Telecom's digital transformation, or how operators “go” to IT

Traditional telecommunication operators, including cellular companies, were in a very unpleasant situation: incomes are practically not growing, and traffic is rapidly increasing. These "scissors" can significantly "cut" their profits and even jeopardize the existence of the market. To avoid this, not being just a "pipe" for pumping traffic, operators need to carry out a deep transformation of their infrastructure and business as a whole. Working with network and telecommunication equipment, we at ompTek analyzed the possibilities of operator transformation. They are inextricably linked with the use of the most modern IT development and the involvement of expertise of IT integrators.

Traffic is growing rapidly, and this is an axiom. As the experience of the South Korean telekom testifies, give the customers a “pipe” as widely as possible, they will find themselves, than fill it up, and back, will not return to lower consumption.

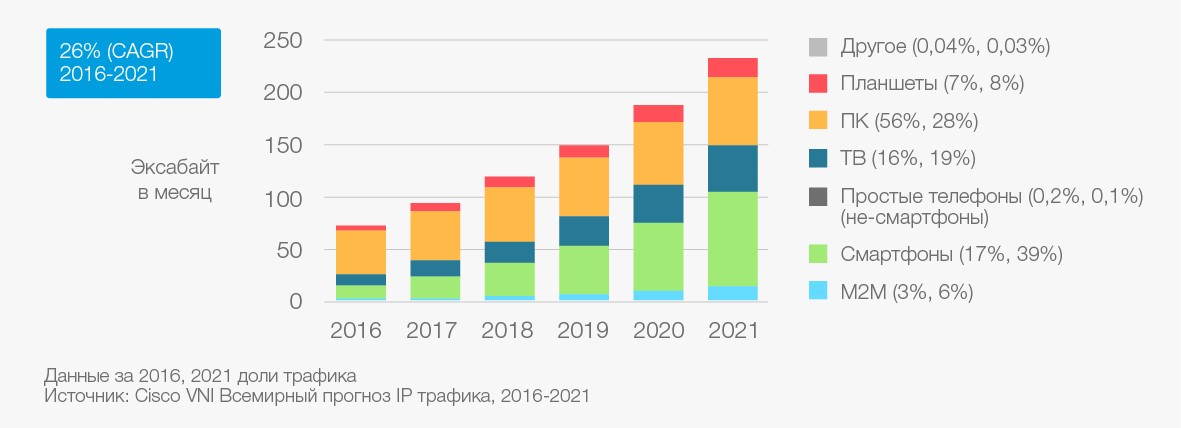

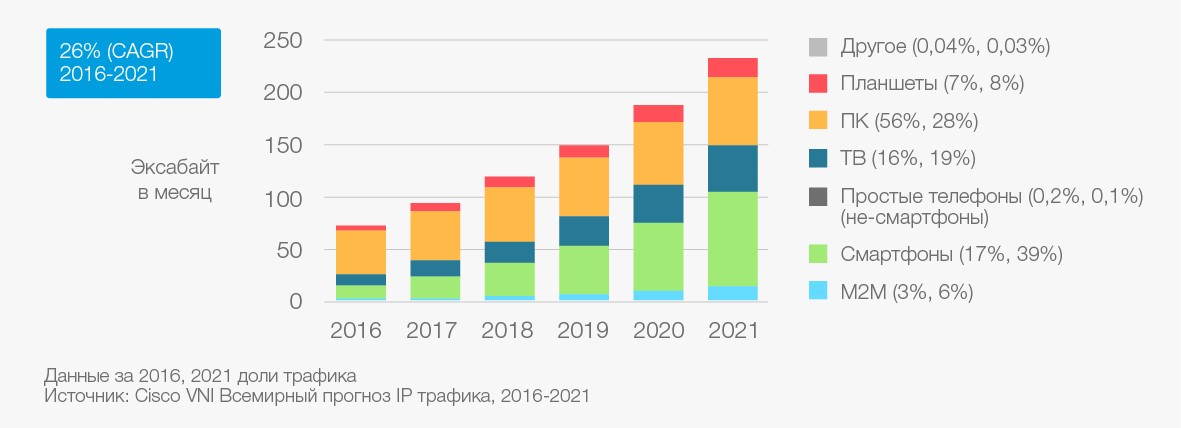

According to Cisco's forecast, by 2021, worldwide, the annual volume of IP traffic will grow to 3,340 exabytes (approximately 2% of this volume will fall to Russia). Recall that in one exabyte - a billion gigabytes that are more familiar to us today. According to IDC estimates, the entire amount of digital information available on the globe in 2006 amounted to “only” 161 exabytes.

')

Growth of IP traffic in the world with details on certain categories of end devices

Growth of IP traffic in the world with details on certain categories of end devices

It is interesting to note that mobile data traffic in 2021 will account for only 17% of the projected 3340 EB. How does this compare with the fact that almost 40% of the traffic will generate / consume smartphones? Very simple: most of the data (45% of 3340 Ebayt) will go through Wi-Fi networks, which will collect data from smartphones and other devices with Wi-Fi support on the “last meters” wirelessly, and then send them to high-speed wired networks. Accordingly, Wi-Fi expertise is becoming increasingly important.

