Fintech-digest: Russians will be able to take a credit by voice timbre, PayPal goes to China, arrest of Cobalt leader

Hello. At the end of March, the world of Fintech pleases us with various news. Newsmakers - PayPal, Russian banks, the creator of the malicious Cobalt, which caused losses of $ 1 billion, and other organizations and individuals.

Let's start with PayPal. The fact is that this company is beginning its expansion into China. The Middle Kingdom, despite the relative closeness of its financial market, will allow foreign companies to gain access to their electronic payment infrastructure. China's central bank said that foreign companies need to get a license to enter the country. If everything is done correctly, this company will work in China. Unless, of course, will comply with the law.

')

PayPal is one of the first to decide to take advantage of this opportunity. She is no longer a novice in China, since she has been cooperating with the giant Baidu for over a year even on a Chinese scale. The agreement allowed 100 million users of the Baidu Wallet system to link their wallets with PayPal.

In addition, in 2016, the payment system began to work with Alibaba, the marketplace, which began to offer its users the opportunity to pay for goods through PayPal. True, China has its own payment systems, to compete with which the company will be difficult. But PayPal executive Dan Schulman has already said that “collaboration with digital payment providers inspires us.”

From June 30, 2018, Russian citizens will be able to become bank customers without visiting their offices. In order to register as a client, it is necessary to provide biometric data once - this is a face image and a voice sample. As far as can be understood, in the future this method of identification can be used in other areas: insurance, pension and notarial.

In order to use a certain service, the user will need to pronounce on the camera a sequence of numbers and letters written on the screen. If the video matches the samples available in the system, the user goes through the identification procedure without any problems.

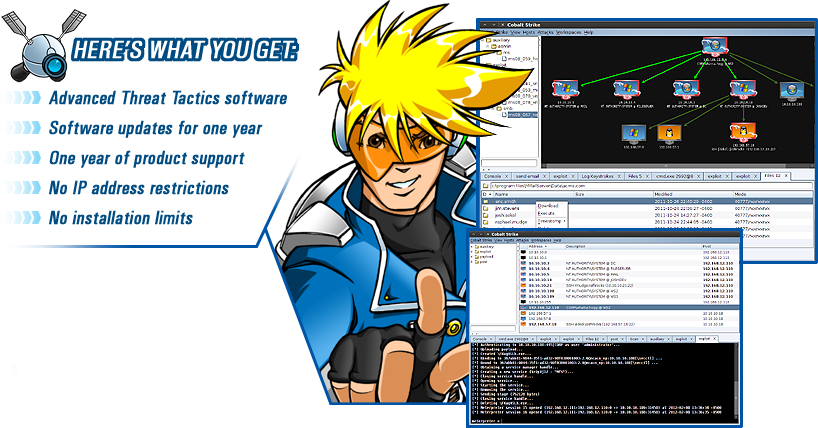

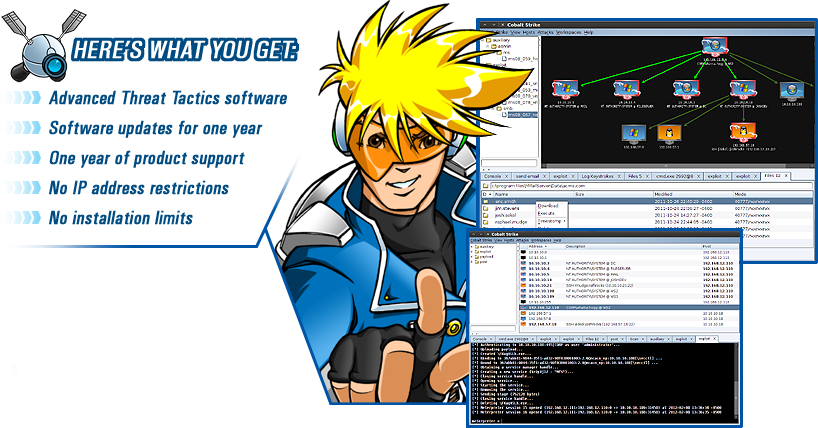

The most interesting thing is that the program itself, which was used by the attackers, is absolutely legal.

Yesterday in Spain, the leader of the hacker group Cobalt was arrested. Last year, she withdrew 1.5 billion rubles from Russian banks (of course, dishonestly). Representatives of the group were introduced into the infrastructure of the bank using the program Cobalt Strike. After that, the funds received were withdrawn in different ways to their accounts.

