Sberbank Business Online on Windows 10 - a new solution for customers, or why UWP applications are driving

Sberbank Business Online - 2017

Sberbank Business Online (SBBOL) is a family of solutions that provide banking services to legal entities - customers of Sberbank.

Almost two million customers, fault tolerance at the level of no more than 15 minutes of downtime per year, the need for perfect implementation of regulatory changes, a serious number of rules limiting from a security point of view are all SBBLs.

')

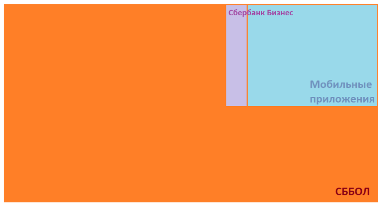

The SBBOL family consists of the following solutions:

- Sberbank Business Online - a web version, in two interfaces: the old and the new, which has already received prestigious design awards.

- There is an almost complete set of all banking products in SBBOL; most of the bank's clients are served here. Any browsers are supported.

- Sberbank Business is a “fat” client bank that has a database on the client side, designed to work with enterprises (but not only). A feature of the solution is support for various operating systems. This is where the most complex functionality, work with packs, and integration with client's ERP systems are presented.

- Mobile applications SBBOL - Android, iOS, Apple Watch, Android Wear, Windows Mobile. Their distribution is carried out through app stores.

- The functionality of the bank’s mobile solutions is limited primarily by security requirements and device screen sizes.

The channel coverage of clients is as follows (see fig.):

- SBBOL - 99%

- Mobile applications - 20%

- SBB - 3%

Thus, bank customers use SBBOL for full functionality. For quick access - mobile versions. For conservatives requiring stationary implementations, using specific products, or working under a firewall on the Linux system, the SBS.

- And Sberbank's clients can directly unload payments through the 1C-direct, seamlessly connect and work with external services through the Fintech-API, etc.

So, we have a titan that can do everything, a combine that can do almost everything, and access points that are compact in size and capabilities. But…

However, the majority of clients work on the web version, have 1-2 accounts, 1-2 users and use a couple of products from strength. They would simplify the interface, make access to any product in one click, and even teach the system to securely provide data before login. In general, to make a “light” shell for 90% of tasks for 90% of clients, leaving 10% for “big” solutions. Used quarterly.

Of course, our team is capable of this challenge. And what if you implement this idea on a completely new channel, be “Ilonmask”? Then such a channel should be not only new, but also popular, not only innovative, but also cheap in development. And so…

New boundaries - Windows 10

In 2015, Microsoft, rethinking the benefits of Windows XP / 7, examining reviews on Windows 8.1, released Windows 10. An important change was announced, a new look at the "classics" of desktop operating systems: now there will be only one OS - Windows

Desktop PCs, server solutions, IoT, XBox, mixed reality, the “forever” expected Surface Phone - all these devices will be under the same OS, with add. components from OEM suppliers. “Now,” of course, will last for several years, but even before this date, MS constantly unified its operating systems, implementing “single engine” technologies for any device.

Desktop PCs, server solutions, IoT, XBox, mixed reality, the “forever” expected Surface Phone - all these devices will be under the same OS, with add. components from OEM suppliers. “Now,” of course, will last for several years, but even before this date, MS constantly unified its operating systems, implementing “single engine” technologies for any device.

The Windows 10 platform for building applications in the Universal Windows Platform leads to the common denominator of application development. No matter, x64, x86, X-Box, ARM, ARM64 - there is a single platform for all systems. C ++, C # (our development team works on it), XAML and .NET, and lots of other languages are supported here.

UWP maintains application interface uniformity regardless of the device on which the application is launched. The size of the window, the controls when changing the work devices may vary, but at first glance it will be clear to the user that he remained working in the same application.

Exit Windows 10 to the leading positions

The released Windows 10 was greeted as usual - with skepticism and antipathy. Work was also done to promote Windows 8, WinRT was “trimmed” in its mind, and the G-7 worked stably. But year after year, release after release, the new OS is gaining momentum. Considerable support for the growth in the number of installations was provided by a free upgrade of old OS

In December 2017, Windows 10 finally became the most popular OS - so far in Europe.

In our country, the “dozen” remains in second place, but with each major update the number of customers working on this system is growing sharply. Judging by the open statistics, the “ten” will be the first already this year. In retail networks, Windows 10 is already preinstalled on every second device (excluding smartphones).

Pioneer of innovation

When we talk about innovations in the field of operating systems and IT giants, it is not Microsoft that comes to mind first, but Android or Apple. In this case, so-called royalties, patent payments of one such giant to another. Globalization is evident, but small-scale ones seem to be losing ...

