Bitcoin broke $ 10,000

Almost no one doubted that the price of Bitcoin would break the mark of $ 10,000, the only question is when. The first and most famous of the hundreds of existing cryptocurrencies takes psychologically important milestones every week. According to CoinMarketCap.com statistics , right now on several of the largest stock exchanges the cost of "digital gold" has crossed this historical barrier, although the weighted average rate currently stands at $ 9,974.28.

10 largest world exchanges

Thus, the dynamics of the course in a historical perspective so far correspond to the law of Moore (like many technologies), only with a different coefficient. At first, it increased 10 times approximately every year (here we simplify a little, in fact, fluctuations occurred during this time, especially in 2013-2016):

2010 - $ 0.10 for Bitcoin

2011 - $ 1 per bitcoin

2012 - $ 10 for Bitcoin

2013 - $ 100 for Bitcoin

')

Then the growth slowed down (with the collapse of the course after the opening of the Mt.Gox scam), and a 10-fold increase in price occurred approximately every two years:

2015 - $ 1000 for Bitcoin

2017 - $ 10,000 for Bitcoin

...

As can be seen from the table above, Bitcoin overcame the $ 10,000 mark on four of the ten largest cryptobirds. These are mainly Korean exchanges: Bithumb, Coinone and Korbit.

For the rest, his rate so far ranges from $ 9,837 to $ 9,914.

The total value of all cryptocurrencies in circulation currently exceeds $ 309 billion. All cryptocurrencies, except for Bitcoin - $ 143 billion. Their course usually depends on the BTC course.

Professional investors when buying any asset indicate stop-loss and take-profit levels. They correspond to the prices of the automatic sale for fixing the loss and profit. It can be assumed that the symbolic $ 10,000 milestone for Bitcoin was indicated by many as the take-profit level. That is why such round numbers are considered “psychological” frontiers, because they are difficult to take: as soon as the course touches the mark, automatic sales begin. Let not the first attempt, but in the end Bitcoin finally and steadily overcome this mark. When he succeeds, there will be no obstacles for further growth. Moreover, overcoming the symbolic milestone of $ 10,000 will most likely cause a wave of publications in the world media, including on television - and will further stir up interest in the “new cryptocurrency” among the broad masses. That is, demand will grow even more.

What will happen next?

The notorious “time traveler” from 2025 warned humanity that we must destroy “this project project”, because the price will continue to grow in the same geometric progression and reach $ 1,000,000 for Bitcoin in 2021. Cryptocurrency price will no longer be denominated in dollars or other national currency. On average, there will be 0.003 BTC per person, but the bulk of the wealth will be concentrated in the hands of a small group of people who will live in the so-called strongholds created to protect early investors.

By 2025, most states will cease to exist, since they will no longer be able to collect taxes due to the anonymity of Bitcoin transactions. Some governments will try to preserve their existence by buying Bitcoins themselves - but by doing so will raise the course even higher.

A guy from the future writes that the economy fell into decay due to deflation of the base currency. A group of early investors realized their mistake and tried to get rid of Bitcoin, but all the people in the world refused to switch to currencies subject to inflation.

At the present time for him - in 2025 - activists are preparing to begin the destruction of all computers in the world: “You should not share our destiny. I do not know how, but you have to destroy this damned project, ”writes the time traveler.

