7 questions to the broker or what the ruble suffers

Year after year, beginning around mid-August, residents of Russia have been following economic events with bated breath. No country in the world has focused so much on changing the rate of the national currency. For example, throughout the world, inflation and price rises cause panic among the population, while in our country, a change in the dollar exchange rate. The numbers on the scoreboard of banks worry everyone: from large companies with foreign exchange contracts to private individuals who do not even think of becoming tycoons of the foreign exchange market. Templates have already formed: oil is getting cheaper - the ruble is getting cheaper, and vice versa. Nevertheless, I constantly have questions related to the influence of factors on the exchange rate and the ability to quickly and safely make money on fluctuations. We have collected 7 of the most common and are ready to answer them.

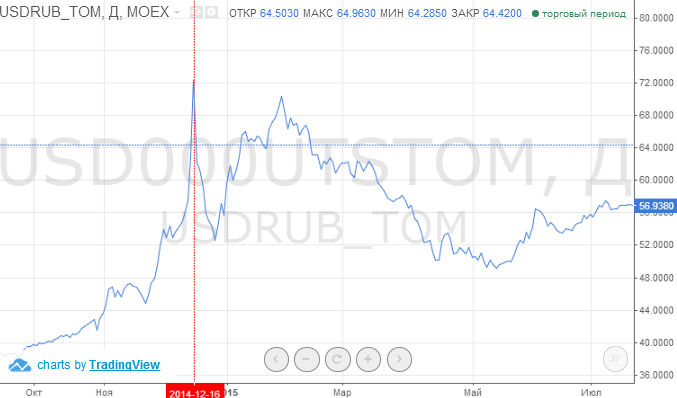

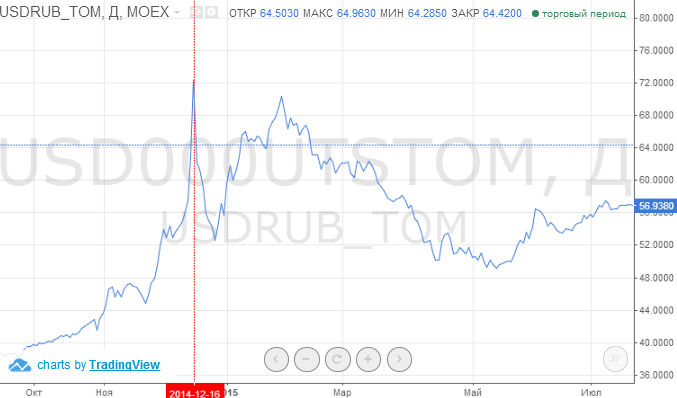

It is quite difficult to give an unambiguous answer to this question, because a large number of factors influence the course, and they are influenced in different directions. For example, from the point of view of the classical economy, the ruble should be strengthened along with oil and even more strengthened with an increase in the key rate of the Central Bank. So it is, but taking into account the nuances. For example, consider the situation at the end of last year. Pay attention to the schedule.

On December 16, 2014, the Central Bank of the Russian Federation, in order to regulate the market, raised the key rate from 10.5% to 17% amid falling oil prices. An inexperienced trader could have expected a fall in the value of the dollar, instead of which a sharp rise took place. But the effect of the regulatory measure was obtained later. The key rate is the interest rate at which the Central Bank of Russia lends to commercial banks for a short time, and at the same time that rate at which the Central Bank of the Russian Federation is ready to accept cash from banks. As a rule, its increase is aimed at preventing the growth of inflation or its reduction to acceptable levels.

Simply put, the Central Bank "expensive" credits commercial banks, it becomes unprofitable for them to distribute cheap loans. Due to high interest rates, lending slows down significantly, while deposits, on the contrary, become extremely attractive, resulting in a decrease in the amount of money in circulation and the purchasing power of the population decreases. All this significantly reduces the demand for various goods, and accordingly forces manufacturers to reduce prices, thereby reducing inflation.

