Escape from New York: Bitcoin startups are leaving the city

On August 8, 2015, the government of New York announced the entry into force of a decree on beatlitsenzii, the essence of which is that the sale of cryptocurrency on the territory of New York threatens to prosecute someone who is not the happy owner of a special permit from the superintendent (head of financial services).

Rebit and Genesis Mining are the last names in an impressive list of Bitcoin companies that disagree with the harsh requirements of the new decree. The reasons for the global runaway from the financial capital, in one way or another, boil down to the reluctance to get involved in the time-consuming and expensive process of obtaining a bitlicense and meet the strict requirements of regulators.

The founder of the new trend - to leave New York instead of bearing the heavy burden of bitlicense - was the electronic exchange ShapeShift , whose director has already launched a website to express protests against the actions of regulators ( PleaseProtectConsumers.org ), followed by BitFinex , Kraken and LocalBitcoins , along with several other startups. All of them clearly expressed their disagreement with the new legislative initiative of the state.

')

Representatives of the company Genesis Mining, in particular, explicitly spoke about this:

Bitlicensing is a long list of rules and conditions aimed at increasing the time and money costs associated with the implementation of a cryptocurrency business in New York, which are already scarce resources for startups.

In particular, section 200.10 looks like an insurmountable obstacle for developing companies:

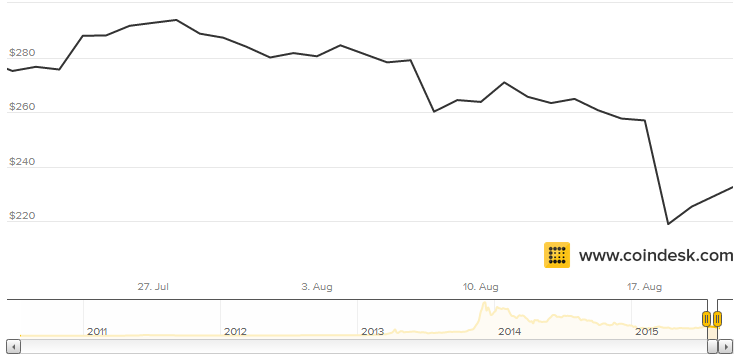

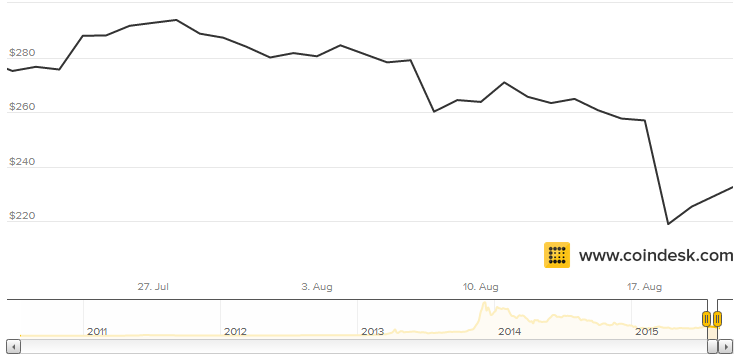

Many adherents of bitcoins fall upon criticism of Ben Lowski, the author of the bit-licensing bill, who also owns his own company that advises bitcoin startups on how best to comply with the norms of the new law. However, it is obvious that the idea of Lowski found a considerable response among other regulators, who jointly declared war on the critical currency start-ups. This provocation immediately affected, among other things, cryptocurrency rates: the law on bitlicense is one of the reasons why the cost of bitcoins continued to decline over the past week.

The beat-license law is contrary to the very innovative spirit of start-ups. Many representatives of the community agree that this set of requirements is impracticable: innovation and the possibility of exponential growth of the value created become, in principle, impossible. Of course, someone will be able to survive in conditions of strict accountability and compliance with the rules, however, these conditions completely destroy the advantages and chances of realizing the large transforming potential of bitcoins. After all, the only advantage that a startup has is its mobility and flexibility among sluggish corporate giants.

