Pros and cons of doing business in the United States: observations after a year of development of their company

Last year I was telling in Habré how I received an O1 visa and moved to the USA to develop my own business. In the comments, readers asked questions about what it is like to work for yourself in America. And if then my experience was too meager to answer, now, after a year of active work, there have been enough impressions. So today I will talk about the pros and cons of running your own business in the States.

Disclaimer: this article reflects only my personal experience and contains judgments that may not be 100% correct - so if you want to use the material as a basis for making any decisions, consider this fact.

')

Introduction

First, a little about myself: I am 29 years old, I have a family, I am a programmer by training, but I have been engaged in journalism and IT marketing for more than 8 years. Now in the States I develop my own IT marketing agency - we help technology start-ups and private clients with creating materials to promote products and services (an approximate essence of the activity can be understood from this habrastaty ), we also develop our own marketing automation tools (chat bots, etc. .)

Prior to that, in Russia, I worked as a journalist in Zuckerberg Call (even before his rebranding), and also developed my own agency.

In fact, a specific area of activity in the context of this article is not very important, it will be more a matter of organizational issues. Another important nuance: we are in Miami, and before that, Moscow was always my base, so the whole experience of life in the United States and Russia is limited to these two cities.

Advantages of doing business in the United States

Let's start with the good process of doing business in the United States. There are many advantages here, I like three main factors:

Developed infrastructure

Doing business is facilitated and developed infrastructure. For example, in the USA, mail is a real engine of the economy. By regular mail, send documents, checks, goods, official documents. Everything works very quickly and almost without problems. In practice, bank checks, which are still very common in America and at first seem to be a relic of a deep past, are quite convenient.

For example, almost all communications with government agencies are carried out by mail. If you need to receive a document, you usually need to download the corresponding file on the website of the desired department, fill it out according to the instructions and send it to the required address by inserting a check with the prescribed amount of the pen to pay the fee.

After a couple of days, the documents will arrive, the check will be cashed, and soon the desired document will be received. Of all the movements - one trip to the mail.

Other business needs are also easily solved. For example, the easiest way to rent an office is in one of the many coworkings, many of which also provide a postal address service. Related accounting services can be ordered from services like Quickbooks or found on Upwork by a licensed accountant who has a partnership agreement with such services — in the end you will receive both software and a personal accountant. With that, for the money it comes out comparable or even cheaper than similar services in Russia.

Perhaps it’s a matter of lack of experience at that time, but at home it took more time and effort to solve such problems.

Country of opportunity

For several years in Russia, I was a co-owner of a business similar to my current project, albeit somewhat less technologically advanced. One of the main memories of this period is the constant struggle with clients, circumstances, requirements of state bodies, etc. In the US, doing almost the same thing, I noticed that the company is developing more actively, with far less effort and resources.

In my opinion the reason for the differences in mentality and attitude to business. In Russia, as a rule, clients are much more demanding, they do not regret the time for regular calls, meetings and agreement negotiations. The process from the first contact to the conclusion of the transaction and receiving the first payment could be stretched for months.

In the US, everything happens much faster, and even when interacting with fellow compatriots who have recently moved. People here literally value their own and other people's time - in Russia, customers would simply not understand if we would ask for money for answers to questions about marketing, working with the media and blogging. In the USA, the concept of paid consultations is familiar to everyone.

In Russia, I was constantly thinking about how to increase revenue, tested some hypotheses, etc. In general, this is a completely normal and correct business process, but in the US, such opportunities arise as if from nowhere - including thanks to a powerful market, a large population and openness of people.

For example, we recently launched a new service - helping to promote not only companies, but also private professionals, who may need good blogs and media publications, for example, to develop a career or get work visas to other countries (the same USA). We were advised to launch this service by one of the customers, who immediately took advantage of it.

Everything is much simpler

The first thing that catches your eye when starting a business in America is how easy it is to launch a new project. I’ll make a reservation that it’s about the start (it’s not always so easy with the activity itself, which is discussed below).

The approach to paperwork is much easier here than at home. For example, I registered the company while still in Russia, and for this I did not have to send any papers — there were enough scans of signed documents or even a simple photo of them on an iPhone. Almost all documents (although not all) were signed in such an electronic form and when applying for a visa. The only time is that thus opening a bank account will not work, for this you will have to go to a branch and sign papers yourself.

