Buy in Europe, deliver to Finland, and still return VAT

It happens that the most perfect gift or just something that you really want to buy, is very close somewhere in Europe. It would seem that the delivery is inexpensive, and Russia is within reach, and you can also deduct VAT.

But, unfortunately, not all online stores agree with this, apparently the "limitless" space of Europe is still more convenient.

Well, okay, you can deliver to pochta.fi in Finland, a friend picks up when they go for cheese and Fairy, and what to do with the VAT, I don’t want to lose this bonus.

And there is a way out, not the easiest, but if VAT is more than 20-30 euros, it makes sense to try.

')

1. The first thing to do is to check how the store, in principle, refers to the return or deduction of VAT. Search it on specialized sites, such as globalblue.com , see what is written in the online store about the sale of VAT Free, write to the support service.

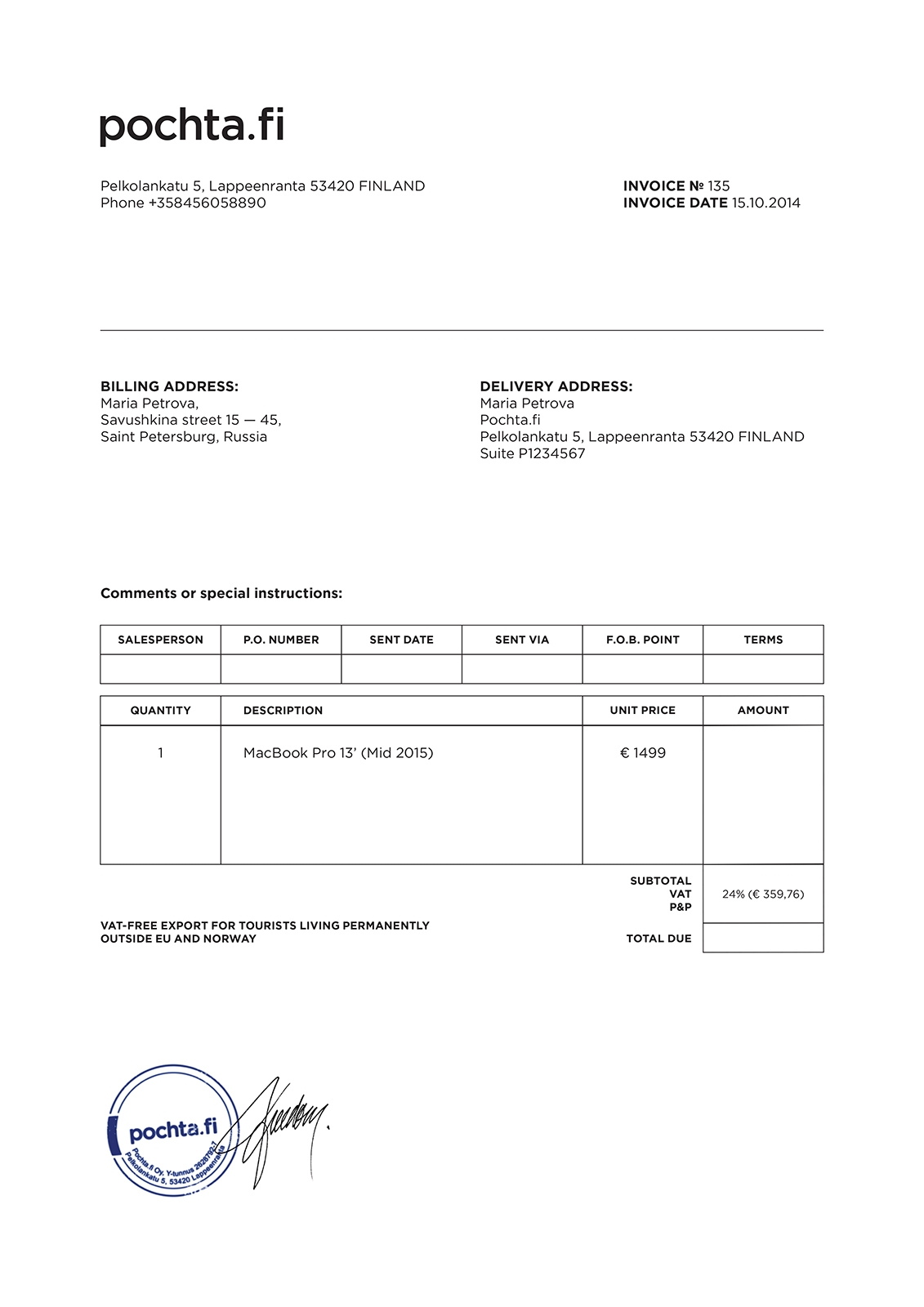

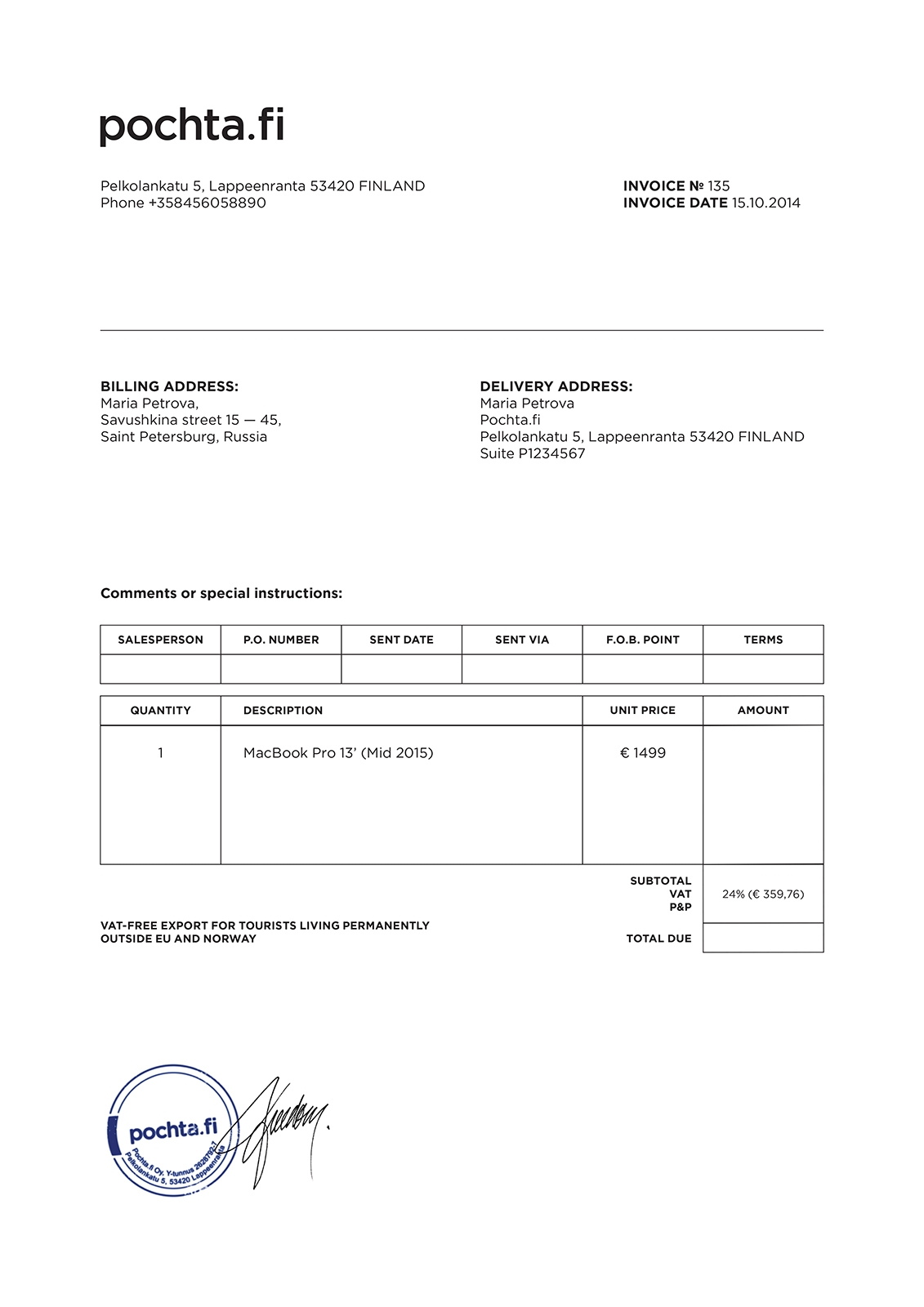

2. Hooray, our shop agrees to return VAT. This is a small victory. Now it is necessary to agree with them that they will send the correct invoice together with the parcel. Such an invoice should contain:

- data of the Russian passport of the person who will transport the package across the border

- billing address in Russia (delivery address remains Finnish)

- original signatures and seals, necessarily originals, scans / copies will not work

- a mark on the sale of VAT Free with an indication of the amount of tax.

3. Finally, the parcel at the point of issue in Finland, you can pick up. At the border, struggling with the temptation to go along the green corridor, turn to the red. Next, you need to print the invoice in the building where the passport control is located and where invoices from Lapland and other stores are usually printed. Customs control will put on the invoice a mark on the export of goods abroad.

4. On the street, to the left of the exit, there is a yellow mailbox of the Finnish post, there you need to drop the printed invoice in the envelope, which is issued along with the parcel at the issuing point.

5. An envelope with an invoice is sent to the seller, the store returns VAT on the card.

This procedure only on paper looks long and tedious, in reality the most difficult thing is to get the store to send the correct invoice.

