IPO and $ 250 million: HeadHunter will be released on Nasdaq

HeadHunter plans to hold an IPO and raise $ 250 million. The organization has already filed documents with the US Securities and Exchange Commission (SEC) and plans to place American depositary receipts (ADR) on the Nasdaq stock exchange. Shares assigned ticker HHR.

The initial placement will be organized by Morgan Stanley, Goldman Sachs, Credit Suisse, BofA, Merrill Lynch, VTB Capital and Sberbank CIB. During the IPO, existing shareholders of HeadHunter - Highworld Investments Limited (a division of Elbrus Capital, owns 59.99999% of HeadHunter) and ELQ Investors VIII Limited (a division of Goldman Sachs Group Inc., owns 40%) - will place their American depositary receipts (ADS ). At the same time, the company will not receive profits from the IPO. The money will be transferred to the current owners.

')

The application for an IPO states that HeadHunter plans to develop its activities in cities with a population of less than 100 thousand people, as well as to increase the number of proposals for working specialties. In addition, management does not exclude the purchase of smaller recruiting Internet companies.

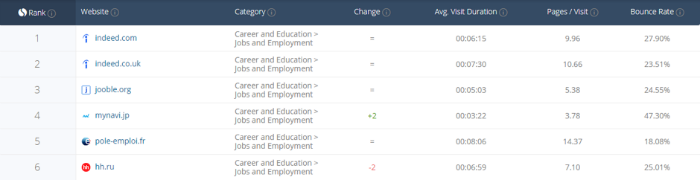

The company exists in the market since 2000 and is among the ten most popular job search services in the world according to the SimilarWeb platform.

In 2016, Elbrus Capital direct investment fund bought HeadHunter from Mail.Ru Group for 10 billion rubles, the asset valuation as part of an IPO is significantly higher than this amount. This is explained by the development of the company: 18 million users visit the site daily, and the database stores 33 million resumes. In addition, the company's revenue grows noticeably every year: in 2017, HeadHunter earned 4.7 billion rubles, which is 44% more than in 2016.

Analysts believe that, taking into account the development of the business and a decrease in the unemployment rate, the asset valuation in the framework of an IPO may be significantly higher than the amount for which Elbrus Capital bought HeadHunter from Mail.Ru Group.

Other materials on finance and stock market from ITI Capital :

- ITI Capital Educational Resources

- Analytics and market reviews

- How the use of the word “blockchain” allows companies to increase capitalization

- How will be organized trading in Bitcoin futures on the Chicago Stock Exchange

- What to do on holidays: write robots for trading on the exchange in the scripting language TradeScript

- Where it is more profitable to buy currency: banks vs exchange

Source: https://habr.com/ru/post/353518/

All Articles