How a programmer created software to track market manipulations and became a thunderstorm of exchanges and HFT traders

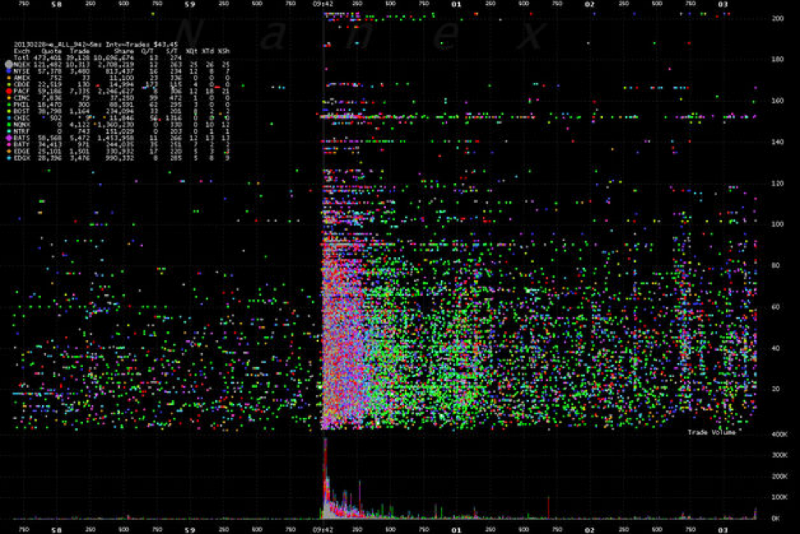

In our blog on Habrahabr, we talked about the Nanex system, which is used to visualize data on exchange trading. The resulting charts allow you to visually see the distribution of trading volumes and identify anomalies in price changes. Today we will talk about the creator of this system, which has become a real hit and a thunderstorm of hedge funds and HFT companies.

Thanks to his knowledge and a thirst for justice, Eric Scott Hunseider has turned from a simple programmer from the American hinterland into a real fighter with a dishonest game in the financial market and has become his real star. MarketWatch journalists have described the biography of the creator of Nanex, and we chose its highlights.

')

Self-taught programmer, easy school

Hunseider was born in 1963 and grew up in Manati, Florida. Talking about his youth, he recalled with a smile sailing along the coast of the Gulf of Mexico. His father was a farmer and grew tomatoes, and his mother was a housewife. Hunseider, the second oldest among four brothers and sisters, was an intelligent teenager who attended school with ease. “Everything was easy for me,” he said in an interview for the online publication MarketWatch. Hunseider began trading stocks after graduating from college. He concluded that he needed to automate applications in order to succeed, so he decided to independently learn the C ++ programming language. His first trading program, which opens up long and short futures positions when their moving averages intersect, allowed him to make $ 6,000 out of $ 6,000 a year.

Such a success could have turned the head of a young man, but instead he decided that he clearly lacked knowledge. He decided to leave the independent trade for a while and started developing software for traders, having worked in many companies leading such projects.

Eric Hunseider

In 1995, confident that the Internet would fundamentally change trading, he left corporate work to write a program that displays information on stocks and futures in real time. In 1996, he sold this program to Quote.com, where he launched Livecharts, a real-time data visualization system, and QCharts, an automated trading workstation for Windows. When Lycos bought Quote.com in 1999, Hunseider received a large sum of money and built a house in Illinois - his whole family lives there now.

And in 2000, Hunseider founded Nanex. A company of three gathered information on trading stocks, futures and options on the New York Stock Exchange, the Nasdaq, BATS and the Chicago Board of Trade.

Nanex buys stock data - uses both historical information and real-time quotes. The system stores about 4600 days of information since 2003. “We are constantly buying new servers,” says Hunseider.

"I looked behind the scenes and I did not like what I saw"

The exchanges began to master electronic trading about three decades ago. E-commerce has allowed some companies to use the rapidly changing market situation for milliseconds faster than their competitors managed to do, which triggered a technological arms race . Over the past 15 years, the global financial market has become much more fragmented: where previously there were three major US exchanges, there are now more than 40 exchanges and alternative trading systems.