Indeed, although Microsoft has many great solutions, their final implementation is often lame. The richest hired manager in the world, Steven Anthony Ballmer, who led MS for 14 years, focused on the main income generators - Windows and Office. So iOS and Android began to dominate the market.

The world has changed, and now Microsoft is catching up with it: the division developing Windows has been optimized into a single Experiences & Devices. The company’s plans have never been to simply “be on the market,” but there was always leadership. It is in this direction that the company works, and the market welcomes the latest news - Microsoft shares are growing. So, soon, Windows 10 will even more penetrate into everyday life, combining workplaces with IoT, adding augmented reality. And the XBox has already been added, it’s lucky.

Feats

Prefixes and virtuality are good. But far from the end consumer of banking services for businesses.

However, there is a mass of "close" to a simple accountant of features that penetrate the new operating system. Our team pays attention to them when planning product development.

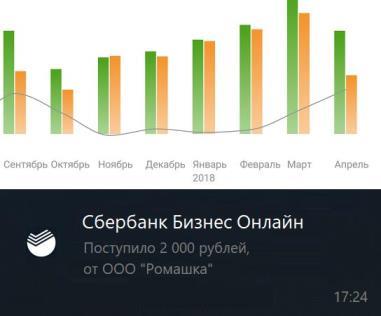

Live tiles, "Live tiles" - a great mechanism for displaying information to the client without / before running the application. Remind about the date of payment of the loan? Get extra interest on the deposit provided by Sberbank during the renewal? Learn about rebalancing? Easily.

In addition to "live tiles", this task is also perfectly performed by the notification center - now Push'i can also be sent to a PC. Toast-notifications can send a schedule of income, request the need to enter the application, notify about the transfer of funds, badge-notifications will display the news with a counter on the icon.

Even more new "chips" in the operating system added the latest Fall Creators Update.

Fall Creators Update

The main releases of Windows 10 are called Fall and Spring Creators Updates: the name contains the direction of updates according to developers and customers. Each such update significantly increases the penetration of the OS, and deservedly so.

Fluent design

Used even with Vista, the Windows Aero interface loaded the video card, “consumed” resources, reduced the interface settings. Metro UI (Windows 8), and now Fluent Design, significantly improved the visual quality of applications. The first to go was UI XBox, the development of applications for desktop solutions followed it.

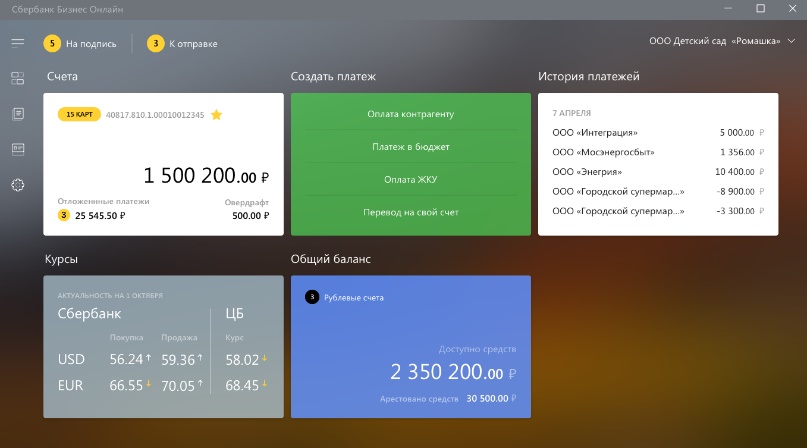

Sberbank Business Online in the new version looks amazing. Now the background of the application can have an “acrylic” effect - the lower layers will appear through it, and the layer itself will look like a “real” material. The buttons have become more elegant with the effect of “reveal” - when the button is highlighted when you hover the cursor, and the appearance of the adjacent buttons also changes. All this adds elegance and uniformity.

One of the "chips" release of the last Fall Creators Update 2017 was the contacts of the Microsoft account. In order for an iOS / Android smartphone user to be able to synchronize their contacts with an account on a PC, several actions will be required - and then a new contact will appear on the PC within an hour. I independently tried to synchronize contacts from Google and Microsoft accounts, and it took me three minutes of work and half an hour of waiting at the stated hour. Now the UWP application can send information directly to the contact book.

Simplify implementation. Controls

The new OS is very conveniently presented development capabilities. Interface uniformity comes from a common approach to controls. Radio buttons, scroll bars, menu lists - everything already has an adaptive layout, just do it.

Standard control UWP: Hub control / pattern

The development and maintenance process is much cheaper than on the web.

Pwa

Before unambiguously choosing UWP, as the mainstream, we studied the next options.

The same giants that were mentioned in the article promote Progress Web Apps as an alternative to store applications. However, this technology is currently at the beginning of its journey. Such solutions, although they look like full-fledged applications, have many limitations: from the ban on NFC to other issues, primarily related to client security. However, technologies such as GPS, access to offline data, notifications and face recognition are already added to PWA solutions, so we will definitely monitor their development.

