Why can't you make a cache

The article is written for novice investors who assess the risks of investing in cryptocurrency, and not for experienced participants in the cryptobank. per.

In public discussions and articles in the media about bitcoins, some assumptions are made:

')

All this is not true.

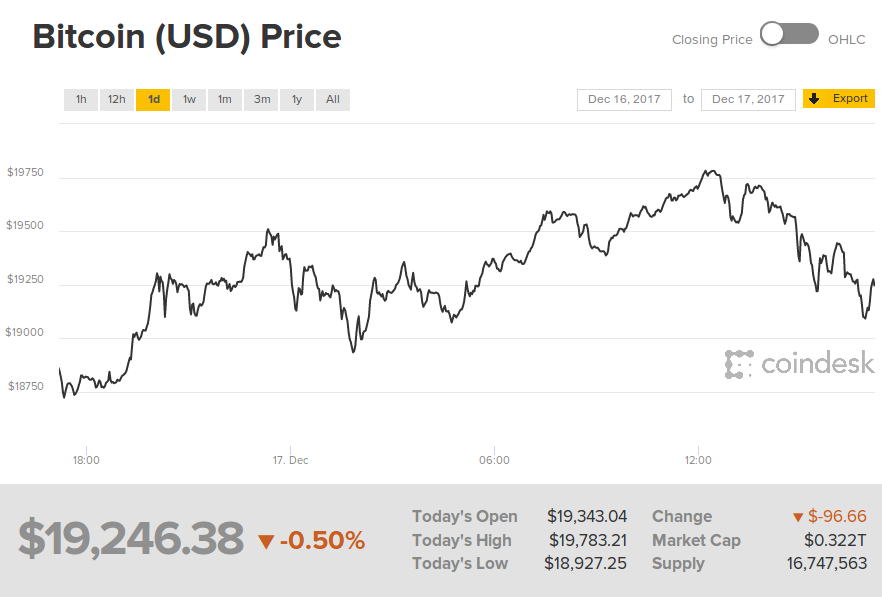

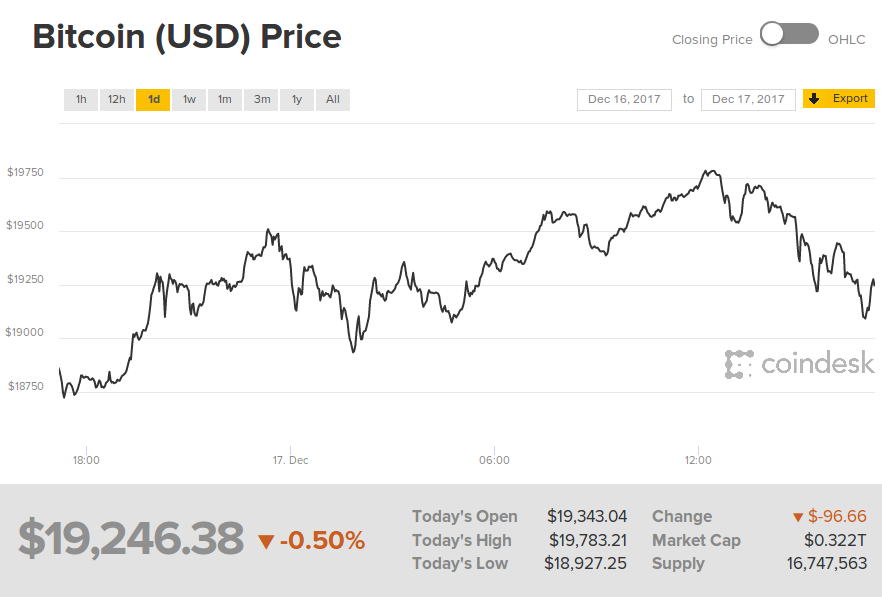

I'm now looking at the CoinDesk Bitcoin Price Index [the first part of the article was published on December 19, 2017 - approx. per.). At the moment there is a price of $ 19,699.46. Oops, already $ 19,691.76! And now $ 19,690.70! And so on.

This figure is bitcoin marketing. It should create the impression that Bitcoin is a reliable traded asset with an orderly market structure, that you can reasonably indicate its price to a cent and that everything is fine and reasonable. But this is an illusion.

There is no single “price” of Bitcoin - this is a made-up figure. You cannot expect to exchange bitcoins at this price — this is the average price of the last transactions on the pile of exchanges (when calculating the CoinDesk index, the Coinbase, Bitstamp, itBit and Bitfinex exchanges are counted.

If you look at the spread between the exchanges - the difference in price for the same Bitcoin - you will see a spread of hundreds of dollars , and at times of volatility, thousands.

