What is SaaS-business

Principles of work and growth mechanisms for SaaS companies

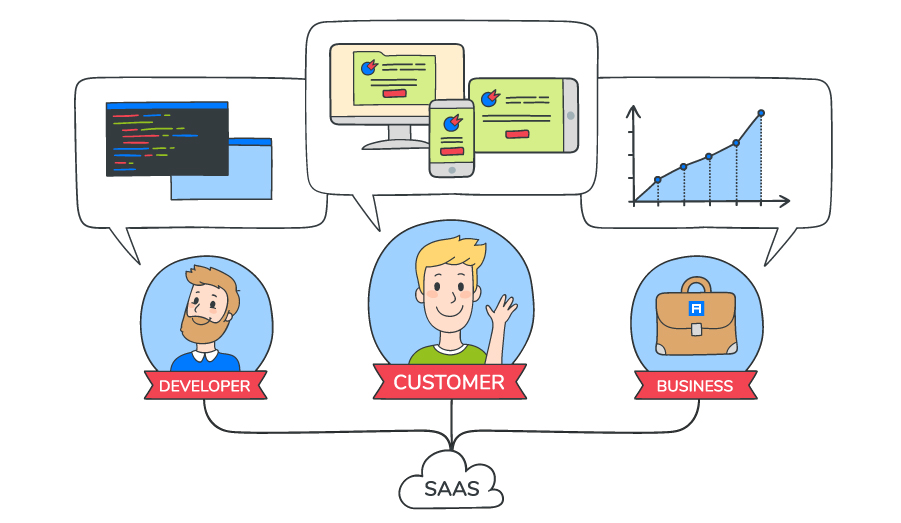

Software as a service (SaaS) is a payment and software delivery model that is so superior to the traditional way of selling software licenses that it reorganizes a company according to its needs. Thanks to this, SaaS companies have gained a very special practical experience. Unfortunately, this path is difficult for many people: they repeat already known mistakes - instead of carefully stuffing cones in new places.

It is unlikely that anyone wants to step on other people's rakes, so we will briefly consider the situation in the SaaS business. To succeed in this sector, you need to learn to better understand the SaaS business model, to be able to foresee what scheme the product should be sold (“with weak contact” or “with strong contact”), and - if you are already working in the SaaS business - be able to assess the state of the company and improve its work.

')

If you are a software developer and at the same time do not sell mobile applications (they have their own payment model defined by application stores of specific platforms), you need to thoroughly understand how the SaaS business works - then you can make more effective decisions regarding the product (and the company) and see business problems in the months and even years before they become apparent. In addition, this understanding will help in negotiations with investors .

Transferred to Alconost

How SaaS takes over the world

SaaS customers love the fact that it “just works.” To use the product, you usually do not need to install anything. Equipment failures and operational errors — problems that often arise when complex machines are not serviced by professionals — do not result in significant data loss. SaaS companies achieve a level of performance (which can be expressed as a percentage of time when the software is available and working correctly), which is significantly higher than the figure that most of the IT departments of companies (not to mention individual people) reach.

In addition, the use of SaaS usually seems to be less expensive than using software sold on other payment models. This is important, for example, for users who are not sure which software should be selected in the long term, or who need software for a short time.

SaaS developers like mainly the delivery model, not the payment model.

Most of the SaaS is in constant development and uses the company's infrastructure. (An important exception is SaaS in the corporate sector, but with the vast majority of SaaS in the B2C and B2B sectors, users work via the Internet from servers supported by the company that developed this software.)

Historically, development companies did not control the environment in which their code was executed, and this complicated both the development and technical support of customers. Any software deployed on client hardware is affected by differences in system configurations, interaction with other installed software, and operator errors. This should be considered when developing software and customer service. Companies that sell their designs and SaaS model, and as installed software, often note that in the case of locally deployed software from one client receives ten or more times requests for support.

Companies and investors like SaaS, because the economic characteristics of SaaS look much more attractive than selling software licenses. SaaS revenue is usually regular and easily predictable, making cash flow in SaaS companies much easier to predict, which allows it to be used in planning and even here and now sell money to investors in the future and, accordingly, fairly generously finance current growth. For this reason, SaaS companies are considered to be among the fastest growing software development companies in history.

SaaS sales models

If you do not go into details, there are two ways to sell SaaS. The sales model defines almost all other aspects of the life of a SaaS company and its product — it penetrates all activities so much that it may come as a complete surprise for newcomers to the SaaS business. One of the most common mistakes SaaS-companies, the elimination of which can take years, is the discrepancy between the product or market and the chosen sales model.