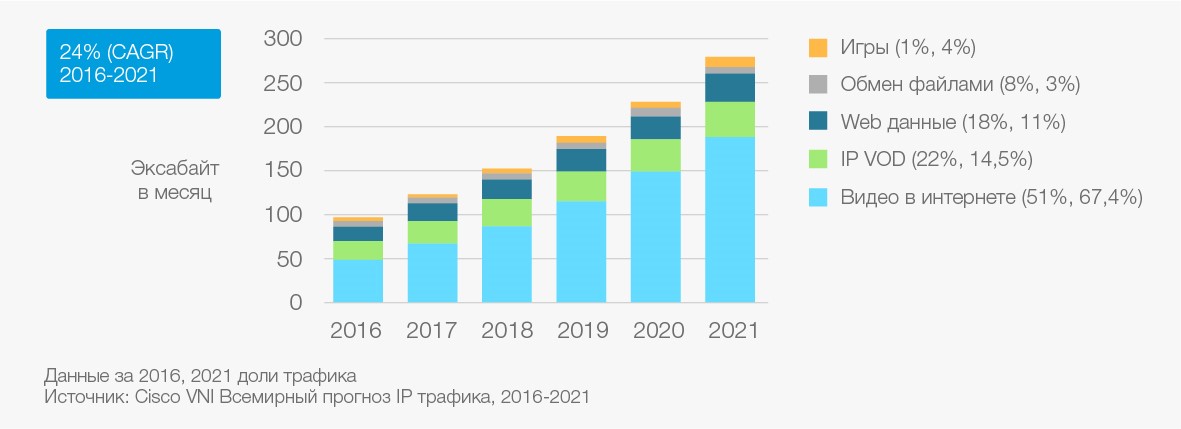

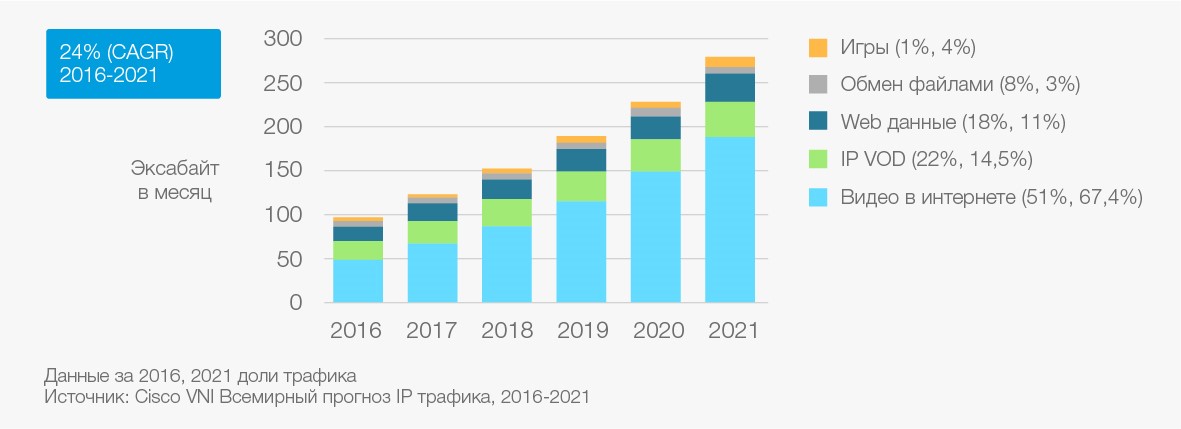

Growth of IP traffic in the world with detail for individual categories of applications

Growth of IP traffic in the world with detail for individual categories of applications

When analyzing the traffic structure, it is obvious that in terms of its generation / consumption, the emphasis from the PC will be transferred to smartphones. In terms of the type of traffic, video has already become the obvious “king”. Admit it, you yourself, for certain, more than once “shortened” the way home from work thanks to the next series of the “Game of Thrones” series. But video is not only the “substitution” of traditional television, it is also distance learning, telemedicine, video communication and video conferencing, which have already become an integral part of corporate communication systems.

