The second wave of FZ-54: the pitfalls of online fiscalization

From July 1, 2018, entrepreneurs will face a second wave of mandatory cash automation due to changes in federal law No. 54. About who will have to climb on its crest, how to understand the financial and technical nuances, what to look for when choosing an online ticket office, we will tell in this article.

Last year, the first wave of mandatory replacement of cash registers was held due to changes in federal law No. 54 . Representatives of large and medium retail should have been the first to go to the online cash registers. But from July 1, 2018, a second wave of transition to work on 54-FZ is coming. Online ticketing will have to apply to small retailers, entrepreneurs who work on a patent and UTII. And if large retail was already familiar with the cash automation, but it also experienced considerable difficulties during the transition, many patents and ENVD have never used fiscal cash registers at all.

So, what entrepreneurs, starting to automate their business from scratch, need to know.

')

Representatives of the microbusiness, especially on the periphery of our Motherland, are now actively complaining about the lack of finance and technical capabilities to modernize their business. In this regard, the state planned to compensate the cost of automation in the amount of 18 thousand rubles ( Federal Law of 27.11.2017 No. 349- “On Amendments to Part Two of the Tax Code of the Russian Federation” ).

It is assumed that this money should be enough for the most simple online CCV and fiscal storage. And nothing more is needed. Let's see if this is so.

To begin with, we will make a reservation that compensation is made by tax deduction. Tax deduction is provided for not more than 18 000 rubles for each copy of the cash desk. Credits include:

In accordance with the updated 54-FZ, a business that previously used cash registers should use a new-style cash register with a fiscal storage (FN).

The cost of the online ticket office with the correct version of the FN now starts at about 14,700 rubles (for example, we took Njager ATOL 91F ).