If you wrote a number like $ 19,699.46 with seven significant digits with a 5% data spread, your high school physics teacher would give you the head punch. This is completely misleading. You should write something like “19,700 plus or minus $ 500,” and this beautiful line graph will turn into a thick gray bar .

"Market capitalization" is even worse. This is just the latest price multiplied by the number of existing tokens. A dummy value that is not applicable to anything at all - it is not equal to the money invested in a cryptocurrency, it is not realizable value, like a company's market capitalization, it does not affect prices - it is just a quickly calculated catchy number that looks nice in the headline. Trading any cryptocurrency is so modest, even Bitcoin, that you can never realize even a small part of this amount. This is just marketing.

Why is bitcoin like that? Why is the price not a reasonable, usable number?

(This is a brief summary of the magnificent article by Paulo Santos “Supplement to the Bitcoin Cycle - Market Structure” (the reader has to log in to read to the end and the author has been paid).

In normal stock trading, if a stock is listed on several exchanges, orders are often redistributed through an automatic routing system , so that a specific buy or sell order is made in the context of all the order registers for a given stock. This avoids the fragmentation of liquidity , when the registers of different exchanges are too isolated from each other. Because of this, trade is difficult, and each individual trading pool becomes more volatile. Routing between exchanges is simple, because, unlike bitcoins, real exchanges do not need to keep stocks in order to conduct a transaction.

This scheme does not work for Bitcoin - on each individual exchange, all trade is isolated, and Bitcoins are actually present on the exchange. This is the reason for the huge volatility and the large price gap.

In addition, in ordinary stock trading, spreads between exchanges are quickly equalized through arbitrage — a purchase on one exchange to sell at a profit on another. This pushes the price up on the first exchange and down on the second.

The structure of the bitcoin market makes arbitration difficult. If you want to profit from the spread in the price of Bitcoin on different exchanges, you need to:

These delays (from ten minutes to more than an hour) and the commissions introduce enough difficulty in arbitration to generate a spread between exchanges, even if it is assumed that everyone has trading bots with maximum speed.

Therefore, each exchange acts as an island. The number with the "price" does not apply to any of these exchanges, islands.

What is it like to live on one of the islands?

When you buy ordinary stocks or commodities, you assume that the trading environment is reasonably regulated, and the exchanges follow the rules established by law, and, in essence, will not bother you .

In the case of Bitcoin, this is impossible to imagine. This is what “unregulated” means.

Regarding the stock market, it is important to understand that every regulation rule appeared because someone robbed many people in this way. Rules ensure market integrity. So even investors who are aware of the high risk, who understand that cryptocurrencies are ridiculously volatile and are not secured in any way - even they may not be fully aware that the trading environment itself is part of the threat to the cryptocurrency trade.

(One striking example was the iGot collapse in Australia in 2016, which hit many small investors: “I just assumed that if there is a stock exchange in Australia, then there must be some kind of security system or regulation, or something like that some minimum standards for the exchange to be responsible for its actions ”).

On cryptobirds are common machinations that are not without reason forbidden on real stock exchanges:

The US Commodity and Futures Trading Commission has identified many of these frauds (PDF) as specific problems that are present in the cryptocurrency market much more than in other markets:

Since cryptobirds live in the Wild West, the interface between them and the normal financial world is strictly regulated. Because of this, there are huge problems with the withdrawal of real money, as we will see in the next section. And there are dubious things that pump up the price ...

Update : do not post comments on how personally you cashed your bitcoins, and therefore everything is fine ! It’s good that you’ve got it, but you know that many beginning investors have problems - and it’s worth talking about.

KYC / AML rules (Know your client and about countering money laundering) - an endless headache for Bitcoin traders.

The rules “Know Your Client” are adopted as part of the US Patriot Act after the September 11 attacks. The idea was to detect money laundering by terrorists and criminals.

For ordinary users, the problem is that the law requires the bank to treat every customer as a threat. And Bitcoin is known as a favorite tool of criminals and drug dealers, therefore, special attention is paid to it by the banks.

This applies to cryptobirds and banks. It is well known that Coinbase requires people to re-upload scans of documents that they have previously sent when accounts are transferred to “restricted” mode (where you cannot withdraw your money). When they cash in, they require more documents for identification than in case of a deposit. All this is automated, practically without any customer service. But they do it not just to hold your money - they are legally obliged to treat you as a threat.

