Briefly about the formats of fiscal documents: shoals version 1.0 and the transition to version 1.05 and 1.1

So, we continue to talk about the FZ-54 and online ticket offices. Entrepreneurs who are waiting for the second wave of automation, it will be useful to learn about the requirements for the design of the cash voucher, what information they should contain, and how it relates to fiscal drives of different versions. In this article we will tell you more about the formats of fiscal documents (FFD), the nuances of the transition from version to version and the pitfalls of registration and transfer of data on cash transactions in the CRF.

In the last article, we talked about what a fiscal drive is and what the numbers 1.0, 1.05 and 1.1 mean in its description.

Numbers denote fiscal document format versions (FFDs).

')

Before we delve into the topic of FFD, we denote the terminology:

The format of fiscal documents is a set of requisites established by law for the exchange of data on fiscal operations. Since there are several participants in such an exchange ( online cash desk of an entrepreneur, CRF, FTS), the information should be transmitted in a single format.

The online cash registers are millions, and in order for the necessary data from CCP to go to the tax authorities via the Internet, there are CRFs - state-accredited organizations that provide services for connecting online cash desks to their data centers, encrypt these data, organize and transfer to the tax authorities im a format. Conclusion of a contract with the CRF is mandatory for an entrepreneur using cash registers.

Federal Tax Service of the Russian Federation (FTS of Russia) - federal executive body (more)

So, now in more detail about FFD, and that it is important to know the businessman.

At the moment there are three versions of FFD: 1.0, 1.05, 1.1. ( Order No. -7-20 / 229 @ of 03/21/2017 )

FFD determines the composition, format and order of details that should be displayed in all fiscal documents (cash receipt, electronic check, BSO, report on the opening / closing of the shift, report on registration, etc.)

Versions of FFD differ among themselves in a set of mandatory details of fiscal documents.

FFD 1.0 - supported by all online cash registers that are in the registry. This is the very first format of fiscal data that came out at the start of federal law No. 54 on the mandatory transfer to online cash registers with fiscal drives.

Those who got into the first wave of FZ-54 and bought a box office with FN 1.0, we think, remembered a lot of amazing synonyms for the word “unfinished”. From the "lucky" required considerable ingenuity for the correct registration of operations. The set of requisites that is in 1.0 is not complete and it cannot provide some of the standards described in FZ-54.

For example, the requisite “Place of settlement”, which, according to the law, should be printed on the check depending on the actual location of this cash desk, could not be changed and the address indicated at check-in desk was always printed.

Such operations as payment "Advance", "Credit" was not provided at all, well, apparently forgotten. Manufacturers of various cash register software, excelled as they could, someone “Advance” spent as a sale of “Gift cards”, someone else came up with some options, but the accounting of enterprises from this was in shock, because tax processing on advance and gift cards are different. We encountered this problem when we were engaged in the development of DM.Mobile trade , including the Federal Law-54.

If for a retail store that sells goods at a stationary checkout, there are almost no problems with 1.0, then we, as software developers for courier delivery , are faced with a lot of problems. And this is not only a "place of settlement" which should be the delivery address where the courier brought the goods and counts the buyer, but also for example "agency sales".

It is no secret that many online stores use someone else's courier service, and for FZ-54 there should be no checks punched in advance. It turns out the courier from another organization punches a check at "his" box office, delivering goods online store. There is an agency agreement for this, so that the courier service does not pay income taxes for the “online store”. Such sales should be displayed in the check as "agent", and in the check must be the details of the supplier of goods, i.e. online store. The same story was with commission goods. All this is already taken into account in FFD 1.05.

As for the report on the closure of the shift and the amount of cash proceeds, which was previously reported in the Z-report when using EKLZ, in version 1.0 this was also not provided, this possibility appears only in version 1.1.

In order to switch from 1.0 to 1.05, an entrepreneur needs to reflash the cashier for firmware supporting FFD 1.05 without replacing the fiscal drive. To switch to FFD 1.1, in addition to the firmware of the device, it is necessary to replace the fiscal drive itself with a drive with the new version 1.1.

Format 1.0 officially works only until 01/01/2019, then everyone should switch to at least 1.05. When there will be a mandatory transition from 1.05 to 1.1 is not yet known. But it would be logical to assume that the new FNs will be sold already with the format 1.1 and gradually all cash registers, with the planned replacement of the FN, will switch to the format 1.1.

