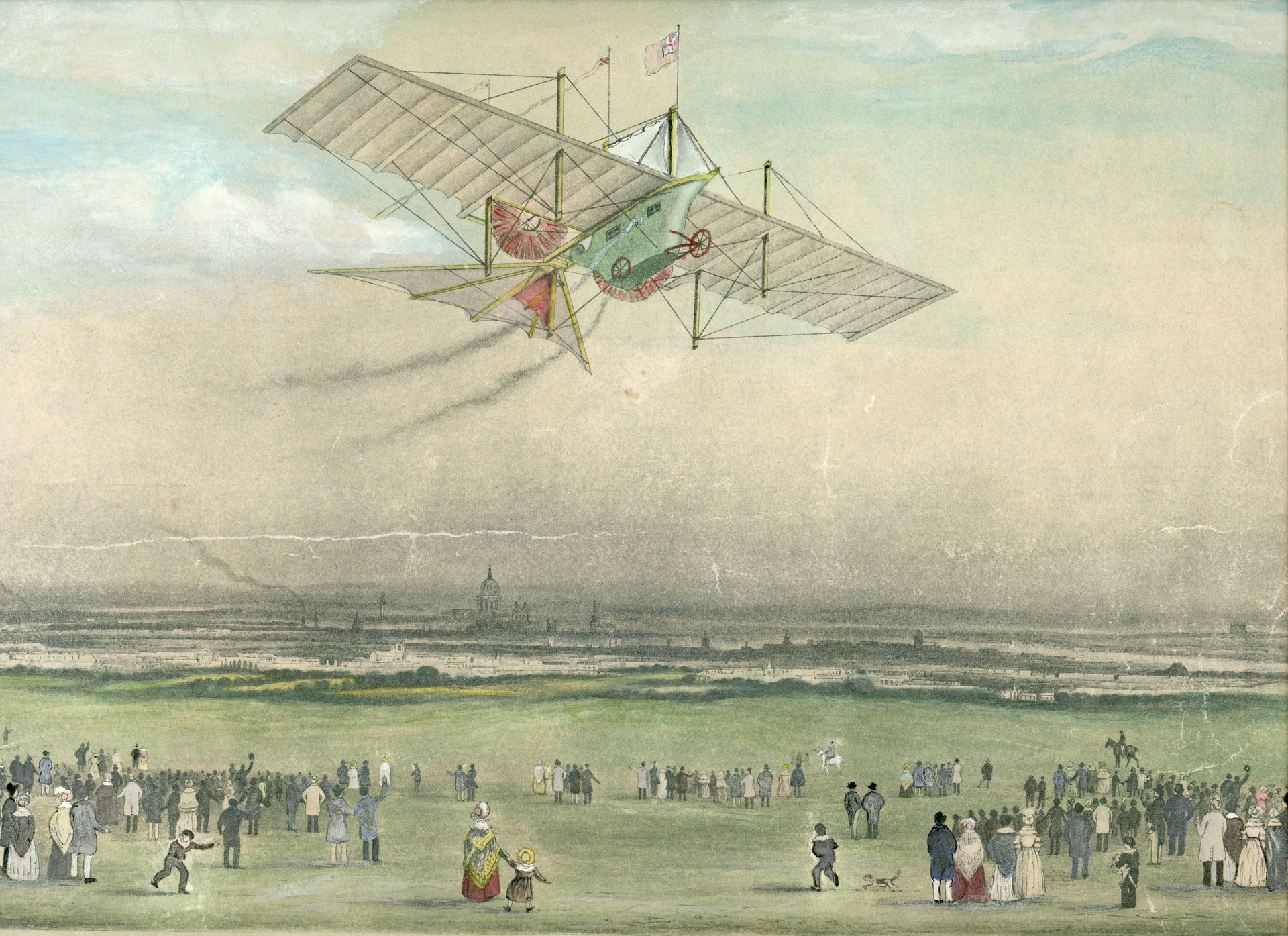

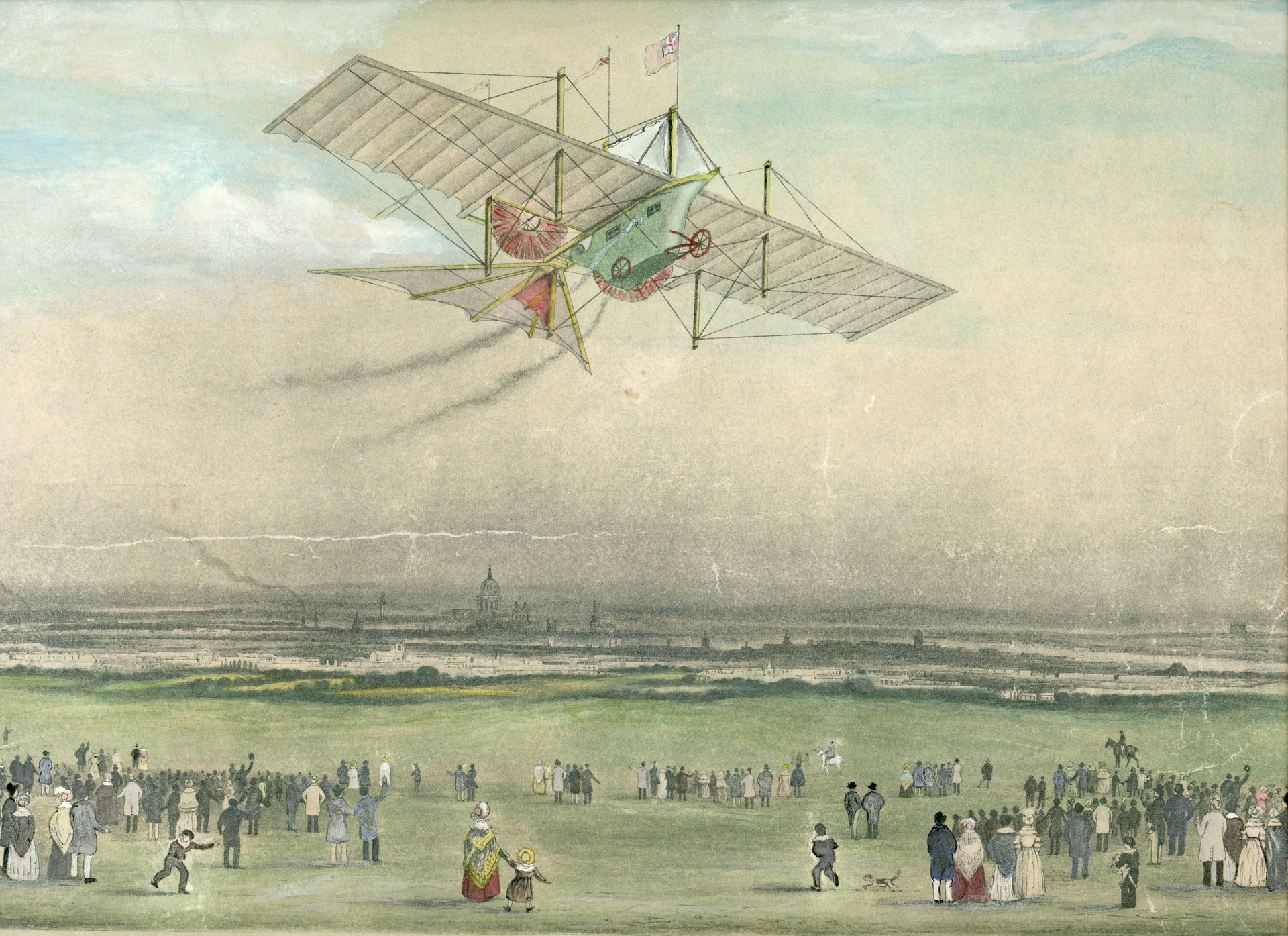

Cryptocurrencies for e-commerce revenues: when card payments are too cumbersome and bank transfers are slower than aircraft

The head of Nextury Ventures, Ilya Laurs , a venture capitalist from Lithuania, rose in the market of mobile applications when he was still emerging, lived and worked in Silicon Valley, and returned to Lithuania to invest in fintek startups in his homeland.