The most significant withdrawal of funds was the attack on the bank "Union" this summer. The attackers were able to replace debit cards with credit cards without a limit and brought about 400 million rubles through a third-party ATM. In total, this group has damaged about $ 1 billion by financial organizations in Russia and the world.

China continues to explore the possibilities of digital currencies. Earlier, the government introduced strict regulation of cryptocurrency and ICO. However, representatives of the country's financial regulator have repeatedly stated that the emergence of China’s own digital currency is only a matter of time.

“I can say that the emergence of digital currency is inevitable due to the development of technology. In the future, the use of conventional banknotes and coins will be reduced to a minimum. Instead of all this, the “figure” will work, ”said one of the high-ranking officials.

On March 20, 2018, a number of deputies of the State Duma of Russia introduced Bill No. 419059-7 “On Digital Financial Assets” . The purpose of the document is the legislative consolidation in the legal field of definitions of cryptocurrency, token, distributed registry of digital transactions and smart contract. It is also the creation of legal conditions for attracting legal entities and individual entrepreneurs to invest by issuing tokens.

So, mining, according to this project, is recognized as a business. However, only if the person who mined, within three months in a row exceeds the limits of energy consumption set by the Russian government.

In addition, cryptocurrency and token are declared property. True, digital financial assets are claimed as such, and are not legal tender on the territory of the Russian Federation.

Let's start with PayPal. The fact is that this company is beginning its expansion into China. The Middle Kingdom, despite the relative closeness of its financial market, will allow foreign companies to gain access to their electronic payment infrastructure. China's central bank said that foreign companies need to get a license to enter the country. If everything is done correctly, this company will work in China. Unless, of course, will comply with the law.

')

PayPal is one of the first to decide to take advantage of this opportunity. She is no longer a novice in China, since she has been cooperating with the giant Baidu for over a year even on a Chinese scale. The agreement allowed 100 million users of the Baidu Wallet system to link their wallets with PayPal.

In addition, in 2016, the payment system began to work with Alibaba, the marketplace, which began to offer its users the opportunity to pay for goods through PayPal. True, China has its own payment systems, to compete with which the company will be difficult. But PayPal executive Dan Schulman has already said that “collaboration with digital payment providers inspires us.”

Russian banks

From June 30, 2018, Russian citizens will be able to become bank customers without visiting their offices. In order to register as a client, it is necessary to provide biometric data once - this is a face image and a voice sample. As far as can be understood, in the future this method of identification can be used in other areas: insurance, pension and notarial.

In order to use a certain service, the user will need to pronounce on the camera a sequence of numbers and letters written on the screen. If the video matches the samples available in the system, the user goes through the identification procedure without any problems.

Where is the money, Cobalt?

The most interesting thing is that the program itself, which was used by the attackers, is absolutely legal.

Yesterday in Spain, the leader of the hacker group Cobalt was arrested. Last year, she withdrew 1.5 billion rubles from Russian banks (of course, dishonestly). Representatives of the group were introduced into the infrastructure of the bank using the program Cobalt Strike. After that, the funds received were withdrawn in different ways to their accounts.

The most significant withdrawal of funds was the attack on the bank "Union" this summer. The attackers were able to replace debit cards with credit cards without a limit and brought about 400 million rubles through a third-party ATM. In total, this group has damaged about $ 1 billion by financial organizations in Russia and the world.

Central Bank of China

China continues to explore the possibilities of digital currencies. Earlier, the government introduced strict regulation of cryptocurrency and ICO. However, representatives of the country's financial regulator have repeatedly stated that the emergence of China’s own digital currency is only a matter of time.

“I can say that the emergence of digital currency is inevitable due to the development of technology. In the future, the use of conventional banknotes and coins will be reduced to a minimum. Instead of all this, the “figure” will work, ”said one of the high-ranking officials.

Russian State Duma

On March 20, 2018, a number of deputies of the State Duma of Russia introduced Bill No. 419059-7 “On Digital Financial Assets” . The purpose of the document is the legislative consolidation in the legal field of definitions of cryptocurrency, token, distributed registry of digital transactions and smart contract. It is also the creation of legal conditions for attracting legal entities and individual entrepreneurs to invest by issuing tokens.

So, mining, according to this project, is recognized as a business. However, only if the person who mined, within three months in a row exceeds the limits of energy consumption set by the Russian government.

In addition, cryptocurrency and token are declared property. True, digital financial assets are claimed as such, and are not legal tender on the territory of the Russian Federation.

Source: https://habr.com/ru/post/352110/

All Articles