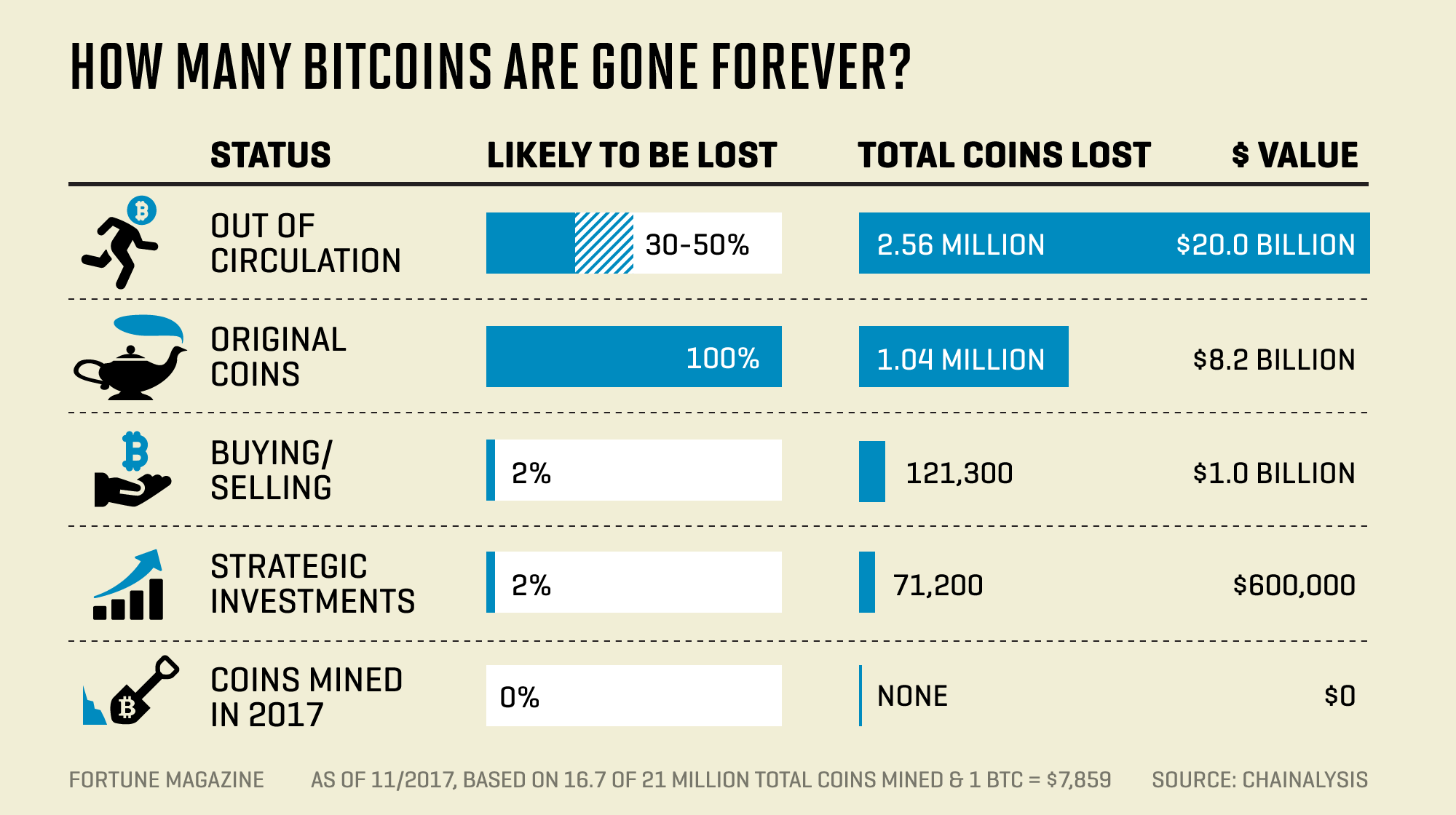

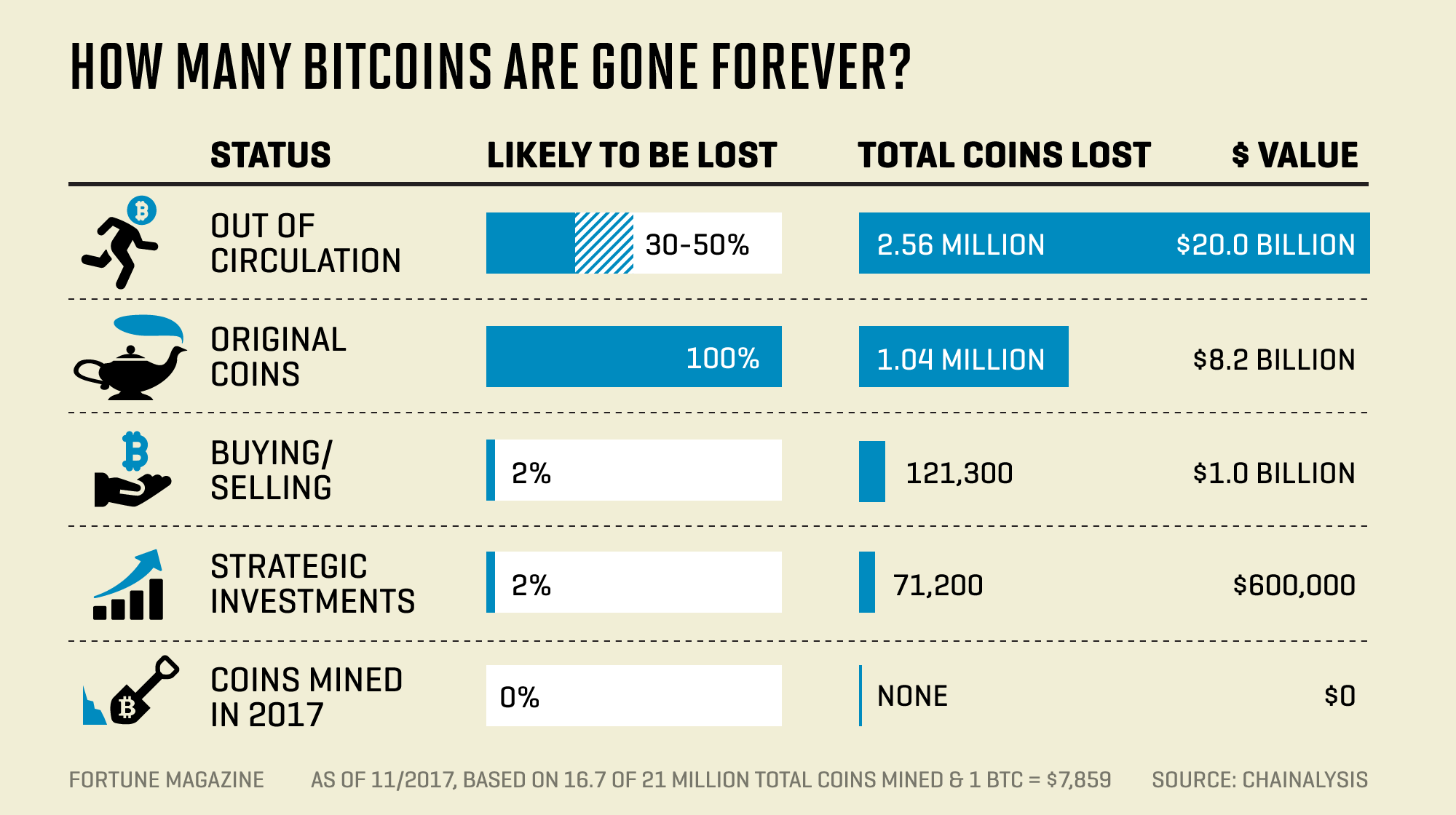

Speaking seriously, the constant and endless rise in the cost of Bitcoin is really theoretically possible, because the number of cryptocurrencies in the world is constantly decreasing due to natural causes (forgotten passwords, computer breakdowns). That is, the supply is constantly decreasing, and even with constant demand, the rate should grow. At the moment, according to Chainalysis , 3.79 million BTC are irretrievably lost.

As you can see, the initially lost Bitcoins on the computer of Satosi Nakamoto also belong to the lost ones. Indeed, they are still lying on Satoshi's purse. If this is one person, then he has long become a billionaire.

Initially, Bitcoin was considered as a convenient means of pseudo-anonymous calculations. For example, if you need to transfer money abroad, not reporting to the state and not paying extortionate bank fees. But now it is clear that Bitcoin is more like an analogue of digital gold, which people use to safely store their savings and investments, knowing about the constant inflation and devaluation of Fiat.

