Why is bitcoin growing again?

The last few days, those who follow the course of Bitcoin as closely as Hashflare , could witness the furious rate jumps on all world markets, during which the price of Bitcoin broke through several psychologically important marks. On Chinese Okcoin, Huobi, BtcChina, the cost of one coin several times exceeded 3300 yuan ($ 500), European exchanges react a little late, but even there the rate approached $ 500 per coin, with subsequent adjustments.

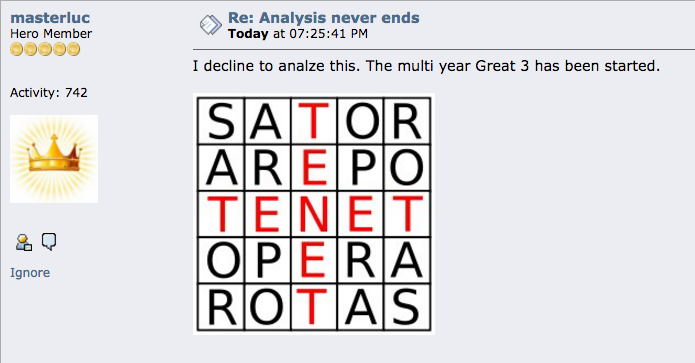

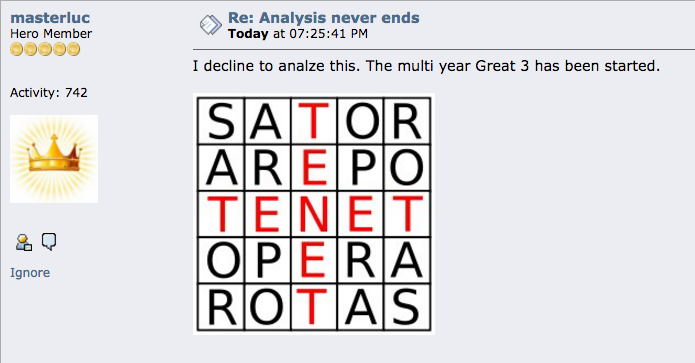

Well-known analyst bitcointalk.org lucif, he masterluc today announced the beginning of the “Great Third Wave”, and that in this regard, he stops publishing his technical analysis.

')

A couple of months ago, against the backdrop of the depreciation of the Chinese national currency, in order to reduce the inevitable capital outflow from the country, the Chinese authorities decided to tighten capital control methods. For adherents of Bitcoin, this was truly good news. Recall that at the beginning of the fall we published the opinion of Kim Dotcom, who, against the background of the Chinese crisis, recommended buying cryptocurrency. At that time, many perceived this advice as another manipulation of public opinion, however, now we can see with the example of our own Bitcoin wallet that the forecast was justified.

A new day, and new turns in the incessant rally. Today (November 5) the price has dropped below $ 400, but will almost certainly continue moving upward in the coming days. This, in addition to technical analysis of growth curves, is evidenced by another, more esoteric analytical tool, but no less accurate: an assessment of market sentiment.

Optimism rolls over. Until yesterday evening, it was possible to buy at any time and at any level, and the position would be in profit within a few hours, and even minutes. This type of buy-throw behavior generates optimism. At current sentiment, many assume a lightning takeoff to the level of 5,000 CNY on Chinese exchanges.

“The time of maximum pessimism is the best time to buy. A time of maximum optimism is the best time to sell, ”said John Templeton.

Bitcoin has always been extremely responsive to political and social upheavals. Earlier this summer, he reacted vigorously to the crisis in Greece, becoming an alternative financial niche for an entire nation in a difficult situation, and at the same time setting off into growth, and then fell, responding to the battle unfolding in the crypto community. Now, if several hundreds of millions of Chinese decide that the hour of bitcoin has come, and invest at least a small part of their deposits, worth 22 trillion dollars, you can rightly expect a second “native”, compared to which the first seems like a low start.

The fact that the reasons for the rapid rise of Bitcoin are rooted in the Chinese economy is evidenced by the fact that the rates on the Chinese stock exchanges are ahead of the world ones by an average of $ 10- $ 15, and some - by all $ 50 (for example, Btc-e).

On October 30, the head of the Chinese stock exchange OKCoin, Jack Liu, said that it was “the busiest day of the year,” although it is likely that since then he has managed to change his mind, since the cost of Bitcoin has risen another 150 dollars over these few days, with periodic adjustments . He also noted that "many players are looking for alternative types of investment, imbued with distrust of the stock market".

Among other things, the recent decision of the European Court of Justice, which decided to exempt the exchange of virtual currency Bitcoin, was added to the flames. "Virtual currencies should be considered on a par with traditional money," - said in a court decision. Thus, the European Union, in fact, recognized bitcoins with money.

Well-known analyst bitcointalk.org lucif, he masterluc today announced the beginning of the “Great Third Wave”, and that in this regard, he stops publishing his technical analysis.

')

A couple of months ago, against the backdrop of the depreciation of the Chinese national currency, in order to reduce the inevitable capital outflow from the country, the Chinese authorities decided to tighten capital control methods. For adherents of Bitcoin, this was truly good news. Recall that at the beginning of the fall we published the opinion of Kim Dotcom, who, against the background of the Chinese crisis, recommended buying cryptocurrency. At that time, many perceived this advice as another manipulation of public opinion, however, now we can see with the example of our own Bitcoin wallet that the forecast was justified.

A new day, and new turns in the incessant rally. Today (November 5) the price has dropped below $ 400, but will almost certainly continue moving upward in the coming days. This, in addition to technical analysis of growth curves, is evidenced by another, more esoteric analytical tool, but no less accurate: an assessment of market sentiment.

Optimism rolls over. Until yesterday evening, it was possible to buy at any time and at any level, and the position would be in profit within a few hours, and even minutes. This type of buy-throw behavior generates optimism. At current sentiment, many assume a lightning takeoff to the level of 5,000 CNY on Chinese exchanges.

“The time of maximum pessimism is the best time to buy. A time of maximum optimism is the best time to sell, ”said John Templeton.

Bitcoin has always been extremely responsive to political and social upheavals. Earlier this summer, he reacted vigorously to the crisis in Greece, becoming an alternative financial niche for an entire nation in a difficult situation, and at the same time setting off into growth, and then fell, responding to the battle unfolding in the crypto community. Now, if several hundreds of millions of Chinese decide that the hour of bitcoin has come, and invest at least a small part of their deposits, worth 22 trillion dollars, you can rightly expect a second “native”, compared to which the first seems like a low start.

The fact that the reasons for the rapid rise of Bitcoin are rooted in the Chinese economy is evidenced by the fact that the rates on the Chinese stock exchanges are ahead of the world ones by an average of $ 10- $ 15, and some - by all $ 50 (for example, Btc-e).

On October 30, the head of the Chinese stock exchange OKCoin, Jack Liu, said that it was “the busiest day of the year,” although it is likely that since then he has managed to change his mind, since the cost of Bitcoin has risen another 150 dollars over these few days, with periodic adjustments . He also noted that "many players are looking for alternative types of investment, imbued with distrust of the stock market".

Among other things, the recent decision of the European Court of Justice, which decided to exempt the exchange of virtual currency Bitcoin, was added to the flames. "Virtual currencies should be considered on a par with traditional money," - said in a court decision. Thus, the European Union, in fact, recognized bitcoins with money.

Source: https://habr.com/ru/post/366931/

All Articles