Is there a link between gold and bitcoin

The relationship between Bitcoin and gold has recently been under the scrutiny of market analysts and the media, since many are intrigued by comparing cryptocurrencies with a safe haven in the harsh times of raging crises and crumbling stock markets - investors are looking for a safe haven.

Bitcoin was repeatedly declared gold 2.0 , but does this mean that both of these markets behave in a similar way? Unlike other investments, Bitcoin has some exciting features. Due to its scarce nature and free market, Bitcoin has the potential for a significant increase in value. In addition, since the volatility (volatility) of prices has decreased slightly, drawdowns occur much less frequently.

Despite the fact that some analysts see a link between the movements of gold and bitcoin, representatives of the cryptocurrency community are denying such connections. However, certain similarities in the essence and behavior of these substances are present : like gold, Bitcoin can easily be divided into small parts that retain the properties of the whole (homogeneous), their number is clearly defined and limited, the amount of growth is predictable and depends on some perfectly factors other than the central bank decision.

')

Bitcoin and gold have repeatedly demonstrated a certain interdependence during periods of macroeconomic collapse, however, after the situation was normalized, this relationship lost its relevance.

Petar Zhivkovsky, the head of the analytical trading platform Whaleclub believes that due to the fact that the history of Bitcoin has only a few years, it is still too early to draw any statistical conclusions. However, there is another opinion, indicating not only the existence, but also the development of this connection.

Undoubtedly, fluctuations in the prices of gold and Bitcoin can be interpreted in different ways, but a certain digression into the history of their fluctuations does not hurt, in order to better inform.

An analysis of historical data over the past few years, carried out by ARK Invest and, in particular, by researcher Chris Burniske, confirms the existence of a certain interrelation, which, however, is far from pronounced:

Two random variables are called correlated if their correlation moment (or correlation coefficient) is non-zero; and are called uncorrelated values if their correlation moment is zero.

