As an entrepreneur to submit reports on the simplified taxation system

There is exactly one week left before the end of the deadline for filing reports on the STS. In this article we will describe how the individual entrepreneur to submit reports on the simplified taxation system, what is included in it, and also how to generate a declaration of the simplified tax system for free on our website.

What kind of reporting does the IP on the simplified taxation system

All entrepreneurs on the simplified tax system, regardless of whether they had income or not, submit a declaration on the simplified tax system for the year. Usually, this must be done before April 30, but this year the term was postponed due to the weekend. Therefore, the SST declaration for 2017 must be submitted before May 3, inclusive.

Also, entrepreneurs on the simplified tax system are obliged to keep a book of income and expenditure records (CUDiR) during the year. You do not need to submit the CUD to the tax office, but you must keep it for 4 years in case of a tax audit. The book can be filled in electronic form, but at the end of the year it is necessary to print, number and flash it.

In addition to tax reporting there are reports in the statistics. A complete statistical observation is carried out once in 5 years, when all entrepreneurs must submit reports. The last time a complete observation was carried out in 2015. In addition, the PI can get into selective observation. Check whether you need to submit reports to the statistics, you can on the website of Rosstat .

If the PI had no income

Then he needs to file a "zero" declaration on the USN.

If ip tax holidays

He still needs to file a declaration on the USN, since tax holidays are not exempt from reporting. In this case, the tax rate is 0%.

If ip patent

If the company has only a patent, without a simplified tax system, then it is not necessary to hand over the declaration. If he combines the patent and the simplified tax system, then he also needs to file a declaration on the simplified tax system (normal or "zero").

How to fill in the declaration on the simplified taxation system

The SST declaration consists of a title page and two sections. It is better to fill in the declaration from the end. Section 2.1.1 indicates the income, tax and insurance premiums paid on a cumulative basis (that is, from the beginning of the year and for the 1st quarter - until March 31, for the half year - until June 30, for 9 months - until September 30, for the year - up to 31 December). Then, on the basis of these data, in section 1.1, advance payments (tax) under the simplified tax system are calculated for payment or reduction.

The declaration does not indicate actually paid advance payments (tax) on the simplified tax system, but the amounts that you had to pay. For example, if you had income in Q1, but you did not pay the advance payment, you still need to specify it in the declaration. If you have paid an advance payment of less or more, the declaration indicates the calculated advance payment, which is calculated using a special formula.

The declaration is submitted to the tax inspectorate at the IP residence. The declaration can be submitted in person or by notary power of attorney, as well as sent by mail with a declared value and investment listing.

Details of your inspection can be found on the tax website .