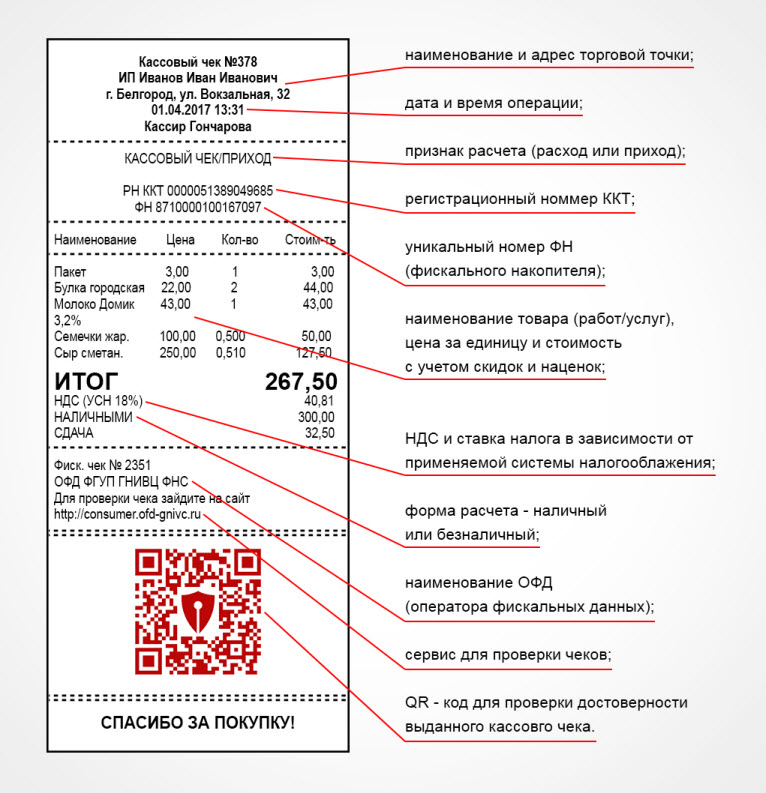

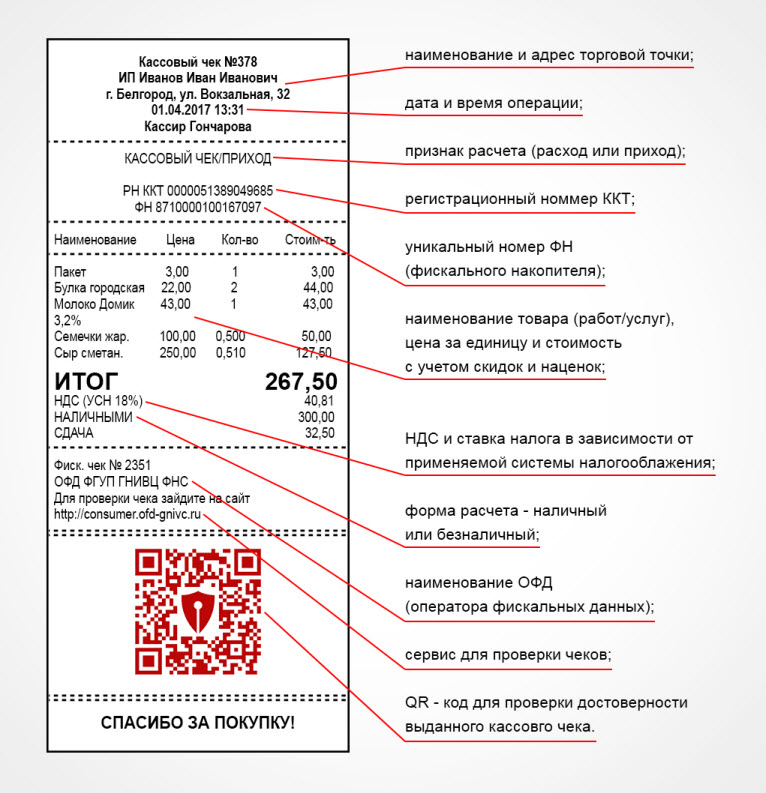

With the help of online cash registers, it is necessary to generate electronic checks and send them in real time to the tax office through an authorized fiscal data operator (CRF).

Service OFD, of course, is not free. The entrepreneur must conclude a binding contract with an operator, the cost of which is about 3000 rubles per year.

We go further.

Cashier new model for good reason called online cash registers. In accordance with the requirements of the amended 54-FZ, an electronic check (ECH) should be generated at the time of purchase of the goods and sent in real time to the OFD system and (upon request) to the buyer via e-mail or mobile phone. And this means that the entrepreneur must resolve the issue of stable wireless communications at the place of use of the CCP .

And if earlier the entrepreneur did not feel such a need and there was no Internet access at the outlet, now he will have to organize such access. And these are additional expenses, moreover they are no longer subject to tax compensation.

Now about the issue of automation software based on online cash registers. If we have to automate from scratch, it makes sense to do it competently and with the ability to scale the system. Now the choice of such software products and services is very large, and the price range of a more or less reasonable system is from 1,000 rubles. per month for cloud services, up to tens of thousands of rubles for full-fledged cash programs for a local server. But in this article we are not even talking about the need for such software, but about the tax deduction that we already had at the stage of buying the cash desk with the FN and the annual contract with the CRF, so we’ll stop here.

If you look at the online cash registers, as they are presented in the price lists, you will see in the title an indication of the presence of a fiscal drive (FN / without FN), the version of the fiscal data and the number of months of use of this drive (for example, KTK ATOL 50F. Dark gray FN 1.1. 36 months ). Explain what this means.

Fiscal storage (FN) - this is the necessary thing to comply with the cash register new law. This device is used to encrypt and protect fiscal data, i.e. information about each cash transaction. For a long time there is a requirement to record and store fiscal data in unchangeable form, for this purpose electronic cash tapes of protection (EKLZ) were used. Now it is still necessary to transfer these data to the CRF, which in turn transfers them to the tax office - and this is already within the power of our little friend, the fiscal accumulator, who replaced the old woman EKLZ.

FNs are of two types in terms of validity: for 13/15 months. (depends on the mode of use and availability of excisable goods) and for 36 months.

And three types of fiscal data format: 1.0, 1.05, 1.1.

The format of fiscal data (FFD) is an approved by law algorithm, according to which various details (reflecting the content of a cash operation performed on the device) are placed on the fiscal document generated by the online cash desk. Fiscal data formats are designed to ensure that all participants in the exchange of information on fiscal operations do this in a single format.

I must say that the conversation about these formats, and how raw the first version 1.0 was at the time the law was released, is the whole story. Even after a year and the launch of the new version of FN 1.1, the business (and we , the software players) still have a lot of questions. The still is the crony of the decision and the isolation of the lawmakers and regulators from the reality of the business. But this is a topic for a separate article.

Here we briefly focus on the main thing. So, now there are three types of FNov, and they have a different term of use permitted by the state:

In conclusion, I would like to note that the potential of the Russian online cash desk market, which, in accordance with the law, will have to issue electronic checks, was estimated in 2017 at 1.3-1.5 million units (according to open sources, in fact, in the first wave FZ-54 was modernized only 1.0 million cash registers). We and our business colleagues, KKT sellers and automators, still remember the hysteria and shortage of the first wave that the market faced (when FNYs worth 7-8 thousand rubles were sold on Avito at 50 thousand rubles and other horrors).