Today, HFT traders use algorithms to analyze the situation on the market and instantly react to the slightest changes, which can also be caused by the actions of robots. Technology has made trading faster and more efficient. But the system did not become more transparent, rather the opposite. Many have wondered if HFT merchants are beneficial, which, in fact, can take advantage of the rest of the bidders at the expense of their incredible speed.

On May 6, 2010, the Dow Jones index fell by almost 1000 points, which was the largest intraday drop of all time. A government investigation cited a large warrant as the reason for the failure that triggered a panic selling of financial instruments, which led to an instantaneous collapse of the stock market. However, the structural problem that led to a sharp drop in the largest financial market by 10% in 20 minutes has not been identified.

In a study published in June of the same year, Hunseider suggested that high-frequency trading companies responded to that very large order with a huge number of their bids, which were canceled even before execution. This led to the "clogging" of the flow of quotations, which is necessary for traders to complete transactions.

According to Hunseider, the use of techniques like this creates illusory liquidity, which led to the crash of the stock market and subsequent dramatic events. To describe the problem, he introduced the new term "quote stuffing" ("quote stuff"). Hunseider said that "it was something like a network attack on a website, the system simply cannot cope with it and collapses."

Hunseider, being confident that he was able to determine the main structural problem, later published over 2000 reports telling about various kinds of manipulations. Some - just a few sentences, others - with a detailed explanation of how, according to him, the markets are manipulated.

“I looked backstage and didn’t like what I saw,” says Hunseider. In reports and social media, he criticizes the non-compliant HFT traders, exchanges that are spared from prosecution; regulatory structures that do not do enough to protect the interests of investors.

The use of "clogging quotes" and other similar tactics should be prosecuted. But until now, such cases are rare, and Hunseider explains this by the fact that the exchanges themselves are not actively investigating the manipulations on their trading floors — many of whom may be guilty of large customers with whom no one wants to quarrel.

In turn, representatives of the exchanges, such as BATS and the Chicago Mercantile Exchange, insist that their companies are closely monitoring possible violations of trade rules, since their main task remains to protect the interests of investors. Some of them, such as the New York Stock Exchange and the Nasdaq, generally refuse to comment on the Hunseider charges.

Hunseider’s investigations have earned him fame as a fighter with a system whose advice is asked by traders, brokers and economists. When there are sharp drops in the market like a collapse on August 24, 2015, when the Dow Jones index fell by 1000 points in 30 minutes, journalists and investors threw him with letters and calls. Representatives of the state are trying to enter into dialogue with him - Hunseider was invited to the round tables and discussions in the Federal Reserve System of Chicago.

Hunseider has become a small media about the situation in the financial markets - he sends dozens of tweets per day, the number of his followers alone on Twitter exceeds 72,000 people, including major exchanges, banks, officials, traders, portfolio managers and journalists. He often illustrates his posts with graphs, attaches links to other articles and screenshots of other people's posts. He himself calls his profile a source of "pure news without a filter." “Whether they like it or not, he has a voice in this discussion,” says Brad Katsuyama, general director of IEX, an alternative trading system.

In life, Hunseider is very friendly and polite, he prefers casual conversation to formal interviews. He especially likes to talk about his family and the achievements of his four daughters. However, in public it can be quite tough and uncompromising. On Twitter, he called one reporter " lobbyist " and suggested that subscribers ignore the marketing research of one CEO in order to "not waste precious time" and "a few IQ points . He recently added a Wisconsin congressman to the Wall of Shame and used the expletive word for a popular TV network .

MarketWatch journalists tried to contact representatives of financial companies, which Hunseider often criticizes. Citadel and KCG declined to comment for an article about it. Virtu did not respond to several emails requesting a comment. In response to a request to comment on the opinion of Hunseider, Bill Hearts, CEO of the Modern Markets Initiative, responded by e-mail that the group “does not know that Mr. Hunseider has conducted any outstanding research” on the topic of high-frequency trading.