The following details appear in the 1.05 and 1.1 formats:

other.

Before moving from version to version, first make sure that all fiscal documents of the old version have been sent to the CRF. This can be done by printing a report on the current status of calculations, which will indicate the date of the first document not transmitted to the CRF, as well as their total number.

If you have an autonomous cash desk, then you just need to reflash it.

If we are talking about a fiscal registrar that works as part of a software front office (that is, it is connected and controlled by some kind of cash program from a PC), then the scheme becomes more complicated:

For businessmen who bought and use the cash desk with FN 1.0, it is important to know that even if the FN term is ordered later than 01/01/2019, they need to install an FN of version 1.05 or 1.1 before that date, regardless of the end of the FN 1.0 term.

Entrepreneurs of the second wave of the Federal Law-54, which will have to be automated from scratch, we advise to do this with the expectation. There is still a lot of legislative initiatives on the through accounting of commodity and cash flows, so you can already think about trading software and bar code equipment , i.e. about complex automation of your business.

In the last article, we talked about what a fiscal drive is and what the numbers 1.0, 1.05 and 1.1 mean in its description.

Numbers denote fiscal document format versions (FFDs).

')

Before we delve into the topic of FFD, we denote the terminology:

What is FFD

The format of fiscal documents is a set of requisites established by law for the exchange of data on fiscal operations. Since there are several participants in such an exchange ( online cash desk of an entrepreneur, CRF, FTS), the information should be transmitted in a single format.

What is OFD

The online cash registers are millions, and in order for the necessary data from CCP to go to the tax authorities via the Internet, there are CRFs - state-accredited organizations that provide services for connecting online cash desks to their data centers, encrypt these data, organize and transfer to the tax authorities im a format. Conclusion of a contract with the CRF is mandatory for an entrepreneur using cash registers.

What is the FTS

Federal Tax Service of the Russian Federation (FTS of Russia) - federal executive body (more)

So, now in more detail about FFD, and that it is important to know the businessman.

FFD Versions

At the moment there are three versions of FFD: 1.0, 1.05, 1.1. ( Order No. -7-20 / 229 @ of 03/21/2017 )

FFD determines the composition, format and order of details that should be displayed in all fiscal documents (cash receipt, electronic check, BSO, report on the opening / closing of the shift, report on registration, etc.)

Versions of FFD differ among themselves in a set of mandatory details of fiscal documents.

FFD 1.0 - supported by all online cash registers that are in the registry. This is the very first format of fiscal data that came out at the start of federal law No. 54 on the mandatory transfer to online cash registers with fiscal drives.

Those who got into the first wave of FZ-54 and bought a box office with FN 1.0, we think, remembered a lot of amazing synonyms for the word “unfinished”. From the "lucky" required considerable ingenuity for the correct registration of operations. The set of requisites that is in 1.0 is not complete and it cannot provide some of the standards described in FZ-54.

For example, the requisite “Place of settlement”, which, according to the law, should be printed on the check depending on the actual location of this cash desk, could not be changed and the address indicated at check-in desk was always printed.

Such operations as payment "Advance", "Credit" was not provided at all, well, apparently forgotten. Manufacturers of various cash register software, excelled as they could, someone “Advance” spent as a sale of “Gift cards”, someone else came up with some options, but the accounting of enterprises from this was in shock, because tax processing on advance and gift cards are different. We encountered this problem when we were engaged in the development of DM.Mobile trade , including the Federal Law-54.

Life example:And only in the process of already existing new rules, legislators began to think about the nuances of the trade and service business and introduce FFD 1.1. This is a difficult matter (how this business works there - this is a dark matter), and this time they decided not to hurry - they released FFD 1.05 as an intermediate format, where the main outright jambs of the first version were fixed.

Let's say you make custom furniture. For manufacturing services, you must take an advance from a client and punch a check, because you have accepted cash. And after the provision of services and the supply of furniture to the client, you must also punch a receipt for the remaining amount of payment. With FN 1.0, this is not possible. You can only give the client a receipt for the advance payment, but this will be against the law. In fact, with FN 1.0 you do not have the right to accept a partial prepayment in cash as an advance.

If for a retail store that sells goods at a stationary checkout, there are almost no problems with 1.0, then we, as software developers for courier delivery , are faced with a lot of problems. And this is not only a "place of settlement" which should be the delivery address where the courier brought the goods and counts the buyer, but also for example "agency sales".