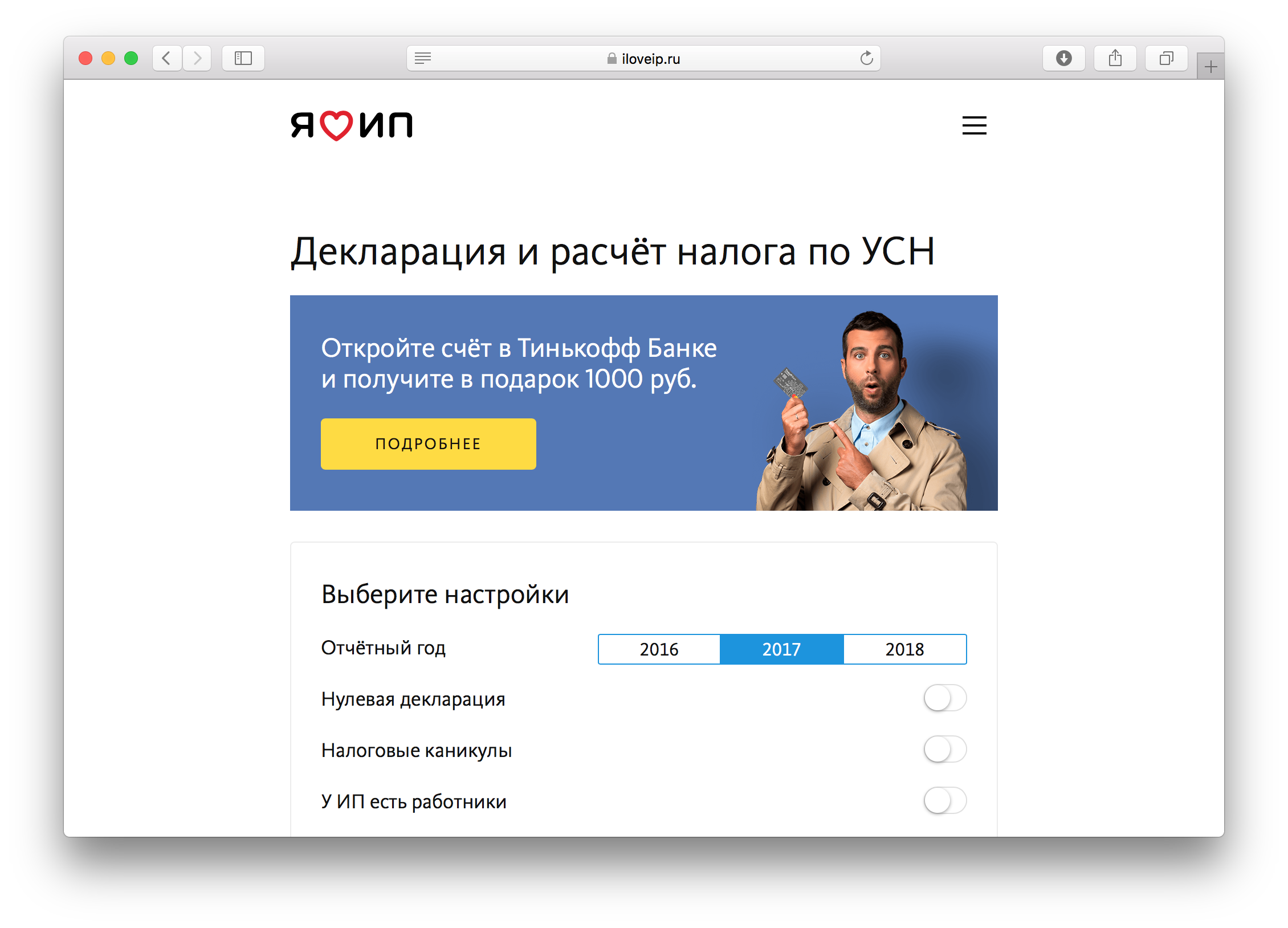

Declaration and calculation of the tax on the simplified tax system online

Calculate the tax and generate a declaration on the simplified tax system is free on our website .

To generate a declaration, specify your TIN (or full name) and address of residence. The remaining data will be filled automatically. Next, specify your income, insurance premiums paid and advance payments on the simplified tax system for each quarter.

The service will calculate the tax under the simplified taxation system and will generate a declaration in PDF format (for filing to the tax) and in XML format (for sending in electronic form). The XML file can be written to a USB flash drive and filed along with a regular declaration.

The declaration in PDF format is formed with a two-dimensional bar code, which is accepted by the tax authorities.

What reporting does not hand over the IP on the simplified taxation system

Individual entrepreneurs on the simplified tax system do not keep accounting records and do not submit accounting reports.

Also, they do not need to report insurance premiums if they do not have employees. If there is, then the PI will have to pass the calculation for insurance premiums, the calculation of 4-FSS, the forms SZV-M and SZV-STAGE, as well as report on personal income tax (form 6-NDFL and 2-NDFL). In this case, it is better to hire an accountant.

As a general rule, SPs on the simplified tax system do not pay VAT. But if an entrepreneur accidentally issued an invoice with VAT, then he would have to pay tax and file a VAT return.

SP on the simplified tax system does not need to file a declaration on property tax, transport tax or land tax, even if they pay them.

What will happen if you do not submit a declaration on the USN

If you are late with filing a declaration for 10 working days, the tax may block your current account.

For not submitting a declaration on the simplified taxation system, a penalty of 5% of the amount of unpaid tax for each month of delay, but not more than 30%. The minimum fine is 1000 rubles, for example, if you have a “zero” declaration or you have not passed the declaration, but have paid the tax.

What happens if you do not pay advance payments

For non-payment of advance payments and tax on the USN tax will charge interest at about 10% per annum. Calculate penalties using a calculator on the link .

What happens if you do not pay tax

In addition to penalties, the tax may impose a penalty of 20 to 40% of the unpaid amount.

We already wrote about how to pay taxes and individual contributions. Since 2018, the size of insurance premiums has changed, and the fixed part is 32,385 rubles. (in the Pension Fund of Russia - 26 545 rubles, in the FFOMS - 5840 rubles). Also changed the term of payment of an additional 1% in the FIU - until July 1. Everything else remains the same.

If you have any questions, write in the comments.

')

Source: https://habr.com/ru/post/354488/

All Articles