The most common and active local currencies of the world

The economic essence of local currencies

In other countries there are examples of more successful use of local currencies. Their ideologist was Robert Swans, who in 1984 wrote the book “The Role of Local Currencies in Regional Economic Development”. There, Swans points out that “for the most part, the tendency that money leaves rural areas and flows into cities is due to the centralization of the banking system. Centralization arose thanks to the Federal Reserve Act of 1913 and the influence of the First World War. Before that, local banks with their gold reserves did not depend on the Central Bank. It was a very important factor in the rapid development of the United States in the 19th century. ”

Formerly everyday in the early 1900s, local currencies at the end of the 20th century received new impetus for development. Economists rightly say that money has three functions: a medium of exchange, a unit of payment, and a store of value. Also, economists have long known that the medium of exchange and the store of value partly contradict each other. Therefore, local currencies turn around much faster as a means of exchange, since there is no point in making savings in them. This revives economic activity in the region. Often this function of local money is further stimulated by the use of demeraj . And yet, they are convenient to pay for various volunteer work for the benefit of the city.

Local currencies help to ensure that money is invested in the region's economy. There were even calculations :

')

- Of every dollar invested in local business, $ 0.45 is reinvested in the region.

- Of every dollar spent on purchases from corporations, $ 0.1 is reinvested in the region.

- Of every dollar spent in the online store, $ 0 is reinvested in the region.

It is necessary to take into account the factor of local patriotism. People who are interested in the prosperity of their native land will use local currencies to help their entrepreneurs. Also, the use of local currencies reduces the number of necessary transportation within the region, and therefore has a beneficial effect on the environment.

The most famous examples of local currencies

BerkShares , the local currency of Berkshire, Massachusetts. Called the “exciting economic experiment” by the New York Times, the BerkShares currency has already been accepted by more than 400 local stores and companies. Moreover, it can be freely changed for the federal currency in eight branches of three banks, at the rate of $ 0.95 for one BerkShare. In total, this currency is in circulation amounting to approximately 7 million US dollars.

Chiemgauer (Chemgauer), the local currency of a province of Bavaria. A total of 154,000 paper and 540,000 electronic units of this currency are in circulation. There are more than 40 points of its exchange for euros. At the same time, the currency turnover for the year is 7,400,000, and the turnover rate of the total gasers is more than three times the turnover rate of the euro.

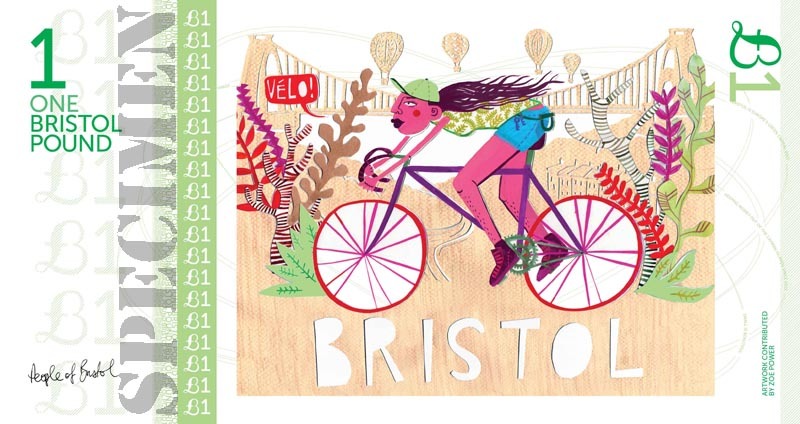

Bristol Pound (Britain). It is the most technically advanced local currency. There is a payment system TXT2PAY, which allows you to make payment by Bristol pounds via SMS, a mobile application and even an API for developers. About £ 1 million is in circulation, with a 1: 1 British and Bristol pound. More than 800 local companies accept this currency, Bristol Mayor George Ferguson receives a salary there, and for the first time in the world local utility bills can be paid in local currency. Similar currencies are in Totnes, Lewis, Brixton and Exeter, the Scottish city of Glasgow is on the way.

A lot of local currencies are also common in the Netherlands: for example, Dam in Rotterdam, PeperMunt in Zwolle, Makkie in Amsterdam. The Bank of the Netherlands invites everyone to release their currencies, if the design of notes or coins does not resemble the design of notes or euro coins. Also, you cannot issue your electronic local currencies without permission from the Central Bank of the Netherlands.

Many local currencies exist in Germany, France, Spain and other European countries. Basically, they have a small audience reach and are used in small communities.

Future local currencies

The main reason for their emergence and development is that money and the development of globalization leave villages and small cities, banks and international corporations “wash out” capital from there, like gold from the earth. But this reason alone is not enough. The success of a local currency requires a combination of three factors: the participation of those engaged in production and consumption, the assistance of local authorities and interaction with local banks, which will give the necessary level of trust. Although local currencies have already found their place in the economy, one cannot say that they have a cloudless future. Maybe the blockchain technology will help them: the Israeli company Colu raised funding of $ 9.6 million to offer a digital solution on the blockchain for issuing various local currencies. And Colu is already working in this direction with different cities, regions, and even countries (Barbados).

Difficulty in using local currencies

So far, local currencies have raised "more questions than answers." And an attentive reader will certainly ask questions:

- Who can start issuing local (read private) currencies and by what laws is this issue regulated?

- What exactly is the benefit from currency circulation within one region?

- Can such an enterprise as the issuance of local currencies be unprofitable?

- What about the taxation of a company that has income and expenses in local currencies?

- How is the law of counterfeiting such bills and who guarantees their exchange rate?

We can immediately say that the answers will be different for each such currency, since the case of any local currency is individual. They are not a panacea for economic problems and each of the local currencies has to wage a difficult struggle for existence. They, as already indicated above, are relatively not liquid, therefore they do not accumulate significant amounts. For example, Berkshire pounds (B £), although they can be obtained from an ATM in the London district of Berkshire, there are only 100,000 B £ ($ 123,000) for an area in which 300,000 people live. The Toronto Dollar, the Ithaca Hour, the Stroud Pound and hundreds of other local currencies barely stagnate, many of them no longer exist and most of this money has no tangible economic effect.

Basically unusual looking bills become a fun souvenir for tourists.

Source: https://habr.com/ru/post/372733/

All Articles