XXI century: the plane flies to America 10 hours, bank payment takes two days

Last week I posted a part of our conversation with him, where it was about bitcoins . Today is the time for dessert, a conversation about how cryptocurrencies can change the payment market in particular and make the entire banking system change as a whole - this is directly the area of Ilya’s professional interests and concerns everyone who has ever dealt with payments from abroad or monetization of projects by micropayments.

Cryptocurrencies are needed by e-commerce, the market desperately needs them, and when the moment comes it will swallow them instantly. Because bank payments and credit cards, like physical money, are incompatible with the virtual economy, none of these tools meet its requirements. This is nonsense, when in the twenty-first century, in order to buy me a button, it was necessary to fill out a form more difficult than to obtain rights: where you live, what address, what phone number, credit card number, to whom it is registered, and so on.

')

Moreover, the degree of fraud and the risk, and files is also inadequate. In e-commerce, the number of scams - that is, the use of other people's credit cards - is off the scale. Uncomfortable, cumbersome, unreliable, and most importantly - a lot of theft. This is in such a segment, where, it would seem, excuse me, guys, banks could try better.

Therefore, all Internet commerce, virtual payments, they just beg: "Give us a convenient, reliable, simple tool to use." I'm not talking about the fact that recent advances in virtual commerce require not even micropayments — nanopayment, when you buy not just a button, but for a digital dress coat of your avatar in some second universe. The cost of payment in physical money can be a third of a cent, and for this to run the whole mechanism of credit cards - it is so cumbersome!

After talking with the guys from the gaming industry, you realize that due to the heaviness of the payment instruments, up to 90% of the profits are lost: that is, they could make ten times more money if all this would be cool and convenient. This is a whole class, let's say: micro, nano payments, normal payments, reliable for all Internet commerce. This is a gigantic market.

Now they talk a lot about the Internet of things, when things themselves communicate with each other. Naturally, trade and market relations will arise between them: a light bulb, relatively speaking, declares to itself how much energy it has consumed, while selling itself directly, it may have some kind of digital balance, and wherever it is turned on, it pays for its the same energy and as it burns itself off. Or you are a designer, your computer requires a three-week render, immediately gets access to a virtual machine - it also compares the workload of the main supercomputers and chooses at the auction which one is less loaded and can offer the best price - and Bitcoins are instantly calculated for using resources - and all this without human intervention.

These self-computations on the Internet of things already suggest themselves. Because, in principle, it is more convenient for people to give up a mobile phone or something else, and you are supposed to consider the normal amount of euro rubles, as they say, and not change the course godlessly - this is also adequate to expect in the twenty-first century. Because now the conversion on the same credit card is predatory: in the same America, restaurants and shops pay the bank up to five percent for servicing the credit card. The user loses up to three percent when converting. In our digital age, it makes no sense at all, it is beneficial only to banks, not the market.

While the development of cryptocurrency is very dependent on how the state will look at Bitcoins. Now there is a lot of gray zone, but the traditional reaction of all regulators to the gray zone: we can punish and close, and we will not understand what and how. But still, money is an area where the presumption of innocence most often does not apply: either you act as permitted, or the step to the side is taken as an escape. That is why one of the main parts of our work now is a kind of evangelism, working together with the state of Lithuania - the Central Bank, the Ministry of Finance, at the level of both the city hall and the ministry of economy: what it is, how it works, what are the potential risks or, conversely, it brings benefits. We are now probably spending more than half of the time clarifying, regulating and dealing with such projects with the state, in order to more or less understand what it is, what laws are applicable, what actions we need to take, so that everything is legal and transparent.

And then you can go back to specific businesses. Here is an illustration for an example: America passed a law that bitcoins belong to the class of physical goods, that is, like, say, oil, they are subject to regulation as commodities. Europe still formally holds the view that it is just a foreign currency. That is, accounting, balance change must follow the same rules as in the presence of foreign currency on the balance sheet. China adopted another law that for them Bitcoin is a digital product.

That is, you can buy, store, invest, and so on. But then the options begin: whether a monetary license is needed or not, whether the Central Bank needs permission or not, whether the law on liquidity is in effect or not, and so on.