The rate also has the most direct effect on the exchange rate: firstly, the ruble mass in the market decreases, and secondly, speculatively-minded banks stop playing their games - it becomes unprofitable for banks to take rubles from the Central Bank to buy currency, return the loan from the income.

Of course, do not forget about the main thing. The ruble is traditionally called the commodity currency, as the country's economy is highly dependent on exports. In the Russian Federation, oil is the key raw material, the price dynamics for which is decisive in the matter of exchange rate. The growth of world prices for raw materials, especially oil prices, leads to an increase in foreign exchange earnings of export companies from foreign trade operations. Exporting companies are actively selling foreign exchange earnings in the domestic foreign exchange market (supply is growing), there are prerequisites for the growth of the ruble exchange rate (due to an increase in demand for the Russian currency). As well as reducing the price of oil causes the opposite effect, if there are not yet any powerful effects.

')

In 2014, the Central Bank of the Russian Federation switched to a floating exchange rate policy, so that the correlation between oil and the ruble has increased significantly since then. Why did it happen? With a controlled ruble exchange rate, the Central Bank could have a significant impact on the exchange rate through foreign exchange interventions. However, such a policy could greatly deplete the country's foreign exchange reserves. A floating exchange rate causes an increase or decrease in the exchange rate depending on the market situation; in fact, the market rate responds symmetrically to the impact, that is, in fact, the ruble has become more sensitive to fluctuations of factors affecting the exchange rate (in particular, oil prices).

In addition to energy prices, the Russian currency, of course, also depends on traditional factors, that is, on the actions of our Central Bank, the balance of payments, government debt parameters, as well as on the overall situation in the economy. Definitely rely on any trend can not.

The rise in prices for oil and other commodities contributes to an increase in foreign exchange earnings that enter the market. This in turn increases sales of dollars and euros from exporting companies, which has a positive effect on the ruble exchange rate. If we observe a decline in prices for exported goods, then the reverse process begins. In this case, the ruble is under pressure, in the absence of a sufficient number of currency sellers. High inflation also affects the rate of the national currency. With rising prices, the Central Bank is struggling by increasing the key interest rate. As we have already said, if the rate rises, then this in theory increases the attractiveness of the ruble against other currencies, since in a country you can get a higher return on investment. The decline in the key rate, on the contrary, is mainly a negative for the ruble, although this stimulates overall economic growth. The combination of all these factors gives the investor an understanding of the general orientation of the ruble exchange rate.

No one has yet succeeded in accurately determining all local pivot points of a currency pair. However, it is possible to track and predict stable market trends with a qualitative analysis of key factors and many investors make money on it. But you have seen the example above - it is impossible to predict the influence of all factors. In addition, you need to be extremely attentive to external and internal political events that can dramatically turn the trend.

There are several different theories about determining a fair fundamental course. This is the use of purchasing power parity, and the principle of relative economic stability or even an exotic type of analysis of the Big Mac index. We already told about many methods in the first post of the blog on GeekTimes. In the Russian version, when forecasting the long-term prospects of the ruble, we can consider the overall potential balance of supply and demand for currency in the future, given the dynamics of government spending. That is, it is necessary to evaluate the expenditure side of the budget of the Russian Federation (which is available to any user) and correlate it with revenues, which are largely formed from the export of raw materials. In this case, the price of oil will be a kind of indicator.

Suppose that the barrel of Brent will fluctuate in the range of $ 45-55. Suppose the preservation of the policy of the floating rate and the stability of the gold and foreign exchange reserves of our country. Then the ruble exchange rate against the dollar, other things being equal, should annually fall in price by approximately the difference in the inflation rates of Russia and the USA. This is the simplest version of the analysis, in which you can add a lot of additional minor factors and get closer to a realistic version of the forecast.

In the current situation there are three main calendar factors.

