In Venezuela, a number of enterprises are obliged to accept the national cryptocurrency "petro"

Venezuelan President Nicola Maduro against the background of the cryptocurrency sign Petro during her official presentation on February 20, 2018

And yet it happened. Laid with international sanctions, the Bolivarian Republic of Venezuela, deprived of access to the international financial market, issued the national cryptocurrency El Petro (PTR) - and began selling it on the market. On February 20, 2018, President Nicolas Maduro announced the start of a private (closed) pre-sale of tokens, which later would go into free circulation. The president did this contrary to the decision of the parliament. He voted against the national issue of cryptocurrency, which violates the laws and the Constitution of the country, and is also "an ideal tool for corrupt practices."

Nevertheless, Maduro is bending his line. He said that the cryptocurrency provided by oil and other minerals (gas, diamonds), and invited OPEC "to consider the creation of a platform for trading oil-backed cryptocurrency." The cost of 1 PTR will be equal to the cost of one barrel of Venezuelan oil, Maduro said. During the pre-sale tokens are sold at a discount of up to 60%.

')

By order of Maduro released 100 million tokens. Under this goal, the president allocated 5 billion barrels of oil from the Ayacucho field in the Orinoco oil belt. Venezuela is the richest oil reserves country in the world .

At the first stage of sales from February 20 to March 19, about 38 million tokens will be available to investors. After the end of the presale period on March 20, another 44 million coins will go on sale to everyone. In total, 82.4 million tokens out of a total of 100 million will go into free circulation. Thus, the government will leave 17.6 million coins for its own needs.

The Parliament regarded Perto with oil supply as cryptocurrency obligations for the forward sale of Venezuelan oil, that is, as an illegal type of government loan.

For Maduro, the release of cryptocurrency is a tricky way to circumvent international sanctions. Because of the sanctions, the country is prohibited to sell oil on the international market and take loans. With the help of cryptocurrency, you can actually do both. Oil itself, even without a sale, acts as a security for cryptocurrencies, and investments are attracted “anonymously” through the sale of PTR coins. It is clear that such frauds will not go unpunished, but Maduro decided to take a chance.

According to the president, on the very first day PTR sold in the amount of 4.777 billion yuan ($ 735 million) . That is almost a billion dollars in foreign investment in the country on the first day! However, according to Nicholas, few believe. He was repeatedly convicted of unsubstantiated statements, while the country was deeply immersed in the economic crisis, and 93% of the population complained of malnutrition . The expected annual rate of inflation is 1000%, and the dollar exchange rate on the black market exceeds the official one by 900 times.

Theoretically, from the sale of 82.4 million coins at the price of a barrel of oil (about $ 60), Venezuela could gain $ 4.944 billion (without taking into account discounts during presale), and then earn extra money on different commissions from cryptocurrency circulation and additional services. Not to mention the fact that the Central Bank of Venezuela can still issue any arbitrary amount of Perto - nothing prevents it from doing so. The presence of a single emission center completely compromises the idea of a peering cryptocurrency, but Nicolas Maduro doesn’t care much.

“Petro was born, and we are going to achieve complete success in the question of the welfare of Venezuela ... The largest and most important blockchain companies in the world are on the side of Venezuela, we are going to conclude agreements with them,” the president said. Earlier, he also stated that “more than 860 thousand miners” were interested in Petro’s booty.

In December 2017, the General Directorate of Cryptocurrency was formed in Venezuela, which is designed to ensure the economic growth of the country and become "an effective resource for combating the speculative dollar."

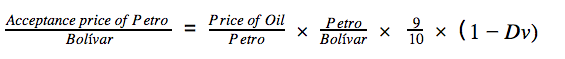

The authorities are going to not only sell Perto to foreign investors, but also to encourage the use of cryptocurrency in the country. A number of enterprises have already obliged to make transactions in the national cryptocurrency Petro by order of the president. In particular, cryptocurrency transactions are required to be conducted by the oil company PDVSA, petrochemical Petroquimica de Venezuela (Pequiven) and CVG corporation engaged in the development of minerals. "Petra" can pay consular fees at the embassies of Venezuela in other countries, fuel for aircraft, hotel services and other tourist facilities. When used internally, the Petro cost is related to the oil rate and the bolivar rate using the following formula.

The NY Times believes that the idea of releasing cryptocurrencies to circumvent sanctions can be understood by the Russian authorities, so the “Venezuelan scenario” can be viewed as one of the scenarios. Some Russian politicians have already expressed such ideas.

Yesterday, the Russian Internet ombudsman Dmitry Marinichev announced the construction of a plant for the production of equipment for mining farms in the industrial park “Velikiy Kamen” near Minsk (Belarus) 200 km from the future Belarusian nuclear power plant .

Crypto Farm Marinicheva near Moscow. Photo: Maxim Zmeyev / Agence France-Presse - Getty Images

The Venezuelan Minister of Finance has now arrived in Russia, where he is holding consultations on Petro at the Russian Ministry of Finance , RIA Novosti reports. Perhaps Venezuela is offering to give a cryptocurrency portion of the debt to Russia.

"We made a giant step in the 21st century. <...> We are at the forefront of global technology," Maduro quoted the Associated Press on a television show.

Source: https://habr.com/ru/post/371285/

All Articles