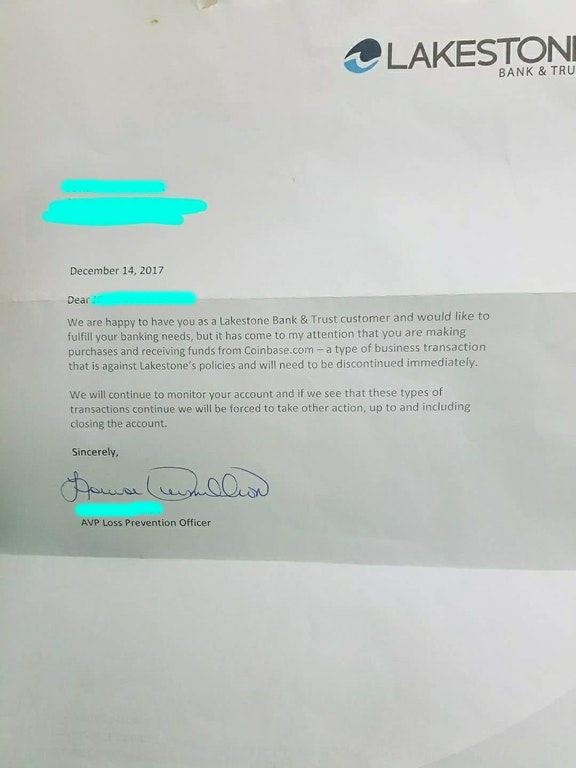

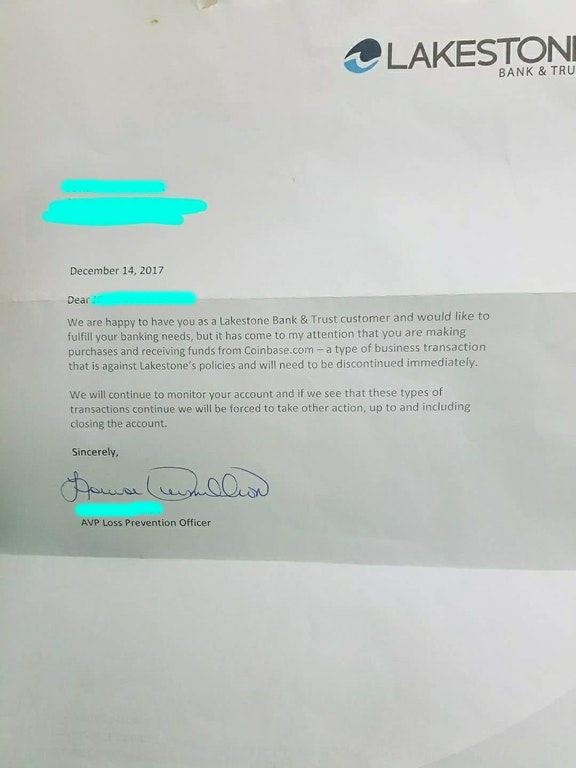

Even if your exchange rosary intends to send money to your bank, it may be wary of having some business with Bitcoin - for example, see this letter to one of the Coinbase users :

(The offended users' associates reacted as expected - that is, they pounced on the bank pages on Facebook and Yelp as rabid cultists).

The problem is that Bitcoin was originally intended as a means of avoiding state control. Its creators are idealistic anarcho-capitalists , who assumed that free independent citizens needed a cryptocurrency to trade among themselves without the threat of state theft — that is, taxation.

Obviously, this attracted the attention of criminals who are endlessly inventive in finding new ways to launder dirty money, as well as drug dealers and other individuals who have problems with using ordinary money, so some kind of surrogate is required.

That is, Bitcoin was from the very beginning literally designed for money laundering and tax evasion. It is not technically anonymous - if you really need to, you can do the tedious work and track the movement of bitcoins in the blockchain - but your bank is not going to bear this burden in order for you to cash out some coins.

Another problem is that Bitcoin users are usually “serial entrepreneurs”. Sometimes this may mean the creation of a number of successful enterprises, but more often they are chronically unemployed, low-income and people prone to fraud. Even if they provide the bank with the history of each Bitcoin, they are already included in the category of risky clients.

(And there are still bitcoiners who are sure that they are smarter than the bank’s compliance staff. For example, these guys prove to the bank that Coinbase is a coin collecting site. Please believe this trick never works).

Coinbase claims that the cache is carried out at the touch of a button. For some, it is, but for too many it is not. Cashout can be slow and painful.

Coinbase claims that the cache is carried out at the touch of a button. For some, it is, but for too many it is not. Cashout can be slow and painful.

Banks have strict reporting requirements. Banks are required to report large deposits, and sometimes refuse to transfer, which is considered dubious.

This is especially true for those who have discovered an old forgotten wallet with bitcoins - and wants to cash them. I know about one such case, when a user sold a car for bitcoins many years ago and wanted to make money on the current bubble. The best that the exchange could offer him was to send several thousand dollars a day. Finding a million dollars of several thousand is not only tedious, but also similar to structuring when someone tries to evade reporting requirements.

US bank customers are most affected by these requirements. As I understand it, it is easier for residents of the UK and Australia - although your bank may still refuse to service you. One case in the UK in July last year shows that HSBC considered the transactions from direct sales between users on LocalBitcoins fraudulent, and the recipient’s account was blocked for several days until they understood.