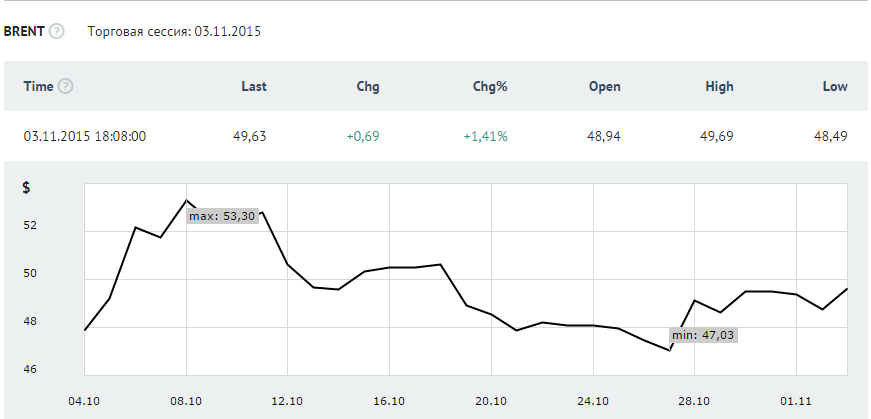

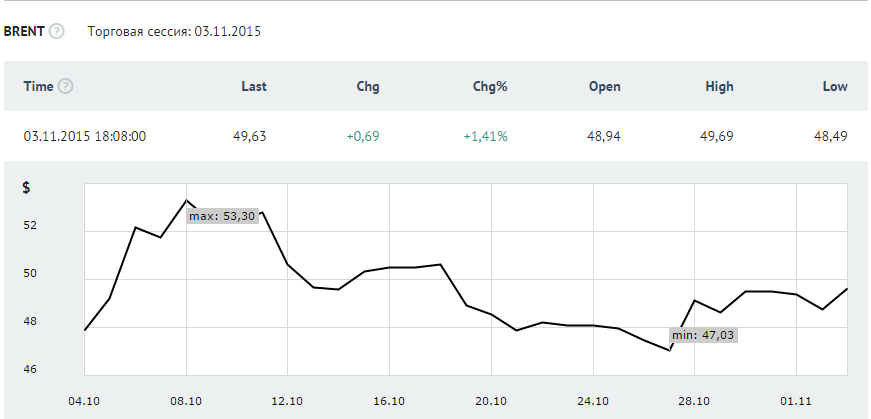

At the moment, the USD / RUB rate is largely tied to the dynamics of oil, the correlation is still quite high. Therefore, in the first place, when determining the course, one should focus on the trends of the black gold market. So now we are seeing that the quotes of the Brent benchmark only hang out within a wide side corridor ($ 46-54 per barrel), not showing any directional trend.

While this situation persists, the dollar will remain within the range of 61-66 rubles. One can argue about some stable positive trend of the ruble in the event that oil goes beyond $ 54 a barrel. According to the calculations of FG BCS analysts, by the end of the year oil prices are expected to rise and the ruble exchange rate will return to values below 60 rubles per dollar.

