The role of mobile operators in the development of the IoT market

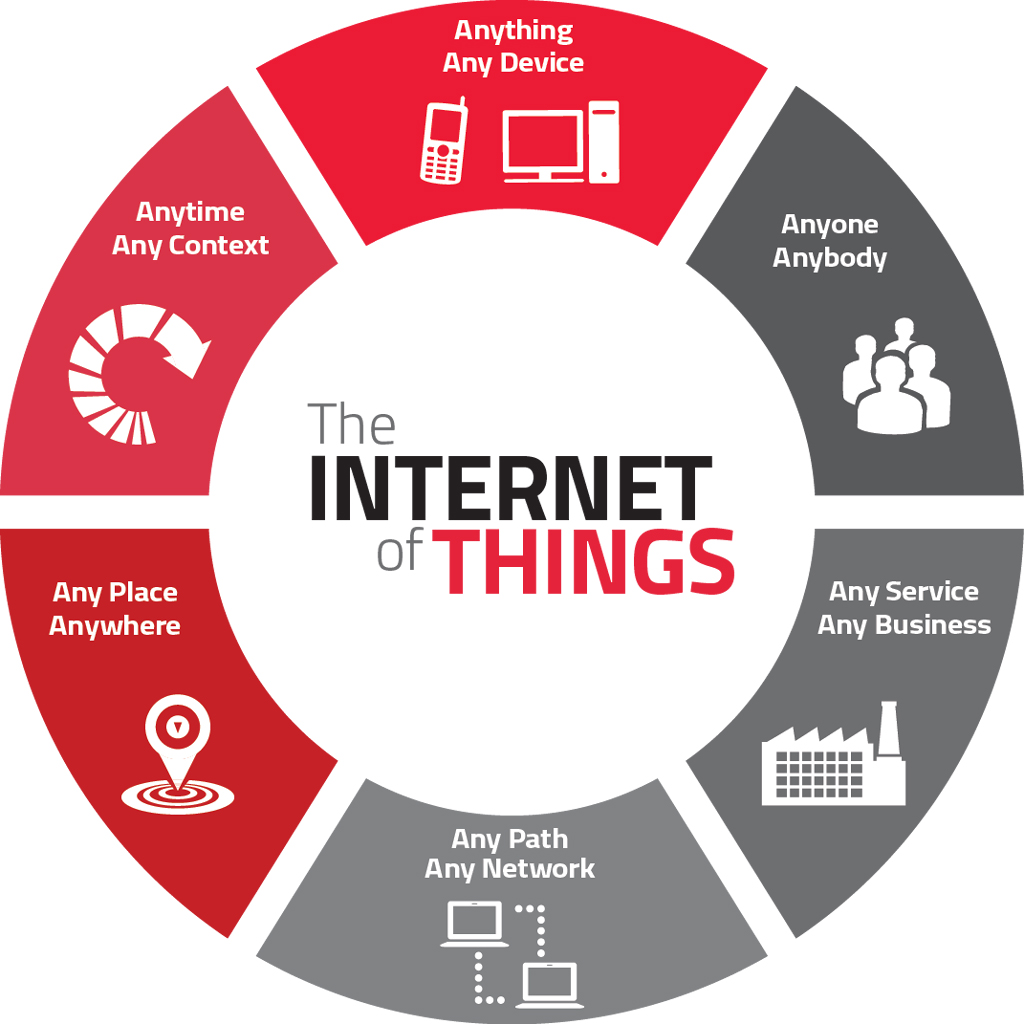

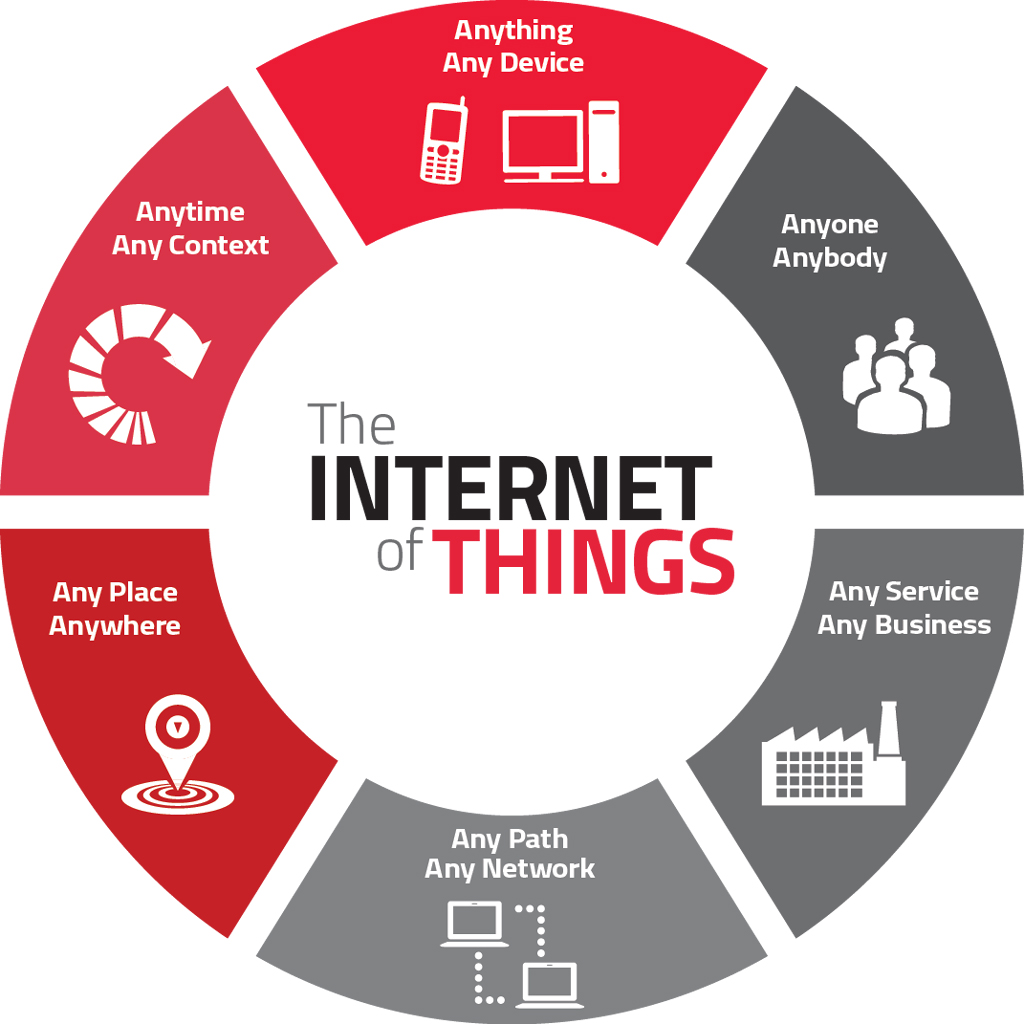

In connection with the growing popularity of the Internet of Things in recent times, more and more companies, one way or another related to the field of IT, are starting to look this way: no one wants to miss the market.

Mobile operators are afraid to miss the right moment more than anyone. The obese years of telecom, when the population was just getting used to the use of mobile communication and the Internet, have passed, and now the number of new customers in the market who have not had any operator before is much less. And in this context, the prospect of a new market with devices instead of people is extremely pleasing to operators. But, as is usually the case, not everything is so simple.

In fact, IoT is not a new phenomenon. He has been talked about a lot in the past year or two, but companies that somehow relate to this market (telecom operators, manufacturers of various equipment, integrators, organizations describing standards in communications) work with the Internet of things in one form or another. long ago.

')

Mobile operators began their journey to the Internet of things, when it seemed a distant perspective, a concept. Gradually, there was a demand for tariffs, which had either a megabyte payment, or included a minimum packet of traffic, and also the CSD (circuit switched data) function is available, data transmission over a switched channel, in other words, similar to a modem). At first, these were mainly banks that needed to connect or reserve an ATM connection. But over time, requests began to appear from other companies, and sometimes even individuals.

Creating a new tariff plan in the structure of a cellular communication operator is far from such an easy task as it might seem, therefore the appearance of allocated tariffs for a specific group of consumers already indicates that there are enough of these consumers for the operator to pay attention to them, analyze the situation, saw the prospects in the development of this direction and invested its own resources in it. This moment, roughly coinciding with the advent of 3G, can be considered the beginning of the work of Russian operators on the M2M market (machine-to-machine, machine-to-machine interaction, without going into details - a synonym for IoT, adopted in some, including operator circles).