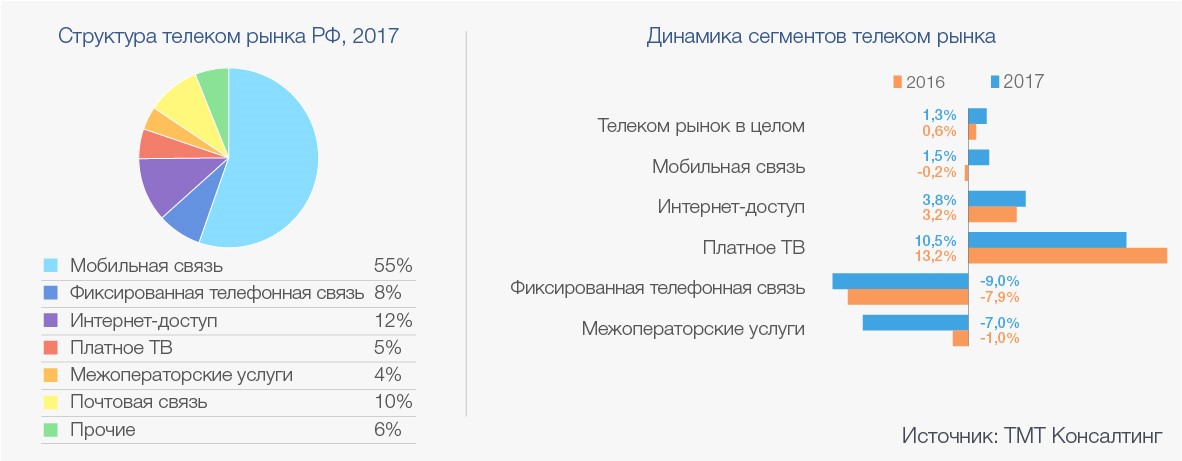

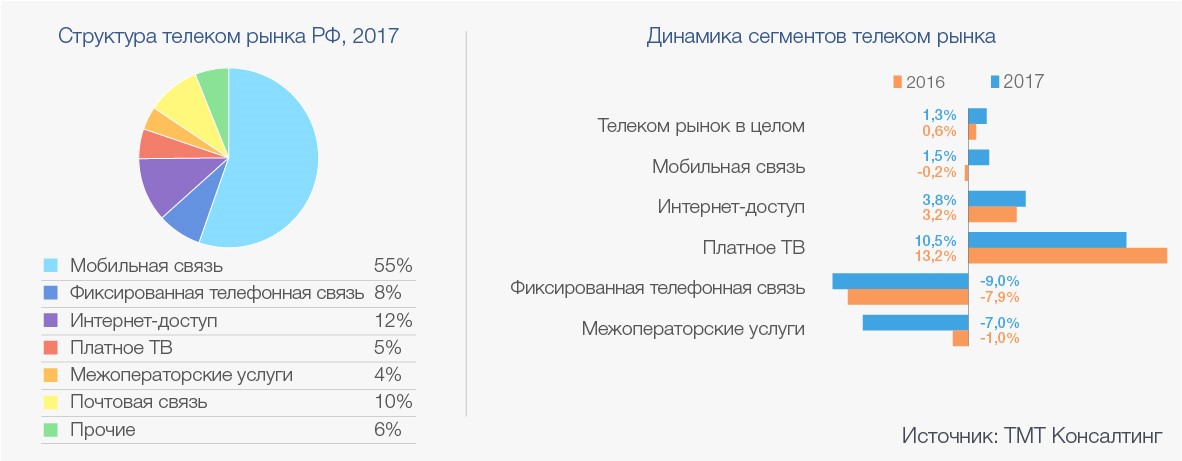

If the volume of traffic is rapidly going up, then the revenues of the operators are “marking time”. And this applies both to the telecommunications industry in general, and to the cellular segment in particular.

Changes in revenues of the telecom sector as a whole

Changes in revenues of the telecom sector as a whole

Change in revenues of mobile operators (right). Sources: Informa; OVUM; GSMA; Ey analysis

Change in revenues of mobile operators (right). Sources: Informa; OVUM; GSMA; Ey analysis

Russian telecom echoes global trends.

For example, according to TMT-Consulting , in 2017, 2.7 million subscribers abandoned fixed telephony, and thus service penetration fell by 4 percentage points to 38%. “Revenues from fixed telephony for the year decreased by 9%. Comparable dynamics will continue in the following years, ”analysts at TMT-Consulting report. The situation with mobile communication is slightly better, but the growth of 1.5% in 2017 does not correspond to the growth of traffic. But in order to support the ever-growing traffic, infrastructure upgrading is not an expensive pleasure.

The growth of traffic is mainly due to the growing popularity of various digital services that are provided "on top" of telecom operators' infrastructures - the OTT (Over The Top) model. The main income from such services is received, obviously, by their providers, and telecommunication operators are the notorious “pipe”, the load on which is rapidly growing.

A source

A source

Today, the basic concepts of what a service is and what a user is. The service is now not only and not so much telephone communication or data transmission, but access to various service platforms, for example, banking, video content, mobile applications, etc., and, as a rule, it is a self-service model, for example, receiving video or music “on demand” (video & music on demand).

And users are now not only people, but also various connected devices (“Internet of Things”), the number of which, according to Gartner's estimates, approaches 8.4 billion and will soon exceed the number of people on the entire planet.

