Why do our jobs never disappear?

Tim O'Reilly's talk about unconditional income with John Maynard Keynes, and Paul Buchheit

At the beginning of the Great Depression, John Maynard Keynes wrote an amazing economic prediction: in spite of the threatening storm enveloping the whole world, mankind was on the verge of solving the “economic task” of searching for livelihoods.

The world of his grandchildren - the one in which we live today - he imagined as follows: “for the first time from the day of creation man will face a real, universal problem: how to use his freedom from urgent economic needs, how to occupy leisure provided by the forces of science and a complex percentage to live your life correctly, reasonably and in harmony with yourself. "

')

Not everything happened the way Keynes imagined. Of course, after the severe Great Depression and World War II, the economy entered a time of unprecedented prosperity. But in recent decades, despite all the progress in business and technology, this prosperity has been distributed very unevenly. The average standard of living in the world has grown very much, but in developed economies the middle class is stagnating, and for the first time in several generations our children may live worse than we do. We met with what Keynes called “huge abnormal unemployment in the full needs of the world,” followed by political instability and incomprehensible prospects for business.

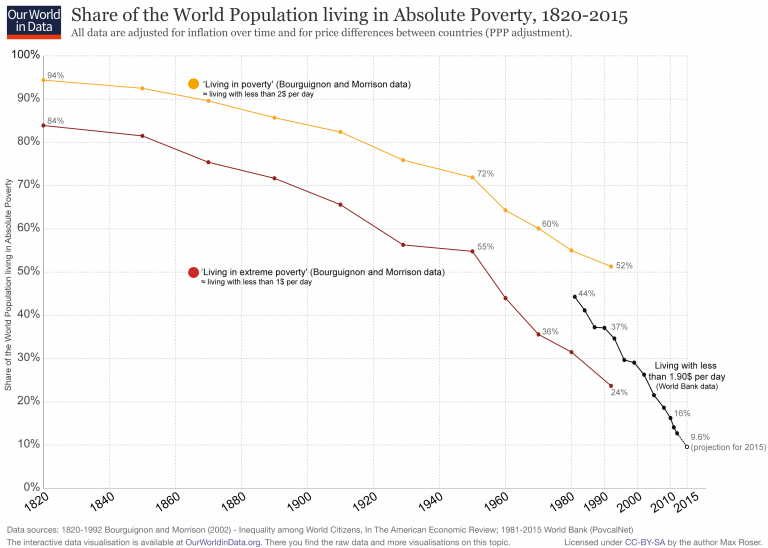

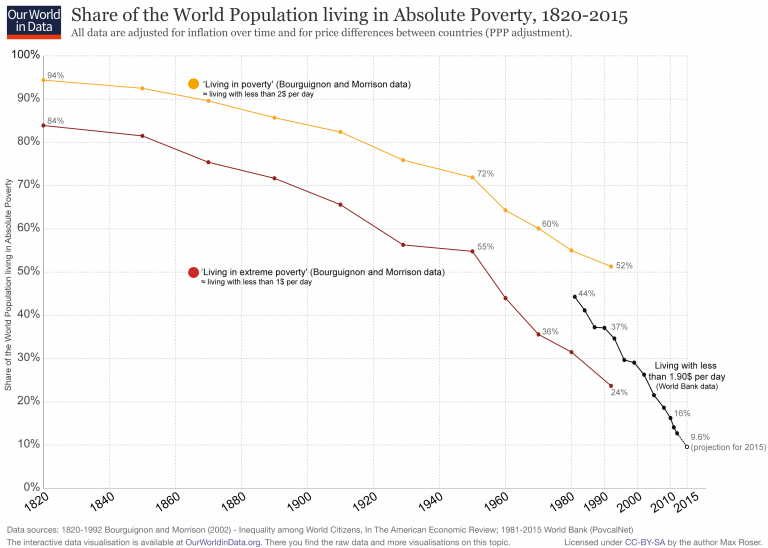

But Keynes was right. The world that he imagined, where the "economic problem" is solved, is still in front of us. The percentage of poverty has fallen to a record, and if we play the cards correctly, we can enter the world predicted by Keynes.

Technology and free trade have reduced world poverty, but have created economic difficulties for workers in developed countries.

As Max Roser, author of Our World in Figures [Our World in Data], notes: “Even in 1981, more than 50% of the world's population lived in poverty - now this percentage is 14%. This is still a very large number of people, but changes are happening very quickly. In our case, the data tells us that poverty disappears faster than ever in history. ”

Much of Keynes's essay entitled “The Economic Opportunities of Our Grandchildren” refers to what people will do when their productivity grows so much that machines will do all the work.