According to analytical estimates, in 2018, up to 3.5 million online booking offices will be commissioned. And here we just keep silent.

The main and main recommendation to entrepreneurs - do not wait until the last moment! It is not worthwhile to engage in discussions on the topic “how hard the life of a businessman is” or hope “perhaps it will blow it over”. Will not carry. This is legal inevitability, and the penalties are extremely cruel. Even if the government relaxes businesses at the time of peak loads of the re-automatization of the market, as it was in the first wave due to the deficit (they allowed to postpone the implementation, if they already had an agreement on the delivery of CCP), in any case year

Already, you need to choose a solution for automation. Purchase cash from FN. When buying an online cash register, you should definitely pay attention to the FNa model, more precisely, the version of the fiscal data format (FFD).

It is difficult to predict how much the procedure for obtaining a tax deduction will be. At the moment, we can only say that there is a Letter of the Federal Tax Service dated February 20, 2017 No. CD-4-3 / 3375 on the procedure for obtaining a deduction for UTII.

At the moment, the current form of the tax return does not provide for the receipt of a deduction for CCP, and a new tax return form is being developed (the planned date of entry is April 2018).

We sincerely wish our Russian business, seafarers, not to drown in the tsunami of global re-automation, to have time to solve this issue for their enterprise, because a wave of introduction of the law will be followed by an equally large wave of control and sanctions. Be prepared, automate correctly.

Last year, the first wave of mandatory replacement of cash registers was held due to changes in federal law No. 54 . Representatives of large and medium retail should have been the first to go to the online cash registers. But from July 1, 2018, a second wave of transition to work on 54-FZ is coming. Online ticketing will have to apply to small retailers, entrepreneurs who work on a patent and UTII. And if large retail was already familiar with the cash automation, but it also experienced considerable difficulties during the transition, many patents and ENVD have never used fiscal cash registers at all.

So, what entrepreneurs, starting to automate their business from scratch, need to know.

')

The cost of automation and compensation from the state

Representatives of the microbusiness, especially on the periphery of our Motherland, are now actively complaining about the lack of finance and technical capabilities to modernize their business. In this regard, the state planned to compensate the cost of automation in the amount of 18 thousand rubles ( Federal Law of 27.11.2017 No. 349- “On Amendments to Part Two of the Tax Code of the Russian Federation” ).

It is assumed that this money should be enough for the most simple online CCV and fiscal storage. And nothing more is needed. Let's see if this is so.

To begin with, we will make a reservation that compensation is made by tax deduction. Tax deduction is provided for not more than 18 000 rubles for each copy of the cash desk. Credits include:

- the online ticket office itself,

- fiscal storage

- necessary software

- works or services for setting up and registering the box office.

We would like to note that if the cash desk is registered after the mandatory transfer period, there will be no possibility to receive a tax deduction. And the deadlines for registering CCV by type of activity are:

- from 01.02.2017 to 01.07.2018 - UTII and Patent: trade and public catering (with hired employees).

- from 01.02.2017 to 01.07.2019 - UTII and Patent: trade and public catering (without hired employees), as well as services and work.

In accordance with the updated 54-FZ, a business that previously used cash registers should use a new-style cash register with a fiscal storage (FN).

The cost of the online ticket office with the correct version of the FN now starts at about 14,700 rubles (for example, we took Njager ATOL 91F ).

With the help of online cash registers, it is necessary to generate electronic checks and send them in real time to the tax office through an authorized fiscal data operator (CRF).

Service OFD, of course, is not free. The entrepreneur must conclude a binding contract with an operator, the cost of which is about 3000 rubles per year.

We go further.

Cashier new model for good reason called online cash registers. In accordance with the requirements of the amended 54-FZ, an electronic check (ECH) should be generated at the time of purchase of the goods and sent in real time to the OFD system and (upon request) to the buyer via e-mail or mobile phone. And this means that the entrepreneur must resolve the issue of stable wireless communications at the place of use of the CCP .

And if earlier the entrepreneur did not feel such a need and there was no Internet access at the outlet, now he will have to organize such access. And these are additional expenses, moreover they are no longer subject to tax compensation.

Online cash register software

Now about the issue of automation software based on online cash registers. If we have to automate from scratch, it makes sense to do it competently and with the ability to scale the system. Now the choice of such software products and services is very large, and the price range of a more or less reasonable system is from 1,000 rubles. per month for cloud services, up to tens of thousands of rubles for full-fledged cash programs for a local server. But in this article we are not even talking about the need for such software, but about the tax deduction that we already had at the stage of buying the cash desk with the FN and the annual contract with the CRF, so we’ll stop here.