I hope that cryptocurrencies will simply replace at some point the current financial system. There is already nothing to reform here, we need a quantum leap: how at one time there was a quantum leap, for example, gold-backed currencies into economically secured, physical paper into digital money. That is, such jumps in the history of mankind occurred. Now we walk with our pieces of gold and still hold on to the number of grams in gold while you just need to take, take a deep breath, turn cold water, feel the first turbulence, it hurts to get on the head because the first experiments always hurt get used to and live in a normal world.

But the only possible path to this is to come from below. I would give maybe five percent of the likelihood that there will be one or two upstart states like Estonia, who will see this as an opportunity, like Japan, to step into the technological future at once and instantly go from pawn to queen. But 95% for the fact that just at some point the use of a crypt will become so massive that it cannot be ignored, and yet the states and banks will submit to the pressure from below.

One of the companies in which we invest and declare it deals with the transfer of payments abroad. Now, in the twenty-first century, the payment travels to America for two days, costs fifty dollars, it is eaten up to five percent for currency conversion - this is completely inadequate, because technologically it is sending a ridiculous number of bytes - less than in e-mail. We do not live in the Stone Age, we do not send messengers with a bag of gold to justify two days to transfer money. I can take cash on a scheduled plane twice as fast as making a bank payment.

And it is already possible to collect on Bitcoin, that the transfer of the euro from Lithuania to dollars in America takes thirty minutes, it costs one dollar - this is for the end user, its cost price is a couple of cents, and currency conversion is almost zero.

It will be a Bitcoin-related business that will use Bitcoin as an intermediate protocol, that is, you send a euro to a Euro account, which determines the essence of the payment, understands where, what the final sender, instantly converts itself into Bitcoin, transfers Bitcoin to America, to America changes Bitcoin to a live dollar in a US account, and already sends it to the end point on American rails.

And inside Europe (after all, Europeans are great), this year a sepa scheme began to work - these are interbank European payments. Therefore, the whole of Europe can be served with just one account.

That is, from the point of view of users, this is the same local payment as any other payment, and the same local receipt of money, but in the interval it acts on the Bitcoin protocol, which is used purely for the transport of money, that is, it is not used at all, except to transmit information. And, by the way, in such services you can easily use in parallel bitcoins, altcoins - anything, because in between the transport layer, it is hidden layer, no matter what is inside, it is not exposed, let's say, to the risk of fluctuations, because in half a second Bitcoin's course does not change terribly. Even if it changes, the risk, expressed in probability and multiplied by losses, is still justified, and if it saves up to twenty percent of its own payment, then such a service, we believe, is simply necessary in our age. We expect that a critical mass of businesses will start to gain momentum, which takes advantage of this, because it is economically beneficial, meaningful, reasonable.

Of course, we are not the first here: there is TransferWise, Lithuanian TransferGo, etc. They are built on slightly different models. For example, the most frequent model is mutual credit accounting, that is, classical clearing: the amount of payments is accumulated in America, the amount of payments in Europe, the difference between the amounts is usually quite small, and only it is cleared, and even then it is aggregated along the way. That is, one hundred debtors in America and one hundred debtors in Europe through one transfer, which is ten percent of the entire mass, are physically sent, cleared, and efficiency is achieved through aggregation and clearing. This is a classic scheme of international payments. But specifically on the Bitcoin rails, so far the companies have not publicly declared themselves. Most likely, I predict there will be a couple dozen startups, and each will have a non-zero chance of becoming the dominant player. Including, I hope, and ours.

The most difficult part here is not technological, but regulatory. Therefore, we are not considering the Russian market right now. I would just say at random that we most likely would have stumbled upon strict rules and restrictions if we wanted to launch such a service now in Russia. That is, we conditionally spend ninety percent of the efforts on legal clarifications, and only when we know for sure that, for example, Europe-America, the euro-dollar, such countries, such countries, do we accurately fit into the space correctly and do not touch the regulatory restrictions, only then we open it. Therefore, most likely, Russia, although it is on the list, will not be the first and will not be soon.