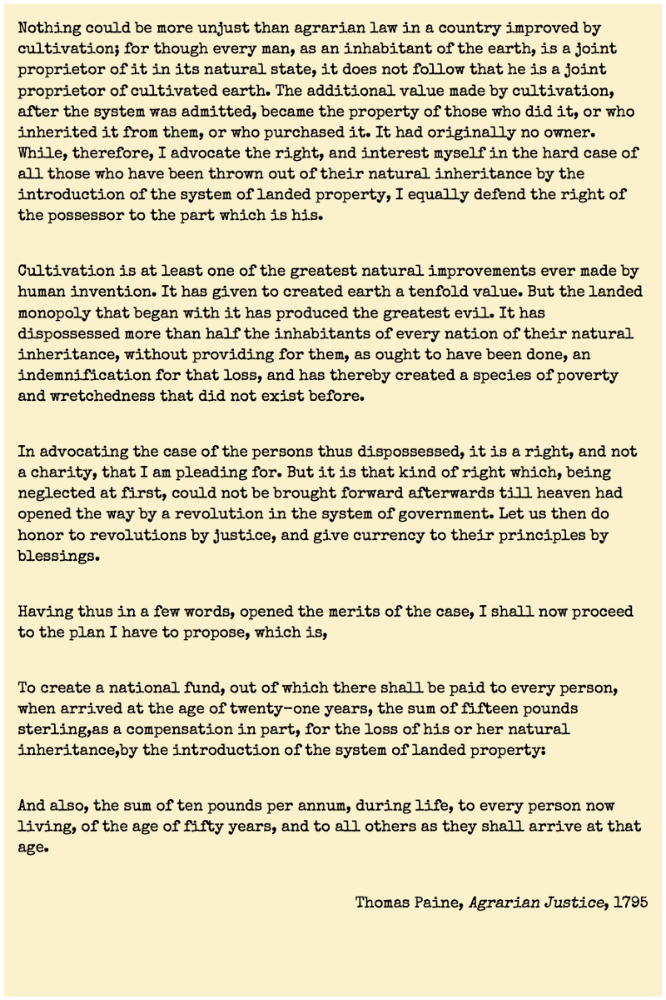

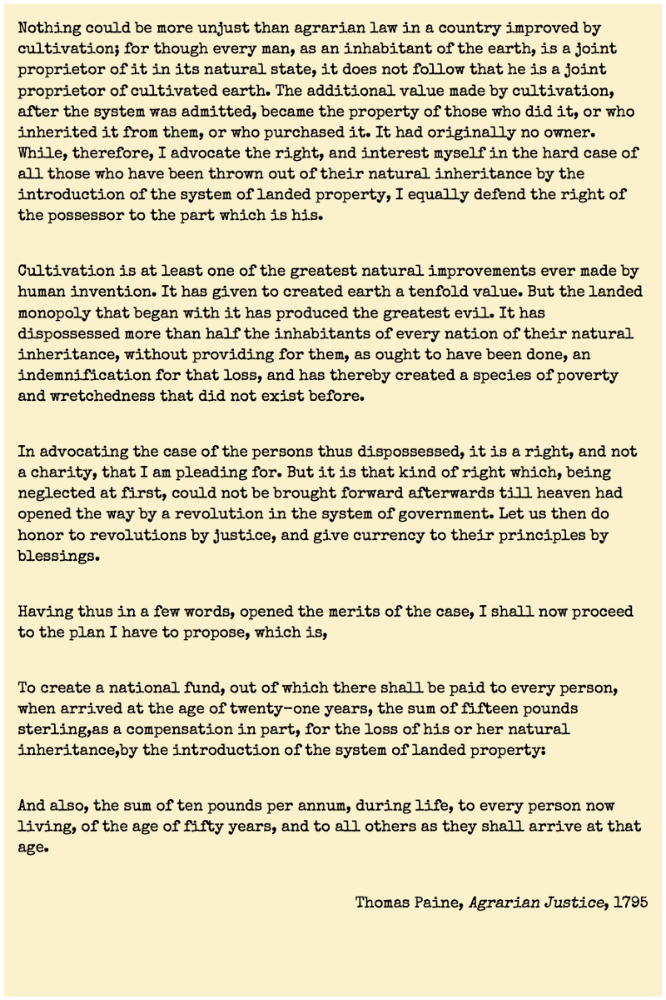

This question has reappeared today as part of the discussion of the Universal Basic Income (UNB). The famous chairman of the international trade union Service Employees International Union (SEIU) resigned from his job to write a book in defense of the database. Y Combinator Research plans to conduct an experiment in Auckland . On the issue of the database passed a referendum in Switzerland . They voted against, but the fact that she was so seriously considered speaks a lot about what a long way this idea went, first proposed by Thomas Payne in 1795, and then by Milton Friedman in 1962 (and Paul Ryan in 2014).