Windows Hello

Sberbank would not have been a reliable bank if it had not been the leader in research and the introduction of advanced security technologies.

Windows Hello is a biometric authentication service built into Windows. In normal devices, Hello will not be useful. If there is a fingerprint scanner, the user can already enter with a finger. On the latest laptops there are cameras that support Intel RealSense technology, with an IR laser and an IR depth sensor.

Camera technologies will sooner or later revolutionize the management of interfaces by canceling the keyboards required for entering information, adding a glance or “smart” gloves as information input tools.

Now with such cameras biometry works Widows Hello. She recognizes the user by the contour of the face (eyes, eyebrows, nose - plus or minus 10 cm from the nose).

Our application was the first release in the Russian Federation among business applications with support for biometric authentication at a glance, and one of the first in the world.

It was impossible not to pay attention to such a platform as UWP, following the principles of multi-channel and omni-channel.

Decision on the development of the application in Sberbank CB

Potential audience

Almost 30% of Sberbank's clients among legal entities are working on Windows 10. Half a million “Yurikov” is weighty. About 300-350 thousand of them are small businesses that work with one account and have one or two users.

There is a very powerful, modern “engine” - Windows 10 OS, with low development cost, fairly low entry cost, with lots of innovation and user-friendly design. There are most devices on this OS, and it is obvious that there will only be more. There are plenty of ULs running on Windows 10, and there is a great opportunity to make an application that covers customer needs. What kind? A lightweight version of the web version, at the same time devoid of problems with debugging for various browsers and able to work with the client, give the client information even before login.

And we have a "new fashion" channel - UWP.

The site holds the client, and the RBS should be invisible

When developing a

Changing yourself is always difficult. Remote banking service (RBS), bank-client live very differently.

The less time a bank customer spends in the RBS, performing the necessary tasks, the better. After all, DBO is “only” transportation.

In life, the best transport to move from point A to point B will be teleportation. So, we have to make such a client bank, in which the client performs his tasks quickly, does not stand in traffic jams and succeeds everywhere.

Pre-authorization zone

How can I speed up the flow of bank services for a client? Provide them before running the bank client.

In Windows 10, as in mobile OS, there are push notifications (as I said earlier). There are several types of them, besides those already described toast and badge , it is worth noting raw or "raw" notifications - they provide only information without the ability to add pictures or rework the UI - and allow you to run tasks in the background. Along with the "live tiles" application already informs customers about the dates of payments on the loan, crediting funds to the account.

In general, while maintaining the required level of security, the pre-authorization zone of the application is an important element of the RBS working environment. And the UWP platform provides good opportunities for the development of services, improving UX in the pre-authorization zone.

Focusing on the main

Customer portrait

To understand the “basic” functionality that will be included in the application, we needed to create a client profile. This profile describes which products the client uses, how often it pays, how many users and accounts it has.

Creating such a client-side portrait, we studied statistics on Sberbank customers with a DBO contract, focusing on the majority number from Pareto’s law - 80%. It turned out that our clients are legal entities with one to three accounts and up to three users.

Products in the app

With the products was carried out similar work. However, albeit with small, but important clarifications. In the RBS system, it is not enough just to implement popular banking products; here you need to create a service. It should be convenient and fully cover the main task implemented by users - calculations with counterparties and the provision of data for account management. That is why, in particular, our first "big" implementation included the exchange of data with 1C - so that clients could work in their system, work with statements, exchange information on payments and statements with their contacts.

"We would just pay"

Payments and statements are 90% of success for the bank client.

In shipping, there is a rule in the exam on navigation lights - tell me which way the bow of the ship is pointing and the ship is standing or sailing - and this is at least a "four". Because the tow or barge, it does not matter, the main thing is to disperse without an accident. The rule is good, and our product team follows it - we simplify the visual forms of documents, create convenient menus, allow you to quickly and easily transfer information about payments through all popular channels, add useful services that create a qualitatively new customer experience.

For example, we have integrated the service of checking counterparties for financial and judicial reliability. During the creation of the payment, the counterparty's icon appears as a “traffic light”, when you click on it, you can see if the client is reliable, or if it has non-payment, arrest, or arbitration. Then you can follow the link to a specialized website and see all the detailed information on this law. to a person - from won (and not only) arbitration cases to affiliates and main owners.

And this giant in terms of services, infrastructure and integration option is hidden behind a small icon, next to the counterparty.

Seven products

Let's return to the products. The application implements a salary project, loans - these products were in the main focus. In addition to them, deposits, business cards, self-collection have been introduced or are being introduced, and other products will appear later. At the same time, the design of the application remains neat: for example, deposits “dissolve” in the accounts, and a separate section of the same name has been created to manage applications for connecting any product or service.

