Parsing ICO TenX: scam or not?

2017 was the year of the boom cryptocurrency and ICO. Billions of dollars were collected by the projects, most of which were only whitepaper and honestly. There were no legal entities, no property, no product, no team. I decided to take a closer look at the projects that collected tens of millions of dollars in 2017 and to understand whether there is any deception there, I decided to analyze the actions of companies after fundraising. Today we will talk about TenX who collected $ 80 million at the exchange rate at that time. Looking ahead, I note that I myself did not expect this from TenX ...

2017 was the year of the boom cryptocurrency and ICO. Billions of dollars were collected by the projects, most of which were only whitepaper and honestly. There were no legal entities, no property, no product, no team. I decided to take a closer look at the projects that collected tens of millions of dollars in 2017 and to understand whether there is any deception there, I decided to analyze the actions of companies after fundraising. Today we will talk about TenX who collected $ 80 million at the exchange rate at that time. Looking ahead, I note that I myself did not expect this from TenX ...Many people still believe that ICO is the same as IPO. I recommend to get acquainted with the comparison of IPO, crowdfunding and ICO.

Still it is recommended to read article on Habré

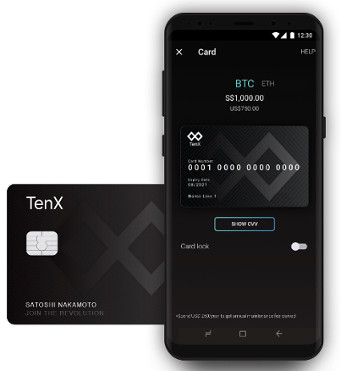

in which the author examines the threats to the application or service from tokenization after ICO. In July 2017, TenX held an ICO, through which more than $ 80 million was raised. The idea behind the project is simple: to issue debit and credit cards, to enable users to replenish their cards with a crypt, make exchanges and withdrawals. TenX did not have a banking license, which made it easier to start.

As long as the company does not have a license, it cannot issue its own cards, but it can use the services of other companies and brand the cards that will be issued by other institutions. In total, in order to launch such a business, you need to come to an agreement with a licensed company and develop your own software for receiving / withdrawing cryptocurrencies and applications for clients (iOS, Android and web applications). Easy!

The company began its journey in 2015 with a small startup and received $ 120k from private investors in the seed round in 2016, in March 2017 another $ 1 million from a group of individuals and the Chinese Fenbushi foundation , and 3 months later the ICO begins. What were you planning to spend the money on? I will give the amount in USD at the time of the beginning of the ICO (1 ETH then cost $ 327), the data is taken from the whitepaper on the project website:

')

- $ 2.4 million to create a client web app;

- $ 2.4 million to create a client iOS application;

- $ 8.1m for searching and signing new partners for card issuers;

- $ 3.2m for financial and information security auditors.

I was just stunned by these numbers. For a web app and an iOS app $ 5 million in total ... these are cuts of a scale of more than contractual state tenders! But just a minute, if you open the announcement of the company and look at what TenX had to spend $ 1 million from investors , then we will see all the same points, only investors didn’t work out $ 5 million development. Or did investors plan to hit the bank on the ICO?

But this is not all, if the project brings together more than 50,000 ETH, then TenX will begin to implement its COMIT network based on the blockchain. Here's how they were going to spend the money:

- $ 9.8mn for the development of the COMIT network;

- $ 3.2mln for information security audit.

In the world of card payments, there are also mandatory security audits (PCI-DSS), but they cost about $ 50-70k for the most expensive level (level 1). But TenX allocates $ 3 million. One could immediately buy an audit company for these funds and pay all the salaries throughout the year. The network was going to build a network for $ 9.8 million until the summer of 2018. A million dollars a month to develop, not bad.

What did the “investors” offer? 0.5% of the turnover of card payments is divided between all owners of tokens and is calculated in proportion to the number of tokens owned by the “investor”. At the ICO, only 51% of all issued tokens were allotted, and the remaining 49% were left to the creators for other incomprehensible “research” needs. Regular users get a bit of tokens for payments with cards. This should create an increase in the price of tokens and “investors” should be sure that the price of tokens will only increase, because the issue is limited. But if you look at the size of such a cashback, then 10% of the tokens left by the owners will be enough to pay tokens to users of the system for 10 years.

Thus, if TenX makes payments for $ 1bn per year, then ICO payments to “investors” will be $ 2.55mn. How long it takes to reach such a turn is unknown, I believe that it will take years. Let me remind you that “investors” invested $ 80 million.

Can buyers of tokens be protected, claim management? Not! In the whitepaper it is repeated many times that the tokens are not securities, the owners of the tokens cannot claim anything, can lose all the tokens and remain without compensation. Tokens can be stolen, this is normal, it is indicated in the conditions. The company will not compensate for the loss. And in general, the company can change the rules and stop making payments, and it will be completely legitimate, because this is indicated in termz.

I am personally surprised that the project raised so much money. Many items of spending are inflated tenfold. Holding an ICO 3 months after raising $ 1 million from investors and funds looks strange. I believe that investors decided to quickly return on investments in the wake of the HYIP and more than pay back them. Well, they succeeded.

Below is the price chart for the TenX token.

It is clearly visible that the price fell 2.5 times after the end of ICO. There were ups at the end of the year. They are due to the launch of TenX cards in Europe, because prices have grown, and then plummeted when the only partner terminated the cooperation. Judging by the publications on their twitter, there is still no new partner and customers cannot pay with cards.

The company continues to say that they expect in the coming months to obtain a banking license. Life will show. The project also does not keep other promises. They promised to make a webapp, for $ 2.4 million, but now the project is closed and development will not be conducted. It is not known what the unspent money of the depositors will go to, if at all ...

The project denies any obligations, they even say in a blog post that they do not support and will not support the possibility of selling tokens. Maybe we should cancel the trade in tokens and tell the investors good bye? Only this step remains ...

We can’t make it clear that we can’t make it clear.

We wouldn’t promise that you could increase the value to PAY. It’s not a problem.As a result, the price of tokens slipped, the obligations are not fulfilled, and the only partner refused to cooperate. What will “depositors” get? Nothing! At the same time, the cost of ETH, for which TenX tokens were sold, increased in price by 2.5 times. So, as for me, the project is in the minus for “investors” and a huge plus for investors and owners. Be careful if you decide to invest in ICO!

Source: https://habr.com/ru/post/349870/

All Articles