I would like to discuss a few key paragraphs of Keynes's essay, and point out their veracity, confirmed by today's headlines. Imagine me in a dialogue with Keynes. Then I will add some thoughts from a recent conversation with Paul Buchheit from Y Combinator on the same topic. These will be only unformed thoughts, not polished conclusions.

So begins the essay of Keynes:

And of course, we will now hear a chorus of pessimists and doubters. Automation will destroy clerk jobs just as she replaced workers in factories. Our economy is based on growth, but the era of growth is over. We live in an era of "age-old stagnation." And so on.

Keynes prophetically gave the name of the essence of our fear:

I will support Keynes in his optimism. If we do everything right, this will remain the "temporary painful phase of adaptation." There can be huge imbalances, but as a result, everything will calm down. Keynes wrote:

“The paradoxical existence of unemployment in a world where there are so many needs” - I love this phrase! As Nick Hanauer told me, “Technology is the solution to the problems of humanity. Until we run out of problems, our work will not end either. ”

We still haven't done so much: it is necessary to make changes in the energy infrastructure in response to climate change, to take care of the health of the nation due to the emergence of new infections, to solve the problem of population aging when a growing number of older people will contain fewer and fewer workers, to restructure the infrastructure cities, give the world clean water, food, clothes and entertain 9 billion people.

Note that Nick said "we will not run out of work," and not "we will not run out of jobs." Part of the problem is that the workplace is an artificial structure in which work is managed and shared by corporations and other organizations that individuals must turn to in order to do work. Financial markets should reward corporations for understanding the work that needs to be done. But as Rana Foroohar noted in her book “Manufacturers and Consumers: The Rise of Finance and the Fall of American Industry” [Makers and Takers: The Rise of Finance], today the difference between what rewards are given by markets and by what the economy really needs.

In corporations, motivation and restrictions are different from individuals, so a situation is possible in which a corporation cannot offer jobs for the area of work that needs to be done. In times of instability, employers do not rush to hire people until they see guarantees of demand. And because of the demand from financial markets, companies often see a benefit in cutting jobs, because managing the value of stocks gives business owners more dividends than hiring people to do work. As a result, the “market” is settling everything (in theory), and corporations are again being able to offer jobs to employees. But too many losses occur in the process.

One of the difficulties of the “Economy of the Future” is to create new mechanisms for connecting people and organizations with the work that needs to be done - a more efficient job market. But it can be said that this factor is a key factor in the development of such companies as Uber and Lyft, DoorDash and Instacart, Upwork, Handy, TaskRabbit and Thumbtack. And you should not be embarrassed that so far these platforms do not provide a steady income and social protection. We must develop them so that they really serve the people working with them, and not wind off time back to the guaranteed employment of the 1950s.

There is also a leadership challenge: choosing the right job to do. It is necessary that companies are engaged in projects whose tasks do not solve the market, but which, on the contrary, require reworking the market. Think about what Ilon Musk did to give impetus to new industries through Tesla, SpaceX and SolarCity, or what Google did to “access all information in the world,” or what the Gates Foundation does to eradicate malaria. Markets are not perfect. Governments can participate in this process, as can be seen from the development of the Internet, GPS and the Human Genome Project. The role of the government is not limited to projects requiring coordination that is not available to private companies. The government must deal with market failures. These can be failures in the market of resources, the malicious intent of entrepreneurs or problems in financial markets, such as the one that still stifles the current economy.

The rest of the essay becomes even more interesting. Repeat some words and combine them with the conclusion:

In a recent conversation, Paul Buchkheit, the creator of Gmail and a partner in Y Combinator, dropped something provocative: “It may be necessary to have two types of money: machine and human. Machine money will be needed to buy what cars produce. And these things will always be cheaper. Human money will be needed to buy something that only people can do. ”

And he continued: “The most important thing is that people can offer, but cars are not,“ authenticity ”. You can buy a cheap table from Amazon, made by a robot, or a hand-carved table is much more expensive (for authenticity, it will have to be done by a local workshop, and not by an unnamed worker from a factory across the ocean). In the long term, the cost of the first, expressed in machine money, will tend to zero, and the second will always cost about the same in human money (which will be an expression of hours spent on work). ”

Paul argues that it will be correct to call unconditional income "citizen dividends." The concept dates back to ancient Athens and to the works of Thomas Paine. According to Payne, the dividend is based on the share of mineral resources - and this approach has already been applied in Norway, Alaska and in the famous experiment of the 1970s in the city of Manitoba.

Paine’s pamphlet Land Justice advocated sharing the value of uncultivated land with each US citizen.