Please contact your bank first. Be prepared to provide a complete history of every cryptomonet you’ve ever received, and where you got the money to buy it. Be prepared to provide sufficient information to the tax office. If we are talking about a substantial amount, find a qualified accountant.

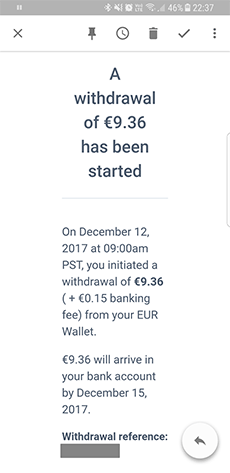

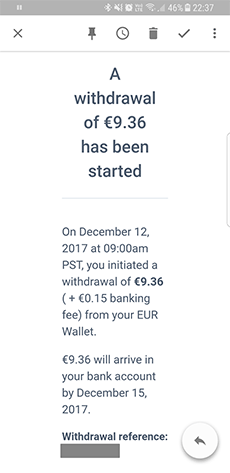

Messages from users give reason to believe that if you once successfully made a cashout and withdraw money, then there will be fewer problems with future transactions. Not quite without problems - but less. The screenshot at the top right was taken by a user from the UK on December 22, 2017. They are convinced that the money will arrive before the 15th ...

The exchanges are very serious about such issues, because the problems of KYC / AML can cut off the exchange from the entire banking system. And it happened.

Bitfinex - still the largest Bitcoin exchange in terms of trading volume - and its parent company Tether lost access to the US banking system in April 2017, when Wells Fargo, their only correspondent bank (intermediary) between Taiwanese banks and their US customers, refused to process transfers to the stock exchange and from it. Bitfinex sued - a good way to ensure that no other banks want to deal with you - but to no avail. As Phil Potter from Bitfinex put it :

As described in detail in the eighth chapter of my book , I am pretty sure that the 2017 crypto bubble began to inflate in this way - people could not withdraw US dollars from Bitfinex, so they bought Bitcoin and other cryptocurrencies to withdraw funds, pushing the price up.

So you bought a bubble. Everything will be fine, you can not lose money! And if it is blown away, just hold the position!

Oops! The price has just dropped from $ 19,000 to $ 11,000. What to do now?

Bitcoin does not have an economy as such. That is, there are many “valuable” Bitcoin papers that may never be realized.

At the end of last year, Twitter @Buttcoin published an explanation of how the Bitcoin market works in practice and why old investors, who have just gone to cash, tell newcomers to simply hold their positions. Or, as they put it , “HODL” :

Bitcoin is not a circulatory system of a functioning economy, there is no circular flow of revenues , that is, a continuous process of exchanging goods and services for money between subjects of the economic system. There is very little you can buy for bitcoins - even drug dealers refuse to accept them , because the commission goes off scale. Bitcoin does not have its own economy.

A bitcoin wallet is not a useful capital repository that you can invest in profitable economic activity and increase wealth. All you can do is sell them again. From a practical point of view, Bitcoin works only within the framework of the usual monetary system .

This makes Bitcoin a zero-sum investment - real output money will never be more than real money input. (Or a bit less, as miners cash rewards from each mined block to pay for electricity). If the amount of money X is invested in Bitcoin - the same amount of money X is immediately withdrawn by another person. That's all that happens.

Again, this is why the “market capitalization” indicator is misleading and useless. If someone bought bitcoins for $ 19,000, this does not make anyone a “bitcoin-billionaire” whose bitcoins can be sold for $ 19,000, because the total amount of actual money in the system has not increased.

Try to de facto realize a significant part of these paper billions - and you will see a price drop, since there is not enough actual money to cash everything. At some point, the mass exodus of users will begin, and most of them will not receive anything for their “profit”.

People invest in the hope of profit. This means that more money must come into the system — new people must be involved in the scheme. This is obvious to every "investor" - they will have to recruit .

In the end, the system is drying up the influx of “more fools” , the bubble bursts and many people remain bag holders .

Old investors receive money from new investors - this is a key characteristic of the financial pyramid . Functionally this is a pyramid. Even if it does not have a specific operator. As interpreted by evilweasel on Something Awful:

The problem with the name of Bitcoin “Ponzi scheme” or “financial pyramid” is that such a pyramid traditionally has a chief executive earning money.

Bitcoin doesn't have that. (And adherents emphasize this as a reason not to call it a financial pyramid! Satoshi Nakamoto, it seems, did not have any ulterior motive when creating Bitcoin.

Even taking into account Nakamoto’s widely documented political goals in creating Bitcoin as an anarcho-capitalist version of the gold standard , with conspiracy theories about the banking system along the way - he was extremely upset about how fans went insane with their greed. He even asked them to refrain from mining on video cards , because this would prevent the system from spreading to all computers.