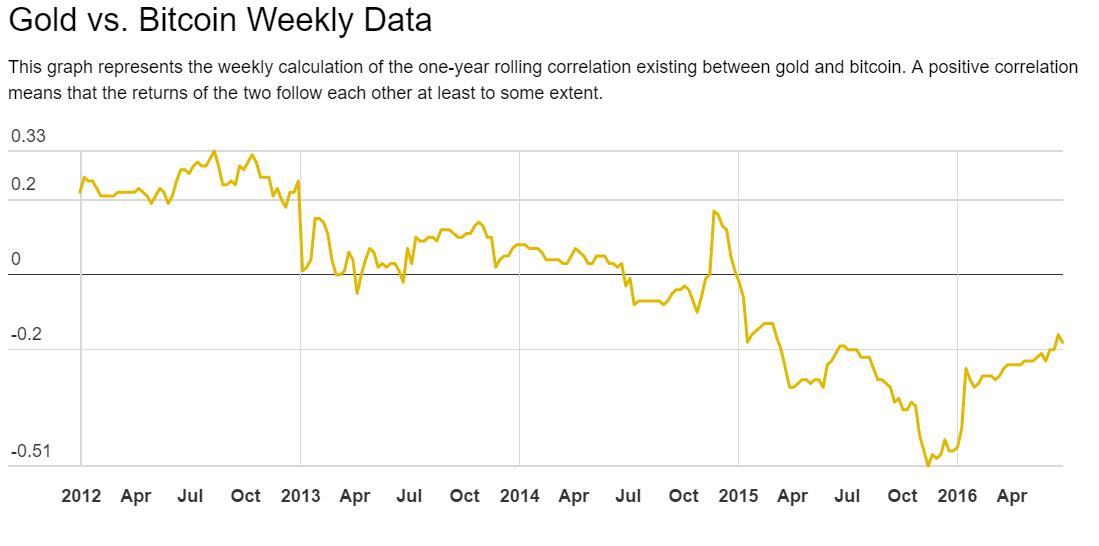

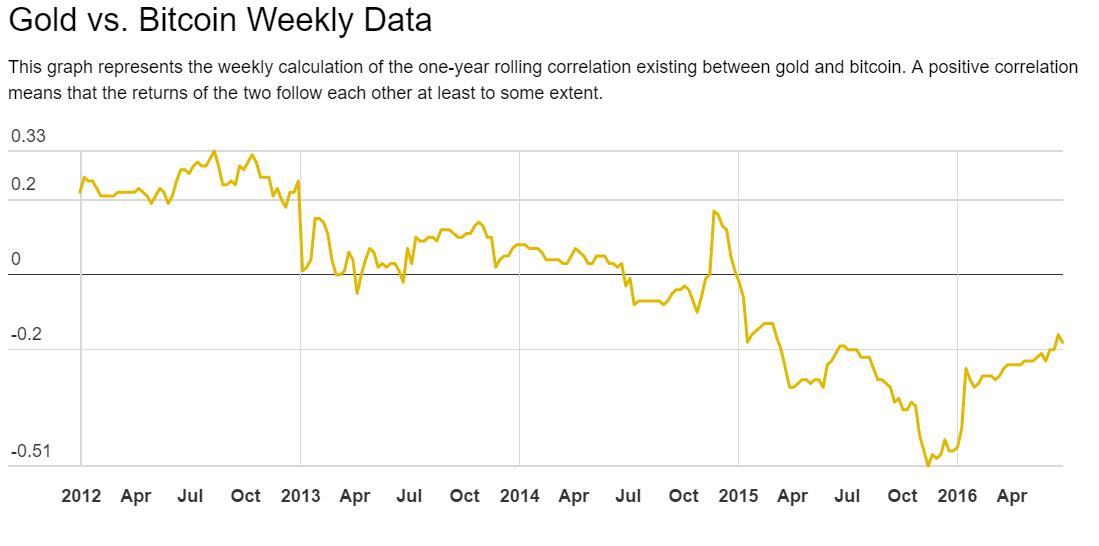

This graph is a summary of the correlation of gold and bitcoin, where repeating each other (modifying each other) patterns are positively correlated, with a coefficient higher than zero.

On average, the correlation coefficient for the entire period of the study was 0.14, which characterizes the non-coherent relationship. With a coefficient of 1, their graphs would show a close relationship, with 0 - no relationship would be traced at all. Since 0.14 is closer to 0 than to 1, then there is no point in talking about a clear pattern.

Over the past years, from June 2014, the correlation of the two trends was mostly negative, but at some point it reached the index of 0.20, as if recalling its existence.

In a column on the NASDAQ website, Martin Tillier talks about a possible connection between the dynamics of the price of gold and Bitcoin: “In the past, gold became more expensive during financial crises. However, at the time of the last fall in Eurozone stocks and the collapse of the Chinese stock exchange, the price of gold first fell. At the same time, the price of bitcoin grew. This suggests that Bitcoin is gradually crowding out gold. ”

At the same time Tillie notes the growth of the value of virtual currency. According to Tillier, while investments in Bitcoin cannot fully protect savings, “however, there is already enough data to buy some Bitcoins before the next crisis.” Martin Tillier is an experienced broker who has been trading in stocks on various American exchanges for many years. In early 2015, Tilier was one of the first analysts to predict the relative stabilization of the Bitcoin rate.

Confirming so far mainly the artistic value of metaphors about gold 2.0, the graphs show a very approximate correspondence, however, some experts, for example, the head of B2C2 Max Bunen, rightly point out that the young market cannot behave the same as the mature one.

While others, for example, Petar Zhivkovski, suggest that there is no connection at all, but there is a huge influence of the Chinese market, which strongly influences both Bitcoin and gold. Thus, many falls on the precious metals market occur precisely under the influence of the rising cost of Chinese companies. Changes in the dollar in a big way also causes fluctuations in the market of precious metals, the consequences of which are reflected again in the value of gold .

In general, so far it is definitely clear only that Bitcoin, like gold, can be used and is already used as a hedge against economic instability, in order to hedge financial turmoil (just look at the growth rates of cryptocurrency deposits in Argentina, Brazil , Russia , where, despite certain prohibitions, people prefer digital money to Fiat melting in front of their eyes.

Since banks and governments have no direct influence on cryptocurrency, official markets cannot directly influence it. In addition to gold, Bitcoin is the only means of preserving value, the value of which has increased significantly since 2009 .

But more importantly, a broker is not needed to trade bitcoins. Interested parties acquire and sell them through online exchanges and exchangers, or through p2p-trading. Users have full control over their money at any time.

