Educational program about ETF: how to buy a piece of a cluster of shares for 50k rubles and how to compare its profitability with a bank deposit

An ETF is, roughly simplifying, cloud-based stock consumption.

Each ETF paper represents a stock of a fund, and the fund itself is actually a “repository” with stocks of a strictly defined list. For example, there may immediately include shares of Apple, MS, Google, IBM, Intel, AMD, HP, Symantec, EMC, SAP and other companies united by some common feature. If companies with this feature are collectively stable and growing, the “cluster” wins.

')

For example, in principle, it is clear that the IT sector will grow in the coming years (and can only be prevented by a global catastrophe). It would be logical to take on a small set of shares of each company and sit to wait for profits. Everyone - because it is not clear which of these comrades will survive and how they will feel. However, in the classic market for this you would need several million dollars.

Naturally, sooner or later a simple and “humanitarian” tool should have appeared for those who are not a broker and do not want to understand the intricacies of investing. Universal automation allowed us to build such an infrastructure and create a tool.

So, one ETF paper represents something “hospital average” among the shares of a fixed list of companies. If Apple wins Google in the smartphone market, or vice versa, you don’t care, because you are only interested in the fact that 20% more devices were sold during the year.

If the market as a whole grows - ETF grows faster than ordinary bank deposits, if the market drops as a whole - ETF also falls.

Naturally, profitability may be lower or higher than that of single equity stakes (even if you “know exactly” who should be taken urgently), but the risks of ETF are always lower due to diversification.

The following comparisons can be made:

- A bank deposit of a physical person up to the sum insured by the state is the safest, but also the lowest-income option. Roughly speaking, the rate of ruble deposits exceeded the actual inflation, except that in 2009 it was the only known case when it was possible to increase money in the bank.

- Buying shares of your chosen company (or group) is the most profitable option in the future if you know what you are doing and you are lucky. Plus, you need the tools of an investor or your own broker, which, you see, is not the best option if you do not play in this market professionally. What happens to ordinary people on the stock market, perfectly demonstrates the feature film "The Wolf of Wall Street."

- The state was well aware of these two features of the market, and therefore, the possibility of “clustering” of shares in mutual investment funds - mutual funds has been working for a long time. They are most similar to the described “cloud” structure, but at the same time, roughly speaking, are manually controlled by the administrator from the console and depend on it very much. About what it is bad for and what risks it creates, is lower. Roughly speaking, you relied on the manager here, which did not always end positively.

We needed a tool for a very simple and transparent management of such "clusters" of shares. In the first place - secure and reliable, so that risks remain only from the markets, and not from intermediate processes. In the second, it is understandable to ordinary people and does not require special knowledge for investment. It turned out ETF.

Physically, an ETF is a repository of securities, which includes the shares listed in a fixed list (it is called an "index") of companies. You invested 1000 rubles - a year later the market grew by 21%, ETF increased by 21% (adjusted for commission) - you have a share of approximately 1,210 rubles.

Solutions required the following problems:

How to protect yourself from the inclusion in the fund of "bad" shares?

- The usual mutual fund scenario looked like this: in case of urgent need (for example, in the interests of a related banking group), the management company simply took and cheated a bit with shares . A little bit. For example, she bought shares in a mutual fund from a friendly company, or, conversely, sold the necessary shares too quickly. There are many descriptions of such scams, but the general point is that the mutual fund mechanism implies that if you need to enter something into the fund, the manager first buys these shares and then reports back to the fact. There were cases of large mutual funds when, in fact, such a report was sold back with a warning in the chest to the manager - but even in this case, the fund as a whole incurs losses. Accordingly, in order to defend against such situations, ETF issuers are allowed to purchase only the shares of companies listed and only as part of a balanced strategy (that is, you cannot repurchase any particular one). Each application is signed by at least an additional controlling body (where the robot is sitting, checking for new shares in the list), so everything happens quickly and ironically. That is, if suddenly the manager of one of the ETF distributors (like us) decides to buy something wrong - in any case, the depository that provides the ETF, these shares will not even get.

- We need protection from leaving the “last link” market , and all previous ones too. About MMM and other noteworthy companies in Russia know firsthand, so the most frequent question when we buy an ETF is to us what will happen if you close your doors tomorrow. It will be sad, but all assets will still be safely stored in the BoNY Mellon. That is, it doesn’t matter who or how the ETF sold you - these papers are provided directly. Now, if both Ireland and London are destroyed at the same time, then — yes, probably, restoration of access to the ETF will take a couple of weeks. True, in this scenario, probably, it will be all the same.

In general, the whole service from the beginning to the end, and we built, and in world practice this way - people are not needed. They are the type of janitors, attendants. Everything else is done solely by the rules and controlled automatically.

So, what happened in this “patch” of investment tools:

- Formed as a mutual index fund (unlimited number of participants and validity).

- Instead of a management company, there is a provider, that is, a company that, in fact, provides technical service, but does not manage investments. Where the investments go is determined by the fund index.