Alternative to the usual stock exchanges

Hunseider is a supporter of the IEX trading platform, owned by asset managers and venture capital investors - we wrote about this platform in this material . Unlike other exchanges, IEX organizers introduced a delay of 350 microseconds to execute orders to equalize the capabilities of all bidders. According to Hunseider, the data show that IEX has the highest percentage of completed deals at the midpoint between the purchase and sale prices, which indicates fairness and objectivity.

IEX, which makes about 2% of US securities transactions, is struggling to get registered as a national stock exchange. The company filed an application in September 2015, but the Securities and Exchange Commission is not in a hurry to meet it - despite the large number of statements in support of initiatives from traders and investors. Old American exchanges and large HFT companies like Citadel opposed the registration of IEX.

The main threat is the loss of market confidence

As Hunseider says, the belief in justice and transparency reinforces his fears. The current rules are sufficient to protect the interests of investors, but often the exchanges of large financial institutions do not comply with these rules, and the regulatory authorities do not hold them to justice. This is partly due to the fact that a technology has not yet been introduced that would help monitor possible manipulations in real time.

Hunseider complains about the lack of a consolidated financial analytics system that would process trading information and analyze market events. The presence of such a tool would help regulatory structures monitor anomalies prior to asset price fluctuations. Without all this, the Securities and Exchange Commission simply lacks convincing evidence of offenses, even when their presence seems highly probable.

Some agree with Hunseider. In September 2015, Commission Commissioner Kara Stein said that “the speed and complexity have become almost insurmountable forces in the market, effective oversight simply cannot happen without a consolidated system of financial analytics.” Co-founder of Themis Trading and, concurrently, another critic of HFT-merchants Joe Saluzzi said in a conversation with reporters that "the markets have advanced a few light years ahead, while the surveillance system is very outdated."

In 2012, the Securities and Exchange Commission ordered the creation of a consolidated financial analytics system, entrusting it to a partnership of national stock exchanges and associations, whose members include the New York Stock Exchange, Nasdaq, BATS, Chicago Mercantile Exchange and the Financial Institutions Agency (independent non-profit organization authorized by Congress to regulate market participants).

The project was planned to be implemented in 2015. According to the Financial Times, more than 700 meetings were held to discuss parameters, costs, suppliers, etc. As a result, as of November 2015, only a short list of potential data providers was published, including the Agency for Regulation of Financial Institutions (Finra), SunGuard and Thesys, which is still under review by the Commission. All of this greatly upsets Hunseider, who calls the task set “obscenely simple”, since he himself is able to collect similar data from his system, although they will not have the identification codes of the bidders. He recently said on his Twitter account that such an analytical system for detecting manipulations "will never be created." SEC does not comment on the progress of this project.

Hunseider also complains about the legal immunity of the exchanges - the investor, who believes that the site has provided important financial information to other players before, will not be able to sue her. Such immunity was granted to exchanges, as they were originally created as non-profit affiliates and were regulated by federal agencies.

Many observers believe that they should have lost this immunity, becoming full-fledged commercial corporations. Without immunity, it would be easier to make the exchange accountable to market participants. Hunseider also believes that the fines for breaking the rules are too low.

Hunseider is always adamant in his demands for justice and the rule of law. In both interviews and social networks, he says that he fears a possible undermining of investors' confidence in the financial system because of the problems that he revealed. And this, in turn, can lead to serious upheavals in the markets themselves: “Once people realize that they are being deceived, they will stop participating in it. What then will be the pride of the United States? ”

Other materials on the topic of algorithmic trading in the ITinvest blog:

- How Big Data is Used to Analyze the Stock Market

- Experiment: the creation of an algorithm for predicting the behavior of stock indices

- GPU vs CPU: Why are GPUs used to analyze financial data

- How to predict a stock price: An adaptive filtering algorithm

- Algorithms and trading on the stock exchange: Hiding large transactions and predicting the price of shares

Source: https://habr.com/ru/post/372089/

All Articles