10 largest world exchanges

Thus, the dynamics of the course in a historical perspective so far correspond to the law of Moore (like many technologies), only with a different coefficient. At first, it increased 10 times approximately every year (here we simplify a little, in fact, fluctuations occurred during this time, especially in 2013-2016):

2010 - $ 0.10 for Bitcoin

2011 - $ 1 per bitcoin

2012 - $ 10 for Bitcoin

2013 - $ 100 for Bitcoin

')

Then the growth slowed down (with the collapse of the course after the opening of the Mt.Gox scam), and a 10-fold increase in price occurred approximately every two years:

2015 - $ 1000 for Bitcoin

2017 - $ 10,000 for Bitcoin

...

As can be seen from the table above, Bitcoin overcame the $ 10,000 mark on four of the ten largest cryptobirds. These are mainly Korean exchanges: Bithumb, Coinone and Korbit.

For the rest, his rate so far ranges from $ 9,837 to $ 9,914.

The total value of all cryptocurrencies in circulation currently exceeds $ 309 billion. All cryptocurrencies, except for Bitcoin - $ 143 billion. Their course usually depends on the BTC course.

What's next?

Professional investors when buying any asset indicate stop-loss and take-profit levels. They correspond to the prices of the automatic sale for fixing the loss and profit. It can be assumed that the symbolic $ 10,000 milestone for Bitcoin was indicated by many as the take-profit level. That is why such round numbers are considered “psychological” frontiers, because they are difficult to take: as soon as the course touches the mark, automatic sales begin. Let not the first attempt, but in the end Bitcoin finally and steadily overcome this mark. When he succeeds, there will be no obstacles for further growth. Moreover, overcoming the symbolic milestone of $ 10,000 will most likely cause a wave of publications in the world media, including on television - and will further stir up interest in the “new cryptocurrency” among the broad masses. That is, demand will grow even more.

What will happen next?

The notorious “time traveler” from 2025 warned humanity that we must destroy “this project project”, because the price will continue to grow in the same geometric progression and reach $ 1,000,000 for Bitcoin in 2021. Cryptocurrency price will no longer be denominated in dollars or other national currency. On average, there will be 0.003 BTC per person, but the bulk of the wealth will be concentrated in the hands of a small group of people who will live in the so-called strongholds created to protect early investors.

By 2025, most states will cease to exist, since they will no longer be able to collect taxes due to the anonymity of Bitcoin transactions. Some governments will try to preserve their existence by buying Bitcoins themselves - but by doing so will raise the course even higher.

A guy from the future writes that the economy fell into decay due to deflation of the base currency. A group of early investors realized their mistake and tried to get rid of Bitcoin, but all the people in the world refused to switch to currencies subject to inflation.

At the present time for him - in 2025 - activists are preparing to begin the destruction of all computers in the world: “You should not share our destiny. I do not know how, but you have to destroy this damned project, ”writes the time traveler.

Speaking seriously, the constant and endless rise in the cost of Bitcoin is really theoretically possible, because the number of cryptocurrencies in the world is constantly decreasing due to natural causes (forgotten passwords, computer breakdowns). That is, the supply is constantly decreasing, and even with constant demand, the rate should grow. At the moment, according to Chainalysis , 3.79 million BTC are irretrievably lost.

As you can see, the initially lost Bitcoins on the computer of Satosi Nakamoto also belong to the lost ones. Indeed, they are still lying on Satoshi's purse. If this is one person, then he has long become a billionaire.

Initially, Bitcoin was considered as a convenient means of pseudo-anonymous calculations. For example, if you need to transfer money abroad, not reporting to the state and not paying extortionate bank fees. But now it is clear that Bitcoin is more like an analogue of digital gold, which people use to safely store their savings and investments, knowing about the constant inflation and devaluation of Fiat.

Source: https://habr.com/ru/post/371045/

All Articles