Mine is not too late:

Bitcoin was repeatedly declared gold 2.0 , but does this mean that both of these markets behave in a similar way? Unlike other investments, Bitcoin has some exciting features. Due to its scarce nature and free market, Bitcoin has the potential for a significant increase in value. In addition, since the volatility (volatility) of prices has decreased slightly, drawdowns occur much less frequently.

Despite the fact that some analysts see a link between the movements of gold and bitcoin, representatives of the cryptocurrency community are denying such connections. However, certain similarities in the essence and behavior of these substances are present : like gold, Bitcoin can easily be divided into small parts that retain the properties of the whole (homogeneous), their number is clearly defined and limited, the amount of growth is predictable and depends on some perfectly factors other than the central bank decision.

')

Bitcoin and gold have repeatedly demonstrated a certain interdependence during periods of macroeconomic collapse, however, after the situation was normalized, this relationship lost its relevance.

Petar Zhivkovsky, the head of the analytical trading platform Whaleclub believes that due to the fact that the history of Bitcoin has only a few years, it is still too early to draw any statistical conclusions. However, there is another opinion, indicating not only the existence, but also the development of this connection.

Analysis of the correlation of gold and bitcoin

Undoubtedly, fluctuations in the prices of gold and Bitcoin can be interpreted in different ways, but a certain digression into the history of their fluctuations does not hurt, in order to better inform.

An analysis of historical data over the past few years, carried out by ARK Invest and, in particular, by researcher Chris Burniske, confirms the existence of a certain interrelation, which, however, is far from pronounced:

Two random variables are called correlated if their correlation moment (or correlation coefficient) is non-zero; and are called uncorrelated values if their correlation moment is zero.

This graph is a summary of the correlation of gold and bitcoin, where repeating each other (modifying each other) patterns are positively correlated, with a coefficient higher than zero.

On average, the correlation coefficient for the entire period of the study was 0.14, which characterizes the non-coherent relationship. With a coefficient of 1, their graphs would show a close relationship, with 0 - no relationship would be traced at all. Since 0.14 is closer to 0 than to 1, then there is no point in talking about a clear pattern.

Over the past years, from June 2014, the correlation of the two trends was mostly negative, but at some point it reached the index of 0.20, as if recalling its existence.

In a column on the NASDAQ website, Martin Tillier talks about a possible connection between the dynamics of the price of gold and Bitcoin: “In the past, gold became more expensive during financial crises. However, at the time of the last fall in Eurozone stocks and the collapse of the Chinese stock exchange, the price of gold first fell. At the same time, the price of bitcoin grew. This suggests that Bitcoin is gradually crowding out gold. ”

At the same time Tillie notes the growth of the value of virtual currency. According to Tillier, while investments in Bitcoin cannot fully protect savings, “however, there is already enough data to buy some Bitcoins before the next crisis.” Martin Tillier is an experienced broker who has been trading in stocks on various American exchanges for many years. In early 2015, Tilier was one of the first analysts to predict the relative stabilization of the Bitcoin rate.

Market size, dynamics, a different look

Confirming so far mainly the artistic value of metaphors about gold 2.0, the graphs show a very approximate correspondence, however, some experts, for example, the head of B2C2 Max Bunen, rightly point out that the young market cannot behave the same as the mature one.

While others, for example, Petar Zhivkovski, suggest that there is no connection at all, but there is a huge influence of the Chinese market, which strongly influences both Bitcoin and gold. Thus, many falls on the precious metals market occur precisely under the influence of the rising cost of Chinese companies. Changes in the dollar in a big way also causes fluctuations in the market of precious metals, the consequences of which are reflected again in the value of gold .

In general, so far it is definitely clear only that Bitcoin, like gold, can be used and is already used as a hedge against economic instability, in order to hedge financial turmoil (just look at the growth rates of cryptocurrency deposits in Argentina, Brazil , Russia , where, despite certain prohibitions, people prefer digital money to Fiat melting in front of their eyes.

Since banks and governments have no direct influence on cryptocurrency, official markets cannot directly influence it. In addition to gold, Bitcoin is the only means of preserving value, the value of which has increased significantly since 2009 .

But more importantly, a broker is not needed to trade bitcoins. Interested parties acquire and sell them through online exchanges and exchangers, or through p2p-trading. Users have full control over their money at any time.

Mine is not too late:

Source: https://habr.com/ru/post/372551/

All Articles