Nakamoto abandoned the project around 2011, and since then his million bitcoins has been lying motionless. But his followers continue to crush.

Preston Byrne describes how Bitcoin works as a pyramid without a top, which he calls the “Nakamoto Scheme” :

Bitcoin is also a popular platform for Ponzi schemes and the like. The history of Pirateat40 is described in detail in the fourth chapter of the book, but "high-yield investment programs" have long been foolishly very popular. And they attract experienced operators of Ponzi schemes, such as Sergey Mavrodi from the MMM pyramid of the 1990s, who launched new bitcoin-based schemes .

In the future, cryptocurrencies proved to be a little better. When Ethereum took the cryptocurrency and introduced smart contracts, the very first contracts written by people turned out to be letters of happiness, lotteries and automatic Ponzi schemes .

Something in cryptocurrency attracts not just naive simpletons, but such naive simpletons who think that Ponzi, letters of happiness and other frankly fraudulent financial schemes are actually a good idea.

And where there are simpletons with burning eyes - there appear scammers to hunt them. This is a new paradigm!

Part 1. Why the "price" of bitcoin is largely fiction

In public discussions and articles in the media about bitcoins, some assumptions are made:

')

- Bitcoin has a price for which you can sell or buy it.

- Bitcoin can be compared with a share in a company or with a product like gold - the market works the same.

- Bitcoin is liquid - it is relatively easy to buy bitcoins or transfer them to money in your bank account.

All this is not true.

How much is bitcoin?

I'm now looking at the CoinDesk Bitcoin Price Index [the first part of the article was published on December 19, 2017 - approx. per.). At the moment there is a price of $ 19,699.46. Oops, already $ 19,691.76! And now $ 19,690.70! And so on.

This figure is bitcoin marketing. It should create the impression that Bitcoin is a reliable traded asset with an orderly market structure, that you can reasonably indicate its price to a cent and that everything is fine and reasonable. But this is an illusion.

There is no single “price” of Bitcoin - this is a made-up figure. You cannot expect to exchange bitcoins at this price — this is the average price of the last transactions on the pile of exchanges (when calculating the CoinDesk index, the Coinbase, Bitstamp, itBit and Bitfinex exchanges are counted.

If you look at the spread between the exchanges - the difference in price for the same Bitcoin - you will see a spread of hundreds of dollars , and at times of volatility, thousands.

If you wrote a number like $ 19,699.46 with seven significant digits with a 5% data spread, your high school physics teacher would give you the head punch. This is completely misleading. You should write something like “19,700 plus or minus $ 500,” and this beautiful line graph will turn into a thick gray bar .

"Market capitalization" is even worse. This is just the latest price multiplied by the number of existing tokens. A dummy value that is not applicable to anything at all - it is not equal to the money invested in a cryptocurrency, it is not realizable value, like a company's market capitalization, it does not affect prices - it is just a quickly calculated catchy number that looks nice in the headline. Trading any cryptocurrency is so modest, even Bitcoin, that you can never realize even a small part of this amount. This is just marketing.

Why is bitcoin like that? Why is the price not a reasonable, usable number?

Isolated islands that pose as continent

(This is a brief summary of the magnificent article by Paulo Santos “Supplement to the Bitcoin Cycle - Market Structure” (the reader has to log in to read to the end and the author has been paid).

In normal stock trading, if a stock is listed on several exchanges, orders are often redistributed through an automatic routing system , so that a specific buy or sell order is made in the context of all the order registers for a given stock. This avoids the fragmentation of liquidity , when the registers of different exchanges are too isolated from each other. Because of this, trade is difficult, and each individual trading pool becomes more volatile. Routing between exchanges is simple, because, unlike bitcoins, real exchanges do not need to keep stocks in order to conduct a transaction.

This scheme does not work for Bitcoin - on each individual exchange, all trade is isolated, and Bitcoins are actually present on the exchange. This is the reason for the huge volatility and the large price gap.

In addition, in ordinary stock trading, spreads between exchanges are quickly equalized through arbitrage — a purchase on one exchange to sell at a profit on another. This pushes the price up on the first exchange and down on the second.

The structure of the bitcoin market makes arbitration difficult. If you want to profit from the spread in the price of Bitcoin on different exchanges, you need to:

- Buy some bitcoins on one exchange.

- Withdraw them from the exchange - suppose, directly to the deposit address of the second exchange - and confirm the transaction in the blockchain (with a delay of at least 10 minutes), paying a large commission if you want to confirm the transaction in the nearest blocks. Or twice as high commission for a guarantee.

- Sell bitcoins on another exchange.