At the time of the emergence of tariffs for the new segment, IoT was still a concept, and the traffic from the connected devices was called differently: telematics, telemetry, M2M. Many devices used to exchange information SMS and CSD instead of the usual now GPRS. But everything has changed with the spread of 3G. The cost of one megabyte began to noticeably decrease, and packet data transmission on available speeds on 3G networks made it possible to connect different types of devices that were inappropriate to use in the previously existing conditions. In addition, no less important, at this time began to actively develop the production technology of the devices themselves, which have become more diverse and cheaper.

Some market participants already in this period began to wonder what would be in demand in the market in connection with these changes. There were a lot of ideas, as always, many of them remained ideas or eventually burnt out, but one of them was brilliant because it could be sold not to individuals who had difficulty conveying the value of connected devices, or even to companies of any kind. a narrow field of activity that is not related to IT, but such large “fish” as mobile operators, who see the development of their business in this direction and are themselves in search of some kind of solution.

The idea behind this idea is the obvious assumption that a significant proportion of Internet-connected devices will be connected via networks of mobile operators. The control model of such devices will differ noticeably from the standard subscriber profile management model: each person usually has his own SIM card, data plan and account, which are managed through a personal account on the website, in the office, by call or through the application, in While the number of connected devices of an operator’s corporate client can reach hundreds of thousands, and they will be managed by a small group of administrators. Operators believed in this idea, and the so-called CMP, Connectivity Management Platform, connection management platform, or, in Russian use, M2M platform began to appear on the market.

In Russia, M2M platforms from mobile operators began to appear in 2010, Beeline was a pioneer here with the M2M Management Center solution from Jasper Wireless. Then, in 2011, MTS was with “M2M Manager”, and in 2014 they were joined by Megaphone with “M2M Monitoring” of Russian production (Peter-service). These solutions have a number of differences in details, and their comparison is a topic for a separate article, but in general they serve a common goal: with their help, administrators of customers of operators can massively (including automated) manage a large number of SIM cards. They have access to the ability to block and unblock both SIM cards in general and individual services, remote reboot, connection diagnostics, alerts or actions in the event of any events, as well as plenty of opportunities for analyzing the operation of these devices and minimizing the cost of connection Manufacturers of these platforms are constantly adding new functionality, for example, determining the location of a SIM card on base stations or monitoring channel status. Also, these platforms usually have an API that allows you to get through the queries most of the same data that is accessible via the web interface. Thanks to the API, the clients of the operators can integrate the platform with their systems and use the data on the state of connections in them.

Data on the number of active SIM cards connected to M2M platforms varies. The operators themselves do not disclose these data, but if we analyze different sources and round off, then on average it will turn out that in Russia there are about 10 million. This number, by the way, does not include connected devices that do not use the platform. Is it a lot or a little? This is not a simple question, and it rather refers not to the activities of operators, but to the specifics of our country's economy. In some areas there is no interest in technology at all, although they could help, somewhere in them there is no significant economic benefit, somewhere on the contrary, due to the influence of the state, there is a great demand, and in some places there is no need for a platform from operator. In any case, you can be sure that the operators will not miss their opportunity if possible. And yet, given the popularity of IoT themes in recent years and forecasts of billions of connections, the number of 10 million (and the market has been developing for almost 10 years) seems rather small. With what it can be connected?

The same question is asked by the operators, who, in the wake of the popularity of the Internet of Things, are waiting year after year for an explosive growth in the number of connections, but it does not happen. A popular reason now that explains everything that happens is that a company that wants to implement technologies with connected devices and get some benefit from it actually needs to do quite a lot of effort, and many (and it’s about including traditional areas such as agriculture or utilities, for which IT is not at all a matter of concern) are simply afraid or are too lazy to get involved in it. Indeed, besides the devices themselves and providing communication for them, these devices need to be somehow installed and maintained, and the data collected from them must be somehow processed. In this whole chain, which is now called the “vertical solution”, the share of the telecom operator (both in complexity and revenue) together with the M2M platform is 10–20 percent. It is much more difficult for some conditional farmer to find a sensor for the soil and correctly process its data than to find an operator with a SIM card.

“Vertical” or “boxed” solutions are quite difficult to make in this case: the devices and data from them are very different in different areas. Moreover, the supplier of this solution does not necessarily have to be a telecom operator, whose share of participation in the “vertical” is the smallest. Nevertheless, there is a prospect in this, and the operators are hoping for it. There are even a few existing examples: for several years, operators have been actively selling solutions in the field of monitoring of transport, there have been several attempts to enter the smart home market, and periodically news headlines about MegaFon ’s housing and utilities solutions and MTS cooperation with Redmond skip the news.