By the end of the article, it will become clear that the sales model for SaaS products determines the company's work to a much greater degree than other differences: sales to individuals (B2C) or enterprises (B2B), the company receives support from venture funds or uses its own funds, which technology product stack under the hood and so on.

Low SaaS Sales Model

Some products sell themselves.

The SaaS model with weak personal contact is suitable for most customers and allows you to buy a product without constant personal interaction with representatives of the developer company. The main sales channels in this case are the software website, email marketing and (very often) a free trial version, which they are trying to develop so that it can be quickly and easily started to use - and then just as easily become a regular user.

Sometimes, such companies still organize sales units, but more often in the form of so-called “customer satisfaction departments”, which are less focused on convincing customers to buy software and, more so, on free trial users to switch to regular use and began to pay for the service at the end of the free version.

Customer support in the case of products with weak contact is usually organized in such a way that it can be scaled: the product is designed in such a way as to avoid cases requiring human intervention - for example, training resources are prepared that extend to the entire customer base. The human resource is used last. At the same time, oddly enough, many of the companies working on this model have excellent customer support. The economic performance of SaaS depends on long-term customer satisfaction, so even a product for which only one application is expected (separate interaction with the customer) for every 20 customer-months can significantly burden the customer satisfaction team.

Weak SaaS products are usually sold on a monthly subscription with a price range of about $ 10 for B2C applications to $ 20–500 per month for a B2B segment. This corresponds to the average contract amount (ACV, English "average contract value") of 100-5000 US dollars. In companies working on a model with a weak contact, the term ACV is usually not used - instead of it, the monthly standard price indicator is used - however it is important for us to compare them with SaaS applications of a model with a strong contact.

If you ask the owner of a SaaS company with a weak contact about the most important indicator, you will be called regular monthly revenue - MRR (“monthly recurring revenue”).

A textbook example of a SaaS company with sales based on a weak contact model - Basecamp . And Atlassian (JIRA, Trello, Confluence and some other products) is probably the most successful public company using this approach.

SaaS sales model with strong contact

Some customers need to be told whether to implement certain products and how to do it.

The SaaS model with a strong personal contact is intended for those cases where the human resource is noticeably involved in the process: the employees of the development company convince customers to implement the software, help successfully put it into operation and strive to ensure continuous use.

In this case, the heart of the organization is almost always the sales department, which is often divided into specialized units: the sales increase specialists (SDR, “sales development representative”) find potential software clients who manage customer accounts (AE). executives ") are in charge of sales for specific clients, and personal managers (AM, eng." account manager ") are responsible for the satisfaction of individual clients and the maintenance of effective work with them.

The sales department, as a rule, is assisted by the marketing division, whose main task is to create a sufficient flow of suitable clients for sales professionals to evaluate prospects and conclude a deal.

According to this model, many quality products are sold, but as a first approximation for a SaaS business with a strong contact, software development and the product itself are considered less important than the sales engine.

The organization of customer support in such companies is very different, but it is usually assumed that the support service will have a lot of work: the expected number of requests for one customer over a certain period of time is several orders of magnitude higher than in the model with weak contact.

According to the model with strong contact, it is possible to work with individuals (for example, insurance services in the United States are traditionally sold through insurance agents), however, it should be borne in mind that the vast majority of such companies work with enterprises that are widely different in the B2B sector and on the expected customer profiles, and ACV indicators (sometimes this abbreviation means not the average, but the annual amount of the contract - English “annual contract value”), and by the complexity of the transaction.

In the lower price range, SaaS products for this model are sold to small and medium businesses (SMB) - here ACV is 6-15 thousand US dollars, but it can be higher. There is no generally accepted exact criterion which companies belong to the SMB segment. In practice, this usually includes companies that can afford to implement software worth $ 10,000: this is unlikely to be a local flower shop, but a private dental clinic with four doctors is quite possible.

The upper price segment - it is called "corporate" - is aimed at very large enterprises and even at governments. In a good way, the contracts here start with hundreds of thousands of dollars, and there is no upper limit. (For example, in the Inovalon annual report there is a customer with a contract worth $ 70 million.)

If you ask the owner of a SaaS company with a strong contact about the most important indicator, you will be called the regular annual revenue - ARR ("annually recurring revenue"). (In essence, this is all the company's constant revenue, minus certain irregular income, such as a one-time installation fee, consulting services, etc. The economic attractiveness of a SaaS business is growth over time, so one-time revenues, especially relatively low-profit ones revenues, business owners and investors are not particularly interesting).