These delays (from ten minutes to more than an hour) and the commissions introduce enough difficulty in arbitration to generate a spread between exchanges, even if it is assumed that everyone has trading bots with maximum speed.

Therefore, each exchange acts as an island. The number with the "price" does not apply to any of these exchanges, islands.

What is it like to live on one of the islands?

What does “unregulated” mean in practice?

When you buy ordinary stocks or commodities, you assume that the trading environment is reasonably regulated, and the exchanges follow the rules established by law, and, in essence, will not bother you .

In the case of Bitcoin, this is impossible to imagine. This is what “unregulated” means.

Regarding the stock market, it is important to understand that every regulation rule appeared because someone robbed many people in this way. Rules ensure market integrity. So even investors who are aware of the high risk, who understand that cryptocurrencies are ridiculously volatile and are not secured in any way - even they may not be fully aware that the trading environment itself is part of the threat to the cryptocurrency trade.

(One striking example was the iGot collapse in Australia in 2016, which hit many small investors: “I just assumed that if there is a stock exchange in Australia, then there must be some kind of security system or regulation, or something like that some minimum standards for the exchange to be responsible for its actions ”).

On cryptobirds are common machinations that are not without reason forbidden on real stock exchanges:

- wash trades - deliberate actions to pump prices up / down or simply to create the illusion of trading volume. Until recently, you could literally do this through the Bitfinex exchange engine .

- spoofing - where you place a large bid to create the illusion of market optimism or pessimism, and shoot as soon as the price approaches it. It is ubiquitous on Bitfinex and Coinbase / GDAX .

- painting the tape - like wash trade, with only two or more participants. Mark Carpeles confessed in court that he used Willybot to pump Bitcoin prices on the Mt.Gox exchange during inflating the bubble in 2013.

- front-running - when an exchange operator satisfies a bid to buy or sell before other customers can.

- insiders with access to the exchange base are trading on their own stock exchange - this was done by Bitfinex employees. They say they avoided conflicts of interest, but there is no control or transparency.

The US Commodity and Futures Trading Commission has identified many of these frauds (PDF) as specific problems that are present in the cryptocurrency market much more than in other markets:

In addition to their practical and speculative functions, the emergence of these emerging markets is marked by causing various damage to retail customers, which requires the attention of the Commission. Among other things, this sudden failures and other violations of market trading 52 , delayed calculations 53 , alleged spoofing 54 , hacks 55 , alleged insider thefts 56 , alleged manipulations 57 , vulnerabilities in programming smart contracts 58 , illegal agreements and other conflicts of interest 59 . Such types of activity of intruders can impede innovation to strengthen the market, undermine its integrity and prevent the further development of the market.

Since cryptobirds live in the Wild West, the interface between them and the normal financial world is strictly regulated. Because of this, there are huge problems with the withdrawal of real money, as we will see in the next section. And there are dubious things that pump up the price ...

Update : do not post comments on how personally you cashed your bitcoins, and therefore everything is fine ! It’s good that you’ve got it, but you know that many beginning investors have problems - and it’s worth talking about.

Part 2. Bitcoin, Money Laundering and KYC (Know Your Client)

KYC / AML rules (Know your client and about countering money laundering) - an endless headache for Bitcoin traders.

The rules “Know Your Client” are adopted as part of the US Patriot Act after the September 11 attacks. The idea was to detect money laundering by terrorists and criminals.

For ordinary users, the problem is that the law requires the bank to treat every customer as a threat. And Bitcoin is known as a favorite tool of criminals and drug dealers, therefore, special attention is paid to it by the banks.

This applies to cryptobirds and banks. It is well known that Coinbase requires people to re-upload scans of documents that they have previously sent when accounts are transferred to “restricted” mode (where you cannot withdraw your money). When they cash in, they require more documents for identification than in case of a deposit. All this is automated, practically without any customer service. But they do it not just to hold your money - they are legally obliged to treat you as a threat.

Banks hate bitcoin due to non-compliance

Even if your exchange rosary intends to send money to your bank, it may be wary of having some business with Bitcoin - for example, see this letter to one of the Coinbase users :

We are glad to see you as a client of Lakestone Bank & Trust and are happy to satisfy your requests in banking services, but my attention was attracted by the fact that you make purchases and receive money from Coinbase.com - this type of business operations is contrary to the rules of Lakestone and should be terminated immediately .

We will continue to monitor your account, and if we see that transactions of this type continue, we will have to take other actions, including closing the account.

(The offended users' associates reacted as expected - that is, they pounced on the bank pages on Facebook and Yelp as rabid cultists).

The problem is that Bitcoin was originally intended as a means of avoiding state control. Its creators are idealistic anarcho-capitalists , who assumed that free independent citizens needed a cryptocurrency to trade among themselves without the threat of state theft — that is, taxation.