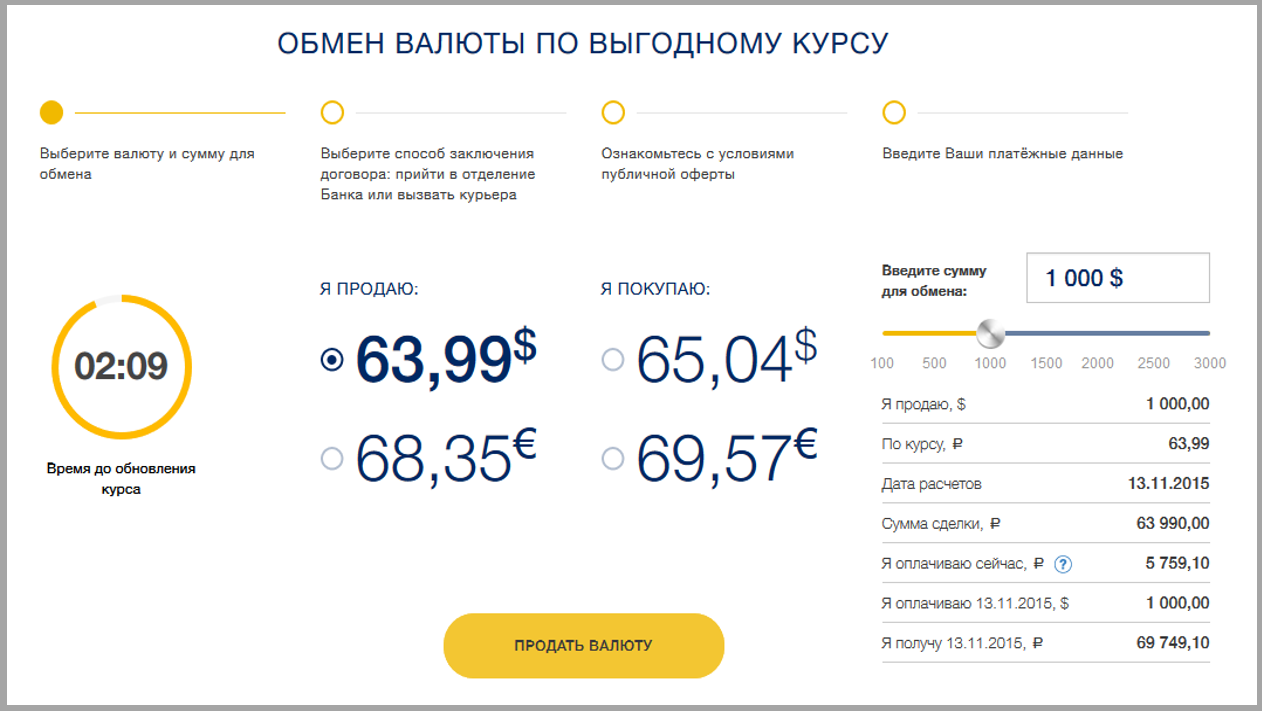

We in BCS often meet with similar questions. Sometimes they are associated not only with the desire to profitably exchange currency, but also to make money on a favorable exchange rate. BCS experts analyzed the problems and requests of customers and created a new extraordinary service that aims at profitability and maximum security for each transaction - a service for buying and selling currency online at the exchange rate with the ability to deliver converted funds to the address specified by the client.

Already today, residents of 46 cities of Russia, including Moscow, can use it.

The service is available at https://valuta.bcs-bank.com/ , it’s as simple as possible, its interface is intuitive. However, this is exactly what its creators wanted, because everything that is required for currency exchange is access to the Internet, a few minutes of free time, as well as a passport and a valid bank card of any bank from which funds for conversion will be debited.

Entering the BCS web portal from a computer or mobile device, you should indicate the currency of exchange, enter the amount for conversion in a special window, and also mark the item “I am selling” or “I am buying”. Every 2.5 minutes, the exchange rates on the website are automatically updated in accordance with the current dynamics of trading on the foreign exchange market of the Moscow Exchange. The minimum amount of conversion is $ 100, the maximum is $ 3000.

After you decide on the currency and amount and enter all the necessary data, you choose the method of receiving the converted funds. There are two of them - in cash at the nearest BCS office or by cashless transfer to the BCS Bank card with its delivery to the client’s address the next day. By choosing the second item, you get a free package of services, which includes: mobile and internet bank, a multi-currency VISA Classic card (rubles, dollars, euros), as well as the ability to make money transfers worldwide at competitive rates. Another difference of the new service is the security of transactions. All of them are recorded on the Moscow Exchange, and the data encryption system provides reliable protection of personal information.

So now you can not think about how to protect yourself from possible problems, but exchange currency at a favorable exchange rate as close as possible to the official rate of the Central Bank, and buy dollars and euros in the same way as you buy tickets for a concert, train or plane. Well, we in BCS will be calm for the safety of our customers.

