Banks in Denmark began to pay interest to mortgage borrowers

The interest rate on the loan is negative

Recently in Denmark, mortgage borrowers received their first payments from banks - a reward for ... using a loan.

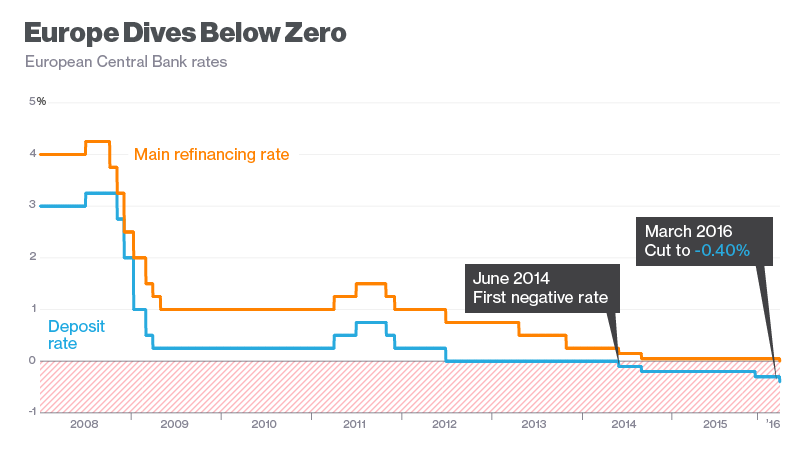

Recently in Denmark, mortgage borrowers received their first payments from banks - a reward for ... using a loan.It sounds strange, but the credit premium is a direct result of the fact that the central banks of some countries set negative interest rates a few years ago. Banks and borrowers are still trying to get used to the fact that the interest rate on the loan can be -0.0562%, for example, as in the Danish Hans-Peter Christensen, writes Wall Street Journal ( translation of "Vedomosti").

In the last quarter, the Dane received 249 kroons ($ 38) from the bank. “My parents said that I had to put this receipt in a box in order to prove to future generations that this was actually happening,” says Christensen.

With the help of negative interest rates, central banks are trying to stimulate the economy by making credit resources more accessible. The European Central Bank, the Bank of Japan, Switzerland, Sweden and Denmark have already taken such measures. For the last three negative rates - not just stimulating the economy, but a means to adjust the rate of national currencies against the euro.

')

Denmark was the first country to take such measures, so mortgage borrowers felt the effect here before others. Now the key interest rate is there -0.65%. Soon Norway plans to take similar measures, the economy of which has suffered from falling oil prices.

Economists view the actions of central banks as an experiment with unpredictable consequences . Negative rates have a negative side, because they apply not only to loans, but also to deposits. So, putting $ 1000 in a deposit, in a year you will receive your money with accrued interest, that is, $ 990, and at best, the same $ 1000.

Because of zero interest rates on deposits, citizens are beginning to actively invest in real estate, so the bubble in the mortgage market is inflated. For example, in Stockholm, real estate prices rose by 17% in 2015, in Copenhagen - by 14.5% in the 4th quarter. 2015 “Our population takes a lot, a lot. It needs to be changed sooner or later, ”says Stefan Ingves, chairman of the Swedish Central Bank.

Some citizens in such conditions will prefer to keep money in cash. Including for this reason, European economists are increasingly offering measures for the full transition to non-cash payments, that is, the refusal of cash, which in such circumstances, in fact, harm the economy.

Source: https://habr.com/ru/post/368743/

All Articles