Nvidia shares rose by 1150% over three years: why is this not the limit

In recent years, the video card developer has shown rapid growth: since February 2016, the value of its shares has grown by 850%, over the past three years - by 1150%. The growth was so rapid that Matt Mali, an analyst at trading company Miller Tabak, saw in this column a new economic bubble in the column for CNBC. On the other hand, at the moment the market situation is such that the growth of shares of technology companies can continue for a very long time.

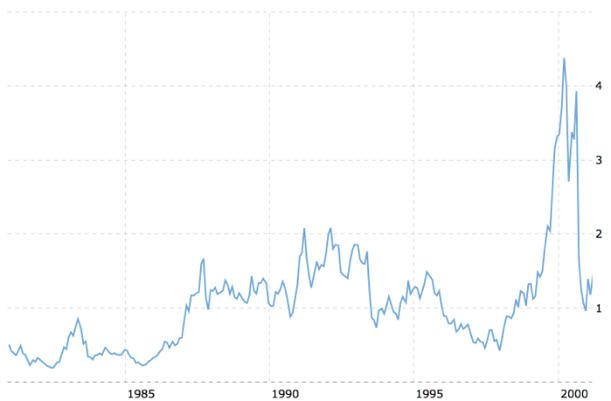

Shares of Nvidia and the dotcom bubble

In such a short period of time, the growth in the value of shares was so strong that they now trade at a mark-up of more than 250%, to a 200-day moving average.

')

A similar position in the market was observed in the shares of some technology companies at a time close to the “explosion” of the economic bubble at the beginning of the two thousandth. For example, similar indicators in 2000 showed shares of Apple.

In this situation, investors are not easy to keep a cool head and competently manage their assets.

What to expect from Nvdia shares further

According to Matt Mali, despite the analogies with the situation of the beginning of the two thousandth years, investors who have invested in Nvidia shares should not get rid of them urgently. If the purchase of shares of Nvidia was made two years ago, today the investor can sell only 11% of the purchased shares and reimburse 100% of the originally spent amount. At the same time, 90% of the portfolio of ever-growing securities will remain.

Therefore, it will be logical to gradually sell them, taking profits, keeping part of the portfolio. Such an approach will allow staying in positive territory even with the inevitable correction of the stock value in the future.

At the same time, it is quite possible that the growth of the shares of Nvidia and other technology companies will continue further, according to analysts at ITI Capital.

Fundamental indicators of US companies included in the S & P index are at historically high values. So, the return on equity (ROE) in 2017 was 16.5% - the highest level in the last 10 years. And it can be expected that individual sectors and companies will continue to grow.

Nvidia is widely known for its graphics processors and is a pioneer in computer visualization. The company offers specialized platforms for the gaming market, automation, data centers. Advanced growth in AI and HPC (high performance computing) can provide significant growth potential. NVIDIA builds on-chip (SoC) systems that enable the development of a wide variety of high-tech sectors, including unmanned vehicles and robotics, big data and cybersecurity, genome research and medical diagnostics. And if the growth rate of demand in the area of AI / HPC solutions remains high, and Nvidia maintains its leading position in these segments, then the growth in profits and quotes of the company may continue to surprise the market.

- Pavel Zakharevich , ITI Capital expert

Other materials on finance and stock market from ITI Capital :

- ITI Capital Educational Resources

- Analytics and market reviews

- How the use of the word “blockchain” allows companies to increase capitalization

- How will be organized trading in Bitcoin futures on the Chicago Stock Exchange

- What to do on holidays: write robots for trading on the exchange in the scripting language TradeScript

- Where it is more profitable to buy currency: banks vs exchange

Source: https://habr.com/ru/post/349628/

All Articles