Getting started with a new client also looks very simple. For this, even an oral agreement and an invoice in electronic form, in which the paid work is indicated, are sufficient. It is clear that in order to avoid problems and disagreements it is better to sign an agreement that lists all the rights and obligations, but this is optional, but I managed to forget about such a thing as a “certificate of service” for a year of work in the United States.

Life Strikes Back: The Cons of US Business

In life, everything always does not go smoothly, so besides the advantages, during the year of work I noticed some drawbacks of doing business in the States. So, here is my personal anti-top of such moments.

Everyone always wants money from you

If you want to feel for yourself what it means to live “under capitalism” - start a business in the USA. You will immediately turn into a purse with legs for everyone around.

Looking for an accountant to prepare the first blank report, because you did not have time to start an activity? They will be happy to help you, you just need to organize a consultation for $ 250 (to answer the question “can you submit a report?”).

Lawyers will be advised to seek additional advice that increases the chances of a successful outcome of the case (but does not guarantee anything) and are conducted on the basis of an hourly rate of $ 300. Lawyers involved in the design of the company will not fail to offer to issue a separate pool of shares, without which an innovative startup cannot live (“in the future you will be able to give options to it to employees” - very important for a small new business, and in just a couple of thousand dollars).

You are unlikely to receive mail in the United States - most often these are different accounts, especially if we are talking about a corporate mailbox. And if half of the letters turns out to be the demands of the spammers, the second half is all the same different notifications from partners and government agencies that cannot be ignored.

Interactions with authorities are not always logical.

The state apparatus in the USA is quite developed, there are many different departments, whose functions are sometimes duplicated up to complete absurdity. A headache is also added by the administrative device, in which the US states have quite ample opportunities to create various rules and laws, including those governing the conduct of business.

Sometimes this translates into seemingly funny situations, which nevertheless require separate efforts and costs. Example - we registered a corporation in the state of Delaware, this is quite a popular jurisdiction for international startups. However, in the USA I live in Florida with my family, we have an office here, a corporate account at the local branch of Bank of America and so on.

It turned out that although it would seem that I had already registered a company in the USA, it must be registered again in Florida under the threat of serious fines. An interesting formulation - in Florida, there are local corporations (domestic corporations) and foreign corporations (foreign corporations). And a corporation registered in the US state of Delaware will be considered foreign in the US state of Florida. And she must go through the registration procedure with the payment of the appropriate fees, the provision of documents from the state of Delaware (where these certificates are also ordered for money) and the obligation to provide annual reports on their activities.

Excerpt about the need to register in Florida from an article on the website of one of the companies registering corporations in the state of Delaware - a clear explanation can be found only on such commercial sites, public resources are extremely uninformative

Another situation is not directly related to the business, but is very indicative. Since I am in the States on an O1 visa, my wife received an O3 visa and has no right to work. Therefore, she is not assigned a SSN taxpayer number, but it is needed in order to file a joint tax return (taxes in the United States are a topic for a separate article).

Purely theoretically, I could file one declaration, but then you would have to pay more, and families could be subject to various deductions, and in the end it may turn out that over the year you even overpaid taxes and give you the difference back ). Our accountant convinced us that our wife still needed to get some tax number. In the US, there is a kind of SSN for those who are not entitled to work, it is called ITIN. And its design was a nontrivial quest.

First it took to call the Internal Revenue Service, which took a couple of days, then make an appointment during a call with an elderly operator who asked each word two or three times, then finally we came to the reception for filing applications for ITIN. And it was at this moment that it turned out that (watch your hands):

- ITIN is needed to create a family income statement;

- To get it, you need to prepare an income statement as if it had already been received (there is no mention of this on the site or anywhere else, even our licensed accountant did not know about it), just filling out an application is not enough, although it is necessary ;

- bring an ITIN application with a printed out declaration (despite the fact that everything is usually done online);

- this package of documents will begin to be processed by the IRS and then will transfer overpaid taxes to a bank account and sometime (“within 11 weeks”) the ITIN card will arrive in the mail.

