The fall of the cryptocurrency market: causes and prospects

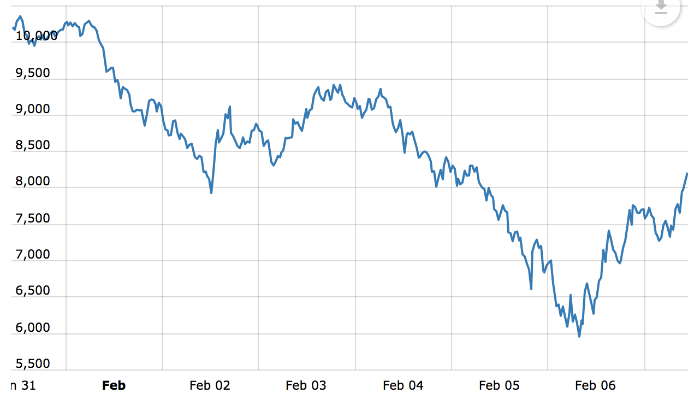

On Monday, the bitcoin rate fell below $ 8,000 and came close to $ 7,000, while high volatility persisted in the digital currency market. The first drop occurred on Friday: then the cost of cryptocurrency dropped to $ 7,700, losing 15% of the initial price at the time of the opening of the exchange, but then the rate began to rise and reached $ 9,000. Subsequently, the price of Bitcoin corrected slightly and returned to a level above $ 8,000.

Along with Bitcoin, the main cryptocurrency demonstrated similar dynamics on the market on Friday: the rate of Ethereum (ETH) fell by 7%, Litecoin (LTC) by 6%, Bitcoin Cash (BCH) by 5.5%, Ripple (XRP) by 7%. The fall in the market was so noticeable that the capitalization of the 50 largest cryptocurrencies, with the exception of two of them, fell by more than 15%.

')

As the CoinMarketCap chart shows, at the peak of Friday's fall, the market capitalization of all cryptocurrencies dropped from $ 500 billion to $ 375 billion in 24 hours.

The change in market capitalization is not an absolute criterion in assessing the situation on the market, but it gives an idea of the scale of the sale of assets.

After a fairly stable weekend, the bitcoin recession resumed on Monday: during day trading, the price fell by 12%. The depreciation is associated with the statements of many large banks prohibiting the use of their credit cards to buy Bitcoins and other cryptocurrencies. JPMorgan Chase, Bank of America and Citigroup announced this in the USA, and Lloyds Bank joined them in England. Tightening followed in China: there the authorities are planning to block sites related to ICO and other forms of trade in cryptocurrencies.

The market of digital currencies is in tension since the beginning of this year due to the decline in trade volumes in Asian regions and due to the tightening of legislative policies regarding digital currencies in different countries of the world. The social network Facebook banned cryptocurrency ads, and the US authorities launched an investigation into Tether's cryptocurrency, which could have contributed to inflating the value of Bitcoin. The Indian government last week announced a tightening of monetary policy and an unwillingness to consider Bitcoin as a means of payment in the country.

However, even such a serious fall and a general negative news background do not mean a complete collapse of cryptocurrencies, experts at ITI Capital are convinced:

Against the background of the fall of Bitcoin over the past month, investors began to consider such pessimistic scenarios as reaching the July 2017 exchange rate of about $ 2,000. Most likely such scenarios are unrealistic. Bitcoin grew too much at the end of 2017, which could not but cause a correction. The price of Bitcoin is now trading at about a 200-day average, from which it always bounced up sharply. Most likely, the situation will repeat and a new round of growth will be waiting for cryptocurrency since the end of February.

- Pavel Zapryagayev, director of the direction of structured products of ITI Capital

Other materials on finance and stock market from ITI Capital :

- ITI Capital Educational Resources

- Analytics and market reviews

- How the use of the word “blockchain” allows companies to increase capitalization

- How will be organized trading in Bitcoin futures on the Chicago Stock Exchange

- What to do on holidays: write robots for trading on the exchange in the scripting language TradeScript

- Where it is more profitable to buy currency: banks vs exchange

Source: https://habr.com/ru/post/348518/

All Articles