XXI century: the plane flies to America 10 hours, bank payment takes two days

Last week I posted a part of our conversation with him, where it was about bitcoins . Today is the time for dessert, a conversation about how cryptocurrencies can change the payment market in particular and make the entire banking system change as a whole - this is directly the area of Ilya’s professional interests and concerns everyone who has ever dealt with payments from abroad or monetization of projects by micropayments.

How cryptocurrencies will change e-commerce

Cryptocurrencies are needed by e-commerce, the market desperately needs them, and when the moment comes it will swallow them instantly. Because bank payments and credit cards, like physical money, are incompatible with the virtual economy, none of these tools meet its requirements. This is nonsense, when in the twenty-first century, in order to buy me a button, it was necessary to fill out a form more difficult than to obtain rights: where you live, what address, what phone number, credit card number, to whom it is registered, and so on.

')

Moreover, the degree of fraud and the risk, and files is also inadequate. In e-commerce, the number of scams - that is, the use of other people's credit cards - is off the scale. Uncomfortable, cumbersome, unreliable, and most importantly - a lot of theft. This is in such a segment, where, it would seem, excuse me, guys, banks could try better.

Therefore, all Internet commerce, virtual payments, they just beg: "Give us a convenient, reliable, simple tool to use." I'm not talking about the fact that recent advances in virtual commerce require not even micropayments — nanopayment, when you buy not just a button, but for a digital dress coat of your avatar in some second universe. The cost of payment in physical money can be a third of a cent, and for this to run the whole mechanism of credit cards - it is so cumbersome!

After talking with the guys from the gaming industry, you realize that due to the heaviness of the payment instruments, up to 90% of the profits are lost: that is, they could make ten times more money if all this would be cool and convenient. This is a whole class, let's say: micro, nano payments, normal payments, reliable for all Internet commerce. This is a gigantic market.

Now they talk a lot about the Internet of things, when things themselves communicate with each other. Naturally, trade and market relations will arise between them: a light bulb, relatively speaking, declares to itself how much energy it has consumed, while selling itself directly, it may have some kind of digital balance, and wherever it is turned on, it pays for its the same energy and as it burns itself off. Or you are a designer, your computer requires a three-week render, immediately gets access to a virtual machine - it also compares the workload of the main supercomputers and chooses at the auction which one is less loaded and can offer the best price - and Bitcoins are instantly calculated for using resources - and all this without human intervention.

These self-computations on the Internet of things already suggest themselves. Because, in principle, it is more convenient for people to give up a mobile phone or something else, and you are supposed to consider the normal amount of euro rubles, as they say, and not change the course godlessly - this is also adequate to expect in the twenty-first century. Because now the conversion on the same credit card is predatory: in the same America, restaurants and shops pay the bank up to five percent for servicing the credit card. The user loses up to three percent when converting. In our digital age, it makes no sense at all, it is beneficial only to banks, not the market.

Bitcoin and the state: coaxing leviathan

While the development of cryptocurrency is very dependent on how the state will look at Bitcoins. Now there is a lot of gray zone, but the traditional reaction of all regulators to the gray zone: we can punish and close, and we will not understand what and how. But still, money is an area where the presumption of innocence most often does not apply: either you act as permitted, or the step to the side is taken as an escape. That is why one of the main parts of our work now is a kind of evangelism, working together with the state of Lithuania - the Central Bank, the Ministry of Finance, at the level of both the city hall and the ministry of economy: what it is, how it works, what are the potential risks or, conversely, it brings benefits. We are now probably spending more than half of the time clarifying, regulating and dealing with such projects with the state, in order to more or less understand what it is, what laws are applicable, what actions we need to take, so that everything is legal and transparent.

And then you can go back to specific businesses. Here is an illustration for an example: America passed a law that bitcoins belong to the class of physical goods, that is, like, say, oil, they are subject to regulation as commodities. Europe still formally holds the view that it is just a foreign currency. That is, accounting, balance change must follow the same rules as in the presence of foreign currency on the balance sheet. China adopted another law that for them Bitcoin is a digital product.

That is, you can buy, store, invest, and so on. But then the options begin: whether a monetary license is needed or not, whether the Central Bank needs permission or not, whether the law on liquidity is in effect or not, and so on.