To find out all this, we had to spend 2 hours of time, despite the fact that we arrived clearly at the time of recording - any Moscow MFC will seem like space after the IRS office in Miami.

Can not relax

The USA is the Mecca of capitalism, a real bank with spiders and snakes. Almost all niches are characterized by strong competition, everyone is trying to earn their own dollar. In general, this is good and moves many industries forward, but such a desire for profit may take not the most pleasant forms. If you relax too much, it will immediately result in direct financial losses.

A simple example from personal experience - after I registered a company in Florida using the scheme described above, our corporate mailbox began to fill up very quickly with letters. Apparently, some of the local agencies “leaked” the base of newly registered companies to firms that provide them with certain services.

All anything, in the end they may offer something useful, but direct marketing in the US is not like Russian. If we all are accustomed to raking bright advertising booklets out of the box (and then throwing them away), they are rarely sent in America, realizing the ineffectiveness of such a promotion. Instead, local marketers play on the ignorance and fears of potential buyers. For this, for example, they disguise their advertisements under the official reports of the authorities: they use official language, similar to official forms, various phrases like “Urgent! The notice requires an immediate response! ”Threatened with fines.

For example, here is a letter stating that we need to order certain stickers / posters that should be placed next to each employee’s workplace:

Each such label costs $ 84, and the information that its absence is punishable is punishable by a fine of $ 17,000. It looks like an awesome letter from the authorities, but in fact it is an intermediary company trying to get a new client to issue these stickers to him. At the time of receiving the letter, we had only one employee in Florida — I, the owner of the company, and such a sticker was not needed at all.

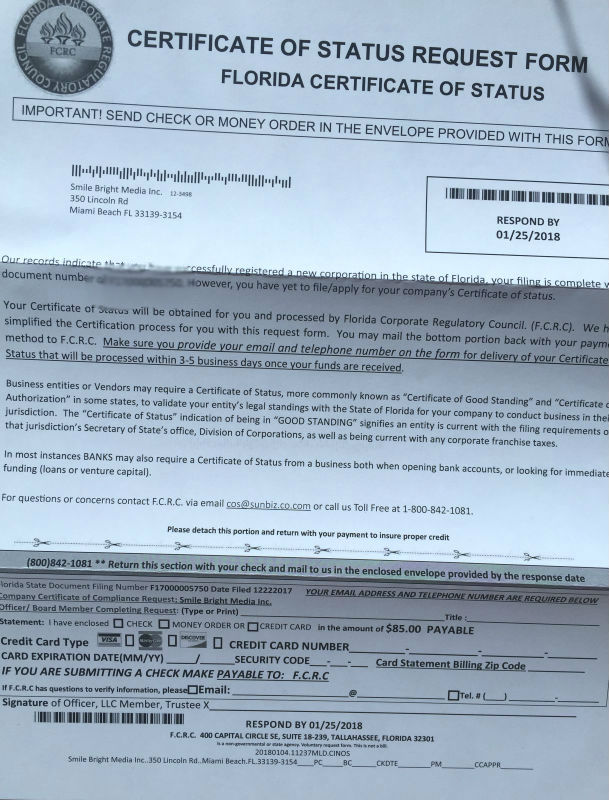

But a letter about the vital need for a certificate confirming the existence of the company (certificate of good standing). There were no threats of fines, they simply listed when and why it might be needed, well, and did not forget to add an official-looking logo on the form:

Such advertising is sent not only to business owners, but also, for example, to car owners or parents. We were sent "requirements" to extend the car after-sales service or medical insurance for children of the company, with whom we have never had any business. At first, such letters seriously embarrassed me, for example, I almost bought the same stickers for $ 84 - I was well aware in time to consult with our accountant, who explained to me how it all worked out.

Total

Having weighed the pros and cons, I can say that I like doing business in the USA more than in Russia. When there is a real cult of entrepreneurship in the country, it is felt in everything. The USA is a country not without its minuses, sometimes quite substantial, but making money here can be much more comfortable, without being distracted by the solution of non-core tasks.

That's all for today, thank you for your attention! If you have any specific questions about visas, business, living in Florida - write in the comments or in a personal, I will try to answer.

Source: https://habr.com/ru/post/351222/

All Articles