it is fomented: after Trump ’s today's speech , in which he promised new jobs and infrastructure projects, the markets have calmed down a bit, and bitcoin bit back.

But the idea is clear: money does not like surprises. And the surprises are unlikely to end. Churchill's famous statement about democracy comes to mind: for all its flaws, mankind has not yet invented a better system. Against the backdrop of political surprises, a cryptocurrency, not subject to any state, may in fact prove to be the best stash. The main thing is to remember not only about the course jumps, but also to back up the wallet.

In one day, Bitcon rose by 3%, almost mirroring the fall of the famous Dow Jones index, which fell by 3.8%. However, by the evening the course was slightly corrected, but still the day of the announcement of the election results ended for cryptocurrency with a result of + 2% - more than any other world currency could boast.

Of course, the point is not that financiers love or dislike Trump - simply, unlike Hillary, his policy is as unpredictable as his victory was. And in moments of uncertainty, money is looking for a safe haven, which, along with gold, is Bitcoin for the umpteenth time.

The very nature of bitcoins makes them look like precious metals, which has been discussed repeatedly. More precisely, the very nature of cryptocurrency - against the news from the United States, not only cue balls but also barely running Zcash are growing. By the way, HashFlare will start to mine Zcash in less than two weeks, on November 21, and you can issue pre-order now - I advise you to use the promotional code HF16MSKCONF10. However, as TechCrunch notes, exchange rate variability is typical for novice currencies.

')

Well, the usual gold, of course, also feels great:

A similar story occurred during this year’s earlier surprise, Brexit. When the people of Great Britain decided to make a pen to the European Union, all markets and major currencies were in a fever - and gold and Bitcoin grew in value. Therefore, all those interested in Bitcoin expected this surge in advance:

Commenting on the prospects for cryptocurrency in the current political situation, some clearly go too far:

I think the Trump presidency will be a gift for Bitcoin - just like a nuclear war. It would be a great disaster in all aspects - economic, geopolitical, democratic - and in an atmosphere of chaos and fear, people would turn to Bitcoin to protect their savings.

Nevertheless, if we abandon the rhetorical exaggeration, investment in Bitcoin actually became a financial incarnation of the expression “the worse, the better.” Unlike most traditional inevstitions, it tends to grow when others are sausage. But from investing in gold, weapons, or whatever it is customary to earn from bad guys in moments of global upheaval, it is characterized by universal accessibility and the lack of need for special knowledge, experience, and even the need to leave home to acquire it.

Of course, gold can also be bought online, but physically it will be stored somewhere else. And the history of the Czechoslovak case and gold reserves of Russia suggests that this is not always a good idea. Especially in moments of really great upheavals.

Of course, not all economists share such unconditional enthusiasm about Bitcoin, and some of them warn about the importance of the accuracy and reasonableness of using cryptocurrency for savings:

Bitcoin lacks the inherent flaws of the technology itself, so only those who fully understand these risks should invest in it. A safe attachment can be considered an attachment, which provides protection against falling below a certain level. I do not think that for Bitcoin this will be possible in the foreseeable future.

Moreover, the hysteria around Trump, like any other media-bloated panic, faded away just as quickly as it is fomented: after Trump ’s today's speech , in which he promised new jobs and infrastructure projects, the markets have calmed down a bit, and bitcoin bit back.

But the idea is clear: money does not like surprises. And the surprises are unlikely to end. Churchill's famous statement about democracy comes to mind: for all its flaws, mankind has not yet invented a better system. Against the backdrop of political surprises, a cryptocurrency, not subject to any state, may in fact prove to be the best stash. The main thing is to remember not only about the course jumps, but also to back up the wallet.

Source: https://habr.com/ru/post/372857/

All Articles