It is no secret that many online stores use someone else's courier service, and for FZ-54 there should be no checks punched in advance. It turns out the courier from another organization punches a check at "his" box office, delivering goods online store. There is an agency agreement for this, so that the courier service does not pay income taxes for the “online store”. Such sales should be displayed in the check as "agent", and in the check must be the details of the supplier of goods, i.e. online store. The same story was with commission goods. All this is already taken into account in FFD 1.05.

As for the report on the closure of the shift and the amount of cash proceeds, which was previously reported in the Z-report when using EKLZ, in version 1.0 this was also not provided, this possibility appears only in version 1.1.

Upgrading from version 1.0 to version 1.05 and 1.1

In order to switch from 1.0 to 1.05, an entrepreneur needs to reflash the cashier for firmware supporting FFD 1.05 without replacing the fiscal drive. To switch to FFD 1.1, in addition to the firmware of the device, it is necessary to replace the fiscal drive itself with a drive with the new version 1.1.

Format 1.0 officially works only until 01/01/2019, then everyone should switch to at least 1.05. When there will be a mandatory transition from 1.05 to 1.1 is not yet known. But it would be logical to assume that the new FNs will be sold already with the format 1.1 and gradually all cash registers, with the planned replacement of the FN, will switch to the format 1.1.

The following details appear in the 1.05 and 1.1 formats:

- Sign of the method of payment (Prepayment 100%, Advance payment, Partial settlement and credit, Transfer on credit, Payment of credit, Full settlement)

- Data on agents, in case of work under an agency agreement

- The subject of the calculation (just a product, excisable goods, work, services, rate of the game, winnings, payment, payment, etc.)

- VAT amount for the calculation subject

- Place of calculation

- Email sender check

- personal cashier inn

other.

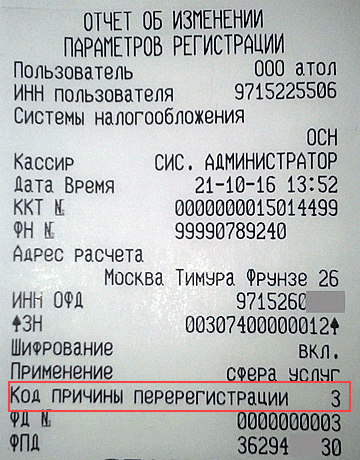

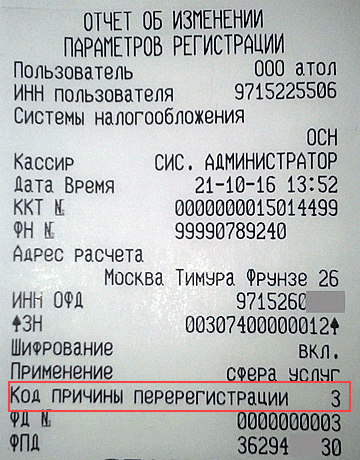

How to switch from version 1.0 to 1.05

Before moving from version to version, first make sure that all fiscal documents of the old version have been sent to the CRF. This can be done by printing a report on the current status of calculations, which will indicate the date of the first document not transmitted to the CRF, as well as their total number.

If you have an autonomous cash desk, then you just need to reflash it.

If we are talking about a fiscal registrar that works as part of a software front office (that is, it is connected and controlled by some kind of cash program from a PC), then the scheme becomes more complicated:

- it is necessary to clarify whether this particular cash desk and this particular software support working with the format of fiscal documents of version 1.05

- if yes, if necessary, update the software version

- further update the firmware at the checkout

- and then generate a “report on the change in the CCP registration parameters” due to a change in the settings on hand (code 4).

In custody

For businessmen who bought and use the cash desk with FN 1.0, it is important to know that even if the FN term is ordered later than 01/01/2019, they need to install an FN of version 1.05 or 1.1 before that date, regardless of the end of the FN 1.0 term.

Entrepreneurs of the second wave of the Federal Law-54, which will have to be automated from scratch, we advise to do this with the expectation. There is still a lot of legislative initiatives on the through accounting of commodity and cash flows, so you can already think about trading software and bar code equipment , i.e. about complex automation of your business.

Source: https://habr.com/ru/post/353046/

All Articles