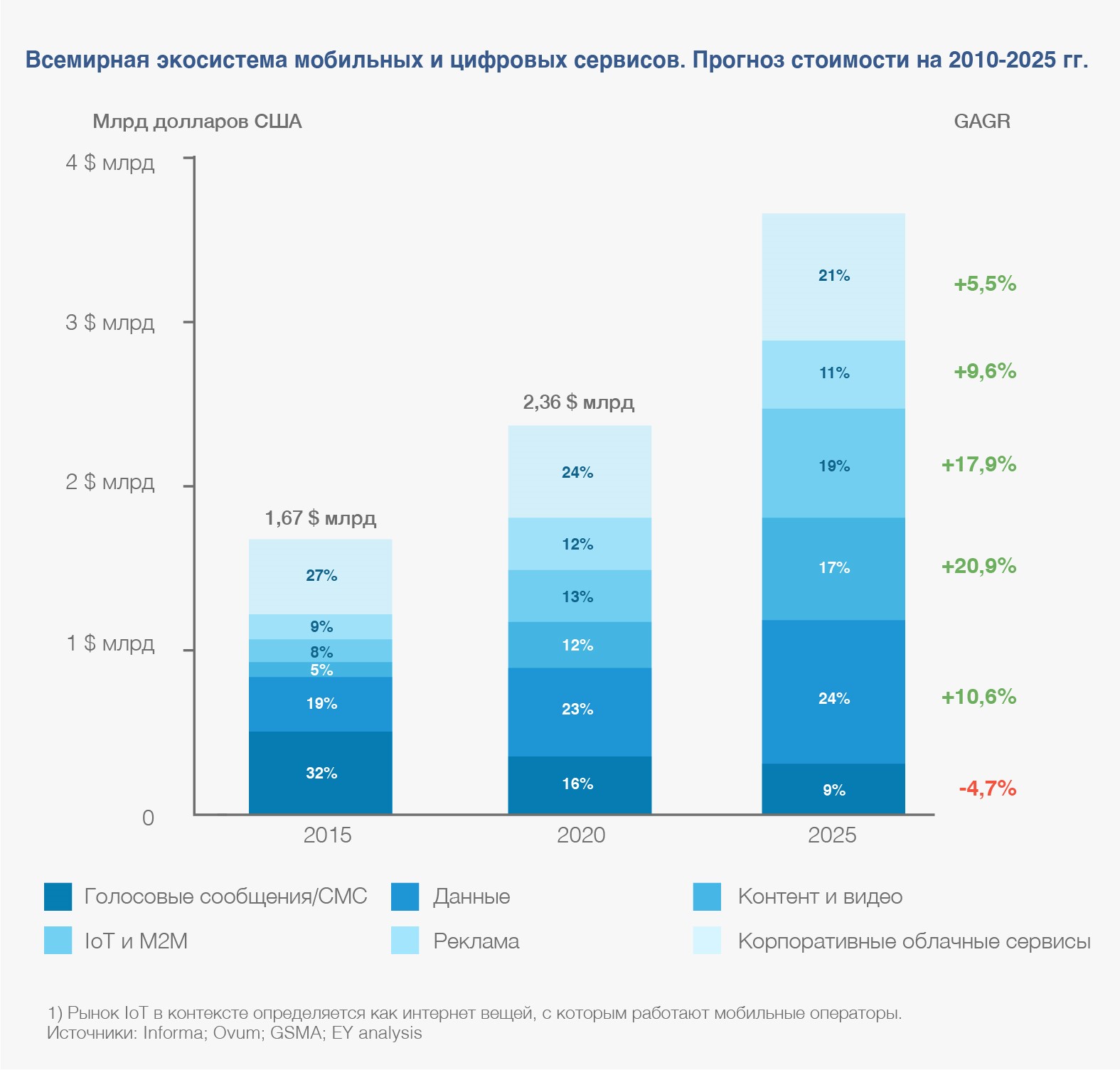

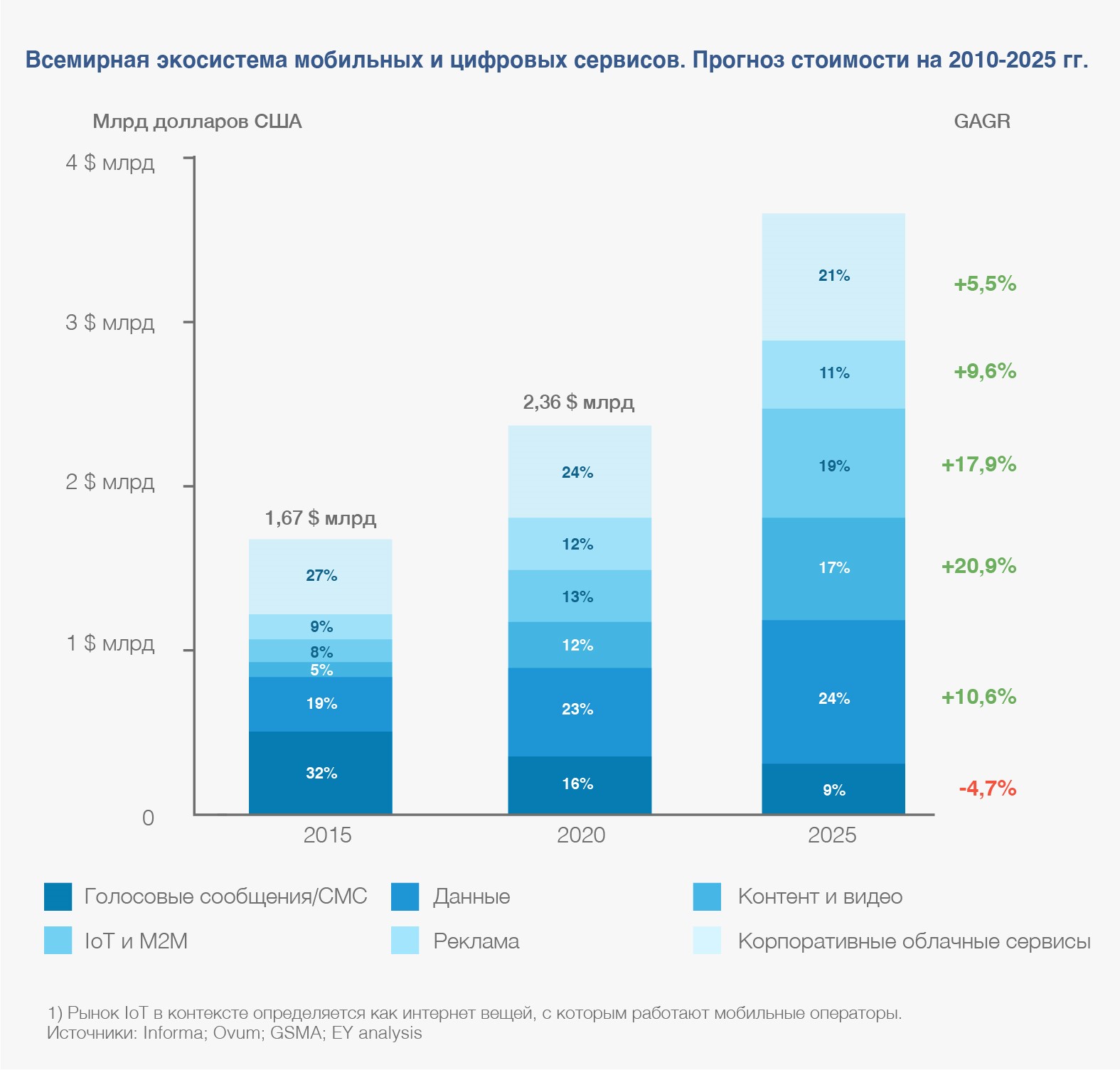

In order to “survive” in the face of declining revenues from traditional telecommunications services, operators must be transformed into digital service providers. What directions should they pay attention to first?

Overall growth of the mobile and digital services ecosystem in the world

Overall growth of the mobile and digital services ecosystem in the world

As follows from the analysis conducted by EY experts, the most promising areas are related to the provision of content services (including video), as well as projects in the field of “Internet of things”. Smaller growth rates in the corporate cloud services segment, but in itself it is so great that operators simply have no right to ignore it.

A source

A source

So, according to the analysis of EY, the greatest growth in the coming years will be in services related to content and video. Operators need to more actively follow the path of content monetization: games, video, music, etc. At the same time, they need to more efficiently use their main asset - infrastructure. This is their "trump card" in the competition with OTT providers.

