What happened in the world of finance in a week # 3

Hi, Geektimes! We continue to publish reports on major events in the world of finance and the stock market.

The previous edition of the information digest can be found at this link .

')

Last week, traditionally, the ruble continued to decline - at the Moscow Exchange trading, the Russian currency broke through 58 rubles per dollar, and the euro rose to 72.94 rubles.

The official dollar rate set by the Central Bank on December 13, 2014, amounted to 56.8919 rubles. The official euro rate was set at 70.5289 rubles.

The ruble fell along with the decline in oil prices - during the evening trading on the ICE Futures Exchange, the cost of futures for Brent crude for delivery in January 2015 dropped below $ 62 a barrel. At the opening of trading per barrel of oil gave $ 63.28.

The drop in oil prices was caused, among other things, by the news that the International Energy Agency (IEA) worsened the forecast of demand for fuel in 2015 for the fourth time in the last five months - analysts believe that next year the demand for oil will not be 93.6 million barrels per day, and only 93.3 million barrels.

OPEC’s oil-exporting organizations ’actions do not contribute to the increase in prices - OPEC’s representatives said they don’t plan to reduce oil production, even if the price of black gold drops to $ 40 a barrel.

Former Russian Finance Minister Alexei Kudrin expressed a forecast that the ruble will continue to fall. According to the expert, there will be no sharp falls over the next year, but in the perspective of two to three years the domestic currency will weaken. The rate will move beyond the price of oil - and according to Kudrin’s forecast, it will first fall to $ 50-60 per barrel, but against the background of economic growth in the world it may increase to $ 80 per barrel.

At the same time, international experts do not predict a rise in oil prices - in their opinion, the “shale revolution” in the United States radically changed the energy market, and you can forget about the three-digit oil prices.

ITinvest analyst Dmitry Solodin also sees no prerequisites for strengthening the ruble in the near future.

Last week, the price of shares of Russian companies in foreign markets declined (in particular, depositary receipts for Yandex shares became cheaper).

See also: Situation: Shares of Russian technology companies are getting cheaper again

Here's how this situation is described in his weekly review of world markets by the chief economist of ITinvest Sergey Egishyants:

On Monday, trading on Russian stock exchanges opened with multidirectional changes in indices - the MICEX index rose slightly (in the morning its value was 1,469.59 points), while the RTS index calculated in dollars, on the contrary, decreased even more - to 795.67 points.

ITinvest analyst Vasily Oleinik believes that Russian indices at the beginning of the week can, in general, expand their movement and begin to grow:

Within the framework of his program, Vasily Oleinik also spoke with domestic experts Grigory Beglaryan and Vadim Pischikov about the prospects for the Russian economy and oil market in 2015:

That's all, thank you for your attention. More analytical materials from leading experts on the ITinvest website .

The previous edition of the information digest can be found at this link .

')

Currency markets

Last week, traditionally, the ruble continued to decline - at the Moscow Exchange trading, the Russian currency broke through 58 rubles per dollar, and the euro rose to 72.94 rubles.

The official dollar rate set by the Central Bank on December 13, 2014, amounted to 56.8919 rubles. The official euro rate was set at 70.5289 rubles.

The ruble fell along with the decline in oil prices - during the evening trading on the ICE Futures Exchange, the cost of futures for Brent crude for delivery in January 2015 dropped below $ 62 a barrel. At the opening of trading per barrel of oil gave $ 63.28.

The drop in oil prices was caused, among other things, by the news that the International Energy Agency (IEA) worsened the forecast of demand for fuel in 2015 for the fourth time in the last five months - analysts believe that next year the demand for oil will not be 93.6 million barrels per day, and only 93.3 million barrels.

OPEC’s oil-exporting organizations ’actions do not contribute to the increase in prices - OPEC’s representatives said they don’t plan to reduce oil production, even if the price of black gold drops to $ 40 a barrel.

"We are not going to change our opinion, because prices have gone up to $ 60 or $ 40," said UAE Energy Minister Suheil al-Mazrui to Bloomberg.

Former Russian Finance Minister Alexei Kudrin expressed a forecast that the ruble will continue to fall. According to the expert, there will be no sharp falls over the next year, but in the perspective of two to three years the domestic currency will weaken. The rate will move beyond the price of oil - and according to Kudrin’s forecast, it will first fall to $ 50-60 per barrel, but against the background of economic growth in the world it may increase to $ 80 per barrel.

At the same time, international experts do not predict a rise in oil prices - in their opinion, the “shale revolution” in the United States radically changed the energy market, and you can forget about the three-digit oil prices.

ITinvest analyst Dmitry Solodin also sees no prerequisites for strengthening the ruble in the near future.

Stock markets

Last week, the price of shares of Russian companies in foreign markets declined (in particular, depositary receipts for Yandex shares became cheaper).

See also: Situation: Shares of Russian technology companies are getting cheaper again

Here's how this situation is described in his weekly review of world markets by the chief economist of ITinvest Sergey Egishyants:

Russian stocks fall by themselves - especially in monetary terms; it would be strange to expect otherwise - with the mess in the country's financial system and the weakness of the economy.

On Monday, trading on Russian stock exchanges opened with multidirectional changes in indices - the MICEX index rose slightly (in the morning its value was 1,469.59 points), while the RTS index calculated in dollars, on the contrary, decreased even more - to 795.67 points.

ITinvest analyst Vasily Oleinik believes that Russian indices at the beginning of the week can, in general, expand their movement and begin to grow:

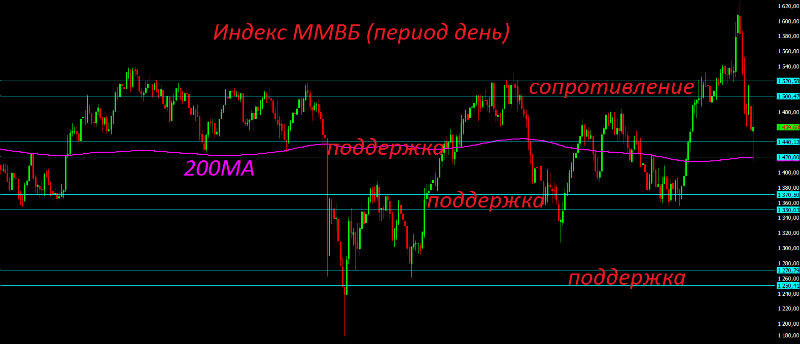

From a technical point of view, Russian indices have come close to resistance levels, from which a technical rebound may well occur. The MICEX index on Friday tested the strength range of 1420-1440, where there is strong support and passes the 200-day sliding from which the index showed a rebound.

[...]

The RTS currency index last week closed below 800 points. From a technical point of view, in the monthly period the price has not yet reached strong support at 700 points, but in the weekly period the price can easily turn from the lower limit of the downward channel, which passes near the mark of 780 points.

Do not forget about the most important internal event of the day - it is a quarterly expiration. It is not excluded that it was for her that the big players tried to lower the RTS currency index as low as possible, because the rates on derivatives are not very small, and on the ruble too. Perhaps it is after expiration that the long-awaited reversal will begin in the Russian currency and in the RTS currency index.

Within the framework of his program, Vasily Oleinik also spoke with domestic experts Grigory Beglaryan and Vadim Pischikov about the prospects for the Russian economy and oil market in 2015:

That's all, thank you for your attention. More analytical materials from leading experts on the ITinvest website .

Source: https://habr.com/ru/post/364397/

All Articles