And if Payne argued that every citizen has a basic right to uncultivated land, Buchkheit invites humanity to enjoy the fruits of technological progress. With the help of taxes, we should take advantage of the high machine productivity, and distribute this amount to people in the form of a scholarship, which should be enough for them for daily needs. This bonus must be distributed so that everyone has enough “machine money” to meet basic needs. And machine productivity should all the time reduce the cost of these goods, increasing the value of civilian dividends. Such a prosperous world made Keynes imagine for his grandchildren.

How can we pay DB? It requires more money than it is spent on all social programs. In a conversation with me, the head of Y Combinator, Sam Altman, explained that people arguing about how we can pay for the database today are missing the point. “I’m sure that if we need him, we can afford it,” he said at a recent meeting on the database in Bloomberg Beta with Ende Stern and Natalie Foster from the Aspen Institute. He explained that the main factor that people miss is the huge amount of possible incomes from productivity, which grows thanks to technology. These revenues can be used to reduce the cost of goods produced by machines. The fact that today costs $ 35,000 may cost $ 3,500 in the future, when the machines replace so many people that a database will be needed. Therefore, Paul agitates for the introduction of "machine money". Instead of inflation peculiar to ordinary currencies, their value will only increase due to the fact that the value of goods will fall, and thus, the purchasing power of money will increase.

I like the division of money into two types, but I wonder if there will be enough of such a division. His concept of "human money" includes two different classes of goods and services: those that require a human approach — education, training, care — and those that include creativity.

Perhaps “human money” needs to be divided into “money for care” and “money for creativity”.

Care is a vital necessity, as food and shelter, and in a fair society it should not be denied to anyone. In an ideal world, care is the natural development of the family and society, because we care for those we love, but there is also a care industry consisting of professionals - teachers, doctors, nurses, elderly care professionals, babysitters, hairdressers, and massage therapists. In a society with an inverted demographic pyramid, where there are much more old people than young people who should support them - and we will see such a picture in many developed countries by the year 2050 - machines can help fill this gap. In general, the problem of care is solved by the proposal of Buchheit - because care requires human resources, and attempts to make it more productive will make it less effective and less human.

Creative money should be used to pay for everything that does not go to basic needs. The latest model of sneakers from the star designer. New song. A glass of wine with friends. Night at the cinema. Beautiful dress, fashionable costume. Sport, music, art, poetry.

Do not think that “creative economy” is limited only by entertainment and art. At all levels of society, people overpay on top of the basic cost of products in order to feel and express beauty, status, belonging, identity. Creative money is what pays for the difference between the Mercedes C-Class and the Ford Taurus, for dinner at a French restaurant instead of a snack at a bistro, or for a snack at a bistro instead of McDonalds. It is because of this that those who can afford it pay five dollars for a cup of coffee with a foam drawing, and do not drink instant coffee. Therefore, we pay a lot of money or wait for years to see the box office musical, while cinema tickets in the nearest shopping center are available even now.

Creative money represents the same competition as machine money. They already represent a large part of the economy: the fashion industry, real estate, luxury things - it all depends on the competition between people who are already rich, and want to have more or just to demonstrate their wealth.

At the end of the 18th century, Samuel Johnson wrote in the short story “The History of Russellas, Prince of Abyssinian”:

That is, even if all needs are met in the world, it will still be “a world full of desires.” Keynes wrote about this competition in his work:

Yes, it is true that human needs may seem unsaturated. But they can be divided into two classes: absolute, experienced by us regardless of what happens to other people, and those that we feel only if their satisfaction raises us above the rest, makes us feel superior (they can be called relative). The needs of the second class, due to our desire to surpass others, may be unsaturated: the higher the overall level, the more intense they are. But this is not so for absolute needs: soon - apparently, much sooner than one could imagine, - we will be able to reach a point where these needs will be met, and we will devote the released energy to non-economic goals.

If income is sufficient to meet needs, some people decide to get off the wheel - to spend more time with family and friends, in creative pursuits, or to do what they like. But even in a world where cars will do most of the work needed, competition for extra creative money will drive the economy.

Keynes foresaw both possibilities. He wrote:

And it is very interesting. Creativity can be the subject of competition to achieve status, so that "one who has built the necessary things as long as the need existed should start building from vanity." But it can also be the key to the future economy of humanity, which will allow everyone to enjoy the fruits of free time, donated to us by machine productivity.

The good life consists in enjoying the creativity of others and in proposing one’s creativity, and not only in satisfying basic needs. And this, like care, is a natural addition to a successful human society, and not an economic goal.

Creativity and patronage of creativity can be a major component of the future economy.

