Fintech Digest: online banking security, 70% of bitcoins extracted, business will lose about $ 2 billion due to RKN blocking

Last week was relatively calm for the FINTECH sector. Nevertheless, the news is, and they are quite interesting. As usual, there is good, there is not very good. Let's deal with that, and with another.

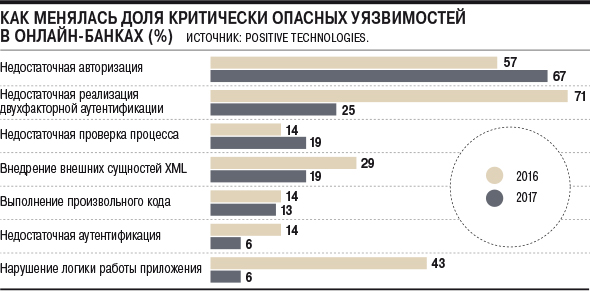

The good can be attributed to the constant increase in the security of online banking and mobile banks. According to Kommersant, for three years the share of banking services containing critical vulnerabilities has decreased from 90% to 56%. The main problem for online banking is the insecurity of the authorization process. Until now, this is practically the No. 1 problem, since attackers can gain access to the client’s personal data.

')

But the situation is improving. In 2015, approximately 90% of online and mobile banks contained all sorts of dangerous vulnerabilities. In 2016, it was already 71%, and at the end of 2017 - 56%. Perhaps by 2020, most banks will be able to correct the situation.

The neutral news should include the fact of extraction of the 17 million bitcoin. As you know, the total number of bitcoins is limited to 21 million. Over time, the complexity of mining is gradually increasing, and now more than 80% of "coins" have been mined. By the way, miners received 16 million bitcoins in the middle of 2016. According to some experts, the 17 millionth bitcoin can create a kind of psychological barrier, since most miners and buyers understand that it remains to extract only less than one fifth of the total number of bitcoins.

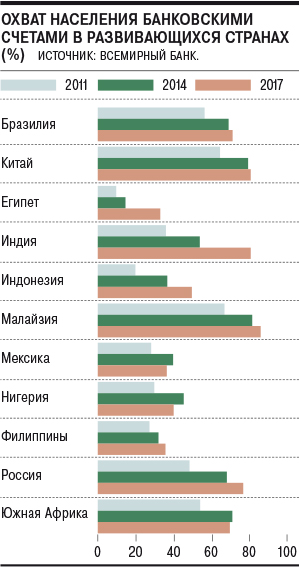

The negative news is the World Bank report. According to the data in the report , more than 70% of Russians have a bank account.

But the problem is that having an account does not imply having money on it. More than 60% of the adult population of Russia speaks about the absence of a savings strategy. That is, the money is either not deposited at all or is deposited, but in minimal amounts.

Another of the not so good is that last month there was an increase in the number of attacks on ATMs in order to steal money. As it turned out, crackers are no longer acting, but teaching others, receiving a percentage of the stolen money. “Over the past month, such attacks on ATMs have been taking place every other day, and there are malicious users in Moscow and the region. The volume of one embezzlement amounts to 2-5 million rubles, three banks have already appealed for help to the law enforcement agencies, ”said the law enforcement official to Kommersant.

The most commonly used technology is Black Box - connecting a third-party device to an ATM in order to get the same cash.

And finally, about blocking Telegram. According to Gazeta.ru, Roskomnadzor’s actions will result in losses for Russian business in the amount of about $ 2 billion. True, this is a manifestation of the worst-case scenario. After the “carpet bombing”, Roskomnadzor promised not to carry out such actions, adding large subnets to the register of prohibited information. Nevertheless, big business is no longer silent, but declares the serious consequences that the thoughtless fan blocking of millions of IP addresses entails.

Source: https://habr.com/ru/post/354812/

All Articles