Obviously, this attracted the attention of criminals who are endlessly inventive in finding new ways to launder dirty money, as well as drug dealers and other individuals who have problems with using ordinary money, so some kind of surrogate is required.

That is, Bitcoin was from the very beginning literally designed for money laundering and tax evasion. It is not technically anonymous - if you really need to, you can do the tedious work and track the movement of bitcoins in the blockchain - but your bank is not going to bear this burden in order for you to cash out some coins.

Another problem is that Bitcoin users are usually “serial entrepreneurs”. Sometimes this may mean the creation of a number of successful enterprises, but more often they are chronically unemployed, low-income and people prone to fraud. Even if they provide the bank with the history of each Bitcoin, they are already included in the category of risky clients.

(And there are still bitcoiners who are sure that they are smarter than the bank’s compliance staff. For example, these guys prove to the bank that Coinbase is a coin collecting site. Please believe this trick never works).

How does it affect caches

Coinbase claims that the cache is carried out at the touch of a button. For some, it is, but for too many it is not. Cashout can be slow and painful.

Coinbase claims that the cache is carried out at the touch of a button. For some, it is, but for too many it is not. Cashout can be slow and painful.Banks have strict reporting requirements. Banks are required to report large deposits, and sometimes refuse to transfer, which is considered dubious.

This is especially true for those who have discovered an old forgotten wallet with bitcoins - and wants to cash them. I know about one such case, when a user sold a car for bitcoins many years ago and wanted to make money on the current bubble. The best that the exchange could offer him was to send several thousand dollars a day. Finding a million dollars of several thousand is not only tedious, but also similar to structuring when someone tries to evade reporting requirements.

US bank customers are most affected by these requirements. As I understand it, it is easier for residents of the UK and Australia - although your bank may still refuse to service you. One case in the UK in July last year shows that HSBC considered the transactions from direct sales between users on LocalBitcoins fraudulent, and the recipient’s account was blocked for several days until they understood.

Please contact your bank first. Be prepared to provide a complete history of every cryptomonet you’ve ever received, and where you got the money to buy it. Be prepared to provide sufficient information to the tax office. If we are talking about a substantial amount, find a qualified accountant.

Messages from users give reason to believe that if you once successfully made a cashout and withdraw money, then there will be fewer problems with future transactions. Not quite without problems - but less. The screenshot at the top right was taken by a user from the UK on December 22, 2017. They are convinced that the money will arrive before the 15th ...

KYC / AML standards also apply to exchanges

The exchanges are very serious about such issues, because the problems of KYC / AML can cut off the exchange from the entire banking system. And it happened.

Bitfinex - still the largest Bitcoin exchange in terms of trading volume - and its parent company Tether lost access to the US banking system in April 2017, when Wells Fargo, their only correspondent bank (intermediary) between Taiwanese banks and their US customers, refused to process transfers to the stock exchange and from it. Bitfinex sued - a good way to ensure that no other banks want to deal with you - but to no avail. As Phil Potter from Bitfinex put it :

In the past, we had bank failures, we could always just get around a problem or solve it, open new accounts, and so on ... register a new legal entity, many tricks of the game of cat and mouse.

As described in detail in the eighth chapter of my book , I am pretty sure that the 2017 crypto bubble began to inflate in this way - people could not withdraw US dollars from Bitfinex, so they bought Bitcoin and other cryptocurrencies to withdraw funds, pushing the price up.

Part 3. Bitcoin - not a pyramid! Technically

“The aquarium without food, where they continue to jump the fish that have heard that there is a buffet. And for the meanest of fishes, it is the way it is. ”(Sid Midnight)

So you bought a bubble. Everything will be fine, you can not lose money! And if it is blown away, just hold the position!

Oops! The price has just dropped from $ 19,000 to $ 11,000. What to do now?

Bitcoin does not have an economy as such. That is, there are many “valuable” Bitcoin papers that may never be realized.

How bitcoin bubbles transfer money from new members to old ones

At the end of last year, Twitter @Buttcoin published an explanation of how the Bitcoin market works in practice and why old investors, who have just gone to cash, tell newcomers to simply hold their positions. Or, as they put it , “HODL” :

An important note for beginners in Bitcoin: old-timers do not care. They actively laugh and scoff at you when the price drops. They need your money, but they hate your presence.

Whenever a fall or crash occurs, if you dare to ask why the market behaves in this way, you will be regularly mocked and said that you “don’t understand Bitcoin”. That in the fall of 40% is nothing new. And why are you newbies altogether worried about big losses?

If you bought for $ 19,000, then you paid the cash out to someone else, and now this person will call you an idiot if you panic about losing money. They will say that you are not smart enough to wait and slowly observe how your “stable stock of value” is rotting for years waiting for the next bubble.