A textbook example of a SaaS company with a strong contact is Salesforce (they literally wrote a book about this model). Small SaaS-companies working on the model of strong contact are huge, but they are less noticeable than companies with weak contact, mainly because the latter attract new customers due to their visibility and popularity, and for the former such an approach will not always optimal. For example, many small SaaS-companies quietly have hundreds and even millions of dollars a year, selling their services in a strictly defined vertical segment.

Mixed sales approach

Sometimes, functionally, the same product is successfully sold on both models. But in the case of SaaS-business, this is a great rarity . Usually, the result of an attempt to simultaneously use both models becomes a relatively successful application of one model, which hinders the normal implementation of the second - because the sales approach permeates the entire activity of the company.

Much more often only separate elements of the second are introduced into one sales model. For example, in many SaaS companies with poor contact, customer satisfaction departments, if you look closely, look almost like remote sales units. Companies with strong contact usually borrow to a lesser degree: most often, a product that the company actually does not sell but spreads according to the model of weak contact is an introduced element in order to attract potential customers to another product whose sales generate the main income.

The main formula of SaaS-business

In the SaaS model, software is not sold as a product with a final cost, but, in fact, turns into a financial instrument with probably predicted cash flow and is sold in such a context.

There are more complex approaches to modeling SaaS-business, but we will limit ourselves to the version that does not require a degree in economics and make some simplifying assumptions (for example, we will not take into account the time value of money) - mathematics above the secondary level will not be needed. The most necessary thing to know about SaaS business is its basic formula: it is like a Rosetta stone for understanding the work of SaaS companies.

The basic idea is very simple: revenue in the long term is the product of the number of customers and the average revenue during the service time for a single customer.

The number of clients here is a product of two indicators: attraction (how much potential clients are attracted to SaaS with poor contact or, in the case of SaaS with strong contact, how effectively you find potential clients and contact them) and conversion rate (percentage of potential clients who start to pay).

The average revenue during customer service (it is also called the client's lifetime value - LTV, “lifetime value”) is the product of the amount paid by the client for a certain period (for example, one month) and the number of periods in which the service was used.

The average revenue per user ( ARPU , English “average revenue per user”) is simply the average revenue per account for a specific period.

Outflow is the proportion of clients who stop paying you; calculated for a specific period. For example, if in January your services are paid for by 200 clients, and in February - already 190, the outflow will be 5%.

Customer service time, if slightly simplified, can be calculated as the sum of an infinite geometric series — in this case, it will be enough just to take the reverse of the outflow. If a product loses 5% of customers per month, then the expected service time will be 20 months; if each client pays $ 30 a month, then the expected total revenue from a new customer will be $ 600.

Conclusions from the SaaS business model

Improving the performance of a SaaS company in several ways gives a multiplier effect.

An increase of 10% in the attraction rate (for example, due to better marketing) and the same 10% conversion rate (for example, due to product refinement or more efficient sales methods) will bring together not 20%, but 21% (1.1 × 1 ,one).

Improving SaaS business performance is incredibly effective .

The SaaS margin is very high, so the long-term valuation of a SaaS business is in fact directly proportional to the long-term revenue. Thus, increasing the conversion rate by 1% means not just an increase in income by 1% next month or even in the long run - this means an increase in the company's market capitalization by 1%.

The price is the easiest lever for increasing the efficiency of a SaaS company.

Improving attraction, conversion, and churn often requires serious efforts by specialists from different departments. And to change the price tag is usually just enough to replace a smaller number with a larger one.

In the end, SaaS-companies come to the limit.

With fixed attraction, conversion and outflow, there comes a moment when the company enters the plateau of revenue. This can be predicted in advance: the number of customers per plateau is equal to the rate of attraction multiplied by the conversion and divided by the percentage of outflow.

SaaS-company, which ceases to increase the attraction, conversion and reduce the outflow, with almost mathematical certainty will cease to grow. And if the company, having ceased to grow, did not manage to cover the fixed costs (for example, salaries for developers), it would be a humiliating death - even if the management did everything right .

SaaS business growth may require significant capital.

In such companies, the initial costs at the growth stage are increased, especially if the growth is dynamic; In the marginal costs per customer, marketing and sales expenses prevail, and they often make up the majority of the company's expenses. Marketing and sales costs associated with a particular customer appear very early in their life cycle, and revenue, which ultimately covers these costs, comes later.