Today, users do not want to wait for the desired service, they want to get it "here and now", and with high quality. Consider a simple example: a user wanted to watch a video from YouTube. The operator can (and, ideally, should) promptly provide him with the appropriate network resources (higher bandwidth) at the time of viewing. This can only be done by the operator - the owner of the infrastructure; it is not available to any OTT providers - unless they, of course, have no agreement with the operator. By the way, the conclusion of such agreements is another recipe for additional revenue for telecoms.

But in order to implement even the simple scenario described above, it is necessary that the network infrastructures and the service platforms running on top of them are adaptive and open, which in fact is far from being the case.

Traditional communication networks were created for the sale of minutes and bytes, and are not very suitable for the provision of new services, especially with the customization of parameters and ensuring the quality of service on an individual level. However, technologies and solutions have already appeared on the market that can help operators optimize their infrastructure for working in new conditions. Speech, first of all, is about technologies of software defined networks (SDN) and virtualization of network functions (NFV).

The concept of SDN involves the separation of traffic transfer functions from the functions of managing this process, including the configuration of network nodes and routing flows. This allows the use of relatively inexpensive "non-intelligent" switches, including bare-metal and / or white box products, which will significantly reduce the costs for operators to upgrade networks to support ever-growing traffic.

But even more importantly, the controller that oversees the operation of switches and other network “hardware” will quickly reconfigure the entire network to fulfill certain requirements from overlying applications or services. If we turn to the example above, the SDN network will provide an opportunity to promptly allocate an additional band for the user to view the video clip of high quality. Or, say, to allocate resources for a video conferencing session of top managers. And this is very important for corporate customers.

NFV technologies, in turn, allow you to implement various network functions and services using software modules (for example, virtual machines) that interact with the network through open software application interfaces (APIs).

For example, if earlier for the in-depth analysis (DPI) of the traffic flow, it was necessary to install special (and very expensive) hardware / software probes, then in the SDN / NFV network, it is enough to install the appropriate software (implementing the DPI functions). Network functions / services implemented by means of NFV can be linked in chains to provide personalized services to specific corporate customers and even individual users.

In general, by reducing the cost of network development, as well as reducing the time it takes to introduce new services, SDN / NFV technologies allow creating fundamentally new services in the mass and corporate markets. The introduction of these technologies helps to reduce the time of preparation for the launch of new products on the market. The minimum time-to-market is strictly obligatory in the face of growing competition: the range of offers must be rapidly expanded; and, if a new product has found its buyer, then it is already worth polishing the quality, and if the offer was a failure, you also need to quickly get rid of it. It is also important that, in the SDN / NFV network, you can set a manageable level of service quality - defined for a specific client, for a specific service.

Street art in Perm

Street art in Perm

There are a large number of fairly mature SDN and NFV solutions in the Russian market, including the development of domestic companies such as the Center for Applied Research of Computer Networks (CPICS) and Brain4Net. However, the introduction of these technologies is at the initial level, in most cases at the stage of experienced network segments.

Among the constraints are problems with the compatibility of solutions from various developers, as well as with the integration of new (SDN / NFV) solutions with legacy infrastructure. In addition, there is a shortage of qualified professionals who can implement and maintain new solutions. Finally, there is the problem of coordinating work within the project: for many operators, the IT department and the technical department of the communication network are separate blocks.

Rostelecom is implementing more activities in the SDN / NFV area. The company plans to upgrade the network infrastructure based on SDN and NFV until 2020. VimpelCom implements SDN / NFV as part of a test project on a fragment of the Russian network in order to automatically calculate, plan and provide additional capacities to customers. Tested and implemented a number of virtualized network functions (vIMS, vPCRF, etc.), as well as the concept of vEPC solutions. Similar operations are carried out by other operators.

If we talk about infrastructure, another important direction for operators is the desire to reduce the costs of its development and maintenance of networks. For example, Megafon and Vimpelcom have separated into a separate business unit a part of the network infrastructure - antenna-mast structures. In addition, companies together build LTE infrastructure in several Russian entities.

Improving the efficiency of the use of infrastructure is the implementation of MVNE (mobile virtual network enabler) projects, when cellular companies offer infrastructure, on the basis of which a virtual operator (MVNO) gets the opportunity to sell services under its brand. Such a model excludes capital expenditures on infrastructure from the virtual operator and gives it operator access to an audience with which, for some reason, the big players could not work, for example, to dissatisfied former subscribers.

Most active in the area of MVNO projects is Tele2. In particular, this operator has already launched such projects with Rostelecom, Sberbank and a number of other companies. Recently, at Mobile World Congress (MWC 2018) in Barcelona, China Mobile, one of the largest mobile operators in China, announced that it plans to create a virtual operator in Russia next year.

If you go back to potential growth points, then, as follows from the above EY forecast, one of the fastest growing is the Internet of Things (IoT) segment - almost 18% growth per year.

According to IKS-Consulting, by 2020, the M2M / IoT market in Russia will grow to 26 million SIM-cards, of which less than 20% of devices will be used in the B2C segment (primarily in the consumer electronics segment, in “smart houses” and connected cars). And the majority of “smart” devices will be required by industry and the corporate sector, for example, transport companies that actively use navigation systems.

Unlike video, M2M / IoT solutions do not generate a large amount of traffic. Other characteristics are more important here: low traffic latency, long battery life for end devices, etc. — that traditional cellular communications technologies designed to serve people, not things, are not capable of providing. To effectively support IoT applications, new radio technologies and network architectures are needed. The concept of 5G is aimed at solving these problems. Thus, as part of the development of LTE, various modes are being developed for this, in particular, eMTC and NB-IoT.

Russian mobile operators are actively testing these new technologies. However, for success in the IoT market, in addition to the infrastructure component, it is important to create an ecosystem with developers of end devices, IoT software platforms and other players. For this, the openness of the infrastructure is important, which is ensured, among other things, by the SDN / NFV solutions discussed above.