Fiscal storage (FN)

If you look at the online cash registers, as they are presented in the price lists, you will see in the title an indication of the presence of a fiscal drive (FN / without FN), the version of the fiscal data and the number of months of use of this drive (for example, KTK ATOL 50F. Dark gray FN 1.1. 36 months ). Explain what this means.

Fiscal storage (FN) - this is the necessary thing to comply with the cash register new law. This device is used to encrypt and protect fiscal data, i.e. information about each cash transaction. For a long time there is a requirement to record and store fiscal data in unchangeable form, for this purpose electronic cash tapes of protection (EKLZ) were used. Now it is still necessary to transfer these data to the CRF, which in turn transfers them to the tax office - and this is already within the power of our little friend, the fiscal accumulator, who replaced the old woman EKLZ.

FNs are of two types in terms of validity: for 13/15 months. (depends on the mode of use and availability of excisable goods) and for 36 months.

And three types of fiscal data format: 1.0, 1.05, 1.1.

On the format of fiscal data is worth to stop, because This is one of the pitfalls, which is worth paying special attention.

Fiscal Data Format (FFD)

The format of fiscal data (FFD) is an approved by law algorithm, according to which various details (reflecting the content of a cash operation performed on the device) are placed on the fiscal document generated by the online cash desk. Fiscal data formats are designed to ensure that all participants in the exchange of information on fiscal operations do this in a single format.

I must say that the conversation about these formats, and how raw the first version 1.0 was at the time the law was released, is the whole story. Even after a year and the launch of the new version of FN 1.1, the business (and we , the software players) still have a lot of questions. The still is the crony of the decision and the isolation of the lawmakers and regulators from the reality of the business. But this is a topic for a separate article.

Here we briefly focus on the main thing. So, now there are three types of FNov, and they have a different term of use permitted by the state:

- FFD version 1.0 - initial, the period of use is limited to 1.01.201g

- FFD version 1.05 - transitional, term is not limited

- FFD version 1.1 - final, term is not limited

The transition from version 1.0 to version 1.05 is possible without replacing the TN.The differences between the versions are in the lists of details, which, in accordance with one format or another, should be included in the fiscal document, as well as in the order of the inclusion of the corresponding details in the fiscal document. In more detail about the formats of fiscal data, the nuances of transition from version to version, aspects of registration of cash transactions and the associated difficulties, we will talk in the next article.

The transition from versions 1.0 and 1.05 to version 1.1 is possible only with the replacement of TN.

Our recommendations to entrepreneurs

In conclusion, I would like to note that the potential of the Russian online cash desk market, which, in accordance with the law, will have to issue electronic checks, was estimated in 2017 at 1.3-1.5 million units (according to open sources, in fact, in the first wave FZ-54 was modernized only 1.0 million cash registers). We and our business colleagues, KKT sellers and automators, still remember the hysteria and shortage of the first wave that the market faced (when FNYs worth 7-8 thousand rubles were sold on Avito at 50 thousand rubles and other horrors).

According to analytical estimates, in 2018, up to 3.5 million online booking offices will be commissioned. And here we just keep silent.

The main and main recommendation to entrepreneurs - do not wait until the last moment! It is not worthwhile to engage in discussions on the topic “how hard the life of a businessman is” or hope “perhaps it will blow it over”. Will not carry. This is legal inevitability, and the penalties are extremely cruel. Even if the government relaxes businesses at the time of peak loads of the re-automatization of the market, as it was in the first wave due to the deficit (they allowed to postpone the implementation, if they already had an agreement on the delivery of CCP), in any case year

Already, you need to choose a solution for automation. Purchase cash from FN. When buying an online cash register, you should definitely pay attention to the FNa model, more precisely, the version of the fiscal data format (FFD).

It is difficult to predict how much the procedure for obtaining a tax deduction will be. At the moment, we can only say that there is a Letter of the Federal Tax Service dated February 20, 2017 No. CD-4-3 / 3375 on the procedure for obtaining a deduction for UTII.

At the moment, the current form of the tax return does not provide for the receipt of a deduction for CCP, and a new tax return form is being developed (the planned date of entry is April 2018).

We sincerely wish our Russian business, seafarers, not to drown in the tsunami of global re-automation, to have time to solve this issue for their enterprise, because a wave of introduction of the law will be followed by an equally large wave of control and sanctions. Be prepared, automate correctly.

Source: https://habr.com/ru/post/352586/

All Articles