This means that a growth - oriented SaaS company will almost always spend more than earn in a specific period of time. And the money for these expenses needs to be taken from somewhere. To finance growth, they often go through the sale of company shares to investors. For investors, SaaS companies are especially attractive, because the mechanism of their work is easy to understand: you create a product, fit into the market, spend a lot of money on marketing and sales in accordance with a relatively reproducible scheme and ultimately sell your share in the business to someone else ( these could be public markets, another company that absorbs yours, or another investor who is looking for a risk-free business with good growth potential).

Margin - as a first approximation - does not matter.

Most companies seriously care about the cost of goods sold (COGS, eng. "Cost of goods sold") and the price that will satisfy the neutral consumer.

For some business platforms (for example, AWS), material costs constitute a significant part of COGS, but for a typical SaaS company, software is the main source of value, which can be replicated at an extremely low level of COGS. Usually, SaaS companies spend less than 5–10% of additional income on the provision of basic services to one client.

This allows SaaS business owners to almost completely ignore the economic indicators of a commodity unit, with the exception of the cost of attracting a single client (CAC, “customer acquisition cost”), which represents marginal marketing and sales costs per one new client. If a company grows quickly, it allows you to ignore costs that do not increase in proportion to the number of customers (engineering costs, general and administrative expenses, etc.) - assuming that a significant CAC will exceed any remaining costs graph.

It takes some time for a SaaS company to grow.

The presentation in the press draws a picture of a rapid growth curve with a small initial segment, but in practice it takes a very long time to gain momentum, polishing the product itself, marketing and sales approaches, and only much later things start to go uphill. This phenomenon has a memorable name: the slow and long rise of SaaS to death .

In the SaaS segment, expectations for growth are very different.

Independent SaaS companies need a year and a half to reach profitability, become competitive and give good money to the founders. After reaching this point, a wide range of acceptable growth rates opens; An annual growth rate of 10–20% can please all stakeholders very, very much.

In the case of SaaS-companies with external financing, money is purposefully invested in growth, which means that they spend a lot of money in advance on improving the work model, and there are almost no cases where it was impossible to spend a lot.

After the model is refined, it is scaled, which usually leads to even more rapid loss of even larger amounts. For business, this is a successful result, which often contradicts the impression of those who follow the software industry. If the business is able to continue to grow, it can eventually pay off any accumulated deficit. If there is no growth, the company will sink into the abyss.

There are many much less stressful business activities in the world than the work of SaaS companies aimed at dynamic growth, which is similar to flying on a rocket: you burn a huge amount of fuel in order to achieve the necessary acceleration ... but if something goes wrong - the rocket will explode .

In practice, for a successful SaaS company aimed at dynamic growth, growth expectations can be described using the “3, 3, 2, 2, 2” scheme: starting from a sufficient basic level (for example, more than $ 1 million ARR - regular annual revenue ), the company must triple its annual income for two years in a row, and then double it for three consecutive years. SaaS-company with external financing, which at the beginning of its journey from year to year grows by 20%, in the eyes of investors will most likely look unattractive.

Criteria you need to know

One of the most popular questions that can be heard from the owners of SaaS companies is: "How can I understand that I have good performance?"

This question is surprisingly difficult to answer, because the industry, and business models, and the stages of development of the company, and the goals of the founders are very different. However, in general, life-taught entrepreneurs use several practical assessment methods.

Indicators for SaaS with poor contact

Conversion rate

In most cases, weak contact SaaS companies distribute a free trial version, using two opposite approaches: registration requires minimum data and a credit card must be associated with the registration card, which will be charged for the subscription if the user does not cancel it. The choice here determines the nature of the free trial version: if starting to work with the software does not require much effort from users, they may not be very sensitive to the evaluation of software, therefore such users must explicitly confirm their purchase decision later; Users who give a credit card number, as a rule, have already carried out some analysis in advance and, in fact, undertake to pay, if they do not expressly express dissatisfaction with the product.

The difference in approaches leads to huge differences in conversion rate.

The conversion rate for the trial version of SaaS-software with poor contact and without binding a credit card:

- Significantly below 1% - usually this indicates a poor fit of the product to the market.

- About 1% - approximately corresponds to the basic level with skillful business organization.

- More than 2% - great!

The conversion rate for the trial version of SaaS-software with weak contact and mandatory binding of a credit card:

- Significantly below 40% - usually this indicates a poor fit of the product to the market.

- About 40% - roughly corresponds to the baseline with skillful business organization.

- More than 60% - business is booming!