For clarity, we apply an example of an invoice with which there will be no problems.

Have a nice shopping!

But, unfortunately, not all online stores agree with this, apparently the "limitless" space of Europe is still more convenient.

Well, okay, you can deliver to pochta.fi in Finland, a friend picks up when they go for cheese and Fairy, and what to do with the VAT, I don’t want to lose this bonus.

And there is a way out, not the easiest, but if VAT is more than 20-30 euros, it makes sense to try.

')

1. The first thing to do is to check how the store, in principle, refers to the return or deduction of VAT. Search it on specialized sites, such as globalblue.com , see what is written in the online store about the sale of VAT Free, write to the support service.

2. Hooray, our shop agrees to return VAT. This is a small victory. Now it is necessary to agree with them that they will send the correct invoice together with the parcel. Such an invoice should contain:

- data of the Russian passport of the person who will transport the package across the border

- billing address in Russia (delivery address remains Finnish)

- original signatures and seals, necessarily originals, scans / copies will not work

- a mark on the sale of VAT Free with an indication of the amount of tax.

3. Finally, the parcel at the point of issue in Finland, you can pick up. At the border, struggling with the temptation to go along the green corridor, turn to the red. Next, you need to print the invoice in the building where the passport control is located and where invoices from Lapland and other stores are usually printed. Customs control will put on the invoice a mark on the export of goods abroad.

4. On the street, to the left of the exit, there is a yellow mailbox of the Finnish post, there you need to drop the printed invoice in the envelope, which is issued along with the parcel at the issuing point.

5. An envelope with an invoice is sent to the seller, the store returns VAT on the card.

This procedure only on paper looks long and tedious, in reality the most difficult thing is to get the store to send the correct invoice.

For clarity, we apply an example of an invoice with which there will be no problems.

Have a nice shopping!

Source: https://habr.com/ru/post/365795/

All Articles