A source

A source

Another important area is the provision of services, including cloud, to corporate customers. Here, the potential growth is not so great (according to the forecast of EY, about 5.5% per year), but the market itself is huge. It is important that, acting as service providers and / or providers of cloud services, telecommunications companies are switching to a different business model of interaction with customers and partners.

It should be noted that Russian analysts predict a significant growth of the market of public clouds in the country. So, according to iKS-Consulting, for the period up to 2021 this growth will be about 20% per year.

Obviously, in order to participate in the division of the growing, like a yeast, cloud pie, operators need to develop cloud platforms, as well as invest in data centers. In fact, they need it to solve the problem of data storage in accordance with the requirements of the law of Spring.

And telecom actively went to the data center. Thus, Rostelecom acquired SafeData, which made it the leader of the Russian market for commercial data centers. The unified competence center “Rostelecom - Data Processing Centers”, RTK-DPC is a group of six companies, under whose management in Russia a total of 5268 racks with equipment in data processing centers with a total area of 46 thousand square meters. m

MegaFon bought Combell (60% of which is owned by Mastertel), a resident of Technopolis Moscow, where the construction of one of the largest data centers in Russia is being completed.

Among the data centers built by the LANIT group is one of the largest data center in Russia, VimpelCom in the Yaroslavl region. Its total area is 9.6 thousand square meters. m. Installed capacity - 12 MW. The modular design suggests the possibility of increasing the area and power, as well as quick dismantling and installation in another place. Innovative technologies are applied in the engineering support of the project. So, for cooling IT equipment, an active free cooling system was designed. This technology allows to drastically reduce energy consumption for creating the required climate regime in the server rooms of the data center.

It is obvious that in the near future we will witness further expansion of telecom operators in the data center and cloud services market. Perhaps some companies will try to take advantage of the available real estate objects, having converted them to data centers.

Russian telecom operators are trying to work more and more actively “at the junction of telecom and IT”. For example, in 2017, VimpelCom launched an application combining the functionality of an instant messenger and an aggregator of online services, and began to position itself as “a company specializing in digital technologies”. To consolidate the transformation in the minds of fellow citizens, the operator announced a change in the name of the holding to Veon . MegaFon has acquired a controlling stake in Mail.Ru in order to work actively with digital users. MTS bought NVision Group system integrator to develop its IT expertise ...

According to data published by RBC, Rostelecom’s strategy for 2018-2022 implies a “transition to a platform-based business model”, following the example of such companies as Amazon, Apple, Google, Alibaba, Facebook, AirBnB, Uber, etc. Speech It is about creating platforms that allow different types of customers and partners to interact using APIs. These are, in particular, platforms for smart homes, smart clothes, digital health care, the industrial Internet, drones, etc. Rostelecom’s strategy presupposes strengthening the company's presence in the IT services market in the conditions of the telecommunications market stagnation.

One of the “IT” areas actively developed by telecom operators is associated with big data. Telecom, a treasury of subscriber data, is moving from internal experiments with big data to the monetization of this asset. The operator can collect information about which programs were watched by customers using Internet TV, which sites they visited, which questions they drove into the search engine - in order to build analytics on this and offer it through data exchanges.

VimpelCom uses Big Data to predict and prevent outflows. The operator offers the developed models as a service - for example, for the financial sector. The Data Monetization Center of Rostelecom, opened in 2016, after pilot projects on outflows in banks, is reformatted to work with online advertising. Tele2 uses information about customer movements to open new points of sale in the places where traffic is greatest.

Another area is mobile finance : the development of our own banks, the issuance of payment cards, microloans, etc. MegaFon has launched its own payment card linked to a mobile number and its account. MTS develops its own bank. VimpelCom issues Beeline MasterCard cards that allow you to pay for purchases all over the world, accumulate bonuses and spend them on paying for communication services, receive discounts on partners' products, replenish and transfer funds without commission.

In general, digital transformation for telecom is not just a matter of increasing competitiveness, it is a matter of survival. And to solve it, it is extremely important to use IT expertise and experience available on the market.

Traffic is growing rapidly, and this is an axiom. As the experience of the South Korean telekom testifies, give the customers a “pipe” as widely as possible, they will find themselves, than fill it up, and back, will not return to lower consumption.

According to Cisco's forecast, by 2021, worldwide, the annual volume of IP traffic will grow to 3,340 exabytes (approximately 2% of this volume will fall to Russia). Recall that in one exabyte - a billion gigabytes that are more familiar to us today. According to IDC estimates, the entire amount of digital information available on the globe in 2006 amounted to “only” 161 exabytes.

')

It is interesting to note that mobile data traffic in 2021 will account for only 17% of the projected 3340 EB. How does this compare with the fact that almost 40% of the traffic will generate / consume smartphones? Very simple: most of the data (45% of 3340 Ebayt) will go through Wi-Fi networks, which will collect data from smartphones and other devices with Wi-Fi support on the “last meters” wirelessly, and then send them to high-speed wired networks. Accordingly, Wi-Fi expertise is becoming increasingly important.

When analyzing the traffic structure, it is obvious that in terms of its generation / consumption, the emphasis from the PC will be transferred to smartphones. In terms of the type of traffic, video has already become the obvious “king”. Admit it, you yourself, for certain, more than once “shortened” the way home from work thanks to the next series of the “Game of Thrones” series. But video is not only the “substitution” of traditional television, it is also distance learning, telemedicine, video communication and video conferencing, which have already become an integral part of corporate communication systems.

If the volume of traffic is rapidly going up, then the revenues of the operators are “marking time”. And this applies both to the telecommunications industry in general, and to the cellular segment in particular.

Russian telecom echoes global trends.

For example, according to TMT-Consulting , in 2017, 2.7 million subscribers abandoned fixed telephony, and thus service penetration fell by 4 percentage points to 38%. “Revenues from fixed telephony for the year decreased by 9%. Comparable dynamics will continue in the following years, ”analysts at TMT-Consulting report. The situation with mobile communication is slightly better, but the growth of 1.5% in 2017 does not correspond to the growth of traffic. But in order to support the ever-growing traffic, infrastructure upgrading is not an expensive pleasure.