Cryptocurrencies to change banks

I hope that cryptocurrencies will simply replace at some point the current financial system. There is already nothing to reform here, we need a quantum leap: how at one time there was a quantum leap, for example, gold-backed currencies into economically secured, physical paper into digital money. That is, such jumps in the history of mankind occurred. Now we walk with our pieces of gold and still hold on to the number of grams in gold while you just need to take, take a deep breath, turn cold water, feel the first turbulence, it hurts to get on the head because the first experiments always hurt get used to and live in a normal world.

But the only possible path to this is to come from below. I would give maybe five percent of the likelihood that there will be one or two upstart states like Estonia, who will see this as an opportunity, like Japan, to step into the technological future at once and instantly go from pawn to queen. But 95% for the fact that just at some point the use of a crypt will become so massive that it cannot be ignored, and yet the states and banks will submit to the pressure from below.

Bitcoin based international transactions

One of the companies in which we invest and declare it deals with the transfer of payments abroad. Now, in the twenty-first century, the payment travels to America for two days, costs fifty dollars, it is eaten up to five percent for currency conversion - this is completely inadequate, because technologically it is sending a ridiculous number of bytes - less than in e-mail. We do not live in the Stone Age, we do not send messengers with a bag of gold to justify two days to transfer money. I can take cash on a scheduled plane twice as fast as making a bank payment.

And it is already possible to collect on Bitcoin, that the transfer of the euro from Lithuania to dollars in America takes thirty minutes, it costs one dollar - this is for the end user, its cost price is a couple of cents, and currency conversion is almost zero.

It will be a Bitcoin-related business that will use Bitcoin as an intermediate protocol, that is, you send a euro to a Euro account, which determines the essence of the payment, understands where, what the final sender, instantly converts itself into Bitcoin, transfers Bitcoin to America, to America changes Bitcoin to a live dollar in a US account, and already sends it to the end point on American rails.

And inside Europe (after all, Europeans are great), this year a sepa scheme began to work - these are interbank European payments. Therefore, the whole of Europe can be served with just one account.

That is, from the point of view of users, this is the same local payment as any other payment, and the same local receipt of money, but in the interval it acts on the Bitcoin protocol, which is used purely for the transport of money, that is, it is not used at all, except to transmit information. And, by the way, in such services you can easily use in parallel bitcoins, altcoins - anything, because in between the transport layer, it is hidden layer, no matter what is inside, it is not exposed, let's say, to the risk of fluctuations, because in half a second Bitcoin's course does not change terribly. Even if it changes, the risk, expressed in probability and multiplied by losses, is still justified, and if it saves up to twenty percent of its own payment, then such a service, we believe, is simply necessary in our age. We expect that a critical mass of businesses will start to gain momentum, which takes advantage of this, because it is economically beneficial, meaningful, reasonable.

Of course, we are not the first here: there is TransferWise, Lithuanian TransferGo, etc. They are built on slightly different models. For example, the most frequent model is mutual credit accounting, that is, classical clearing: the amount of payments is accumulated in America, the amount of payments in Europe, the difference between the amounts is usually quite small, and only it is cleared, and even then it is aggregated along the way. That is, one hundred debtors in America and one hundred debtors in Europe through one transfer, which is ten percent of the entire mass, are physically sent, cleared, and efficiency is achieved through aggregation and clearing. This is a classic scheme of international payments. But specifically on the Bitcoin rails, so far the companies have not publicly declared themselves. Most likely, I predict there will be a couple dozen startups, and each will have a non-zero chance of becoming the dominant player. Including, I hope, and ours.

The most difficult part here is not technological, but regulatory. Therefore, we are not considering the Russian market right now. I would just say at random that we most likely would have stumbled upon strict rules and restrictions if we wanted to launch such a service now in Russia. That is, we conditionally spend ninety percent of the efforts on legal clarifications, and only when we know for sure that, for example, Europe-America, the euro-dollar, such countries, such countries, do we accurately fit into the space correctly and do not touch the regulatory restrictions, only then we open it. Therefore, most likely, Russia, although it is on the list, will not be the first and will not be soon.

Source: https://habr.com/ru/post/372823/

All Articles