Half a minute to pay

While the time to make a payment in the application - from the moment of clicking on the icon to the pop-up window “payment sent to the bank” - we managed to reduce to one minute. All tasks can be started from the corresponding section or from the Dashboard. We try to maintain an approach in which one entry point is not enough, and three is already a bust.

And the task of our team is to make the client able to send a payment through the application in 30 seconds. Only 4.5 times slower than Usain Bolt.

Underwater rocks

All strong ideas have weaknesses. UWP allows you to create lightweight visual solutions:

- not demanding a lot of resources (Windows Phone fans remember that on all Lumia all applications worked without brakes, Windows 10 inherited this trait);

- not requiring huge investments in development;

- easily customizable;

- fast - faster than browser counterparts (it is not known when Progress Web Apps will become as stable and functional);

- secure (installed in protected directories, so even the sysadmin does not have access to these directories).

But ... there are several "but."

Too new

Our application - a new look at the "bank-client" - has an additional obstacle - novelty. Accountants and directors of enterprises and organizations, IP and LLC are accustomed either to Internet banking, or to the “fat” client bank, from the database being installed from the disk received in the bank. And in any of these cases, we look like a duplicate, backup use case. Many innovations, used or potential, “slightly” overtake the present, current customer habits.

True, this minus can be turned into a plus.

“Dislike” for MS Store

PC users do not have the habit of installing apps from a store, like on smartphones. Neither Microsoft nor Apple have made tangible progress in instilling attitudes towards stores in their users as a means of distribution. After all, for decades, customers have been quietly downloading applications directly from developer sites. Plus, Microsoft Store allows you to download the application only to users with a Live ID authorized in the store. That is, the owner of the service does everything to ensure that the service is not popular. Laughter through tears.

A little dream

Great hopes are seen in the Internet of Things and Augmented Reality.

Unlink communications with the bank, with your account from a particular device, and make the client work with his account and financial instruments without any technological limitations at all - sounds cool.

And if you make the "smart" sensor-beacon receive the signal to any refrigerator or refrigerator and transmit the authorization data to the server, and then the client input the payment by voice?

Hey, Cortana, when will you speak Russian, catching up with Siri and Google Assistant?

"Cloud" technology now allows you to implement something similar. Only this is unprofitable from the point of view of development. It should be measured seven times. But it is time to start “measuring out”, just yesterday it was time - because technologies do not stand still, and competitors are already exploring the possibilities of new technologies.

The combination of virtual and real world is inevitable. Already in 2016, Citi is conducting a Mixed Reality trading pilot, aiming at creating a full-fledged MR-based workstation (in the photo). In turn, BNP Paribas and Santander regularly hold various events and VR / AR idea contests.

According to Goldman Sachs, by 2025 the market size of MR / AR / VR could reach $ 110 billion. Digi Capital estimates the market at $ 150 billion by 2020, where the share of AR / MR will be $ 120 billion. .

Although today classical solutions for banking performed in various types of virtual reality have not been implemented, the market for such solutions is in a state of “low start”. With the very first successfully implemented idea, the market will “run.”

What are the forecasts for the actual use of such a channel? First is the analytics. A fundamentally new way of providing information allows you to provide analytical materials in a completely new way.

Secondly, communication: with the help of augmented reality, it will be possible to collect all decision-makers in one place, in front of the SBBALL dashboard, to make key decisions and sign important documents. Remember the holos in Star Wars? Even such simple things as recognition of accounts and automatic creation of payment documents look different in the context of augmented reality.

New technologies require close attention and detailed study. While observing control over costs and safety requirements, the creation of products based on these technologies is a prerequisite for maintaining the leading position in the competitive race.

Forecast

It turned out beautiful, but difficult picture.

Indeed, our “bicycle” looks very good, its potential is enormous. But there are a lot of questions before us, before other developers, who decided to make a new RBS channel and support omnichannel-principles:

- Will bank customers working on Windows 10 be able to do everything with licensed OS installations under their own accounts?

- It should be noted here that, of course, we are really studying the possibility of installing the application not from the store, but through - and here we have foreseen! - sideloading technology.

- Will customers leave their familiar web interface?

- Can Microsoft keep the bar, will it keep one OS for all devices?

- Will new devices and new form factors conquer our life?

For our part, we will do our best to promote our favorite application.

Invisible Bank

Augmented reality and biometrics. The pre-authorization zone is a bank on a PC without unnecessary actions, actually built into the OS, imperceptible, very fast, efficient.

Less than a minute to pay. A couple of clicks to send a document to your contacts, directly from the bank client.

Customer friendly, implemented on UWP under Windows 10 Sberbank Business Online. So far the only innovative bank in Russia for legal entities.

The update follows ...

Source: https://habr.com/ru/post/353118/

All Articles