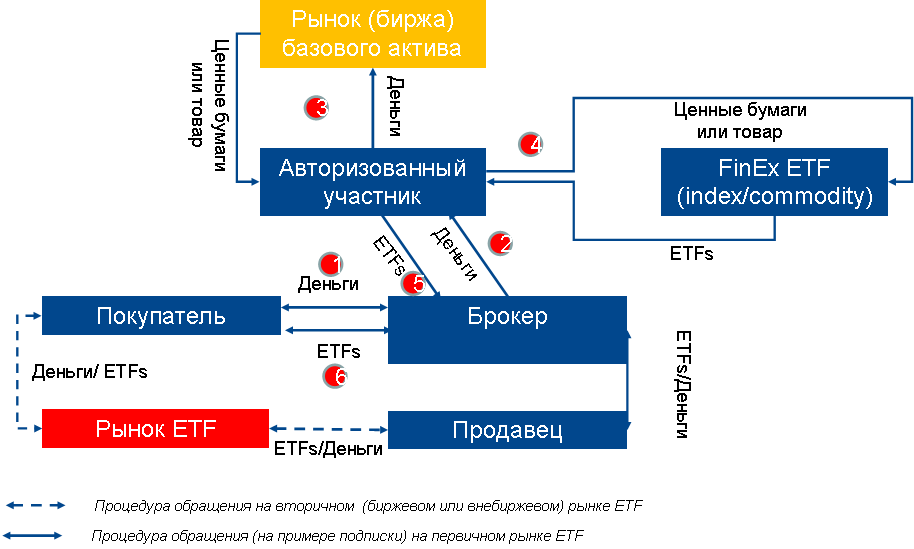

- It is traded as a stock - for example, you can buy various ETFs directly on the Moscow Stock Exchange through one of the programs (QUIK, Transaq, Alfa-direct, etc.) or simply by calling a broker. On the OTC market, ETFs can be purchased from authorized persons (authorized participants). Directly ETF-provider (FinEx) does not sell and does not buy ETF shares in the secondary market.

- Accordingly, each transaction for the purchase of ETF from the provider corresponds to a transaction for adding shares to the fund by index.

- Each transaction in the secondary market directly corresponds to the purchase and sale of underlying assets.

The tool is used quite successfully in the USA and Europe, and, of course, it is much more popular than in Russia. The main problem is the fact that the organization of ETF trade in the Russian Federation requires the organization of a rather complex infrastructure on the basis of a link between IT and the legal sphere. That is what we did.

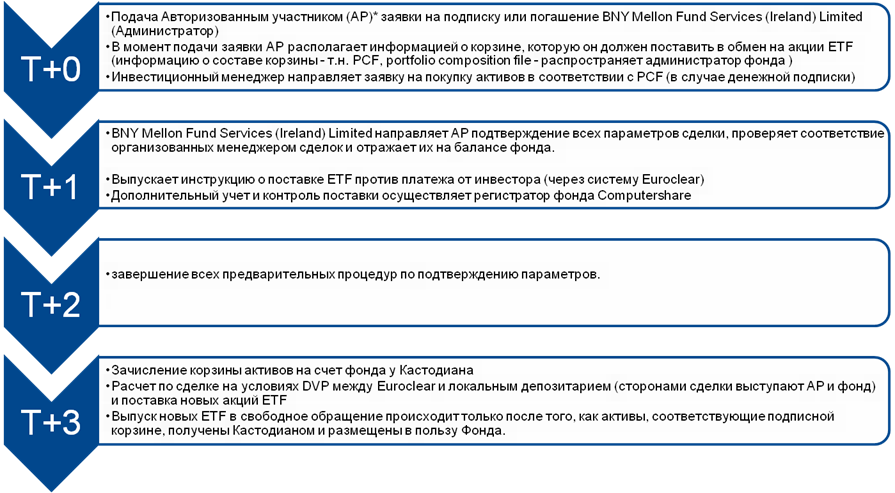

RF bidding procedure

In more detail about the IT side of the issue, you can read here on Habré — in short, we have built a huge infrastructure in 4 years so that it can even be possible for it to work without people where it is possible.

Total

As a result, the usual way to buy ETF in Russia is quite simple. At first, a person over 10 years of experience, with sincere surprise, finds out that keeping money in a bank is not a sensible idea, since there is inflation. Then he reads about how easy it is to “pin up” on the stock exchange due to operational peculiarities, and then either loses interest in the question with the words “need to understand”, or chooses one of the ready-made tools with reduced operational risks. There are no options, in fact, this is either an ETF or its analogs (in fact, ETFs wrapped in a mutual fund shell from two green banks).

Physically, you need to contact the broker and open an account. Previously, it was necessary to go, now it is enough to contact any company like Finam - they open it by credit card. Some brokers need to physically receive EDS, this is the most difficult question (some do not bother with physical delivery, but give the file). Usually solved in 3-4 days.

Then you either install a QUIK broker-client or TRANSAQ to work with securities, or work in the web interface, or simply trade in voice over the phone. You can only buy what is presented on the Moscow Exchange or on SPBEX. For example, with IT companies the focus will not work - to collect your own portfolio from a pile of different stocks will not work. Apple is represented (about 50 more names on SPBEX without the consent of the issuer are listed), but others are not.

Another problem of working not with the ETF, but with shares directly is the risk from the broker and the fund (they put the shares in the depositary or not), the tax issue (you have to declare it yourself), the risk issue - who worked with Cyprus, remembers that Many securities did not reach the depositories, but hung on the accounts of management companies and, as a result, did not reach investors. Another difficulty is that Western brokers very often refuse to work with Russia. Plus, again, taxes - from a Russian broker you have a benefit of 9 million rubles on the Russian income (this is important if the exchange rate fluctuates).

As a result, we were able to bring the sale of ETF to Russia - in fact, we localized from scratch a very necessary world tool for working with finances in the long term.

Phew ... If you have questions in general - ask, tell you more. Once again I remind: a technical post about the infrastructure and organization here in Habré .

Source: https://habr.com/ru/post/367095/

All Articles