In this sense, I really like the comment by Google’s chief economist, Hal Varian [Hal Varian], which he made at dinner: “If you want to understand the future, see what the rich are doing today.” It’s easy to treat this as an insensitive libertarian comment. Our companion at dinner, a former student of Hal, Carl Shapiro, who had just completed work as an economic adviser on the White House council, looked shocked. But if you think about it, it makes sense.

Dinner in restaurants was once the property of the rich. Now so many dine. In the largest cities, the privileged class feels the taste of the future, which may become the future of the masses. Restaurants compete in creativity and service, “personal drivers for everyone” carry people comfortably, from entertainment to entertainment, and unique boutiques offer unique products. The rich once went on a tour of Europe, and now football hooligans are doing it. Mobile phones, designer clothes, entertainment - all this has become more democratic. Mozart was patronized by the emperor, and now Kickstarter, GoFundMe and Patreon give this opportunity to millions.

New industries with unique offers appear everywhere. In the US, 4,200 craft breweries already occupied 10% of the market and ask for twice the price than for beer produced by industry. In the first quarter of 2016, 25 million customers purchased hand-made products from Etsy. These are still timid sprouts in an economy in which mass-produced products predominate, but they give us valuable lessons about the future.

What happens in the entertainment world can give even more interesting predictions. While in Hollywood and in the New York publishing house “blockbusters” prevail, an increasing number of people spend their time playing in social networks and consuming the content created by their friends and the same people. This shift in the consumption of media content has greatly enriched Facebook, Google and the current generation of media platforms, while becoming a real source of income for an increasing number of individuals who are creators of media content.

As the star of YouTube and impresario VidCon Hank Green [Hank Green] wrote recently:

“Money from YouTube”, about which Hank speaks, is only one of the many new forms of creative money available on online platforms. There are already Facebook Money, Etsy Money, Kickstarter Money, App Store money and others.

Some of these markets went further than others in creating opportunities for individuals and small companies to convert attention (source material for creative money) into cash. In the next few years, there will be an explosion of startups that will find new ways to convert more and more attention spent online to regular money.

As Jack Comte, a member of the musical duo Pomplamoose, and founder and director of crowdfunding Patreon, said, he started his project after “Natalie and I earned 17 million views of our videos, and it turned into $ 3,500 advertising revenue. Our fans appreciate us more. ”

As crowdfunding sites show, there are more and more new opportunities for ordinary people to compete for real money, and not only for attention, in a creative economy. These sites still represent a small part of the global economy, but they can teach us a lot about the possible directions for the future.

At the beginning of the Great Depression, John Maynard Keynes wrote an amazing economic prediction: in spite of the threatening storm enveloping the whole world, mankind was on the verge of solving the “economic task” of searching for livelihoods.

The world of his grandchildren - the one in which we live today - he imagined as follows: “for the first time from the day of creation man will face a real, universal problem: how to use his freedom from urgent economic needs, how to occupy leisure provided by the forces of science and a complex percentage to live your life correctly, reasonably and in harmony with yourself. "

')

Not everything happened the way Keynes imagined. Of course, after the severe Great Depression and World War II, the economy entered a time of unprecedented prosperity. But in recent decades, despite all the progress in business and technology, this prosperity has been distributed very unevenly. The average standard of living in the world has grown very much, but in developed economies the middle class is stagnating, and for the first time in several generations our children may live worse than we do. We met with what Keynes called “huge abnormal unemployment in the full needs of the world,” followed by political instability and incomprehensible prospects for business.

But Keynes was right. The world that he imagined, where the "economic problem" is solved, is still in front of us. The percentage of poverty has fallen to a record, and if we play the cards correctly, we can enter the world predicted by Keynes.

Technology and free trade have reduced world poverty, but have created economic difficulties for workers in developed countries.

As Max Roser, author of Our World in Figures [Our World in Data], notes: “Even in 1981, more than 50% of the world's population lived in poverty - now this percentage is 14%. This is still a very large number of people, but changes are happening very quickly. In our case, the data tells us that poverty disappears faster than ever in history. ”

Much of Keynes's essay entitled “The Economic Opportunities of Our Grandchildren” refers to what people will do when their productivity grows so much that machines will do all the work.

This question has reappeared today as part of the discussion of the Universal Basic Income (UNB). The famous chairman of the international trade union Service Employees International Union (SEIU) resigned from his job to write a book in defense of the database. Y Combinator Research plans to conduct an experiment in Auckland . On the issue of the database passed a referendum in Switzerland . They voted against, but the fact that she was so seriously considered speaks a lot about what a long way this idea went, first proposed by Thomas Payne in 1795, and then by Milton Friedman in 1962 (and Paul Ryan in 2014).

