Went out for bread - bought a house: augmented reality as the future of banking

The idea of the post was born thanks to research by Infosys, in which it systematized the use of AR in the banking and insurance industries. The authoritative research company IDC predicts that in the next four years, the profits of the global VR / AR market will grow at least twice each year. There is an even more accurate forecast - from $ 11.4 billion this year to almost $ 215 billion in 2021th. And after 2018, in VR / AR-duet, augmented reality will take a larger share. We decided to present and evaluate scenarios for its use in the financial sector, which is closest to us.

Little about technology

Since the mid-2000s, there has been a steady trend towards the transfer of banking services online. Here AR is the next step in technological development, bringing banking applications to a new level of comfort and visibility, and AR opens up new scenarios and benefits for users.

Let's estimate from a technical perspective how a typical AR scenario is implemented using the Apple ARKit framework. In augmented reality, the main tool is a smartphone. Through it, using the ARWorldTrackingConfiguration base class, the augmented reality application detects flat surfaces in the image captured with the camera, and also tracks the movement of the device in three dimensions with six degrees of freedom (6DOF). Then the relative position and orientation of the planes are analyzed using the ARPlaneAnchor. Here it is necessary to highlight the ARFaceTrackingConfiguration class, created specifically for working with individuals using TrueDepth cameras of the new iPhone X.

')

After analyzing and processing information about the real world, you can proceed to work with virtual objects. To integrate three-dimensional objects created with SceneKit into a real image, the ARSCNView class is used. It is also possible to bind SceneKit objects to specific objects of the real world - ARSCNViewDelegate protocol is used. For the integration of two-dimensional objects created on SpriteKit, the ARSKView class is used.

The ARFrame class, which is responsible for collecting information about the real picture in the camera lens, can work not only with spatial parameters, but also collect illumination data. They are taken into account when rendering 3D objects, which makes them more realistic.

Based on this general scheme, specific scenarios are created in the banking industry. Some of them are already familiar, but some look original and promising.

Navigation

The most simple and therefore worked out scenario today. The algorithm of actions in this case is quite simple:

- The user directs the phone in the right direction.

- The image shows the nearest ATM / bank branches.

- The user selects an ATM and gets to the place by virtual signs.

Many banks experiment with such functions. The Dutch bank ING and the Spanish Bankinter have already implemented them in their applications.

Planning a visit to the bank

This is a sophisticated version of the previous script. Suppose you need to meet with a bank representative in the nearest branch:

- You turn the phone in the right direction.

- Choose the right branch of those that are displayed there.

- You get up in a virtual queue, take a number, get an approximate waiting time ...

- ... and do not roll your eyes in the stuffy room of the bank!

Detailed information about offers

This option is already actively used not only in the banking industry. For example, the company Delaval, which produces agricultural equipment, builds three-dimensional models of farms using augmented reality. Here the principle of action is quite simple:

- You direct the phone to a booklet / billboard or other advertising medium of interest.

- The system recognizes the proposal for a photo and sends you detailed information in response.

In the same way you can get personal information. For example, this is how the application interface of Westpac, a New Zealand bank, looks like, in which you can visually see the balance of your cards, the payment schedule, the services used and the accumulated bonuses.

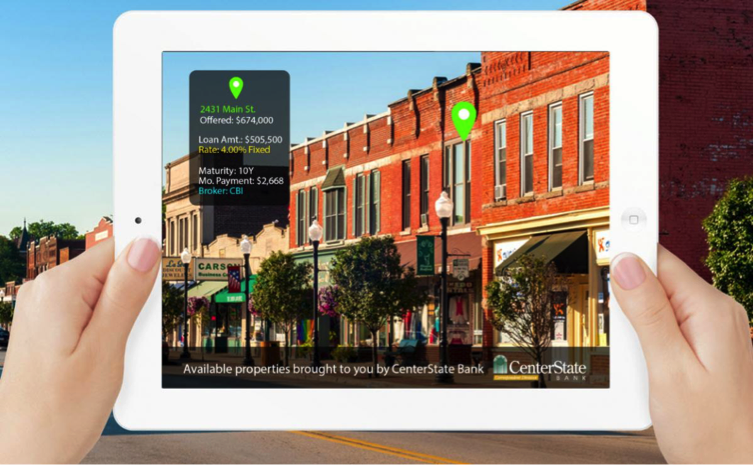

Buying a property

British Halifax and Australian St. George Bank using AR allows potential home buyers to view data on objects right on the street:

- You point the phone in the right direction.

- You see on the screen data on the value of real estate, the number of proposals.

- Customize the offer using a connected mortgage calculator.

- Discuss with the manager all the formalities and send a request to the bank.

- Using biometric authentication tools (voice, iris), the bank confirms your identity and processes the request without wasting time

Buying a car

Scenario close to the purchase of real estate, but more technological. Indeed, unlike the purchase of real estate, the system will be much more difficult to navigate by the location of the object:

- You are photographing a car (or reading its unique identifier - a chip or a QR code) that you are going to purchase from a dealer, and send a request to the server.

- You get all the available information on the car: the history of repairs and technical inspections, mileage, previous owners.

- If you decide to buy a car, you send a request to the insurance.

- The server calculates the cost of insurance and sends it back.

- You contact the insurance company if the offer suits you.

- You will immediately receive all the necessary documents.

Customer interaction

Augmented reality technology helps not only clients, but also bank employees. With the help of augmented reality, bank managers can get information about a client during communication, plan work and make decisions based on this information:

- The employee receives a video call from the client.

- At the client's request, the manager can create a route for him.

- The resulting image displays the status of the client and information about it.

The employee can even track the location of clients for more convenient communication. Of course, from the point of view of the law, this is prohibited, but if you, as a customer, without looking, allowed the banking application to access information about your location, then do not be surprised.

Augmented reality has great potential in the financial industry. But to uncover it, the development of other related technologies is also needed - machine learning and natural language. Alone, changing the world is unlikely to succeed, and what do you think about this? Let's talk in the comments.

Source: https://habr.com/ru/post/352314/

All Articles