How do bank transfers actually work?

There is one of the most advanced automated clearing systems in the United Kingdom called Faster Payments Scheme (FPS). Launched in 2008, the real-time interbank payment network allows anyone with a bank account in the UK to send money to almost any other account in the kingdom countries. Recently, the maximum limit on the amount of the operation was raised to 250 thousand pounds per payment. However, in practice, many banks impose much greater restrictions.

There is one of the most advanced automated clearing systems in the United Kingdom called Faster Payments Scheme (FPS). Launched in 2008, the real-time interbank payment network allows anyone with a bank account in the UK to send money to almost any other account in the kingdom countries. Recently, the maximum limit on the amount of the operation was raised to 250 thousand pounds per payment. However, in practice, many banks impose much greater restrictions.We know firsthand about FPS and the work of the UK banking system, as we ourselves work in the jurisdiction of the United Kingdom - our company Wirex , a supplier of Blockchain-based banking solutions, is located in London. And recently, we came across a good article, which, as it seems to us, can complement this material, which aroused great interest among readers of Geektimes. Next, we offer an adapted translation.

In the general case, when the systems of both participating banks support the processing of transactions in real time, the transfer reaches the recipient's account within seconds, and the operations themselves are available 24 hours a day. Each transfer costs the banks a few pence, but none of the participating banks today charges customers a fee for such services. Faster Payments Scheme Ltd receives commissions for transactions, while the main operating and technical activities are performed by another operator, VocaLink, who, in addition to FPS, also oversees the popular payment system for payroll and direct debit of Bacs and the LINK ATM network.

In the UK, the existence of such a network is taken for granted, but we should not forget that there is no such system in the United States as such, so checks are still popular with Americans in the payment method.

')

Let's take a closer look at technology, thanks to which money transfers totaling several trillion pounds are made all over the country every year.

Suppose I want to send 50 pounds to my girlfriend. To do this, I find out from her account number and the code identifier of her bank. I enter this data into the application of my bank and fill in the 18-character field of payment purpose at my own discretion (emoji is prohibited). The bank performs a series of simple checks to determine the correctness of the specified combination and account number and bank identifier, after which the bank branch issues an internal FPS payment. These procedures by themselves do not guarantee the success of the payment, but they allow to exclude some basic mistakes in the design of the payment.

When you click on the "send money" button, your bank immediately blocks £ 50 in your account, preventing them from being re-spent. After that, he sends to VocaLink a message, issued in accordance with ISO 8583 standard and containing detailed information about the payment and its recipient. Using a bank identifier, VocaLink for several milliseconds forwards the message to the recipient's bank. The recipient's bank accepts the message and performs its own type checks, confirming that the account is open and has the ability to accept funds. If everything is in order, the bank of my girlfriend credits the funds to her account and sends confirmation of successful payment to VocaLink.

Then Vocalink accepts this confirmation and transfers it to my bank, which, in turn, removes the 50-pound block and deducts them from my account. That's all, now there is no money in the account. If the bank's IT systems are modern enough, all these actions will take only a few seconds. Otherwise it may take several hours. Some large banks, for example, still do not process payments on weekends!

Net settlement

So, we have described the change in balances in two accounts, but no “movement” of money between banks has yet occurred. Only email exchange.

To “move” money, FPS uses a system called “deferred net settlement”. Withdrawing money from my account, the bank simultaneously credits £ 50 to its current account with Faster Payments, which is recorded in the operator’s account book. In the same way, the bank of my girlfriend takes 50 pounds from her Faster Payments account, at the same time crediting them to her account. So there is any movement of funds in the bank, and this approach is called the “double entry accounting entry method”. In fact, my bank says it owes FPS 50 pounds, and my friend's bank expects to receive 50 pounds from FPS.

Thousands of payments are made and accepted within one working day, and each bank keeps track of the funds that it owes to the system or expects to receive from it. Separate payments are summed up or, in other words, their “net amount” is calculated, as a result of which the current balance amount on the bank account in the system is determined. At the same time, we are still talking about internal banking calculations, no real “cash flows” have yet occurred.

Three times during each weekday VocaLink sends a message to all participating banks containing information about their net position. This information is also provided to the Bank of England , where each member bank has a current account. A little later, each of them either makes one payment in favor of FPS (if the participant’s balance was negative at the time), or receive a similar payment (if the net transfer amount was in favor of the participant). At the Bank of England, this payment is also processed using double-entry bookkeeping. A certain amount is debited from the bank account of the participating bank and credited to the account in the FPS.