The growth of traffic is mainly due to the growing popularity of various digital services that are provided "on top" of telecom operators' infrastructures - the OTT (Over The Top) model. The main income from such services is received, obviously, by their providers, and telecommunication operators are the notorious “pipe”, the load on which is rapidly growing.

Today, the basic concepts of what a service is and what a user is. The service is now not only and not so much telephone communication or data transmission, but access to various service platforms, for example, banking, video content, mobile applications, etc., and, as a rule, it is a self-service model, for example, receiving video or music “on demand” (video & music on demand).

And users are now not only people, but also various connected devices (“Internet of Things”), the number of which, according to Gartner's estimates, approaches 8.4 billion and will soon exceed the number of people on the entire planet.

In order to “survive” in the face of declining revenues from traditional telecommunications services, operators must be transformed into digital service providers. What directions should they pay attention to first?

As follows from the analysis conducted by EY experts, the most promising areas are related to the provision of content services (including video), as well as projects in the field of “Internet of things”. Smaller growth rates in the corporate cloud services segment, but in itself it is so great that operators simply have no right to ignore it.

Content and video

So, according to the analysis of EY, the greatest growth in the coming years will be in services related to content and video. Operators need to more actively follow the path of content monetization: games, video, music, etc. At the same time, they need to more efficiently use their main asset - infrastructure. This is their "trump card" in the competition with OTT providers.

Today, users do not want to wait for the desired service, they want to get it "here and now", and with high quality. Consider a simple example: a user wanted to watch a video from YouTube. The operator can (and, ideally, should) promptly provide him with the appropriate network resources (higher bandwidth) at the time of viewing. This can only be done by the operator - the owner of the infrastructure; it is not available to any OTT providers - unless they, of course, have no agreement with the operator. By the way, the conclusion of such agreements is another recipe for additional revenue for telecoms.

But in order to implement even the simple scenario described above, it is necessary that the network infrastructures and the service platforms running on top of them are adaptive and open, which in fact is far from being the case.

Infrastructure transformation ...

Traditional communication networks were created for the sale of minutes and bytes, and are not very suitable for the provision of new services, especially with the customization of parameters and ensuring the quality of service on an individual level. However, technologies and solutions have already appeared on the market that can help operators optimize their infrastructure for working in new conditions. Speech, first of all, is about technologies of software defined networks (SDN) and virtualization of network functions (NFV).

The concept of SDN involves the separation of traffic transfer functions from the functions of managing this process, including the configuration of network nodes and routing flows. This allows the use of relatively inexpensive "non-intelligent" switches, including bare-metal and / or white box products, which will significantly reduce the costs for operators to upgrade networks to support ever-growing traffic.

But even more importantly, the controller that oversees the operation of switches and other network “hardware” will quickly reconfigure the entire network to fulfill certain requirements from overlying applications or services. If we turn to the example above, the SDN network will provide an opportunity to promptly allocate an additional band for the user to view the video clip of high quality. Or, say, to allocate resources for a video conferencing session of top managers. And this is very important for corporate customers.

NFV technologies, in turn, allow you to implement various network functions and services using software modules (for example, virtual machines) that interact with the network through open software application interfaces (APIs).

For example, if earlier for the in-depth analysis (DPI) of the traffic flow, it was necessary to install special (and very expensive) hardware / software probes, then in the SDN / NFV network, it is enough to install the appropriate software (implementing the DPI functions). Network functions / services implemented by means of NFV can be linked in chains to provide personalized services to specific corporate customers and even individual users.

In general, by reducing the cost of network development, as well as reducing the time it takes to introduce new services, SDN / NFV technologies allow creating fundamentally new services in the mass and corporate markets. The introduction of these technologies helps to reduce the time of preparation for the launch of new products on the market. The minimum time-to-market is strictly obligatory in the face of growing competition: the range of offers must be rapidly expanded; and, if a new product has found its buyer, then it is already worth polishing the quality, and if the offer was a failure, you also need to quickly get rid of it. It is also important that, in the SDN / NFV network, you can set a manageable level of service quality - defined for a specific client, for a specific service.

There are a large number of fairly mature SDN and NFV solutions in the Russian market, including the development of domestic companies such as the Center for Applied Research of Computer Networks (CPICS) and Brain4Net. However, the introduction of these technologies is at the initial level, in most cases at the stage of experienced network segments.

Among the constraints are problems with the compatibility of solutions from various developers, as well as with the integration of new (SDN / NFV) solutions with legacy infrastructure. In addition, there is a shortage of qualified professionals who can implement and maintain new solutions. Finally, there is the problem of coordinating work within the project: for many operators, the IT department and the technical department of the communication network are separate blocks.

Rostelecom is implementing more activities in the SDN / NFV area. The company plans to upgrade the network infrastructure based on SDN and NFV until 2020. VimpelCom implements SDN / NFV as part of a test project on a fragment of the Russian network in order to automatically calculate, plan and provide additional capacities to customers. Tested and implemented a number of virtualized network functions (vIMS, vPCRF, etc.), as well as the concept of vEPC solutions. Similar operations are carried out by other operators.

... and increasing the efficiency of its use

If we talk about infrastructure, another important direction for operators is the desire to reduce the costs of its development and maintenance of networks. For example, Megafon and Vimpelcom have separated into a separate business unit a part of the network infrastructure - antenna-mast structures. In addition, companies together build LTE infrastructure in several Russian entities.

Improving the efficiency of the use of infrastructure is the implementation of MVNE (mobile virtual network enabler) projects, when cellular companies offer infrastructure, on the basis of which a virtual operator (MVNO) gets the opportunity to sell services under its brand. Such a model excludes capital expenditures on infrastructure from the virtual operator and gives it operator access to an audience with which, for some reason, the big players could not work, for example, to dissatisfied former subscribers.