What factors influence the ruble exchange rate?

It is quite difficult to give an unambiguous answer to this question, because a large number of factors influence the course, and they are influenced in different directions. For example, from the point of view of the classical economy, the ruble should be strengthened along with oil and even more strengthened with an increase in the key rate of the Central Bank. So it is, but taking into account the nuances. For example, consider the situation at the end of last year. Pay attention to the schedule.

On December 16, 2014, the Central Bank of the Russian Federation, in order to regulate the market, raised the key rate from 10.5% to 17% amid falling oil prices. An inexperienced trader could have expected a fall in the value of the dollar, instead of which a sharp rise took place. But the effect of the regulatory measure was obtained later. The key rate is the interest rate at which the Central Bank of Russia lends to commercial banks for a short time, and at the same time that rate at which the Central Bank of the Russian Federation is ready to accept cash from banks. As a rule, its increase is aimed at preventing the growth of inflation or its reduction to acceptable levels.

Simply put, the Central Bank "expensive" credits commercial banks, it becomes unprofitable for them to distribute cheap loans. Due to high interest rates, lending slows down significantly, while deposits, on the contrary, become extremely attractive, resulting in a decrease in the amount of money in circulation and the purchasing power of the population decreases. All this significantly reduces the demand for various goods, and accordingly forces manufacturers to reduce prices, thereby reducing inflation.

The rate also has the most direct effect on the exchange rate: firstly, the ruble mass in the market decreases, and secondly, speculatively-minded banks stop playing their games - it becomes unprofitable for banks to take rubles from the Central Bank to buy currency, return the loan from the income.

Of course, do not forget about the main thing. The ruble is traditionally called the commodity currency, as the country's economy is highly dependent on exports. In the Russian Federation, oil is the key raw material, the price dynamics for which is decisive in the matter of exchange rate. The growth of world prices for raw materials, especially oil prices, leads to an increase in foreign exchange earnings of export companies from foreign trade operations. Exporting companies are actively selling foreign exchange earnings in the domestic foreign exchange market (supply is growing), there are prerequisites for the growth of the ruble exchange rate (due to an increase in demand for the Russian currency). As well as reducing the price of oil causes the opposite effect, if there are not yet any powerful effects.

')

In 2014, the Central Bank of the Russian Federation switched to a floating exchange rate policy, so that the correlation between oil and the ruble has increased significantly since then. Why did it happen? With a controlled ruble exchange rate, the Central Bank could have a significant impact on the exchange rate through foreign exchange interventions. However, such a policy could greatly deplete the country's foreign exchange reserves. A floating exchange rate causes an increase or decrease in the exchange rate depending on the market situation; in fact, the market rate responds symmetrically to the impact, that is, in fact, the ruble has become more sensitive to fluctuations of factors affecting the exchange rate (in particular, oil prices).

In addition to energy prices, the Russian currency, of course, also depends on traditional factors, that is, on the actions of our Central Bank, the balance of payments, government debt parameters, as well as on the overall situation in the economy. Definitely rely on any trend can not.

Is it possible to identify factors of growth or fall of the ruble?

The rise in prices for oil and other commodities contributes to an increase in foreign exchange earnings that enter the market. This in turn increases sales of dollars and euros from exporting companies, which has a positive effect on the ruble exchange rate. If we observe a decline in prices for exported goods, then the reverse process begins. In this case, the ruble is under pressure, in the absence of a sufficient number of currency sellers. High inflation also affects the rate of the national currency. With rising prices, the Central Bank is struggling by increasing the key interest rate. As we have already said, if the rate rises, then this in theory increases the attractiveness of the ruble against other currencies, since in a country you can get a higher return on investment. The decline in the key rate, on the contrary, is mainly a negative for the ruble, although this stimulates overall economic growth. The combination of all these factors gives the investor an understanding of the general orientation of the ruble exchange rate.