However, cryptocurrency startups are not inclined to give up easily under the onslaught of the authorities, moreover, the very concept of a cryptocurrency economy implies freedom from geographical boundaries. New York is considered the financial capital of the United States and the rest of the world, but it is not the only city in the world. Bitcoin has already demonstrated to us how a small crypto community can build a powerful network whose speed is higher than the aggregate figures of 500 supercomputers. On the other hand, over time, a beat-license can spread across the entire territory of the United States, and in many other countries something similar may appear.

Perhaps the best way to change this scenario is to bring Bitcoins into the mainstream as soon as possible, so that a developed innovation environment itself becomes the source of a new “ peering right ”.

Rebit and Genesis Mining are the last names in an impressive list of Bitcoin companies that disagree with the harsh requirements of the new decree. The reasons for the global runaway from the financial capital, in one way or another, boil down to the reluctance to get involved in the time-consuming and expensive process of obtaining a bitlicense and meet the strict requirements of regulators.

The founder of the new trend - to leave New York instead of bearing the heavy burden of bitlicense - was the electronic exchange ShapeShift , whose director has already launched a website to express protests against the actions of regulators ( PleaseProtectConsumers.org ), followed by BitFinex , Kraken and LocalBitcoins , along with several other startups. All of them clearly expressed their disagreement with the new legislative initiative of the state.

')

Representatives of the company Genesis Mining, in particular, explicitly spoke about this:

We express the position of the entire cryptocurrency community: we believe that this particular government initiative is a serious and insurmountable obstacle to the development of the free market. We believe that this is its main meaning. Despite the fact that the government may mistakenly consider our flight as a victory, winning the battle and winning the war is not the same thing. ”

Bitlicensing is a long list of rules and conditions aimed at increasing the time and money costs associated with the implementation of a cryptocurrency business in New York, which are already scarce resources for startups.

In particular, section 200.10 looks like an insurmountable obstacle for developing companies:

Section 200.10 Making Major Changes in a Business.

(a) Each licensee must obtain the prior written approval of the superintendent (supervisory inspector) for the introduction of any plan or new product, service or activity, or when making significant changes to an existing product, service or activity, if it is a business related with the city of New York or its inhabitants.

Many adherents of bitcoins fall upon criticism of Ben Lowski, the author of the bit-licensing bill, who also owns his own company that advises bitcoin startups on how best to comply with the norms of the new law. However, it is obvious that the idea of Lowski found a considerable response among other regulators, who jointly declared war on the critical currency start-ups. This provocation immediately affected, among other things, cryptocurrency rates: the law on bitlicense is one of the reasons why the cost of bitcoins continued to decline over the past week.

The beat-license law is contrary to the very innovative spirit of start-ups. Many representatives of the community agree that this set of requirements is impracticable: innovation and the possibility of exponential growth of the value created become, in principle, impossible. Of course, someone will be able to survive in conditions of strict accountability and compliance with the rules, however, these conditions completely destroy the advantages and chances of realizing the large transforming potential of bitcoins. After all, the only advantage that a startup has is its mobility and flexibility among sluggish corporate giants.

However, cryptocurrency startups are not inclined to give up easily under the onslaught of the authorities, moreover, the very concept of a cryptocurrency economy implies freedom from geographical boundaries. New York is considered the financial capital of the United States and the rest of the world, but it is not the only city in the world. Bitcoin has already demonstrated to us how a small crypto community can build a powerful network whose speed is higher than the aggregate figures of 500 supercomputers. On the other hand, over time, a beat-license can spread across the entire territory of the United States, and in many other countries something similar may appear.

Perhaps the best way to change this scenario is to bring Bitcoins into the mainstream as soon as possible, so that a developed innovation environment itself becomes the source of a new “ peering right ”.

Source: https://habr.com/ru/post/368025/

All Articles