Most active in the area of MVNO projects is Tele2. In particular, this operator has already launched such projects with Rostelecom, Sberbank and a number of other companies. Recently, at Mobile World Congress (MWC 2018) in Barcelona, China Mobile, one of the largest mobile operators in China, announced that it plans to create a virtual operator in Russia next year.

“Internet of Things” - IoT / M2M

If you go back to potential growth points, then, as follows from the above EY forecast, one of the fastest growing is the Internet of Things (IoT) segment - almost 18% growth per year.

According to IKS-Consulting, by 2020, the M2M / IoT market in Russia will grow to 26 million SIM-cards, of which less than 20% of devices will be used in the B2C segment (primarily in the consumer electronics segment, in “smart houses” and connected cars). And the majority of “smart” devices will be required by industry and the corporate sector, for example, transport companies that actively use navigation systems.

Unlike video, M2M / IoT solutions do not generate a large amount of traffic. Other characteristics are more important here: low traffic latency, long battery life for end devices, etc. — that traditional cellular communications technologies designed to serve people, not things, are not capable of providing. To effectively support IoT applications, new radio technologies and network architectures are needed. The concept of 5G is aimed at solving these problems. Thus, as part of the development of LTE, various modes are being developed for this, in particular, eMTC and NB-IoT.

Russian mobile operators are actively testing these new technologies. However, for success in the IoT market, in addition to the infrastructure component, it is important to create an ecosystem with developers of end devices, IoT software platforms and other players. For this, the openness of the infrastructure is important, which is ensured, among other things, by the SDN / NFV solutions discussed above.

Data Centers and Cloud Services

Another important area is the provision of services, including cloud, to corporate customers. Here, the potential growth is not so great (according to the forecast of EY, about 5.5% per year), but the market itself is huge. It is important that, acting as service providers and / or providers of cloud services, telecommunications companies are switching to a different business model of interaction with customers and partners.

It should be noted that Russian analysts predict a significant growth of the market of public clouds in the country. So, according to iKS-Consulting, for the period up to 2021 this growth will be about 20% per year.

Obviously, in order to participate in the division of the growing, like a yeast, cloud pie, operators need to develop cloud platforms, as well as invest in data centers. In fact, they need it to solve the problem of data storage in accordance with the requirements of the law of Spring.

And telecom actively went to the data center. Thus, Rostelecom acquired SafeData, which made it the leader of the Russian market for commercial data centers. The unified competence center “Rostelecom - Data Processing Centers”, RTK-DPC is a group of six companies, under whose management in Russia a total of 5268 racks with equipment in data processing centers with a total area of 46 thousand square meters. m

MegaFon bought Combell (60% of which is owned by Mastertel), a resident of Technopolis Moscow, where the construction of one of the largest data centers in Russia is being completed.

Among the data centers built by the LANIT group is one of the largest data center in Russia, VimpelCom in the Yaroslavl region. Its total area is 9.6 thousand square meters. m. Installed capacity - 12 MW. The modular design suggests the possibility of increasing the area and power, as well as quick dismantling and installation in another place. Innovative technologies are applied in the engineering support of the project. So, for cooling IT equipment, an active free cooling system was designed. This technology allows to drastically reduce energy consumption for creating the required climate regime in the server rooms of the data center.

It is obvious that in the near future we will witness further expansion of telecom operators in the data center and cloud services market. Perhaps some companies will try to take advantage of the available real estate objects, having converted them to data centers.

At the junction of telecom and IT

Russian telecom operators are trying to work more and more actively “at the junction of telecom and IT”. For example, in 2017, VimpelCom launched an application combining the functionality of an instant messenger and an aggregator of online services, and began to position itself as “a company specializing in digital technologies”. To consolidate the transformation in the minds of fellow citizens, the operator announced a change in the name of the holding to Veon . MegaFon has acquired a controlling stake in Mail.Ru in order to work actively with digital users. MTS bought NVision Group system integrator to develop its IT expertise ...

According to data published by RBC, Rostelecom’s strategy for 2018-2022 implies a “transition to a platform-based business model”, following the example of such companies as Amazon, Apple, Google, Alibaba, Facebook, AirBnB, Uber, etc. Speech It is about creating platforms that allow different types of customers and partners to interact using APIs. These are, in particular, platforms for smart homes, smart clothes, digital health care, the industrial Internet, drones, etc. Rostelecom’s strategy presupposes strengthening the company's presence in the IT services market in the conditions of the telecommunications market stagnation.

One of the “IT” areas actively developed by telecom operators is associated with big data. Telecom, a treasury of subscriber data, is moving from internal experiments with big data to the monetization of this asset. The operator can collect information about which programs were watched by customers using Internet TV, which sites they visited, which questions they drove into the search engine - in order to build analytics on this and offer it through data exchanges.

VimpelCom uses Big Data to predict and prevent outflows. The operator offers the developed models as a service - for example, for the financial sector. The Data Monetization Center of Rostelecom, opened in 2016, after pilot projects on outflows in banks, is reformatted to work with online advertising. Tele2 uses information about customer movements to open new points of sale in the places where traffic is greatest.

Another area is mobile finance : the development of our own banks, the issuance of payment cards, microloans, etc. MegaFon has launched its own payment card linked to a mobile number and its account. MTS develops its own bank. VimpelCom issues Beeline MasterCard cards that allow you to pay for purchases all over the world, accumulate bonuses and spend them on paying for communication services, receive discounts on partners' products, replenish and transfer funds without commission.

In general, digital transformation for telecom is not just a matter of increasing competitiveness, it is a matter of survival. And to solve it, it is extremely important to use IT expertise and experience available on the market.

Source: https://habr.com/ru/post/353870/

All Articles