Will I be able to independently determine where the course will unfold?

No one has yet succeeded in accurately determining all local pivot points of a currency pair. However, it is possible to track and predict stable market trends with a qualitative analysis of key factors and many investors make money on it. But you have seen the example above - it is impossible to predict the influence of all factors. In addition, you need to be extremely attentive to external and internal political events that can dramatically turn the trend.

Is a long-term forecast of course dynamics possible?

There are several different theories about determining a fair fundamental course. This is the use of purchasing power parity, and the principle of relative economic stability or even an exotic type of analysis of the Big Mac index. We already told about many methods in the first post of the blog on GeekTimes. In the Russian version, when forecasting the long-term prospects of the ruble, we can consider the overall potential balance of supply and demand for currency in the future, given the dynamics of government spending. That is, it is necessary to evaluate the expenditure side of the budget of the Russian Federation (which is available to any user) and correlate it with revenues, which are largely formed from the export of raw materials. In this case, the price of oil will be a kind of indicator.

Suppose that the barrel of Brent will fluctuate in the range of $ 45-55. Suppose the preservation of the policy of the floating rate and the stability of the gold and foreign exchange reserves of our country. Then the ruble exchange rate against the dollar, other things being equal, should annually fall in price by approximately the difference in the inflation rates of Russia and the USA. This is the simplest version of the analysis, in which you can add a lot of additional minor factors and get closer to a realistic version of the forecast.

Is there really seasonal demand for currency?

In the current situation there are three main calendar factors.

- The summer season is traditionally accompanied by an increase in the population’s demand for currency. However, the influence of this factor is not very significant. Purchase of currency by the population definitely cannot predetermine ruble trends.

- Periods of tax payments. After the 20th of each month, the so-called “tax period” begins - this is the time when large volumes of taxes must be paid by exporters. The volume of supply of currency in such periods increases slightly.

- External debt repayment factor. In the conditions of limited access of Russian companies to foreign currency funding abroad, months of maximum payments on foreign debts may be accompanied by an increased demand for foreign currency. This factor, as the debt burden of companies decreases, gradually loses its significance.

What to expect in this November-December?

At the moment, the USD / RUB rate is largely tied to the dynamics of oil, the correlation is still quite high. Therefore, in the first place, when determining the course, one should focus on the trends of the black gold market. So now we are seeing that the quotes of the Brent benchmark only hang out within a wide side corridor ($ 46-54 per barrel), not showing any directional trend.

While this situation persists, the dollar will remain within the range of 61-66 rubles. One can argue about some stable positive trend of the ruble in the event that oil goes beyond $ 54 a barrel. According to the calculations of FG BCS analysts, by the end of the year oil prices are expected to rise and the ruble exchange rate will return to values below 60 rubles per dollar.

I want to exchange currency profitably. What to do?