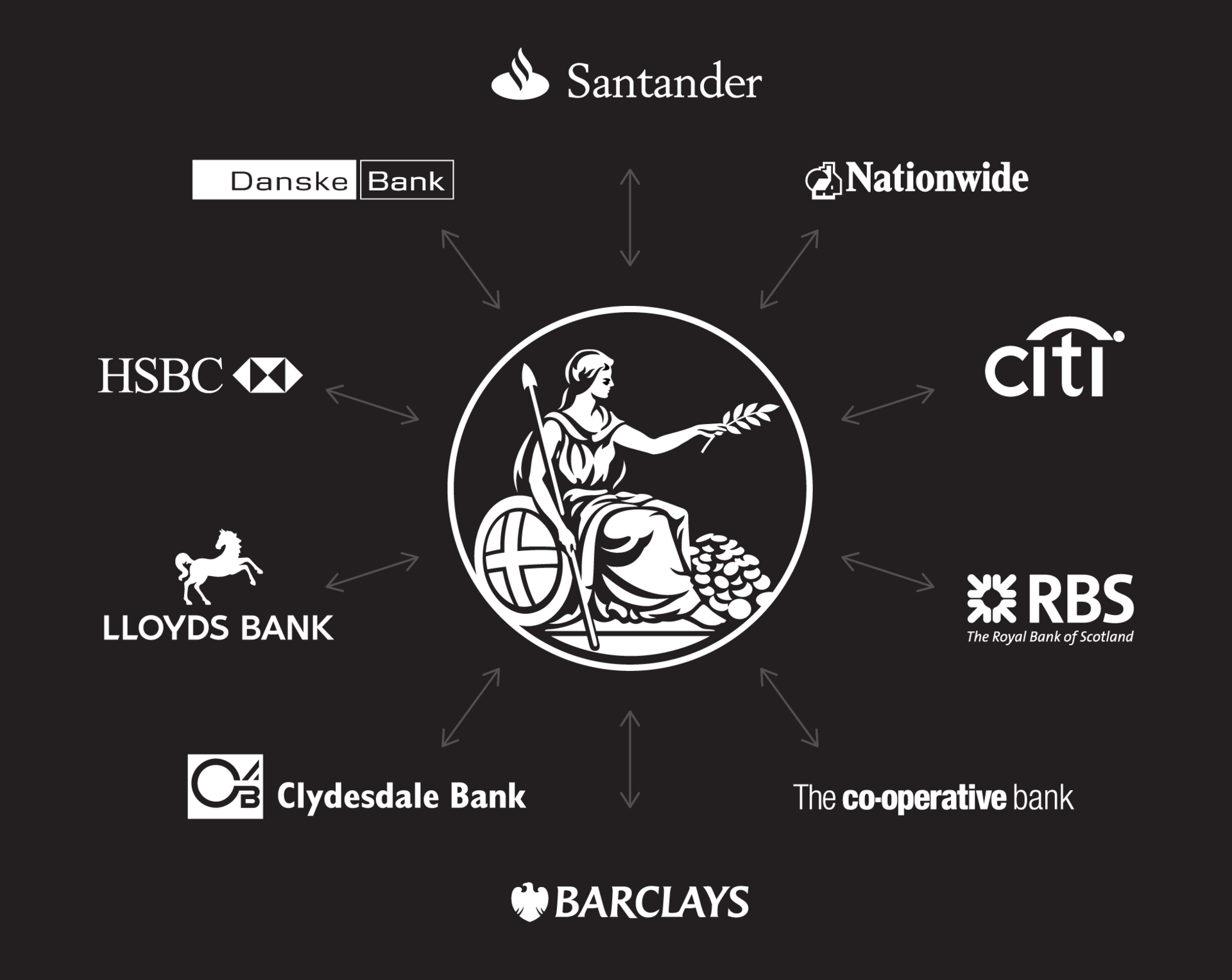

10 largest participating banks FPS (source: system website )

This is the essence of “deferred net settlement”. “Deferred”, because the actual settlement occurs after the movement of funds, “net”, because each bank summarizes incoming and outgoing payments and calculates a “net” result. The opposite idea is the real-time gross settlement system that underlies the CHAPS , TARGET2 or Fedwire schemes, which are used to transfer large amounts between banks.

Net settlement is used because it allows you to fit millions of daily payments into a small group of entries in the Bank of England ledger. The downside of this effectiveness is the risk of default on member banks. If one of them goes bankrupt, then he will most likely have no cash left to complete the daily settlement. For this reason, each of the participating banks undertakes to keep on its deposit account with the Bank of England an amount equal to or exceeding its maximum indebtedness as a defense against insolvency.

Agent banks

Only 10 large banks involved in the daily “clearing” work directly with the FPS, but in fact the scheme is used by hundreds of different banking institutions and building savings cooperatives. Each of them concludes an agreement on obtaining the rights of an agent bank with one of the clearing banks. A small savings cooperative may have one code identifier, but in fact a clearing bank operates with this code. When a payment needs to be redirected to this code identifier, VocaLink knows in advance which bank it needs to address. The latter, having received the message, forwards it to the agent bank. Depending on the capabilities of the IT infrastructure, the agent may inquire about the payment in real time or have to wait several hours.

With the advent of a new regulatory body in the country, initiatives have been announced to facilitate direct access to the FPS for small banks. It is assumed that the result of these initiatives will be a reduction in the cost of making payments. However, the cost of the initial connection, testing and certification is still quite high. To date, no new bank has joined the FPS directly. And although those wishing to line up, only one of the small banks announced such an intention.

Paym

Paym is a new type of service from VocaLink, launched in 2014, which allows you to send money to friends using only a mobile number instead of a combination of account number and bank identifier.

From a technical point of view, the service is implemented very simply. In practice, Paym is a huge compliance table, where mobile numbers are associated with banking information. When you enter a friend’s mobile number into the banking application, the bank quickly finds your friend’s name, account number and bank code. After that, the payment passes as the most usual FPS transfer with the addition of several additional fields, which show that it was originally made using Paym.

Theoretically, any unique value can be used as a key for searching the table. That is, an email address or, for example, a Twitter username, can equally well function as a mobile number.

Unfortunately, the spread of Paym is very slow. Since the appearance of the service, about 3 million accounts have been registered, and large banks, apparently, are not in a hurry to advertise the service among their customers.

Prepared according to Mondo . If you have any questions, feel free to ask them in the comments. Subscribe to our articles and do not forget to leave an application for a Wirex dual-currency card.

Source: https://habr.com/ru/post/372099/

All Articles