I would like to discuss a few key paragraphs of Keynes's essay, and point out their veracity, confirmed by today's headlines. Imagine me in a dialogue with Keynes. Then I will add some thoughts from a recent conversation with Paul Buchheit from Y Combinator on the same topic. These will be only unformed thoughts, not polished conclusions.

So begins the essay of Keynes:

Today we are experiencing an acute attack of economic pessimism. A common place was the talk that the era of amazing economic progress inherent in the nineteenth century was over, that the rapid rise in living standards would soon slow down, and that in the next decade we would most likely face not a rise in wealth, but a fall. In my opinion, the basis of all these conversations is a deep misconception about what is happening to us now. We are not suffering from the “rheumatism” of the old era, but from growing pains caused by too rapid changes, from the difficulties of transition to a new economic period.

And of course, we will now hear a chorus of pessimists and doubters. Automation will destroy clerk jobs just as she replaced workers in factories. Our economy is based on growth, but the era of growth is over. We live in an era of "age-old stagnation." And so on.

Keynes prophetically gave the name of the essence of our fear:

We are overwhelmed by a disease that some readers may not have heard about, but which will be much discussed in the coming years - technological unemployment. It arises because the speed with which we discover labor-saving technologies surpasses our ability to find new uses for the released labor. But this is only a temporary painful phase of adaptation.

I will support Keynes in his optimism. If we do everything right, this will remain the "temporary painful phase of adaptation." There can be huge imbalances, but as a result, everything will calm down. Keynes wrote:

World Depression, the paradoxical presence of unemployment in a world where there are so many needs, the catastrophic mistakes that we made - all this prevented us from seeing what is really happening, what the background to long-term trends is.

“The paradoxical existence of unemployment in a world where there are so many needs” - I love this phrase! As Nick Hanauer told me, “Technology is the solution to the problems of humanity. Until we run out of problems, our work will not end either. ”

We still haven't done so much: it is necessary to make changes in the energy infrastructure in response to climate change, to take care of the health of the nation due to the emergence of new infections, to solve the problem of population aging when a growing number of older people will contain fewer and fewer workers, to restructure the infrastructure cities, give the world clean water, food, clothes and entertain 9 billion people.

Note that Nick said "we will not run out of work," and not "we will not run out of jobs." Part of the problem is that the workplace is an artificial structure in which work is managed and shared by corporations and other organizations that individuals must turn to in order to do work. Financial markets should reward corporations for understanding the work that needs to be done. But as Rana Foroohar noted in her book “Manufacturers and Consumers: The Rise of Finance and the Fall of American Industry” [Makers and Takers: The Rise of Finance], today the difference between what rewards are given by markets and by what the economy really needs.

In corporations, motivation and restrictions are different from individuals, so a situation is possible in which a corporation cannot offer jobs for the area of work that needs to be done. In times of instability, employers do not rush to hire people until they see guarantees of demand. And because of the demand from financial markets, companies often see a benefit in cutting jobs, because managing the value of stocks gives business owners more dividends than hiring people to do work. As a result, the “market” is settling everything (in theory), and corporations are again being able to offer jobs to employees. But too many losses occur in the process.

One of the difficulties of the “Economy of the Future” is to create new mechanisms for connecting people and organizations with the work that needs to be done - a more efficient job market. But it can be said that this factor is a key factor in the development of such companies as Uber and Lyft, DoorDash and Instacart, Upwork, Handy, TaskRabbit and Thumbtack. And you should not be embarrassed that so far these platforms do not provide a steady income and social protection. We must develop them so that they really serve the people working with them, and not wind off time back to the guaranteed employment of the 1950s.

There is also a leadership challenge: choosing the right job to do. It is necessary that companies are engaged in projects whose tasks do not solve the market, but which, on the contrary, require reworking the market. Think about what Ilon Musk did to give impetus to new industries through Tesla, SpaceX and SolarCity, or what Google did to “access all information in the world,” or what the Gates Foundation does to eradicate malaria. Markets are not perfect. Governments can participate in this process, as can be seen from the development of the Internet, GPS and the Human Genome Project. The role of the government is not limited to projects requiring coordination that is not available to private companies. The government must deal with market failures. These can be failures in the market of resources, the malicious intent of entrepreneurs or problems in financial markets, such as the one that still stifles the current economy.

The rest of the essay becomes even more interesting. Repeat some words and combine them with the conclusion:

World Depression, the paradoxical presence of unemployment in a world where there are so many needs, the catastrophic mistakes that we made - all this prevented us from seeing what is really happening, what the background to long-term trends is. [...] For the first time from the day of creation, a person will face a real, universal problem: how to use his freedom from pressing economic needs, how to occupy leisure provided by the forces of science and a complex percentage in order to live his life correctly, reasonably and in harmony with himself.