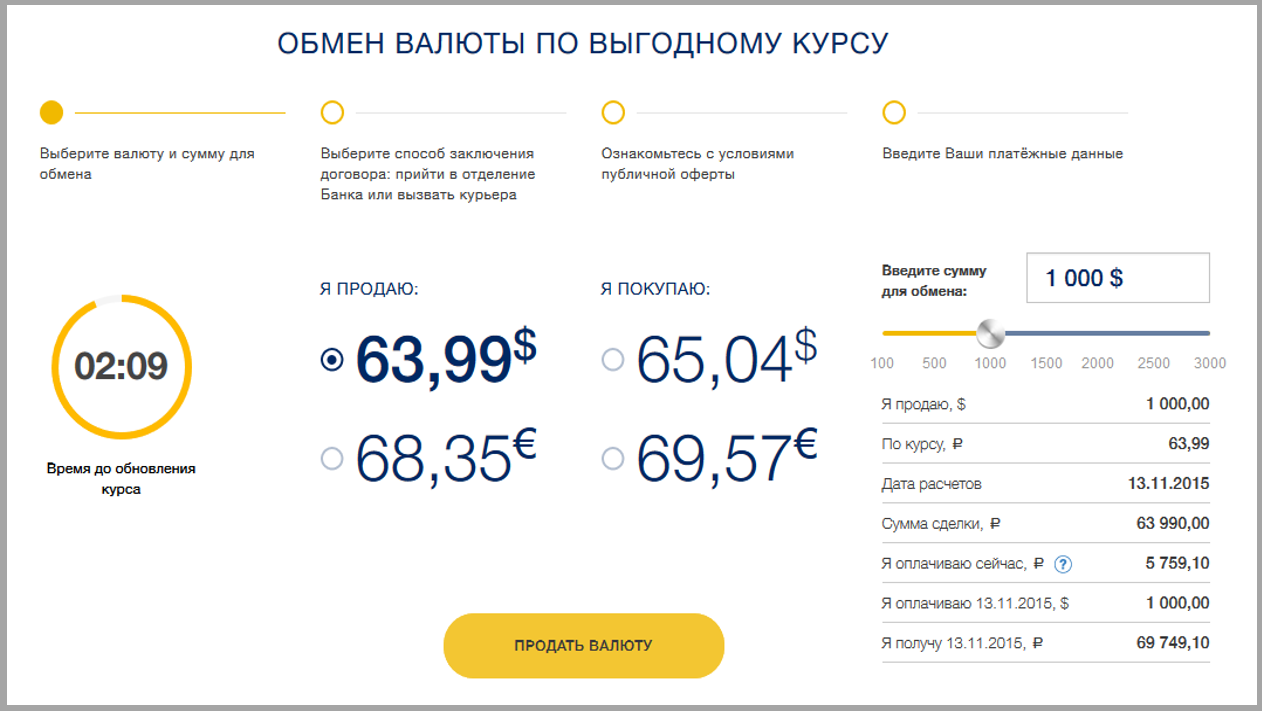

We in BCS often meet with similar questions. Sometimes they are associated not only with the desire to profitably exchange currency, but also to make money on a favorable exchange rate. BCS experts analyzed the problems and requests of customers and created a new extraordinary service that aims at profitability and maximum security for each transaction - a service for buying and selling currency online at the exchange rate with the ability to deliver converted funds to the address specified by the client.

Already today, residents of 46 cities of Russia, including Moscow, can use it.

The service is available at https://valuta.bcs-bank.com/ , it’s as simple as possible, its interface is intuitive. However, this is exactly what its creators wanted, because everything that is required for currency exchange is access to the Internet, a few minutes of free time, as well as a passport and a valid bank card of any bank from which funds for conversion will be debited.

Entering the BCS web portal from a computer or mobile device, you should indicate the currency of exchange, enter the amount for conversion in a special window, and also mark the item “I am selling” or “I am buying”. Every 2.5 minutes, the exchange rates on the website are automatically updated in accordance with the current dynamics of trading on the foreign exchange market of the Moscow Exchange. The minimum amount of conversion is $ 100, the maximum is $ 3000.

After you decide on the currency and amount and enter all the necessary data, you choose the method of receiving the converted funds. There are two of them - in cash at the nearest BCS office or by cashless transfer to the BCS Bank card with its delivery to the client’s address the next day. By choosing the second item, you get a free package of services, which includes: mobile and internet bank, a multi-currency VISA Classic card (rubles, dollars, euros), as well as the ability to make money transfers worldwide at competitive rates. Another difference of the new service is the security of transactions. All of them are recorded on the Moscow Exchange, and the data encryption system provides reliable protection of personal information.

So now you can not think about how to protect yourself from possible problems, but exchange currency at a favorable exchange rate as close as possible to the official rate of the Central Bank, and buy dollars and euros in the same way as you buy tickets for a concert, train or plane. Well, we in BCS will be calm for the safety of our customers.

Source: https://habr.com/ru/post/366971/

All Articles