Why hold a position? In translation, this means something like the following: “Please, you do not need to drop the price, just sit and wait until new suckers come.” Nobody buying in 2017 thinks that Bitcoin will replace Fiat.

That's why people call Bitcoin a pyramid. Every time this bubble inflates, new people are drawn into it and YEARS sit on their bitcoins until the market warms up and the new bubble inflates - and they can finally get out without a loss.

The money pool does not grow: it comes as much as it leaves

Bitcoin is not a circulatory system of a functioning economy, there is no circular flow of revenues , that is, a continuous process of exchanging goods and services for money between subjects of the economic system. There is very little you can buy for bitcoins - even drug dealers refuse to accept them , because the commission goes off scale. Bitcoin does not have its own economy.

A bitcoin wallet is not a useful capital repository that you can invest in profitable economic activity and increase wealth. All you can do is sell them again. From a practical point of view, Bitcoin works only within the framework of the usual monetary system .

This makes Bitcoin a zero-sum investment - real output money will never be more than real money input. (Or a bit less, as miners cash rewards from each mined block to pay for electricity). If the amount of money X is invested in Bitcoin - the same amount of money X is immediately withdrawn by another person. That's all that happens.

Again, this is why the “market capitalization” indicator is misleading and useless. If someone bought bitcoins for $ 19,000, this does not make anyone a “bitcoin-billionaire” whose bitcoins can be sold for $ 19,000, because the total amount of actual money in the system has not increased.

Try to de facto realize a significant part of these paper billions - and you will see a price drop, since there is not enough actual money to cash everything. At some point, the mass exodus of users will begin, and most of them will not receive anything for their “profit”.

People invest in the hope of profit. This means that more money must come into the system — new people must be involved in the scheme. This is obvious to every "investor" - they will have to recruit .

In the end, the system is drying up the influx of “more fools” , the bubble bursts and many people remain bag holders .

Old investors receive money from new investors - this is a key characteristic of the financial pyramid . Functionally this is a pyramid. Even if it does not have a specific operator. As interpreted by evilweasel on Something Awful:

Bitcoin distributes tokens among early adherents precisely in order to get them to promote the system. This is an automated pam and dump system , an “honest financial pyramid”.

The main innovation of Bitcoin is largely the creation of an “honest pyramid”. It works because early adherents automatically receive a direct monetary incentive to promote it.

Well, technically it's not a ponzi ...

The problem with the name of Bitcoin “Ponzi scheme” or “financial pyramid” is that such a pyramid traditionally has a chief executive earning money.

Bitcoin doesn't have that. (And adherents emphasize this as a reason not to call it a financial pyramid! Satoshi Nakamoto, it seems, did not have any ulterior motive when creating Bitcoin.

Even taking into account Nakamoto’s widely documented political goals in creating Bitcoin as an anarcho-capitalist version of the gold standard , with conspiracy theories about the banking system along the way - he was extremely upset about how fans went insane with their greed. He even asked them to refrain from mining on video cards , because this would prevent the system from spreading to all computers.

Nakamoto abandoned the project around 2011, and since then his million bitcoins has been lying motionless. But his followers continue to crush.

Preston Byrne describes how Bitcoin works as a pyramid without a top, which he calls the “Nakamoto Scheme” :

The Nakamoto Scheme is an automated hybrid of the Ponzi scheme and the pyramid scheme, where, from the point of view of managing a criminal enterprise, the strengths of both schemes are combined and their weaknesses are absent (at present).

The Nakamoto scheme draws strength from the same things that make the pyramids and Ponzi so compelling. It promises an insane return on investment, is accessible to a person from the street with little or no effort, and recruits individual members as new, interested evangelists.

The regulators, blinded by lobbying from Silicon Valley, viewed these schemes as futuristic and ultra-modern, and not as what they really are: factories of victims, which in the next crash will spawn hundreds of thousands of screaming investors with little or no legal resource due to four years inaction on the part of regulators.

Bitcoin as a Ponzi Platform

Bitcoin is also a popular platform for Ponzi schemes and the like. The history of Pirateat40 is described in detail in the fourth chapter of the book, but "high-yield investment programs" have long been foolishly very popular. And they attract experienced operators of Ponzi schemes, such as Sergey Mavrodi from the MMM pyramid of the 1990s, who launched new bitcoin-based schemes .

In the future, cryptocurrencies proved to be a little better. When Ethereum took the cryptocurrency and introduced smart contracts, the very first contracts written by people turned out to be letters of happiness, lotteries and automatic Ponzi schemes .

Something in cryptocurrency attracts not just naive simpletons, but such naive simpletons who think that Ponzi, letters of happiness and other frankly fraudulent financial schemes are actually a good idea.

And where there are simpletons with burning eyes - there appear scammers to hunt them. This is a new paradigm!

Source: https://habr.com/ru/post/371295/

All Articles