In a recent conversation, Paul Buchkheit, the creator of Gmail and a partner in Y Combinator, dropped something provocative: “It may be necessary to have two types of money: machine and human. Machine money will be needed to buy what cars produce. And these things will always be cheaper. Human money will be needed to buy something that only people can do. ”

And he continued: “The most important thing is that people can offer, but cars are not,“ authenticity ”. You can buy a cheap table from Amazon, made by a robot, or a hand-carved table is much more expensive (for authenticity, it will have to be done by a local workshop, and not by an unnamed worker from a factory across the ocean). In the long term, the cost of the first, expressed in machine money, will tend to zero, and the second will always cost about the same in human money (which will be an expression of hours spent on work). ”

Paul argues that it will be correct to call unconditional income "citizen dividends." The concept dates back to ancient Athens and to the works of Thomas Paine. According to Payne, the dividend is based on the share of mineral resources - and this approach has already been applied in Norway, Alaska and in the famous experiment of the 1970s in the city of Manitoba.

Paine’s pamphlet Land Justice advocated sharing the value of uncultivated land with each US citizen.

And if Payne argued that every citizen has a basic right to uncultivated land, Buchkheit invites humanity to enjoy the fruits of technological progress. With the help of taxes, we should take advantage of the high machine productivity, and distribute this amount to people in the form of a scholarship, which should be enough for them for daily needs. This bonus must be distributed so that everyone has enough “machine money” to meet basic needs. And machine productivity should all the time reduce the cost of these goods, increasing the value of civilian dividends. Such a prosperous world made Keynes imagine for his grandchildren.

How can we pay DB? It requires more money than it is spent on all social programs. In a conversation with me, the head of Y Combinator, Sam Altman, explained that people arguing about how we can pay for the database today are missing the point. “I’m sure that if we need him, we can afford it,” he said at a recent meeting on the database in Bloomberg Beta with Ende Stern and Natalie Foster from the Aspen Institute. He explained that the main factor that people miss is the huge amount of possible incomes from productivity, which grows thanks to technology. These revenues can be used to reduce the cost of goods produced by machines. The fact that today costs $ 35,000 may cost $ 3,500 in the future, when the machines replace so many people that a database will be needed. Therefore, Paul agitates for the introduction of "machine money". Instead of inflation peculiar to ordinary currencies, their value will only increase due to the fact that the value of goods will fall, and thus, the purchasing power of money will increase.

Why do we need "human money"?

I like the division of money into two types, but I wonder if there will be enough of such a division. His concept of "human money" includes two different classes of goods and services: those that require a human approach — education, training, care — and those that include creativity.

Perhaps “human money” needs to be divided into “money for care” and “money for creativity”.

Care is a vital necessity, as food and shelter, and in a fair society it should not be denied to anyone. In an ideal world, care is the natural development of the family and society, because we care for those we love, but there is also a care industry consisting of professionals - teachers, doctors, nurses, elderly care professionals, babysitters, hairdressers, and massage therapists. In a society with an inverted demographic pyramid, where there are much more old people than young people who should support them - and we will see such a picture in many developed countries by the year 2050 - machines can help fill this gap. In general, the problem of care is solved by the proposal of Buchheit - because care requires human resources, and attempts to make it more productive will make it less effective and less human.

Creative money should be used to pay for everything that does not go to basic needs. The latest model of sneakers from the star designer. New song. A glass of wine with friends. Night at the cinema. Beautiful dress, fashionable costume. Sport, music, art, poetry.

Do not think that “creative economy” is limited only by entertainment and art. At all levels of society, people overpay on top of the basic cost of products in order to feel and express beauty, status, belonging, identity. Creative money is what pays for the difference between the Mercedes C-Class and the Ford Taurus, for dinner at a French restaurant instead of a snack at a bistro, or for a snack at a bistro instead of McDonalds. It is because of this that those who can afford it pay five dollars for a cup of coffee with a foam drawing, and do not drink instant coffee. Therefore, we pay a lot of money or wait for years to see the box office musical, while cinema tickets in the nearest shopping center are available even now.

Creative money represents the same competition as machine money. They already represent a large part of the economy: the fashion industry, real estate, luxury things - it all depends on the competition between people who are already rich, and want to have more or just to demonstrate their wealth.

At the end of the 18th century, Samuel Johnson wrote in the short story “The History of Russellas, Prince of Abyssinian”:

The construction of the pyramids does not justify the effort and cost spent on working on them. The narrowness of the rooms proves that it was impossible to retreat from them, and the jewels could be placed with the same security at lower costs. Apparently, they were erected only in accordance with the hunger of imagination that parasitizes life, and must be constantly satisfied with some activities. And those who already have all this should increase their desires. He who built the necessary things as long as the need existed, should start building out of vanity, and expand his plans to the limits of human capabilities, so that he would not have to come up with a new desire soon.