So far, the main task of mobile operators is the sale of SIM cards and attempts to come up with something new, manufacturers of various equipment and developers of new communication standards are doing their job and in the near future we will see a number of new technologies in action:

As you can see, the tasks for the development of their networks for mobile operators are no end, and the future carries for them both a mass of new opportunities and new competitors. It is very interesting what kind of niche the operators will occupy in this market: will they just provide constantly decreasing communication services, or will they lead the process of introducing innovations into our lives. One thing is obvious, our daily life will gradually change with the development of these technologies. Hopefully for the better.

Mobile operators are afraid to miss the right moment more than anyone. The obese years of telecom, when the population was just getting used to the use of mobile communication and the Internet, have passed, and now the number of new customers in the market who have not had any operator before is much less. And in this context, the prospect of a new market with devices instead of people is extremely pleasing to operators. But, as is usually the case, not everything is so simple.

Prerequisites

In fact, IoT is not a new phenomenon. He has been talked about a lot in the past year or two, but companies that somehow relate to this market (telecom operators, manufacturers of various equipment, integrators, organizations describing standards in communications) work with the Internet of things in one form or another. long ago.

')

Mobile operators began their journey to the Internet of things, when it seemed a distant perspective, a concept. Gradually, there was a demand for tariffs, which had either a megabyte payment, or included a minimum packet of traffic, and also the CSD (circuit switched data) function is available, data transmission over a switched channel, in other words, similar to a modem). At first, these were mainly banks that needed to connect or reserve an ATM connection. But over time, requests began to appear from other companies, and sometimes even individuals.

Creating a new tariff plan in the structure of a cellular communication operator is far from such an easy task as it might seem, therefore the appearance of allocated tariffs for a specific group of consumers already indicates that there are enough of these consumers for the operator to pay attention to them, analyze the situation, saw the prospects in the development of this direction and invested its own resources in it. This moment, roughly coinciding with the advent of 3G, can be considered the beginning of the work of Russian operators on the M2M market (machine-to-machine, machine-to-machine interaction, without going into details - a synonym for IoT, adopted in some, including operator circles).

M2M: the beginning

At the time of the emergence of tariffs for the new segment, IoT was still a concept, and the traffic from the connected devices was called differently: telematics, telemetry, M2M. Many devices used to exchange information SMS and CSD instead of the usual now GPRS. But everything has changed with the spread of 3G. The cost of one megabyte began to noticeably decrease, and packet data transmission on available speeds on 3G networks made it possible to connect different types of devices that were inappropriate to use in the previously existing conditions. In addition, no less important, at this time began to actively develop the production technology of the devices themselves, which have become more diverse and cheaper.

Some market participants already in this period began to wonder what would be in demand in the market in connection with these changes. There were a lot of ideas, as always, many of them remained ideas or eventually burnt out, but one of them was brilliant because it could be sold not to individuals who had difficulty conveying the value of connected devices, or even to companies of any kind. a narrow field of activity that is not related to IT, but such large “fish” as mobile operators, who see the development of their business in this direction and are themselves in search of some kind of solution.

The idea behind this idea is the obvious assumption that a significant proportion of Internet-connected devices will be connected via networks of mobile operators. The control model of such devices will differ noticeably from the standard subscriber profile management model: each person usually has his own SIM card, data plan and account, which are managed through a personal account on the website, in the office, by call or through the application, in While the number of connected devices of an operator’s corporate client can reach hundreds of thousands, and they will be managed by a small group of administrators. Operators believed in this idea, and the so-called CMP, Connectivity Management Platform, connection management platform, or, in Russian use, M2M platform began to appear on the market.

M2M platform in Russia

In Russia, M2M platforms from mobile operators began to appear in 2010, Beeline was a pioneer here with the M2M Management Center solution from Jasper Wireless. Then, in 2011, MTS was with “M2M Manager”, and in 2014 they were joined by Megaphone with “M2M Monitoring” of Russian production (Peter-service). These solutions have a number of differences in details, and their comparison is a topic for a separate article, but in general they serve a common goal: with their help, administrators of customers of operators can massively (including automated) manage a large number of SIM cards. They have access to the ability to block and unblock both SIM cards in general and individual services, remote reboot, connection diagnostics, alerts or actions in the event of any events, as well as plenty of opportunities for analyzing the operation of these devices and minimizing the cost of connection Manufacturers of these platforms are constantly adding new functionality, for example, determining the location of a SIM card on base stations or monitoring channel status. Also, these platforms usually have an API that allows you to get through the queries most of the same data that is accessible via the web interface. Thanks to the API, the clients of the operators can integrate the platform with their systems and use the data on the state of connections in them.