In general, if you require credit card information in advance, the number of new users of the paid version increases (the transition rate of customers from the trial version to the paid version increases more than the number of those who decide to try the free version decreases). This factor loses its significance if the company contacts the trial version users more purposefully and deliberately (trying to make them use the software intelligently) - as a rule, they improve the user interaction with the product, send emails at various stages of the life cycle and attract specialists customer satisfaction department.

Conversion rate (relative to registration in the trial version).

It is also necessary to measure the conversion rate between the unique page views and the start of using the trial version, but for the company it is not the most effective indicator, and it is difficult to give good advice on expectations.

This conversion rate is highly dependent on how much attractive visitors you attract. It may seem strange, but in companies that are better at marketing, this figure is lower .

In the case of good marketing, the company attracts many more potential customers, among which, however, there are many inappropriate. Companies that are worse off with marketing are caught only by those who are already well acquainted with the market - and such people are usually much better as customers: they are so unhappy with the status quo that they are actively looking for other options, make a lot of effort and are ready use products of unknown companies if their offer may be better than what is currently used. The rest of the market participants are not likely to actively look for an alternative right now; they can be satisfied with work with solutions from well-known market players or companies from the first page of Google issue; they may not have the incentive to risk changing the provider of the solution they need.

The percentage of customer churn.

In the case of SaaS with poor contact, most customers have monthly contracts, so the percentage of churn is calculated per month. (The sale of annual subscriptions is certainly also a good idea: it allows you to receive money in advance and reduces the percentage of outflows. However, in reports on outflow, annual subscriptions are usually converted into monthly figures.)

- The outflow of 2% is a very attractive product that blends well with the market, in which considerable resources were invested in reducing the outflow.

- The outflow of 5% usually starts somewhere from this figure.

- An outflow of 7% is likely either another seductive offer is hindering the prevention of a voluntary outflow, or you are working in a difficult market.

- More than 10% is evidence of a very low compliance of the product with the market and threats to the existence of the company.

In some markets, the outflow will be fundamentally higher: if you sell the product to consumer producers or representatives of more free forms of business, such as freelancers who have a high chance of leaving the business, this significantly affects the percentage of outflow. More reputable companies fall apart much less often; in addition, they have much less need to save up to the last 50 dollars.

Higher prices naturally eliminate economically worst customers, so price increases are more efficient than they usually expect : by raising prices by 25%, you can suddenly reduce outflows by 20% simply by changing the distribution of customers who buy the product. This feature forces many SaaS companies with poor contact to move to the upper echelons of the market over time.

Indicators for SaaS with strong contact

Strong contact SaaS companies usually differ much more in terms of how the conversion rate is measured (mainly due to differences in how a “potential deal” is determined) and what indicator is achieved with similar definitions. The reason for this is different industries, sales processes, etc.

But the percentage of outflows are divided quite clearly: the annual outflow of approximately 10% is an acceptable figure for the company in the first years of operation. 7% outflow is an excellent indicator. It should be noted that even among mediocre SaaS companies with strong contact, the percentage of outflow is fundamentally lower than even among the best representatives of the model with weak contact.

Companies with strong contact often measure two indicators: the so-called “outflow by firms” (when a client company is taken as a unit of payment, regardless of how many departments use the software, how many users there are, what they pay for, etc.) and income outflow. In the case of a weak contact SaaS, this separation is less important because these indicators are usually very similar.

Strong contact SaaS companies set prices to increase the amount of revenue during customer service — by selling additional quotas to users, other products, etc., so many of them track the outflow of net revenue , which is the difference in revenue for a group of customers for the year. The generally accepted standard for such companies is the negative outflow of net revenue : switching to more expensive versions, extending the contract from year to year and cross-selling to existing customers outweigh the impact on the revenue of customers who have abandoned this software or reduced its use. (Practically none of the weak contact SaaS companies achieve negative net outflow, because the percentage of outflow is too high to compensate for it.)

Product conformity to the market

SaaS — . ( , : « , , ?»

, . , , , .

SaaS-, , : « , , — , ». , , , .

SaaS, , ; . — , , «». SaaS- , : — SaaS-, , , .

— , , . , , , .

«»? , ( , , . .), , ( ) (ACV). , SaaS- , , , .

About the translator

The article is translated in Alconost.

Alconost is engaged in the localization of games , applications and sites in 68 languages. Language translators, linguistic testing, cloud platform with API, continuous localization, 24/7 project managers, any formats of string resources.

We also make advertising and training videos - for websites selling, image, advertising, training, teasers, expliners, trailers for Google Play and the App Store.

Source: https://habr.com/ru/post/350594/

All Articles