That is, even if all needs are met in the world, it will still be “a world full of desires.” Keynes wrote about this competition in his work:

Yes, it is true that human needs may seem unsaturated. But they can be divided into two classes: absolute, experienced by us regardless of what happens to other people, and those that we feel only if their satisfaction raises us above the rest, makes us feel superior (they can be called relative). The needs of the second class, due to our desire to surpass others, may be unsaturated: the higher the overall level, the more intense they are. But this is not so for absolute needs: soon - apparently, much sooner than one could imagine, - we will be able to reach a point where these needs will be met, and we will devote the released energy to non-economic goals.

If income is sufficient to meet needs, some people decide to get off the wheel - to spend more time with family and friends, in creative pursuits, or to do what they like. But even in a world where cars will do most of the work needed, competition for extra creative money will drive the economy.

Keynes foresaw both possibilities. He wrote:

Other energetic and goal-oriented businessmen may even take us into the arms of economic abundance. But only those who survive will not sell for their means of subsistence and save, bringing to perfection the art of life as such, will be able to take advantage of abundance when it comes.

And it is very interesting. Creativity can be the subject of competition to achieve status, so that "one who has built the necessary things as long as the need existed should start building from vanity." But it can also be the key to the future economy of humanity, which will allow everyone to enjoy the fruits of free time, donated to us by machine productivity.

The good life consists in enjoying the creativity of others and in proposing one’s creativity, and not only in satisfying basic needs. And this, like care, is a natural addition to a successful human society, and not an economic goal.

Creativity and patronage of creativity can be a major component of the future economy.

In this sense, I really like the comment by Google’s chief economist, Hal Varian [Hal Varian], which he made at dinner: “If you want to understand the future, see what the rich are doing today.” It’s easy to treat this as an insensitive libertarian comment. Our companion at dinner, a former student of Hal, Carl Shapiro, who had just completed work as an economic adviser on the White House council, looked shocked. But if you think about it, it makes sense.

Dinner in restaurants was once the property of the rich. Now so many dine. In the largest cities, the privileged class feels the taste of the future, which may become the future of the masses. Restaurants compete in creativity and service, “personal drivers for everyone” carry people comfortably, from entertainment to entertainment, and unique boutiques offer unique products. The rich once went on a tour of Europe, and now football hooligans are doing it. Mobile phones, designer clothes, entertainment - all this has become more democratic. Mozart was patronized by the emperor, and now Kickstarter, GoFundMe and Patreon give this opportunity to millions.

New industries with unique offers appear everywhere. In the US, 4,200 craft breweries already occupied 10% of the market and ask for twice the price than for beer produced by industry. In the first quarter of 2016, 25 million customers purchased hand-made products from Etsy. These are still timid sprouts in an economy in which mass-produced products predominate, but they give us valuable lessons about the future.

What happens in the entertainment world can give even more interesting predictions. While in Hollywood and in the New York publishing house “blockbusters” prevail, an increasing number of people spend their time playing in social networks and consuming the content created by their friends and the same people. This shift in the consumption of media content has greatly enriched Facebook, Google and the current generation of media platforms, while becoming a real source of income for an increasing number of individuals who are creators of media content.

As the star of YouTube and impresario VidCon Hank Green [Hank Green] wrote recently:

I started paying my bills with money earned on YouTube when I got a million views a month. My content was low-budget, and “views” are not the best measure of measurement (their exact meaning varies greatly depending on the platform), but guess how many channels on YouTube get more than a million views per month? A couple hundred? Thousand?

What about 37,000?

For comparison, 12,000 people work on Facebook. If there were such a company as “Internet Creator”, it would hire people faster than any company from Silicon Valley.

“Money from YouTube”, about which Hank speaks, is only one of the many new forms of creative money available on online platforms. There are already Facebook Money, Etsy Money, Kickstarter Money, App Store money and others.

Some of these markets went further than others in creating opportunities for individuals and small companies to convert attention (source material for creative money) into cash. In the next few years, there will be an explosion of startups that will find new ways to convert more and more attention spent online to regular money.

As Jack Comte, a member of the musical duo Pomplamoose, and founder and director of crowdfunding Patreon, said, he started his project after “Natalie and I earned 17 million views of our videos, and it turned into $ 3,500 advertising revenue. Our fans appreciate us more. ”

As crowdfunding sites show, there are more and more new opportunities for ordinary people to compete for real money, and not only for attention, in a creative economy. These sites still represent a small part of the global economy, but they can teach us a lot about the possible directions for the future.

Source: https://habr.com/ru/post/369517/

All Articles