Data on the number of active SIM cards connected to M2M platforms varies. The operators themselves do not disclose these data, but if we analyze different sources and round off, then on average it will turn out that in Russia there are about 10 million. This number, by the way, does not include connected devices that do not use the platform. Is it a lot or a little? This is not a simple question, and it rather refers not to the activities of operators, but to the specifics of our country's economy. In some areas there is no interest in technology at all, although they could help, somewhere in them there is no significant economic benefit, somewhere on the contrary, due to the influence of the state, there is a great demand, and in some places there is no need for a platform from operator. In any case, you can be sure that the operators will not miss their opportunity if possible. And yet, given the popularity of IoT themes in recent years and forecasts of billions of connections, the number of 10 million (and the market has been developing for almost 10 years) seems rather small. With what it can be connected?

"Vertical Solutions"

The same question is asked by the operators, who, in the wake of the popularity of the Internet of Things, are waiting year after year for an explosive growth in the number of connections, but it does not happen. A popular reason now that explains everything that happens is that a company that wants to implement technologies with connected devices and get some benefit from it actually needs to do quite a lot of effort, and many (and it’s about including traditional areas such as agriculture or utilities, for which IT is not at all a matter of concern) are simply afraid or are too lazy to get involved in it. Indeed, besides the devices themselves and providing communication for them, these devices need to be somehow installed and maintained, and the data collected from them must be somehow processed. In this whole chain, which is now called the “vertical solution”, the share of the telecom operator (both in complexity and revenue) together with the M2M platform is 10–20 percent. It is much more difficult for some conditional farmer to find a sensor for the soil and correctly process its data than to find an operator with a SIM card.

“Vertical” or “boxed” solutions are quite difficult to make in this case: the devices and data from them are very different in different areas. Moreover, the supplier of this solution does not necessarily have to be a telecom operator, whose share of participation in the “vertical” is the smallest. Nevertheless, there is a prospect in this, and the operators are hoping for it. There are even a few existing examples: for several years, operators have been actively selling solutions in the field of monitoring of transport, there have been several attempts to enter the smart home market, and periodically news headlines about MegaFon ’s housing and utilities solutions and MTS cooperation with Redmond skip the news.

Technological perspectives

So far, the main task of mobile operators is the sale of SIM cards and attempts to come up with something new, manufacturers of various equipment and developers of new communication standards are doing their job and in the near future we will see a number of new technologies in action:

- 5G. We are accustomed to the fact that each new generation of mobile data transfer standards brings us an increase in bandwidth. Every year there is more and more talk about the new generation (although in Russia we still have not even started transmitting voice within 4G), but the new generation will have an important feature: in addition to the traditional increase in bandwidth, these standards imply the active development of the Internet of Things;

- Every year, mankind manages to increase the capacity of autonomous power sources while maintaining their size. This means a widespread, for example, wearable electronics in the near future and incredible opportunities in the future;

- LPWAN. An important addition to the previous point is the Low Power WAN technologies developed specifically for IoT. Now there are several different standards, united by a common goal - to minimize the cost of power supply when the device transmits small amounts of information. These standards can be divided into two groups: those provided by mobile operators within licensed frequencies and standards that, like Wi-Fi, can be used in unlicensed frequencies by anyone. This second group is viewed with interest by the most diverse players in the IT market, who previously in the overwhelming majority of cases were forced to use the services of cellular operators: integrators, equipment manufacturers, fixed-line operators, and others.

As you can see, the tasks for the development of their networks for mobile operators are no end, and the future carries for them both a mass of new opportunities and new competitors. It is very interesting what kind of niche the operators will occupy in this market: will they just provide constantly decreasing communication services, or will they lead the process of introducing innovations into our lives. One thing is obvious, our daily life will gradually change with the development of these technologies. Hopefully for the better.

Source: https://habr.com/ru/post/371353/

All Articles